Types Of Home Loans Available In Michigan

Its important to weigh the benefits and drawbacks of various lenders and loan programs to ensure you are making the best financial decision, says Dina Maeweather, a Realtor at Keller Williams. While many buyers believe that shopping for the lowest possible interest rate is the best way to shop for a mortgage loan, the type and terms of the loan you select can often save you the most money.

Common loans available in Michigan include conventional loans, FHA loans, and VA loans. In addition to having a combination of different rates and fees, you may also be able to choose the length of your loan and whether you want a fixed or adjustable rate mortgage, so its a good idea to consider multiple mortgage lenders before making any final decisions.

Next Steps For Your Move To Michigan

- If youre nervous about dealing with the financial effects that come with a large move, you may want to talk to a financial advisor. These professionals can also help you with long-term financial planning for retirement or buying a home. Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free toolmatches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Physical access to your bank account is important to many Americans. So if youre considering moving to the Wolverine State, here are a few local banks to look into First National Bank of America, Sterling Bank and Trust, Mercantile Bank of Michigan, First National Bank in Howell and First State Bank.

What Is A Mortgage Point

Some lenders may use the word points to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

Also Check: How To File Bankruptcy Without A Lawyer In Nebraska

Ology: How We Got Our Average Number

To determine how much the average borrower pays for their mortgage each month, we used the average home sales price according to data from the Census Bureau and the Department of Housing and Urban Development. In Q1 of 2022, the average price was $507,800. We then took the typical down payment of 13% to determine an average loan size. Freddie Mac data was also used to find average mortgage rates for 30-year and 15-year fixed-rate mortgages in Q1 of 2022: 3.82% and 3.04%, respectively.

Go Big On The Down Payment But Dont Stretch Your Means

So far weve covered how to calculate how much you can afford to put toward a mortgage payment and its associated costs every month. But the down payment, a sizable chunk of change you put toward your house at the time of closing, separates the renters from the owners. Trouble is the down payment is often the no. 1 obstacle to achieving homeownership.

Not everyone has the funds to make it happen, but if your savings allow for a 20% down payment on your home, you will likely be able to avoid paying private mortgage insurance on a conventional loan.

Recommended Reading: How Long Does Bankruptcy Chapter 7

The Average Down Payment On A Home Today

According to a recent report by the National Association of Realtors, nearly half of consumers believe they need to pay at least 16% of the home value or more for a down payment, while one in 10 think they need to pay more than 20%.

Fortunately, that just isn’t the case. The report states the average down payment on a home in 2021 was just 7% for first-time homebuyers and 17% for repeat buyers.

Among the many difficulties for potential homebuyers is the fact that over the last two years, they’ve had to compete with cash buyers. The National Association of Realtors stated in May 2022 that 25% of buyers had enough cash on hand to purchase a house without needing any financing, essentially putting everyone else hoping to buy at an immediate disadvantage.

However, since the buying market has drastically slowed down due to elevated interest rates, homebuyers in general are now getting a better shot at landing their dream homes, regardless of the size of their down payment.

I purchased my home in Jan. 2022 with a conventional loan and a 5% down payment I didn’t experience any pushback after making a down payment that was less than 20%. By putting down a smaller amount, I can continue paying down other debt and invest for the future. That said, I’m still subject to paying Private Mortgage Insurance, or PMI, which will eventually fall off my mortgage once I hit the 20% equity mark.

Closing Costs For Michigan Homes: What To Expect

According to recent data from Bankrate, home buyers in Michigan pay an average of $1,958 in closing costs. $946 of this goes to the origination fee. This is the fee charged by the lender to cover the costs of processing your mortgage. The rest of these fees are third-party fees.

However, the Bankrate study does not account for a range of variable costs, like title insurance, real estate transfer taxes, and escrow fees. To ensure that you are fully prepared, it is important to note that buyers will typically pay between 2% and5% in closing costs.

For example, if we were to take the current median home value of $151,700 , buyer’s in Michigan pay anywhere between $3,034 and $7,585.

While closing costs can be expensive, one of the largest mortgage expenses is the interest rate. Over the life of the loan, a few small percentage points can result in hundreds of thousands of dollars in interest payments.

One of the best ways to lower your interest rate? Shop around and compare lenders! Fill out the form below for a quote from a licensed, local lender â even if youâre pre-approved it pays to compare.

Recommended Reading: How Long Will Bankruptcy Stay On Your Credit Report

Average Monthly Mortgage Payment In The Us

The median monthly mortgage payment in the U.S. is $1,100, based on the most recent American Housing Survey data provided by the U.S. Census Bureau.

The average monthly mortgage payment is not as easy to calculate, as there is no official government source to pull from. However, we can start by looking at data from the 2020 National Association of REALTORS®Profile of Home Buyers and Sellers.

According to this study, the national median home price is $272,500 and the median down payment is 12% of the purchase price. This brings the total loan size to $245,250. Note that this does not take into account any closing costs, HOA fees, homeowners insurance or any outside expenses. A mortgage calculator may help you to further estimate your total housing costs.

