Tracking The Federal Deficit: April 2019

The Congressional Budget Office reported that the federal government generated a $161 billion surplus in April, the seventh month of Fiscal Year 2019, for a total deficit of $531 billion so far this fiscal year. Aprils surplus is 33 percent less than the surplus recorded a year earlier in April 2018. If not for timing shifts of certain payments, the surplus would have been 5 percent smaller than the surplus in April 2018. Total revenues so far in Fiscal Year 2019 increased by 2 percent , while spending increased by 6 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Income tax refunds were down by 5 percent compared to last tax season, contrary to many analysts expectations. Further, outlays from the refundable earned income and child tax credits increased by 12 percent versus last year, reflecting expansions enacted in the Tax Cuts and Jobs Act of 2017. Net interest payments on the public debt continued to rise, up 13 percent compared to last year, largely as a result of higher interest rates and the nations steadily growing debt burden.

Us Government Debt Soars To $223 Trillion As Cost Of Servicing This Borrowing Rises

-

In 2021, US government borrowed an extra $3,434 on behalf of each citizen

-

US government debt is now a third larger than its pre-pandemic level, compared to an increase of just over one fifth for the rest of the world

-

Amid the growing US debt burden, the US economy performed very strongly, expanding 9.0% in 2021, significantly faster than the rise in borrowing for the year

DENVER, April 06, 2022—-As the second year of the pandemic passed, US government debt increased 6% in 2021 to $22.3 trillion according to the second annual Janus Henderson Sovereign Debt Index. The growth in US debt is poised to continue as the cost of servicing this borrowing is expected to reach record levels in 2023.

Globally, sovereign debt is expected to rise by 9.5% in 2022, up by $6.2 trillion to a record $71.6 trillion. The increase will be driven by the US, Japan and China in particular, though almost every country is likely to borrow further.

2021 saw sovereign debt levels hit new records

Every country Janus Henderson examined saw borrowing rise in 2021. Chinas debts rose fastest and by the most in cash terms, up by a fifth, or $650 billion. Among large, developed economies, Germany saw the biggest increase in percentage terms, with borrowing rising by one seventh , almost twice the pace of the global average.

2022 will see debt servicing costs significantly increase

Bond market opportunities for investors

|

Region |

|

|

100% |

2.17% |

Notes to editors

D10035

Contacts

How Much Is The Us National Debt

According to the U.S. Treasury Department, the current national debt of the U.S. is $31.3 trillion. Thatâs a huge number, and on a per capita basis, it equates to roughly $94,000 per citizen.

Individuals, however, donât have to worry about paying off their portion of the national debt. Instead, a percentage of the annual budget is used to service the debt.

Roughly 12% of total government spending for the year, or $48 billion, was employed in maintaining the U.S. national debt as of October 2022.

Also Check: Will Filing Bankruptcy Fix My Credit

How Consumer Debt Benefits The Economy

Consumer debt contributes to economic growth. As long as the economy grows, you can pay off this debt more quickly in the future. You go into debt for your education, which allows you to get a better-paying job. The job helps you pay for that education, furnish your home better, or get a car without having to save for it.

When consumers take out debt, they are spending. Consumer spending is good for businesses because it means they can make profits. Profits can be shared with investors or reinvested into businesses to help them grow, which is also good for the economy.

Interest rates on debt are one of the Fed’s economic control mechanisms that help to keep the economy from growing or shrinking too quickly. When debt is controlled, it can be healthy for an economy.

Debt By Year Compared To Nominal Gdp And Events

In the table below, the national debt is compared to GDP and influential events since 1929. The debt and GDP are given as of the end of the fourth quarter in each year to coincide with the end of the fiscal year. That’s the best way to accurately determine how spending in each fiscal year contributes to the debt and compare it to economic growth.

From 1947-1976, debt and GDP are given at the end of the second quarter since, during that time, the fiscal year ended on June 30. For years 1929 through 1946, debt is reported at the end of the second quarter, while GDP is reported annually, since quarterly figures are not available.

