Why Does Larger National Debt Attract Bond Buyer

Having a large national debt doesnt always discourage buyers of bonds. For example, the United States has a debt to GDP ratio of 108% and a lot of people want to buy US Treasury bonds.

You can see this data summary of US Local & State Government Debt for more information.

Some countries, such as the USA are always considered a good place to invest, and the government bonds of those countries are always in high demand.

Why Does The National Debt Matter

What makes America strong is our willingness to build and leave a better future for the next generation. Unfortunately, our growing debt is doing the opposite.

America faces many challenges including rising inequality, unaffordable healthcare, a changing climate, failing education, crumbling infrastructure, and unpredictable security threats. To address these challenges we will need significant resources. Every dollar that goes toward interest payments means less resources available to build a stronger, more resilient future.

Being irresponsible with our budget is simply not fair to our kids and grandkids, who will inherit this debt.

RISING INTEREST IN THE BUDGET

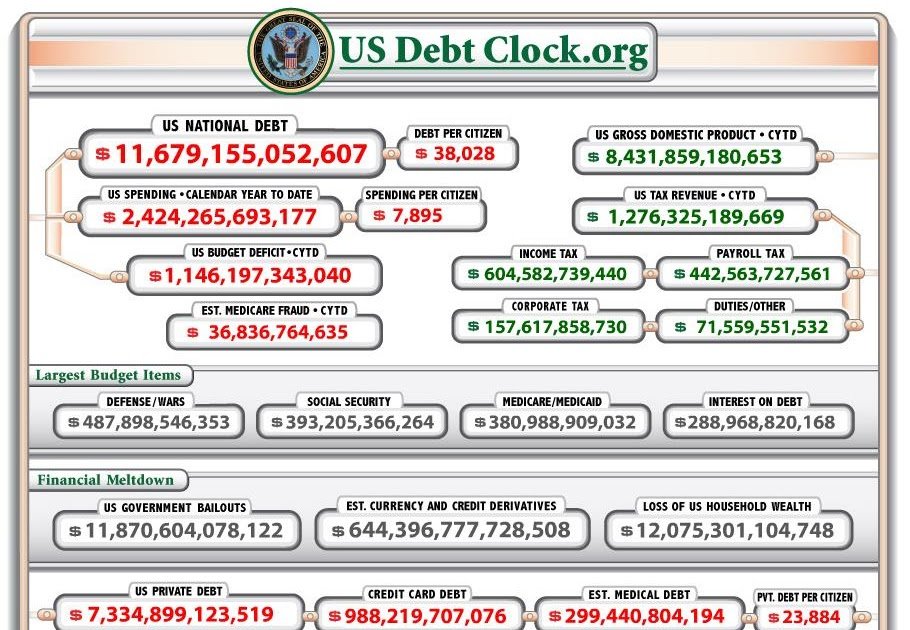

Each business day, the U.S. Treasury Department reports the amount of total debt outstanding as of the previous business day. Our debt clocks are updated daily based on this number. In addition, our formula uses the debt projections from the Congressional Budget Office , to estimate the rate at which the debt is currently growing. Those CBO projections are updated 2-3 times per year.

Debt per person is calculated by dividing the total debt outstanding by the population of the United States, as .

The $30 trillion gross federal debt equals debt held by the public plus debt held by federal trust funds and other government accounts. Learn more about different ways to measure our national debt.

MORE RESOURCES

Do Government Deficits Recover

This situation creates an annual deficit that is unlikely to end until the accumulated debt becomes unsustainable and the governments finances collapse.

Other governments only borrow to stimulate the economy during a recession, calculating that they can repay that debt once expansion returns and produces a government budget surplus.

If the country and its government have a good reputation, the instruments that it issues in order to raise debt to cover a deficit represent a safe investment. See our example on foreign investors in U.S debt.

Governments that run constant deficits to buy votes find it difficult to attract loans.

Read Also: Can A Creditor Sue After Bankruptcy

Other Sources Of Public

This identified 30 trillion Yuan of debts raised through the derivative markets and other shadow banking methods.

The Institute also noted a further total of 10 trillion Yuan in obligations that were obscured by lease agreements and other public-private partnership techniques.

