How To Pursue Student Loan Discharge In Bankruptcy Proceedings

Meeting the standard of undue hardship is incredibly difficult, so its worth speaking with a bankruptcy lawyer to see if its even a possibility in your unique situation. However, you may be able to claim it under certain circumstances, such as living with a permanent disability or terminal illness.

Even if you think you meet the standard of undue hardship, its important to understand that discharging student loans involves additional work on top of the standard bankruptcy proceeding.

Its not as simple as filing for bankruptcy, Kantrowitz says. Its an adversary proceeding within a bankruptcy proceeding. That means the lender gets to defend against bankruptcy discharge.

Getting Help With Student Loan Bankruptcy

As you can see, filing bankruptcy on student loans is a complex matter. A lot depends on your financial situation and how it aligns with bankruptcy regulations. To ensure you have the best chance at relieving your student loan debt through bankruptcy, you may wish to get the help of an experienced bankruptcy attorney. The bankruptcy attorney can assess your situation to see if student loan bankruptcy could be possible and, if so, guide you through the proceedings.

Brock and Stout have over 25 years of experience helping clients get the financial fresh start they need. Contact us for a free evaluation of your financial situation to see if we can help you.

How To Determine Whether Filing Bankruptcy Will Help With Student Loan Debt

Different formulas are used specifically to test for your personal dischargeability of student loans ? the most common of which is the ?Brunner Test,? which is used by 9 of the 13 judicial circuit courts. ?Prior to 2005, the bankruptcy law allowed individuals to eliminate student loan debt much easier than it does now. ?The changes made to the bankruptcy code in 2005 placed restrictions on who can discharge their student loan debt when they file for bankruptcy. ?Most individuals don?t file for bankruptcy based solely on student loans, but in some instances, the amount of debt they carry including student loans is crushing, and if they prove the right elements, there is some hope they may qualify for a student loan bankruptcy.

Don’t Miss: Federal Home Relief Program

The Brunner Test In The Sixth Circuit

In 1987, well before BAPCPA swept private and all other student loans into Section 528, the 9th Circuit Court of Appeals in California issued a decision denying the discharge of student loan debt owed by a woman named Marie Brunner.

The definition of undue hardship that this Court elaborated in that case has since come to be relied upon and utilized by nearly all bankruptcy courts in the United States.

What is it? The so-called Brunner Test is a 3-prong test for undue hardship in any given Chapter 7 or Chapter 13 bankruptcy case.

Although Brunner was a Ninth Circuit Case, the Sixth Circuit Court of Appeals, which includes Michigan in its jurisdiction, has wholeheartedly adopted its test.

The Sixth Circuit has echoed the Brunner Test as follows:

Repayment of student loan debt imposes an undue hardship if the debtor shows

- that the debtor cannot maintain, based on current income and expenses, a minimal standard of living for herself and her dependents if forced to repay the loans

- that additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the repayment period of the student loans and

- that the debtor has made good faith efforts to repay the loans.

Further, the Sixth Circuit requires, in demonstration of good faith efforts, that you have attempted to take advantage of all income-based repayment plan, deferment, and forbearance options prior to the filing of your bankruptcy case.

Deferment Forbearance Parent Plus

For the years you have zero income, send in your zero payment while you are on unemployment or social security. Never go into forbearance when a zero payment would eliminate another year of payments. Parent Plus loans need to look at the ICR program which is very similar to the IBR. However, the ICR has a difficult formula and IBR-type programs like PAYE and REPAYE generally have lower payments than the IBR program. If you work for the government or a non-profit entity like a hospital, charity, or school the public service program allows you to pay off the IBR loan within 10 years with 10% of the loan repaid for every year of public service. Church employees that do non-religious work qualify for the public service program. Even doctors qualify. Just fill out the Public Service Loan Forgiveness form.