Don’t Miss: Us Debt To Gdp Chart

Us National Debt To Gdp

Thegross domestic product of a country is a measurement of economic activity. This can be further defined as the value that goods and services of the United States holds. The debt of the country is how much the country has borrowed to fund its sectors and activities. Debt-to-GDP is a measure of what a country owes compared to what it produces, and is an indicator of how a country might be able to pay back its debt. If a country is able to continuously pay interest on its debt without refinancing or hampering with economic growth, it is considered stable. The higher the debt-to-GDP ratio, the more trouble a country will have paying off public debt to external lenders.

The U.S. debt-to-GDP ratio was110% in the first quarter of 2020. This number is the U.S. national debt divided by the nominal GDP. The nominal GDP is the economic production with the current prices of goods and services considered. According to theWorld Bank, a debt-to-GDP ratio that exceeds 77% can slow down economic growth. Some consequences of this include lower wages, increased inflation, and higher taxes.

Changes Since Cbos Previous Projections

Relative to its estimates from September 2020, CBOs estimate of the deficit for 2021 is now $448 billion larger, and its projection of the cumulative deficit between 2021 and 2030 is now $345 billion smaller. In 2021, the costs of recently enacted legislation are partly offset by the effects of a stronger economy. In subsequent years, the largest changes stem from revisions to the economic forecast. CBO now projects stronger economic activity, higher inflation, and higher interest rates, boosting both revenues and outlaysthe former more than the latter.

Don’t Miss: Furniture Pallets For Sale

Forms Of Government Borrowing

In addition to selling Treasury bills, notes, and bonds, the U.S. government borrows by issuing Treasury Inflation-Protected Securities and Floating Rate Notes . Its borrowing instruments also include savings bonds as well as government account securities that represent intergovernmental debt.

Other nations have borrowed from international organizations like the International Monetary Fund and The World Bank as well as private financial institutions.

How To Look At The National Debt By Year

It’s best to look at a country’s national debt in context. During a recession, expansionary fiscal policy, such as spending and tax cuts, is often used to spur the economy back to health. If it boosts growth enough, it can reduce the debt. A growing economy produces more tax revenues to pay back the debt.

The theory of supply-side economics says the growth from tax cuts is enough to replace the tax revenue lost if the tax rate is above 50% of income. When tax rates are lower, the cuts worsen the national debt without boosting growth enough to replace lost revenue.

You May Like: Bankruptcy Process Chapter 13

Fiscal Year 2020 In Review

The federal government ran a deficit of $3.1 trillion in fiscal year 2020, more than triple the deficit for fiscal year 2019. This years deficit amounted to 15.2% of GDP, the greatest deficit as a share of the economy since 1945. FY2020 was the fifth year in a row that the deficit as a share of the economy grew. Revenues in FY2020 fell 1% from last year, while outlays surged 47%.

The FY2020 budget splits into two distinct halves: before and after COVID-19 and its economic fallout. In the first six months of the fiscal year , the deficit was running 8% above last years rate in the last six months , the deficit soared to eight times its level in those months last year.

Meanwhile, outlays in the first half of FY2020 grew 7% from last years rate. Then, from April through September, outlays almost doubled their level from those months last year, a $2 trillion increase. The character of spending increases also changed from the first to the second half of the year. From October through March, higher spending was driven by mandatory programsSocial Security, Medicare, and Medicaid. In the next six months, spending ballooned because of emergency responses to the pandemic and recession. Compared to the same months in FY2019, spending increased in April through September 2020 by:

Debt Issuance: Government Account Series

Debt held by government accountsin the form of Government Account Series securitiesis mostly determined by the transactions of a few large trust funds. When a trust fund receives cash that is not immediately needed to pay benefits or to cover the programs expenses, the Treasury credits the trust fund with that income by issuing GAS securities to the fund. The Treasury then uses the cash to finance the governments ongoing activities. When revenues for a trust fund program fall short of expenses, the reverse happens: The Treasury redeems some of the GAS securities. The crediting and redemption of securities are intragovernmental transactions between the Treasury and trust funds, but both directly affect the amount of debt subject to limit.