This amounts to an extra 40 trillion Yuan of public debt that is not reported in the countrys national debt figure.

That is another 41.6% of GDP, bringing the true debt to GDP ratio for Chinas national debt up to 92.8%.

Student Loan Debt Clock

Student Loan Debt Clock

This Student Loan Debt clock reports an estimate of current student loan debt outstanding, including both federal and private student loans. This student loan debt clock is intended for entertainment purposes only. The actual total debt outstanding demonstrates more volatility at the beginning of each semester, when most student loans are disbursed.

In June 2010, total student loan debt outstanding exceeded total credit card debt outstanding for the first time. The seasonally adjusted figure for revolving credit in the Federal Reserves G.19 current report was $826.5 billion in June 2010. Revolving credit started declining in September 2008 when it reached a peak of $975.7 billion. The decrease is probably due a combination of higher minimum payments on credit cards, which were increased to 4% from 2%, lower credit card limits and tighter credit underwriting. Student loan debt, on the other hand, as been growing steadily because need-based grants have not been keeping pace with increases in college costs. Federal student loan debt outstanding reached approximately $665 billion and private student loan debt reached approximately $168 billion in June 2010, for a total student loan debt outstanding of $833 billion. Total student loan debt is increasing at a rate of about $2,853.88 per second.

Practical tips for minimizing debt and reducing the cost of education financing include:

Don’t Miss: When Should A Company File For Bankruptcy

Who Manages Chinas National Debt

There are two types of public debt instruments in China:

- Central government bonds

- Municipal bonds

The Chinese central governments Ministry of Finance is responsible for raising funds for the national government and also supervising debt instruments issued by local governments.

Overall economic activity and public finances are governed by a separate committee, called the Central Economic and Financial Commission.

The Ministry of Finance and even the Minister of Finance is answerable to this committee, which is steered by the President of the Republic, Xi Jinping.

How Are Debt Clocks Calculated

Well use the United Kingdom as an example:

1 We obtain the latest data regarding the countrys national debt and the 10-year average interest rate they pay on it, like:

National Debt: $1,717,879,000,000 10-Year Interest Rate: 2.50

2 Using these two figures we can then calculate how much the debt increases per year and subsequently per second.

Increase per Year: $42,946,975,000 Increase per Second: $1,362

3 We then work out the time difference between when the data was obtained and when the debt clock is being viewed by a visitor.

Time Difference = Time and Date of Visit Time and Date of Official Figure

4 The current debt is then calculated by adding the increase over this time to the official figure.

Current National Debt = Official Figure +

5 The debt clock then updates every two seconds, increasing according to the figures calculated in step 2.

Current National Debt = ) x Exchange Rate

Contents

You May Like: How To File Bankruptcy In Kansas

What Is The National Debt

The national debt is the debt that the federal government holds which includes public debt, federal trust funds, and government accounts. As the total amount of deficit that the government has garnered, it is a number that encompasses what the government owes itself and others. The national debt is looked at in three parts: debt held by the public, gross federal debt, and debt subject to limit. Debt held by the public is the money gathered to fund activities and programs, with money borrowed from external lenders. The gross federal debt includes the public debt, but also adds federal trust funds and governments. Debt subject to limit is similar to gross federal debt, but only includes debt issued by the treasury and Federal Financing Bank.

As of July 2020, the national debt is more than $26.5 trillion. This number equates to $80,422 for every person living in the u.S., and is 123% of the U.S.’s annual economic output. As of June 2020 the debt-to-GDP ratio was 120.5%, due to the economic strain of the COVID-19 pandemic.

Summary Of Chinese Public Debt Types

The majority of Chinese public debt is not officially owed by the central government.

However, all of that debt is ultimately guaranteed by the national government of China and should rightfully be recorded in its entirety as the Chinese national debt. The location of those debts are ranked below:

So, an investigation of Chinas national debt requires more research at the local government level that in the national government accounts.

These figures for total public debt also do not touch upon the undisclosed debts of state-owned banks and state-owned enterprises, which represent a large sector of the Chinese economy.

What facts should you know about Chinas national debt?

- You could wrap $1 bills around the Earth 35,794 times with the debt amount.

- If you lay $1 bills on top of each other they would make a pile 1,004,216 km, or 623,990 miles high.