Here are four examples of jobs that qualify:

You May Like: How Does Bankruptcy Affect Tax Return

Student Debt Less Than Seven Years Old

If your student loan is less than 7 years old, then you still have student loan forgiveness options that can help make repayment of your student debt easier. Negotiate new payment arrangements. Try contacting the student loans office to negotiate a new payment arrangement. Repayment assistance is available through the National Student Loan Service Centre and their Repayment Assistance Plan. You can:

- Ask for a temporary reduction in payments including making interest only payments.

- Ask for more time to repay your student debt. You can extend your payment period for up to 14.5 years.

- Apply for a hardship reduction. The government will reduce your interest costs for the first 10 years and may reduce the principal owing after 10 years. However, you must prove financial hardship to qualify, including meeting an income threshold and approval is not guaranteed.

Be aware that the first two options will keep you in debt longer and will increase the total interest you pay on your student debt. The hardship option is the only option, other than bankruptcy or a consumer proposal, that will reduce the total student loan payments you make over time. If you are successful in negotiating new student debt repayment terms, do your best to maintain the payments to sustain your agreement. The area of bankruptcy and student debt can be complicated. We answer more questions on our student debt help FAQ page.

Whats Student Loan Bankruptcy

It should be noted that theres no student-loan-specific bankruptcy. Chances are youve heard or read that student debts arent dischargeable in bankruptcy even if you have a good credit score. The truth is oversimplified in such a statement.

In some situations, you will still be able to discharge your student loan. However, the procedure is much more difficult compared to other kinds of unsecured debts. There is an extra step that involves filing an adversary proceeding.

Related: How To File For Bankruptcy In Hawaii

You May Like: What Does Declaring Bankruptcy Do For Me

Why Cant People Get Rid Of Student Loans Through Bankruptcy Now

Although not impossible, discharging student loans in bankruptcy is difficult. Due to a 1976 law, student loans are not treated during bankruptcy proceedings like other forms of debt, such as credit card debt or auto loans. This policy stems from a federal commission on bankruptcy laws, which heard testimony that claimed the easy discharge of educational loans in bankruptcy could undermine federal student loan programs. Congress was concerned that students might borrow thousands of dollars from the federal government, graduate, declare bankruptcy to have their student loans discharged and never repay their educational debt.

In an extension of the Higher Education Act of 1965, Congress passed the 1976 law, which made borrowers wait five years after the first student loan payment was due before they could have the loan discharged through bankruptcy. Congress created an exception that allowed for discharge within that five-year period if the loan caused undue hardship.

Congress extended the five-year bankruptcy ban to seven years in 1990. Then Congress extended it to the borrowers lifetime in 1998.

Currently the undue hardship exemption is the only way to have student loans discharged in bankruptcy that is a much higher threshold than many other common forms of debt. This higher threshold includes both federal student loans and, since 2005, most forms of private student loans.

What You Need To Prove To Get An Undue Hardship

To prove undue hardship and discharge a student loan in bankruptcy, a debtor must prove that he or his dependants would be unable to maintain a minimal standard of living if forced to repay student loans. This requires you to document past, present, and future good faith efforts along with the inability to repay. The following is a list of requirements at a minimum.

To prove it, you must gather evidence of undue hardship that makes it unlikely your situation will improve. This includes evidence that shows you are unable to pay a student loan over a long time. One such example is if you have a disability. You may not be disabled enough to qualify for the disability discharge with Social Security or the Department of Education but disabled enough to discharge the debt with the bankruptcy court. Remember, obtaining the undue hardship discharge is possible if you qualify, but it isnt easy. Even if you dont qualify for the hardship discharge filing the case will often force the servicer to make a federal loan affordable. With private loans, you can often discharge the loan because there are few or no income-based repayments plans for private loans.

Recommended Reading: How Many Times Can You File Bankruptcy In Tn

The Bankruptcy Code And Non

Section 528 of the Bankruptcy Code details the specific types of debts that are not dischargeable in bankruptcy.

Until the Code was amended from its original form, student loan debts were not listed in Section 528 at all. The Code was then amended to include government subsidized student loans among the non-dischargeable debts. Then, in BAPCPA, amended again to include all student loans, including private student loans.

