You Cant Force The Creditors To Accept Lump Sum Payment Through Debt Settlement

For Debt Management to be effective, the creditors have to accept your offers. Creditors can be forced to take a court-approved Chapter 13 bankruptcy plan or Chapter7. Bankruptcy has the power of a federal judge and court orders to force creditors. These orders can strip a second mortgage or order the lender to release the lien from your car if you pay the cars value through redemption, whether the bank likes it or not. Only bankruptcy has the power to force a restructure. Some states allow the credit card company to take the debt settlement payment and sue anyway due to a lack of consideration.

How Does Bankruptcy Affect Your Credit

Chapter 7 bankruptcy remains on your credit reports for ten years from the filing date a Chapter 13 bankruptcy will affect your credit reports and scores for seven years. However, over time, the impact on your score will fade.

According to FICO, the higher your starting score, the more points youll lose by filing bankruptcy. If your score is 680, expect to lose 130-150 points. And if youre starting at 780, a bankruptcy filing will cost you 220-240 points.

Is Bankruptcy Or Debt Relief Right For Me

Have an attorney explain your state’s exemptions and bankruptcy laws, and give you honest feedback on your financial situation. A debt settlement program could be the right step for you if your debt is not very large or you have a steady income. In many cases, filing a bankruptcy case is the fastest way to bring down your total debt.

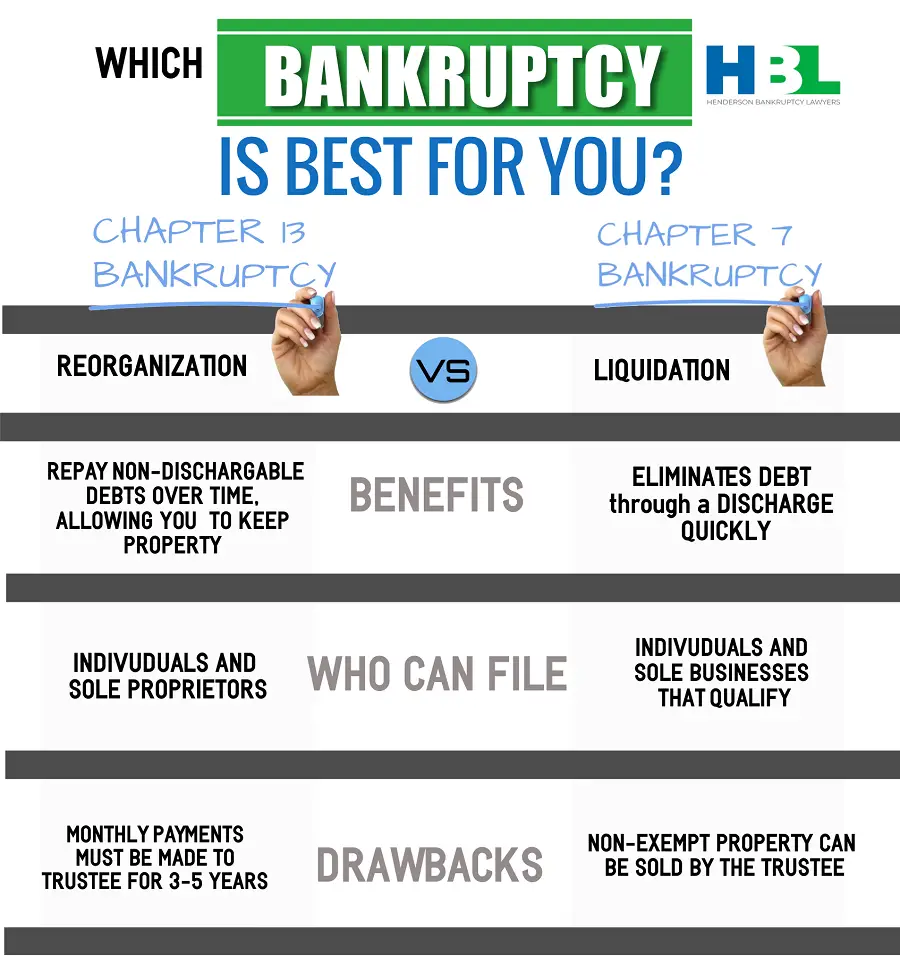

Chapter 13 bankruptcy requires a repayment plan, so it may not be the right type of bankruptcy if you do not have a steady income. It can help people who want to stop creditor harassment and need more time to pay down their debt. Chapter 7 bankruptcy will dismiss unsecured debts, and you do not need to pay them back. It also requires creditors to follow bankruptcy laws, helps control asset repossession, and can rebuild creditworthiness as you make new payments on time.