On many days, the amount of outstanding GAS securities does not change much. However, that amount can fall noticeably when redemptions occur because of the payment of benefits under programs such as Social Security and Medicare. The Treasury normally offsets the redemption of GAS securities, which reduces the amount of debt subject to limit, by borrowing additional amounts from the public to obtain the cash necessary to make benefit payments. In addition, most GAS securities pay interest to the funds holding them, and those payments are reinvested in the form of additional securities.7

Recommended Reading: How Long Does It Take To File Bankruptcy In Colorado

How The Large Us Debt Affects The Economy

In the short run, the economy and voters benefit from deficit spending because it drives economic growth and stability. The federal government pays for defense equipment, health care, building construction, and contracts with private businesses. New employees are then hired and they spend their salaries on necessities and wants, like gas, groceries, new clothes, and more. This consumer spending boosts the economy. As part of the components of GDP, federal government spending contributes around 7%.

Over the long term, debt holders could demand larger interest payments, because the debt-to-GDP ratio increases, and this high ratio of debt to gross domestic product tells investors that the country might have problems repaying them. That’s a newerand worryingoccurrence for the U.S. Back in 1988, the national debt was only half of what the U.S. produced that year.

What Was The National Debt At The End Of 2019

Debt subject to limit is similar to gross federal debt but does not include debt issued by agencies other than the Treasury and Federal Financing Bank. At the end of fiscal year 2019, this number was $22.7 trillion. The federal government creates an annual budget that allocates funding towards services and programs for the country.

You May Like: How To File Bankruptcy On Federal Student Loans

Tracking The Federal Deficit: April 2020

The Congressional Budget Office reported that the federal government generated a $737 billion deficit in April, the seventh month of fiscal year 2020. Aprils deficit is a $897 billion swing from the $160 billion surplus recorded a year earlier in April 2019. Aprils shortfall brings the total deficit so far this fiscal year to $1.48 trillion, which is 179% higher than the same period last year. Total revenues so far in FY2020 decreased by 10% , while spending increased by 29% , compared to the same period last year.

How Is The National Debt Measured

Measuring the national debt can bebroken into three parts: debt held by the public, gross federal debt, and debt subject to limit.

Debt held by the public is the amount of money that the U.S. treasury borrows from external lenders through financial markets. The money gathered funds the governments activities and programs. Many financial analysts and economists think of this portion of the debt as the most meaningful because it focuses on the money that is raised through financial markets. This portion of the debt is made up of two-thirds domestic creditors and one-third foreign creditors. By the end of fiscal year 2021, the debt held by the public was $22.3 trillion.

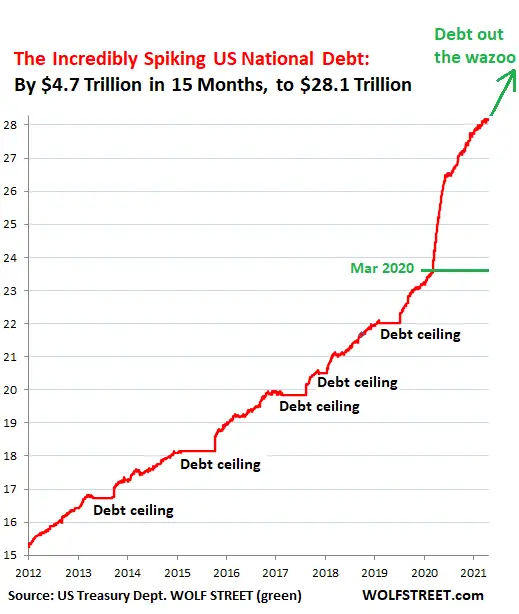

Gross federal debt includes the public debt and federal trust funds and other government accounts. This is the amount that the government owes other governments and itself. By the end of fiscal year 2021, the gross federal debt was $28.4 trillion .

Debt subject to limit is similar to gross federal debt but does not include debt issued by agencies other than the Treasury and Federal Financing Bank. At the end of fiscal year 2021, this number was $28.4 trillion.