Why? Was there really a big problem with rich doctors running straight from medical school to bankruptcy court?

There was not. What there was, however, was a strong lobbying push by Sallie Mae and other student loan debt servicers in Congress. In other words, palms were greased, and a law was passed that made life worse for everybody except student loan servicers.

What Section 528 of the Code now reads is that student loan debt is non-dischargeable unless repayment would impose an undue hardship on the debtor and the debtors dependents.

Did Congress go so far, however, as to also include in the Code a definition of undue hardship?

It did not. It left that definition to the Courts.

Well-heeled, well-paid Federal judges naturally remembered where they came from when figuring it out.

Not.

You Can Get Student Loans While Youre In Chapter 13

Before you can borrow student loans, or any new debt, in Chapter 13, you have to get permission from the trustee. Youll also need to prepare a plan showing:

-

How continuing your education will help you repay your debts.

-

The new student loan debt wont stop you from making your plan payments.

-

You can pay back the student loan.

-

How the degree will increase your employment prospects and earning potential.

Student loan consolidation or refinance may be considered new debt in your jurisdiction. Check with your attorney before you apply for either type of loan.

Don’t Miss: Can You Discharge Medical Bills In Bankruptcy

Combining Government Loans Into Paye Repaye Ibr Idr Or Icr

An IBR or income-based repayment plan allows you to combine government loans into an affordable repayment that is never more than 15% of income. They base this on a sliding scale of 0% at the poverty level to 15% at the highest income for the worst income-based repayment program. Also, please note that some IBR programs cap at 10% others at 12%. At the end of 20 years, the balance is forgiven if the loan remains in a good payment status until it discharges. Payments are as low as zero dollars for IBR and since the program rewards you for every year the loan is repaid you never want to use an unemployment deferment or forbearance for IBR and public service loan programs. IBR is income-driven and based upon your disposable income and never more than 10%.

Havent There Been Cases Where People Still Got Rid Of Their Students Loans Through Bankruptcy

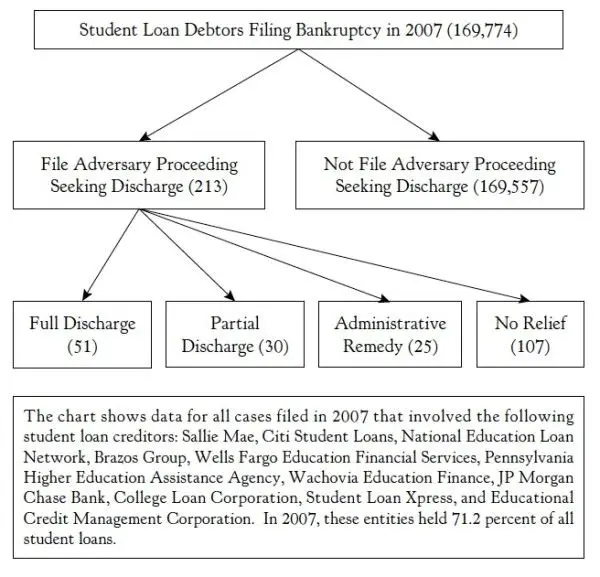

Absolutely. Though difficult, it is still possible to have student loans discharged through bankruptcy by meeting the undue hardship requirement. A 2011 study found that only 1 in 1,000 student loan borrowers who declared bankruptcy even tried to have their student loans discharged. However, those that did succeeded at a rate of 40%.

Section 523 of the Bankruptcy Code does not set out a specific test to determine what qualifies as undue hardship. The federal courts are split on what the appropriate standard should be for discharging student loan debt. The Second Circuit case, Brunner v. New York State Higher Education Services Corporation, established three requirements that determine whether undue hardship applies.

First, the borrower must demonstrate that if forced to repay the student loans, they will be unable to meet a minimal standard of living based on income and bills.

Second, the borrower must be unable to repay for a significant portion of the repayment period.

