Bank Of America Preferred Rewards Tiers

The Bank of America Preferred Rewards program offers five tiers: Gold, Platinum, Platinum Honors, Diamond and Diamond Honors. Both the benefits members receive and the combined balance required to qualify increase with each successive tier.

If your balances drop below the Preferred Rewards Tier level you have achieved, you will keep the higher tier level for a full year. After a year plus a three-month grace period youll be reassigned to a lower tier based on your current balances.

How Do Credit Consolidation Companies Work

The term credit consolidation companies” covers a lot of ground in the debt-relief industry. They range from giant national banks to tiny nonprofit counseling agencies, with several stops in between and offer many forms of .

To simplify things, it is easiest to divide credit consolidation companies into two categories:

- Those who consolidate debt with a loan based on your credit score

- Those who consolidate debt without a loan and dont use a credit score at all

Banks, credit unions, online lenders and credit card companies fall into the first group. They offer debt consolidation loans or personal loans you repay in monthly installments over a 3-5 year time frame.

They start by reviewing your income, expenses and credit score to determine how creditworthy you are. Your credit score is the key number in that equation. The higher, the better. Anything above 700 and you should get an affordable interest rate on your loan. Anything below that and you will pay a much higher interest rate or possibly not qualify for a loan at all if your score has dipped below 620.

The second category companies who provide without a loan belongs to nonprofit credit counseling agencies like InCharge Debt Solutions. InCharge credit counselors look at your income and expenses, but do not take the credit score into account, when assessing your options.

Best Bank Of America Travel Card

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

The Bank of America Premium Rewards credit card is great for travel and dining purchases, which earn you 2 points for every dollar spent. You also earn 1.5 points on all other eligible purchases, and you can enjoy travel benefits you wont find with other Bank of America cards, including up to $100 in Airline Incidental Statement Credits annually.

- This card charges a $95 annual fee.

- There are no intro APR offers on purchases or balance transfers.

additional features

- This card charges a 3 percent foreign transaction fee.

- There is no rewards program for the card, decreasing its long-term value.

additional features

You May Like: Everfi Credit And Debt Answers

Don’t Miss: Do You Claim Bankruptcy On Your Taxes

Whats A Debt Management Plan

A good credit counselor will spend time reviewing your specific financial situation and then offer customized advice to help you manage your money. After that review, a counselor might recommend that you enroll in a debt management plan to help repay your unsecured debts like credit card, student loan, or medical debts.

But if a credit counselor says a debt management plan is your only option, and says that without a detailed review of your finances, find a different counselor.

If you and your counselor decide a debt management plan is best for your situation, its a good idea to check with all of your creditors. You want to be sure they offer the types of modifications and options the credit counselor describes to you.

Heres how a debt management plan generally works:

- The counselor develops a payment schedule with you and your creditors. Your creditors may agree to lower your interest rates or waive certain fees.

- You deposit money each month with the credit counseling organization.

- The counselor uses your deposits to pay your unsecured debts, like your credit card bills, student loans, and medical bills, according to the payment plan.

Bank Of America Travel Rewards Credit Card: Best For Qualifying Travel Purchases

- What we love about this card: Cardholders will earn for a wide variety of travel purchases. Their costs will also be kept lower by forgoing an annual fee.

- Who is this card good for: Travelers who value flexibility and versatility in their travel card. Get rewarded for purchases from art galleries, to zoos and campgrounds with this card.

- Alternatives: The Bank of America travel card does offer flexibility in terms of what you can redeem for travel but if flexibility to you means being able to redeem rewards for cash back, you might be better off with the Discover it® Miles.

Dont Miss: Will Credit Card Companies Forgive Debt

Read Also: How Long Does Bankruptcy Stay On Your Credit Report

What Do I Need To Do After I File For Bankruptcy

You have to take a debtor education course from a government-approved organization about things like developing a budget, managing money, and using credit wisely. To find a counseling organization, check the list of approved debtor education providers. You have to file a certificate with the bankruptcy court proving that you took the course.