Entertainment Costs In Michigan

What about the cost of non-necessities in Michigan? Theres a range of options for you to pick from in the entertainment category. According to Statista data, the average ticket price for the Detroit Tigers baseball team is $28.15. If youre more of an art-lover, you can check out the Frederik Meijer Gardens and Sculpture Park, where admission is $14.50 for adults. Or, theres the Detroit Institute of Art, with tickets for $14.

Are you an outdoor enthusiast? You can visit the Grand Island National Recreation Area via ferry for $20 a round trip. If you love history, check out the car-free and history-filled Mackinac Island State Park, no tickets are required. Events here do cost money, though. Michigan also has plenty of places to visit where you can spend hundreds or thousands of dollars, depending on what you do and how long you stay. This includes the upper peninsula of the state that many people forget about when considering places in Michigan.

Read Also: How Much To File Bankruptcy In Wisconsin

Typical Home Price In West Virginia: $137286

- Typical single-family home value in 2022: $137,286

- West Virginia mortgage rate, July 2022: 5.83%

- Average mortgage payment to median income: 16.5%

The most affordable housing in the country goes to West Virginia. Its median income may be 24% less than the nationwide median, but it also has the lowest typical house price and average mortgage payment.

Typical Home Price In Nebraska: $239814

- Typical single-family home value in 2022: $239,814

- Nebraska mortgage rate, July 2022: 5.84%

- Average mortgage payment to median income: 20.7%

Nebraska ranks as one of the better states for home affordability. It has inexpensive housing costs, low interest rates on mortgages, and a median income 7% above that of the United States.

You May Like: How Long Is A Bankruptcy On Your Credit Report

Start House Hunting In Michigan

ð Key takeaway:

The prices for homes in Michigan are likely to stay within your budget expectations, as listing prices have barely increased over the last year. While that may be the case, inventory hasn’t picked up much either, so you may still be limited in terms of options. Be a bit more flexible with your requirements for your new home â your real estate agent can show you some great listings that may not be exactly what youâre looking for, but they still might surprise you.

Searching for homes in Michigan is the fun part of the home buying process! You’ll get to look at a variety of homes and discover what you really want in a home.

Make a list of everything you want in a home and prioritize them. At the top of the list should be the items that are most important to you. This will help you separate your “must-haves” from your “nice-to-haves.”

Your agent can help you understand if your wants are realistic for your budget and favorite neighborhoods or if you need to rethink what you’re looking for.

Home Prices In Michigan

The average home in Michigan sells for $170,100 with a median list price of $175,000 based on information collated in March 2020. However, prices throughout the state vary significantly. To live in Ann Harbor, buyers can expect to pay $355,900 on average for a home with a median list price of $399,900, compared to the neighboring city of Detroit where the typical home value is valued at $36,293.

Slightly north of Detroit is the town of Warren. The median home price here is $127,300 with an average listing of $115,000.

To the west of the state is the city of Grand Rapids. The market here is currently very hot with home values soaring 7.1% over the past year. The median price of homes is $185,000 with a close average list price of $184,400.

Read Also: How To Access Bankruptcy Court Filings

How Much House Can I Get For $5000 A Month

Lets say you earn $5,000 a month . According to the 25% rule we mentioned earlier, that means your monthly house payment should be no more than $1,250. Stick to that number and youll have plenty of room in your budget to tackle other financial goals like home maintenance and investing for retirement.

Dont Miss: Rocket Mortgage Loan Types

Average Price To Build A House In Michigan By Number Of Bedrooms

Depending on the number of bedrooms, the average house in Michigan costs $45,500 to $480,000 for a modular house and $54,000 to $600,000 for a stick-built house. If the house has multiple bedrooms, more materials and labor will be spent on the house, which raises the total building cost. Most homes in Michigan have two or three bedrooms, depending on the layout, but the number of bedrooms varies. The table below illustrates how much you can expect to spend to build a house in Michigan based on the number of bedrooms.

| Number of Bedrooms |

|---|

| $135K – $600K |

Recommended Reading: What Does A Bankruptcy Discharge Letter Look Like

How Do Canadians Get A Mortgage For A Us Property

Not all Canadian lenders are able to offer a mortgage for a US property purchase because they do not have legal jurisdiction in the US. The only exception is if the Canadian-based lender also operates in one or more states. In that case, the lender may be able to supply a mortgage to you. Before filling out an application, ask the lender if it operates in the US and, if so, in which states.