You May Like: How Long Does Filing Bankruptcy Affect Your Credit

Gross Federal Debt Vs Net Debt

Chart D.16f: Federal Debt Gross and Net

The US federal government differentiates between Gross Debt issued by the US Treasury and Net Debt held by the public. The numbers on Gross Debt are published by the US Treasury here.Numbers on various categories of federal debt, including Gross Debt, debt held by federal government accounts, debt held by the public, and debt held by the Federal Reserve System, are published every year by the Office of Management and Budget in the Federal Budget in the Historical Tables as Table 7.1 Federal Debt at the End of the Year. The table starts in 1940. You can find the latest Table 7.1 in here.

The chart above shows three categories of federal debt.

1. Monetized debt , i.e., federal debt bought by the Federal Reserve System

2. Debt held by the federal government e.g., as IOUs for Social Security

3. Other debt , i.e., debt in public hands, including foreign governments.

Federal Outlays For The Major Health Care Programs By Category

Percentage of Gross Domestic Product

Medicare spending is projected to account for more than four-fifths of the increase in spending for the major health care programs over the next 30 years.

Data source: Congressional Budget Office. See www.cbo.gov/publication/56977#data.

CHIP = Childrens Health Insurance Program.

a. Includes the effects of premiums and other offsetting receipts.

b. Marketplace Subsidies refers to spending to subsidize health insurance purchased through the marketplaces established under the Affordable Care Act and related spending.

Also Check: How To File For Bankruptcy Without A Lawyer

Interest Rates On Federal Debt Held By The Public

CBO also examined the sensitivity of its projection of federal debt to changes in interest rates. The agency projected economic and budgetary outcomes under two scenarios in which federal borrowing rates are higher and lower, respectively, by a differential that increases by 5 basis points per year relative to the rates underlying the agencys extended baseline.35

- If federal borrowing rates were higher by a differential that starts at 5 basis points in 2021 and increases by 5 basis points each year , federal debt held by the public would be 260 percent of GDP in 2051 rather than the 202 percent in the extended baseline projection.36

- If federal borrowing rates were lower by a differential that starts at 5 basis points in 2021 and increases by 5 basis points each year , federal debt held by the public would be 160 percent of GDP in 2051.37

Effects Incorporated In Cbos Extended Baseline Projections

The high and rising path of federal borrowing in CBOs extended baseline projections would have adverse economic consequences over the longer term. Although interest rates remain low for an extended time in those projections, the eventual rise in rates together with the larger amount of debt would lead to an increase in interest costs over the next 30 years. CBOs extended baseline projections and the accompanying economic projections reflect the effects of those rising costs on investment and on national income.

Crowding Out of Private Investment. When the government borrows in financial markets, it does so from people and businesses whose savings would otherwise finance private investment, such as factories and computers. Although an increase in government borrowing strengthens peoples incentive to savein part by boosting interest ratesthe resulting rise in private saving is not as large as the increase in government borrowing therefore, national saving, or the amount of domestic resources available for private investment, declines.11 Private investment falls by less than national saving does in response to larger government deficits, however, because the higher interest rates that are likely to result from increased federal borrowing tend to attract more foreign capital to the United States.

Read Also: Chapter 7 Bankruptcy Virginia

Tracking The Federal Deficit: February 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $312 billion in February 2021, the fifth month of fiscal year 2021. This months deficitthe difference between $246 billion in revenue and $558 billion in spendingwas $77 billion more than last Februarys. The deficit so far in fiscal year 2021 has climbed to just over $1 trillion, an 83% year-over-year increase . Year-over-year, total spending has risen by 25% and revenues have increased by 5%.

Analysis of Notable Trends: Increased spending in February, and fiscal year 2021 as a whole, mostly resulted from pandemic relief legislation. For instance, the Small Business Administrations Paycheck Protection Program accounted for most of the $133 billion spending increase from last February to this one. SBA outlays soared to $91 billion this February compared to only $100 million in the same month last year. The other largest spending changes were greater outlays on unemployment compensation and $17 billion less in refundable tax credit payments because of a delayed start to the tax filing season this year.

Despite a historic recession, revenues were 5% higher in the first five months of fiscal year 2021 than during the same period last year . This healthy growth is surprising, especially when compared to the onset of the last major recession: In the first five months of fiscal year 2009, revenues plunged 11% year-over-year.