Staying On Track After Consolidating Your Debts

After consolidating your debt, it’s important to create a monthly budget and keep your spending in check. “Don’t run up the balances on your cards again,” Lawler says. “But don’t immediately close out your cards, either. Figure out what route will help you accomplish your financial goals while also helping you build your credit score.”

If it makes sense to keep the cards open, use them sparingly, and try not to carry more than 30% of debt in relation to your limits on each card.

“Also, if it’s possible, make more than the minimum payment on your loans,” Lawler says. “Even a little more each month can really cut into the amount of interest you’ll pay.”

Debt can weigh on you, but you may be able to lessen the load through consolidation. Remember to carefully research your options and calculate the total cost of all options to determine if debt consolidation is right for you.

Also Check: Can You Buy A Home After Bankruptcy

General Reasons For Consolidating Debts

People choose debt consolidation for many reasons but the most popular include:

- Reducing Interest Rates: Interest rates for mortgages are generally lower than that for other kinds of debts.

- Reducing Monthly Rates: By spreading out a loan over a long time, you end up paying lower monthly instalments.

- Improving Credit Score: If you have pending debts, they are certainly affecting your credit score. A debt consolidation loan is a great way to improve a poor rating by paying off expensive loans.

What If My Debt Is Old

Debt doesnt usually go away, but debt collectors do have a limited amount of time to sue you to collect on a debt. This period of time is called the statute of limitations, and it usually starts when you first miss a payment on a debt. After the statute of limitations runs out, your unpaid debt is considered to be time-barred. That means the collector can no longer sue or threaten to sue you to pay the debt because so much time has passed. Its against the law for a debt collector to sue you for not paying a debt thats time-barred. If you do get sued for a time-barred debt, tell the judge that the statute of limitations has run out.

How long the statute of limitations lasts depends on what kind of debt it is and the law in your state or the state specified in your credit contract or agreement creating the debt.

Under the laws of some states, if you make a payment or even acknowledge in writing that you owe the debt, then the debt isnt time-barred anymore. The clock resets and a new statute of limitations period begins.

Also Check: What Happens If You Declare Personal Bankruptcy

Compare Offers To Find The Best Loan

When searching for a personal loan, it can be helpful to compare several different offers to find the best interest rate and payment terms for your needs. With this comparison tool, you’ll just need to answer a handful of questions in order for Even Financial to determine the top offers for you. The service is free, secure and does not affect your .

This tool is provided and powered by Even Financial, a search and comparison engine that matches you with third-party lenders. Any information you provide is given directly to Even Financial and it may use this information in accordance with its own privacy policies and terms of service. By submitting your information, you agree to receive emails from Even. Select does not control and is not responsible for third party policies or practices, nor does Select have access to any data you provide. Select may receive an affiliate commission from partner offers in the Even Financial tool. The commission does not influence the selection in order of offers.

Private Student Loan Consolidation

* Bank of America student financial products are in flux due to recent changes in the way student loans are issued. The following is offered as a historical reference, and outlines a program that may have changed. Bank of America Student Center provides up-to-the-minute information about BOA student services.

Students that need assistance beyond federal loans and scholarships seek private student loans. The Bank of America Student Program Consolidation Loan gives borrowers the flexibility to roll multiple private education loans into one consolidated loan. Eligible loans include those that were used for expenses like textbooks and computers.

A single, consolidated monthly payment offers relief from high interest rates and reduces administration costs on multiple loans. The minimum consolidation loan is valued at $10,000. Borrowers with 48 consecutive on-time payments earn a .78% interest rate reduction and an additional .25% is discounted when participants enroll in an automated withdrawal payment program. Use these ten tips for paying back student loans.

Background Information

You May Like: How To Find Out If A Business Filed Bankruptcy

What Should I Do If Im Having Trouble Paying My Mortgage

Contact your lender immediately. Dont wait, or a lender could foreclose on your house. Most lenders will work with you if they believe youre acting in good faith and your situation is temporary.