If you cant find a Canadian lender thats willing to work with you, you can always work with a US lender. Many Canadians purchase property in the US, and there are many lenders in the market that work with snowbirds. The main challenge you will face is getting approved. Mortgage eligibility can be more challenging to meet as a foreign buyer.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

Don’t Miss: How To Buy A New Car After Bankruptcy

Next Steps: What To Do After You Have Estimated Your Mortgage Payments

How Lenders Decide How Much You Can Afford To Borrow

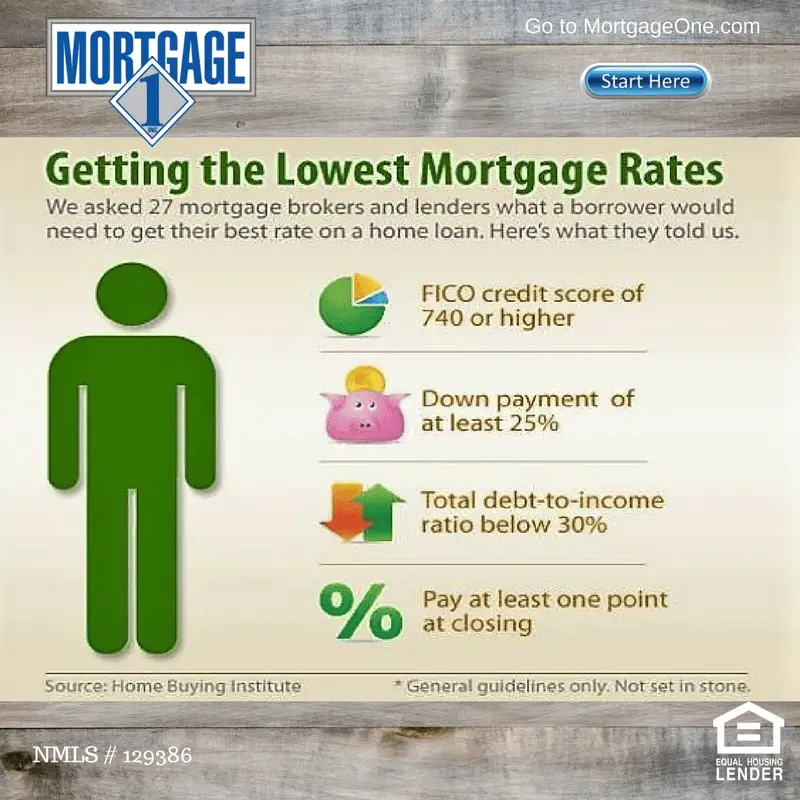

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio.

Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

Don’t Miss: Where Do You File For Bankruptcy

Typical Home Price In Nevada: $484530

- Typical single-family home value in 2022: $484,530

- Nevada mortgage rate, July 2022: 5.73%

- Average mortgage payment to median income: 48.9%

The typical Nevada resident has a tough time paying for a home because of high prices. Incomes aren’t enough to balance that out, as they’re 10% less than the national median.

Typical Home Price In Tennessee: $297943

- Typical single-family home value in 2022: $297,943

- Tennessee mortgage rate, July 2022: 5.76%

- Average mortgage payment to median income: 33.6%

Tennessees lower-than-average housing costs isnt enough to compensate for incomes 19% under the national median. As a result, average mortgage payments exceed the 28% rule.

Recommended Reading: How Does Filing Bankruptcy Affect Buying A House

How A Mortgage Calculator Helps You

Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living.

Using NerdWallets mortgage calculator lets you estimate your mortgage payment when you buy a home or refinance. You can change loan details in the calculator to run scenarios. The calculator can help you decide:

Recommended Reading: Rocket Mortgage Launchpad

Typical Home Price In Virginia: $379206

- Typical single-family home value in 2022: $379,206

- Virginia mortgage rate, July 2022: 5.67%

- Average mortgage payment to median income: 28.3%

Virginia doesn’t quite pass the 28% rule, but it’s close. That’s primarily due to a median income 21% greater than the national median, which isnt quite enough despite home prices below the national median.

Read Also: Can You Buy A House With Bankruptcy On Your Record

Closing Costs For Sellers In Michigan

Seller closing costs typically add another cost of 1.7% or more to the homes final sale price, according to our data.

Based on the average Michigan home value of $236,675, the typical home sellers pays $4,128 in closing costs.

Michigan seller closing costs typically include owners title insurance, transfer taxes, recording fees, prorated property taxes, and attorney or settlement fees.

The seller might also be responsible for Homeowners Association fees, mortgage payoff and/or prepayment penalties, and any concessions offered to the buyer, such as a home warranty.

Buyers are generally on the hook for everything else, including appraisal and inspection fees, title search fees, lenders title insurance, and loan origination fees.

Michigan Job Stats To Consider

Michigan’s economy is quite diverse. However, the state is known for being the center of the automotive industry in the U.S., home to Renault, Peugeot, and Citroen. The upper peninsula receives a lot of tourism for its natural resources while the rest of the state boasts a healthy economy focusing on agriculture, services, manufacturing, and high-tech industries.

The median personal income in Michigan is $27,549 and per household, $56,697. Michigans income per capita is significantly less than the national average of $54,420. The unemployment rate is roughly the same as the national average of 3.7%, according to information gathered by U.S. Bureau of Labor Statistics.

Michigan has a flat income tax rate across the state, although some cities do charge an additional rate. The marginal tax rate in 2019 for single filers was 4.25% with an effective rate of 3.98%. Sales tax for the state sits at 6%.

Job Stats

Don’t Miss: Can You File Bankruptcy On Medical Bills