Many people think hiring a bankruptcy lawyer will increase their debt. While you must pay filing fees and attorney’s fees , it can be cost-effective in the long run as your debts are fully discharged faster.

You May Like: City Of Jacksonville Foreclosure Listings

Con: You Are Responsible For Making Sure That The Settlement Is Properly Documented

When entering into a settlement agreement, it is not enough to have the creditors customer service representative tell you that if you pay a certain amount, the debt will be settled. In fact, a good rule of thumb is that anything you are told verbally means nothing, unless you get it in writing. I cannot count the number of times Ive been told by a client that they were offered a settlement if they just paid a certain amount immediately, and after they made the payment, the creditor would change the terms, or would deny that there was a settlement agreement at all. So, again, any settlement agreement that you enter into must be in writing.

How Debt Settlements Work

Most debt settlement agencies operate by making the client send in monthly payments to the settlement company which are are held in an account. The account continues to grow–without any payments being made to your creditors. Once the debt settlement agency reaches an agreement with one of your creditors, they pay out the funds in the account to that particular creditor and the process starts all over again. The process of settling a debt with just one creditor can take several months to years. During this time, your other creditors get nothing and continue to harass you. Furthermore, your accounts are still being reported as “delinquent”.

CONSEQUENCES OF DEBT SETTLEMENT

NO GUARANTEE OF SUCCESS: Your creditors do not have to agree to debt settlements nor do they even have speak with these companies. Creditor participation is voluntary. Even if the debt settlement agency is able to settle one of your debts, you are likely to still be left with thousands of debt from the creditors that have refused to negotiate.

PENALTIES AND INTEREST CONTINUE TO ACCRUE: Debt settlements can take a very long time. During this process, penalties, interest, and late fees continue to accrue on your accounts.

NO LEGAL PROTECTION: During your debt settlement program, there is no legal protection that prevents you from being sued or having your wages garnished by any of your creditors. Furthermore, debt settlement companies cannot stop a foreclosure, repossession or wage garnishment.

You May Like: Can You Refile Bankruptcy If Dismissed

Pro: No Formal Court Proceeding

Debt settlement is done by working directly with the creditor. Therefore, there are no formal court proceedings involved, and no need to comply with complex court rules or to obtain the approval of a judge. This means that you do not have to pay court filing fees, and incur other expenses normally associated with court proceedings. The only thing that is required is that you and the creditor agree on the terms of the settlement, and that each of you do what you agreed to do. Of course, this does not mean that the debt settlement process is completely informal, and you still have to make sure that the settlement is properly documented .

Which Is Right For You

Neither debt settlement nor bankruptcy should be your first approach to dealing with debt. Assuming youve exhausted all other options , debt settlement or bankruptcy could offer a way out.

If youve managed to keep your accounts in good standing thus far, understand that stopping payments to start the process of debt settlement is going to do real harm to your credit reputation, and you could be bombarded with collection calls or even lawsuits. On the other hand, filing for bankruptcy removes the pressure of debt collectors, but it will become a part of your public record and remain on your credit report for up to 10 years.

That said, bankruptcy is best for those who have a very large amount of debt, and for whom there is no end in sight for reducing that debt. Though bankruptcy has consequences from a credit perspective and youll have to pay lawyer fees, it shuts down debt collectors and forgiven debt is not taxable. Then, once your balances are discharged , you can start back on the road to recovery.

For those with the means to set aside some funds, or who dont have enough debt to warrant a bankruptcy filing, negotiating down what you owe through debt settlement could end up being the more favorable option. You could try to do this on your own, but the risky part is that there are no guarantees that your creditors will agree to work with you.