Third, they must have made good-faith efforts to repay the student loan.

If a bankruptcy court agrees that a borrower meets these three requirements, the court can discharge the student loan debt.

But bankruptcy courts in the Eighth Circuit and occasionally courts in the First Circuit reject Brunner and examine the totality of the circumstances instead.

You May Like: What Is The Chapter 11 Bankruptcy

Significance Of The New Guidance

Student loans are dischargeable in bankruptcy only because of undue hardship, and current bankruptcy court practice has made such discharges difficult to obtain while being overly intrusive in requiring personal information from the debtor. The Guidance seeks to rectify this by setting clear, transparent, and consistent expectations for discharge, reducing burdens on debtors by simplifying the process, and increasing the number of cases in which ED agrees to support a discharge.

To achieve these goals, the Guidance provides a more objective framework for applying the three-part test courts have used in deciding undue hardship:

- For the debtors present circumstances, the IRS Collection Financial Standards are used to determine that the debtor cannot repay the student loans while maintaining a minimal standard of living.

- For future circumstances, there is a presumption that the debtors inability to repay will persist if certain circumstances apply to the debtor.

- For good faith, objective criteria are used in its evaluation.

Decide Which Type Of Bankruptcy To File For

Next, on your own or with your lawyer, youll need to decide whether to file for Chapter 7 or Chapter 13 bankruptcy. Student loan bankruptcy can be addressed under either Chapter 7 or Chapter 13 bankruptcy, though its treated differently under the two categories.

Below is a breakdown of some of the qualifications and how each type of bankruptcy treats student loan debt:

Chapter 7 bankruptcy

- You must prove you have little disposable income available to pay off your debt.

- Most unsecured debt can get wiped out.

- Student loan debt may be eligible for discharge.

- The process can take about four months.

Chapter 13 bankruptcy

- You have some income to use to repay some of your debts.

- Your debt will be restructured, and some of it will need to be repaid.

- Student loan debt may be eligible but your repayment will be restructured, not discharged.

- The court process can last from two to six months, and the repayment plan can take three to five years.

Note that personal bankruptcy can come at the cost of hurting your credit for years. When it comes to your credit report, a Chapter 7 bankruptcy remains there for 10 years, while a Chapter 13 bankruptcy stays for seven years, which can make it difficult for you to secure loans or credit, as well as favorable rates. When you file for bankruptcy, you can also rack up significant legal and court fees along the way.

Don’t Miss: Can You File Bankruptcy On Student Loans In Kentucky

Procedure To Seek A Discharge

The court must consider these factors when you file an adversary proceeding against the lender asking that you be relieved of the student loan. This is like any lawsuit where you file a complaint against the lender setting forth the factors favoring discharge, and they are given an opportunity to answer. Thereafter, a hearing is conducted to determine if requiring you to repay the student loans would be an undue hardship on you or your dependents.

Consider Other Options Before Bankruptcy

Obtaining a bankruptcy discharge of your student loans is not easy, and fortunately there are other steps desperate borrowers can take before making this last-ditch effort.

“In proceedings where clients of ours have tried , if they can’t prove that they have no hope of paying back the debt, then the Department of Education usually responds by telling the borrower to enroll in an income-based repayment plan,” Hornsby explains.

Federal income-driven repayment plans recalculate your monthly bill based on any changes in your income. Your monthly student loan payment is therefore reflective of how much you can afford to pay.

Hornsby suggests income-driven repayment plans such as Pay As You Earn and Revised Pay As You Earn . With these programs, your credit score won’t be ruined like it would in bankruptcy proceedings, plus you’ll only need to pay 10% of your discretionary income. After the repayment period ends, any remaining balance is forgiven.

If your monthly payment is just too high, consider refinancing your student loans. Through refinancing, you can both score a lower interest rate and extend your loan term so that your monthly payments are lower. Though this means more months, or years, of interest collecting, it can help you in the immediate term if you are tight on cash.

You May Like: How Long After Bankruptcy Can You Buy A Car