Your lender might be willing to

- lower or suspend your payments for a short time

- extend your repayment period to lower your monthly payments

Before you agree to a new payment plan, find out about any extra fees or other consequences. If you cant work out a plan with your lender, contact a non-profit housing counseling organization. Reach a free, HUD-certified counselor at 800-569-4287. Also, contact your local Department of Housing and Urban Development office or the housing authority in your state, city, or county. You dont need to pay a private company for these services.

Some companiespromise to make changes to your mortgage loan or take other steps to save your home, but they dont deliver. Theyre scammers. Never pay a company upfront for promises to help you get relief on paying your mortgage. Learn the signs of a mortgage assistance relief scam and how to avoid them.

Balance Transfer Credit Card

With a balance transfer card, you shift your credit card debt to a new credit card with a 0 percent introductory rate. The goal with a balance transfer card is to pay off the balance before the introductory rate expires so that you save money on interest. When you calculate potential savings, make sure you factor in balance transfer fees.

Keep in mind that paying off existing credit card debt with a balance transfer to another credit card isn’t likely to lower your credit utilization ratio like a debt consolidation loan would.

A debt consolidation loan also is going to offer higher borrowing limits, enabling you to pay off more debt, as well as fixed monthly payments, which make it easier to budget and stay disciplined with paying off debt.

Who this is best for: Borrowers who can pay off existing debt quickly.

Balance transfer credit card vs. debt consolidation loan: Often, balance transfer cards are the best choice for borrowers who have the means to pay off their debt within 18 months, which is a standard 0 percent APR period. If you need longer to pay off your debt, or if you have a lot of debt, a debt consolidation loan is a better choice.

Recommended Reading: Us Debt Clock Org

How Is My Personal Loan Rate Decided

As you shop for a low-interest loan or credit card, remember that banks are looking for reliable borrowers who make timely payments. Financial institutions will look at your credit score, income, payment history and, in some cases, cash reserves when deciding what APR to give you.

To get approved for any kind of credit product , youll first submit an application and agree to let the lender pull your . This helps lenders understand how much debt you owe, what your current monthly payments are and how much additional debt you have the capacity to take on.

Once you submit your application, you may be approved for a variety of loan options. Each will have a different length of time to pay the loan back and a different interest rate. Your interest rate will be decided based on your credit score, credit history and income, as well as other factors like the loans size and term. Generally, loans with longer terms have higher interest rates than loans you bay back over a shorter period of time.

Select now has a widget where you can put in your personal information and get matched with personal loan offers without damaging your credit score.

Apply For A Bank Loan

After youve shopped around for quotes from different lenders and found the right offer for you, you can complete the application process. If approved, you can sign the loan agreement. Youll need to provide some personal information and bank account details for debt consolidation loans, you may be able to provide creditor information for the lender to send the funds.

Some companies will disburse loan funds as soon as the same or the next day, while others may take several business days. Youll typically be given an online dashboard from which you can view your payoff timeline, make payments, and otherwise manage your loan.