- That’s equivalent to 2.61 trips to the Moon.

Don’t Miss: When Will My Bankruptcy Be Off My Credit Report

When Was The Debt Clock Installed

Real estate investor Seymour Durst created the debt clock in 1989. At that time, the national debt was almost $3 trillion and 50% of the gross domestic product . It was initially installed on 42nd Street and Sixth Avenue in New York City. Durst is famously quoted as saying, If it bothers people, then it’s working.

Durst also bought front-page newspaper ads to further express his concern about the growing national debt. He conveyed a prophetic message in his 1991 message: “Federal debt soaring, national economy shrinking, soon the twain shall meet.”

The debt clock faithfully recorded the increasing U.S. debt until 2000. That’s when the prosperity of the 1990s created enough revenue to reduce the federal budget deficit and debt. It seemed as if the debt clock had accomplished its goal.

Unfortunately, that prosperity didnt last. The 2001 recession and the 9/11 terrorist attacks meant lower revenues and higher government spending, which added to the debt. The national debt exceeded $6 trillion by July 2002more than double what the national debt was when the clock was initially installed. The Durst Corporation reactivated the clock at that time. When the debt exceeded $10 trillion in September 2008, one more digit had to be added.

The national debt has grown by more than $18 trillion since the financial crisis in 2008. In 2020 alone, the national debt hit four new milestones. The table below highlights several national debt milestones from 2017 through 2021.

| Debt Milestone |

|---|

Quebecs Public Sector Debt

Our Quebec Debt Clock shows the growth of the public sector debt in real time. Public sector debt includes the governments gross debt as well as the debt of Hydro-Québec, of the municipalities, and of the universities other than the Université du Québec and its constituent universities.

Based on data provided by the Quebec Department of Finance in its March 2022 budget , we estimate that the debt will increase by $14.9 billion by March 31, 2023, the equivalent of $40.8 million per day, $28,344 per minute, or $472 per second.

When analyzing a governments indebtedness, it is necessary to go beyond what it manages directly and include the health and education networks, municipalities and other entities under the governments ultimate responsibility, since the government guarantees their debt. Public sector debt is therefore the most exhaustive measure of Quebecs debt, the one that provides a picture of what the government of Quebec borrows either directly or indirectly.

The only liquid assets of the government, those that could be sold quickly to pay off debt, are net financial assets. These assets came to $16 billion as of March 31, 2022. It is hard to assess the market value of government-owned fixed assets and infrastructure since there are no relevant markets. Moreover, it is highly unlikely that the government would sell schools or bridges at some point to pay off the debt.

Components of the public sector debt

Recommended Reading: How To Declare Bankruptcy In Missouri

How Does The Chinese Government Raise Loans

The Ministry of Finance does not advertise its schedule of bond sales, nor does it disclose any other securities that it might use to cover cash flow issues or raise short-term financing.

All government debt is issued in Yuan, which is not convertible to foreign currencies and so there is no interest in these bonds for foreign investors.

Similarly, municipal bonds are written in Yuan and not intended for purchase by overseas investors.

Central government bonds are not intended for sale to the general public but are distributed behind closed doors to the major Chinese banks, which are all state-owned.

Personal Debt In Ontario

So, as you can see, Ontario has a real problem with debt. However, so do the citizens of the province. While they have one of the more manageable individual debt levels in the country, that doesnt mean people still dont have trouble dealing with their debts.

Check out our infographic to know more about the rise of household debt in Canada.

Also Check: Can You Include Tax Debt In Bankruptcy

How Government Debts Affect You

The approximate interest rate on the cost of market debt in Canada is about 2.01 percent. Interestingly enough, the country accrues $75 million of debt per day in interest charges alone. That trickles down to the taxpayers, many of whom are seeking debt relief options for themselves.

According to the Financial Post, a study shows that Canada is a world leader in debt. One hypothesis for the debt getting so high is the fact that Canada came out largely unscathed from the last financial crisis. Low interest rates encouraged more borrowing, which led to bankruptcies and other economic downturns.

Other Impacts Of Rising Interest Rates

When interest rates rise, the cost of mortgages on properties rise and so the cost of rents also rise. The increase in the cost of premises forces businesses to increase their prices in order to remain in profit.