Read Also: Northern District Of Texas Bankruptcy

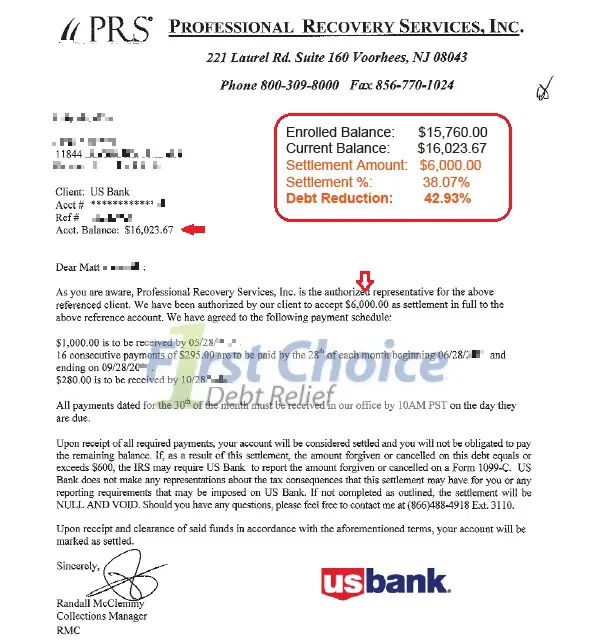

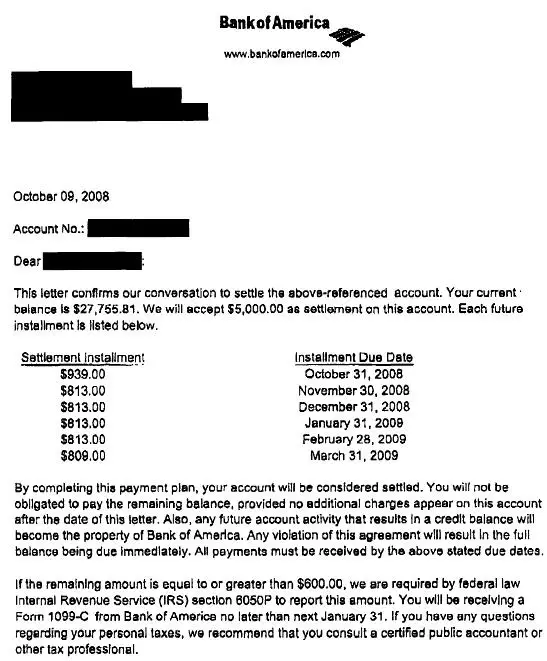

Bank Of America Debt Relief Plans

Bank of America also works with credit counseling agencies and debt consolidation professionals to help its customers negotiate settlements and pay off their debts in a timely fashion. If youre unable to negotiate a settlement directly with the company directly over the phone, this will likely be the next step in the process.

If youre struggling to make your minimum payment each month, the interest rate on your outstanding balances is probably quite high. Although every case is different, past Bank of America debt consolidation clients have shaved an average of nine percentage points off of their old rate of interest. If youve been paying penalty interest rates of 25 percent or more, you may be able to save even more than this. Remember, reducing your interest rate by even a single percentage point will save you $100 per year.

Reducing the average interest rate on your outstanding balances can be helpful, but oftentimes its not enough. Cutting the annual rate of interest on a balance of $20,000 from 20 percent to 10 percent will save $2,000 per year, a not-insignificant sum.

Bank of America clients who negotiate an outright settlement on their outstanding debts, however, can save many times that. If you see your settlement process through to completion, you can expect to knock over 50 percent, on average, off of your debt. Fill out the free form or call today to connect with a debt settlement professional and get the most out of your Bank of America debt consolidation!

Remove Bofa Collections From Your Credit Report

If Bank of America has contacted you about a debt you supposedly owe, and youve noticed a negative mark on your credit report, try sending a Debt Validation Letter. The Fair Debt Collection Practices Act protects consumers from abusive and manipulative debt collection tactics. You might feel that youve experienced such tactics with Bank of America. If this is the case, sending a Debt Validation Letter can protect you from further harrassment.

When Bank of America contacts you about a debt you owe, it must verify the debt within 5 days of initial contact . You should send a Debt Validation Letter within 30 days of initial contact, especially if you suspect that the debt is fraudulent or past the statute of limitations. BofA must validate the debt or stop contacting you after receiving request for debt validation. If BofA keeps trying to contact you about the debt without validating it, this is a clear violation of the FDCPA.

Bank of America must include the following information to validate the debt:

For more information on drafting and sending a Debt Validation Letter, check out this video:

Read Also: Debt Collection Agency For Small Business

Recommended Reading: House For Sale By Bank

How The 2022 Fed Rate Hike Affects Debt Consolidation Loans

In an effort to combat rising inflation, the Federal Open Market Committee raised interest rates by three-quarters of a percentage point in June, July, September and November. These rate hikes have caused interest rates on personal loans to rise.

Most personal loans have fixed rates, meaning that borrowers who already have a personal debt loan for debt consolidation do not need to worry. However, those looking to take out a new loan may face higher rates.

If you are in the market for a debt consolidation loan and want to ensure you get the best rate possible, here are some steps you can take:

- Prequalify if possible

- Check your credit score before applying

- Apply with a co borrower

- Shop around and compare rates