This in turn increases the cost of living and causes inflation without economic growth. A workforce faced with an increased cost of living will demand higher wages.

This increases business costs and the price of goods, stoking inflation further. It doesnt help that companies tend to cut costs through employee salaries.

Eventually, businesses will be squeezed to the point of bankruptcy or move their production abroad to save their profitability.

You May Like: How Many Times Can You File Bankruptcy In North Carolina

Why Is National Debt A Problem

If a government increases its national debt to a level that the market thinks is too high, it will have to increase the interest it pay in order to find lenders.

With the backstop of a high return from a safe source, banks do not need to lend to businesses to make a profit. When banks are less interested in offering loans, they raise interest rates for all borrowers.

High interest on loans increases business costs and the return on investment that is funded on debt reduces. In this instance, businesses cease to expand and unemployment rises.

Which Countries Have The Lowest National Debt

Does national debt matter? Is it an indication of financial stability? Not always.

There is only one debt-free country as per the IMF database. For many countries, the unusually low national debt could be due to failing to report actual figures to the IMF.

Another instance where low national debt might be a bad sign is if a countrys economy is so underdeveloped that nobody would want to lend to them.

Here the ten least indebted nations in the world in 2020 as per the IMFs reported data:

| Rank | |

|---|---|

| Congo, Dem. Rep. of the | 16.1% |

| 16.5% |

Don’t Miss: What Assets Are Exempt In Chapter 7 Bankruptcy

Do Foreign Countries Own National Debt

For example, Japan owns $1.276 trillions worth of US government debt.

You can research the economies of the largest US national debt holders. See our economic overviews of Brazil, China, the UK, Belgium, and India.

The ten largest holding nations of US government debt as of September 2020 are shown in the table below:

| Rank |

|---|

Why Is This Important

Interests costs continue to rise, meaning that much of government spending may go towards paying it off. This means that areas of development such as education and infrastructure could receive less funding as more and more is allocated towards interest payments. In addition to this, higher interest rates create obstacles for private investments which affect economic growth. When the interest rate is high, it can be harder for businesses and individuals to receive funding and investments.

The national debt does not only affect the economy and its growth – it can also have a large effect on individuals and their livelihoods. As investments become harder to gain, businesses increase the costs of goods and services to balance out debt service obligations. In the long term, this can lead to lower investment returns. In addition to the possibility of paying more for goods and services, the average income for a family of four is projected to if debt continues to grow. This means that the money spent on necessities and luxuries will decrease. In addition to this, rising debt can equate to higher interest rates, meaning that houses, cars, and loans for college or businesses will become more expensive. In addition to this, the government may need to cut budgets around various programs which can affect those who rely on Medicare or Social Security to live.

Want to know more about how the debt is affecting our fiscal future? Check out our graphs and see it for yourself!

Don’t Miss: What Is The Best Way To Rebuild Credit After Bankruptcy

America’s $28t Debt Explained In One Chart

In response to the pandemic, the U.S. Government initially sent $2T of stimulus into the economy. Nearly a year later, theyre readying another set of relief money. Everything from direct payments to workers, guaranteed loans to small businesses, and unemployment benefits are on the table. All the activity from the first bill has been adding to the national debt, which as our latest visual illustrates, has been exploding for years. And this next bill could accelerate the move. You can check out the U.S. debt clock in real-time here.

- For the first 50 years in our visual from 1929 until 1979, the U.S. national debt only grew gradually. It was just $16B in 1929 or about 16% of GDP, rising to $827B or 31% of GDP in 1979.

- Debt levels started to explode during the 1980s and 1990s, rising from $908B when Volcker raised the Fed rate to 20% to tame inflation to $5.6T when the Glass-Steagall Act was repealed in 1999.

- In the late 1990s, the growth of the national debt slowed down. The U.S. government actually ran a surplus in 2000, and the debt decreased as a percentage of GDP from 65% in 1995 to 55% in 2001.

-

The U.S. debt resumed its skyrocketing trajectory with the War on Terror, the Great Recession, and now the Coronavirus crisis. It already hit 127% of GDP in Q3 of 2020 and is projected to double to 202% by 2051.

About the article