Read Also: Can You Discharge Private Student Loans In Bankruptcy

Who Chapter 13 Bankruptcy May Be Best For

- Borrowers who can afford three to five years of payments: To get a Chapter 13 bankruptcy approved, a borrower must propose a reasonable payment plan for the next three to five years. The net payment may be less than the overall debt, but it needs to meet the courts requirements and must be maintained.

- Those who have assets to protect: Because there isnt a liquidation of nonexempt assets in a Chapter 13 bankruptcy, it works well for those who have assets they want to protect.

- Individuals who do not qualify for Chapter 7: When a borrower fails the means test or doesnt qualify for Chapter 7 for another reason, Chapter 13 might be a suitable alternative.

- Consumers with debt that doesnt exceed limits: Chapter 13 is limited to borrowers who have no more than $394,725 of unsecured debt or $1,184,200 of secured debt.

How Chapter 13 Bankruptcy Works

Unlike Chapter 7, which entirely wipes out your debt by liquidating your assets, Chapter 13 involves a court-approved three to five years payment plan to pay off your debts. Once youve made all the payments under the plan, youll get a discharge of your debts.

Also referred to as reorganization bankruptcy or wage earners plan, this type of bankruptcy protects your personal property. However, it can have a severe impact on your credit score.

Recommended Reading: What Is Filing For Bankruptcy Mean

Debt Settlement Vs Filing For Bankruptcy: Pros And Cons

- Copy Link URLCopied!

Dear Liz: I owe a credit card company about $16,900. I have not been able to make payments for almost two years and have no money. They recently sent me a proposal to pay off the entire amount at 30 cents on the dollar by making 24 payments of a little over $200 per month. Im concerned they can then resell the unpaid amount to a debt collector and that it really isnt a solution for the entire debt to be extinguished, even if I agree to their proposal. Am I right?

Answer: In the past, poor record-keeping and unethical behavior meant some debt buyers routinely re-sold debts that were supposed to be settled. While that can still happen, its less likely, especially if youre dealing with the original creditor or a company thats collecting on the creditors behalf, rather than a company that purchased an older debt.

Youve been offered a pretty good deal, says Michael Bovee, president of debt settlement company Consumer Recovery Network. Typically debts are settled for 40 to 50 cents on the dollar.

That doesnt mean you should take it, necessarily. You have to be able to make the payments to get the debt settled, for one thing. Also, any debt thats forgiven can be treated as income to you. The creditor will send you a Form 1099-C showing the forgiven amount and youll typically owe income taxes on that amount unless youre insolvent. If youre in the 25% tax bracket, that would add roughly $3,000 to the cost of settling this debt.

Defining Debt Settlement And Bankruptcy

As you probably know, bankruptcy means you legally admit that you cannot pay your debts. Bankruptcy is a legal process that protects you against your creditors, discharges most of your debt, and allows you to rebuild your finances essentially from scratch. Not paying your debts severely damages your credit, but filing for bankruptcy helps fix your credit.

Debt settlement is when you negotiate with your creditors to settle your debt in a lump sum for less than the total amount. For example, lets say you have $25,000 in credit card debt. You may settle with the credit card company by paying a lump sum of $15,000 if you have the money. A credit card debt settlement company or debt settlement attorney negotiates with the creditor by withholding your payments until the creditor agrees to a lesser amount. Your credit ends up hurting badly just as with bankruptcy, but the damage sometimes isnt as bad.

Read Also: Free Government Foreclosure Listings

Getting Advice On Debt Settlement Vs Bankruptcy

Neither bankruptcy nor debt settlement is a simple process. Thats why, when considering debt settlement vs bankruptcy, its important to seek financial advice from a certified credit counselor. At American Consumer Credit Counseling , we offer free credit counseling sessions that can help you to size up the benefits of debt settlement vs bankruptcy, as well as a variety of other options for finding debt relief. Our counselors are available six days each week by phone or in person to help you take stock of your financial situation and explore all your options for getting out of debt. We can answer questions like, What is a debt settlement programs impact on my credit rating? and direct you to social service and educational resources that can help you to better address your financial issues.

Contact us today for a free credit counseling session to discuss the benefits of debt settlement vs bankruptcy, as well as other options such as a debt management plan.

Cons Of Chapter 13 Bankruptcy

- It can take as many as five years to repay your debts.

- Your disposable income that money you have after necessities are paid is obligated to payments for the duration of the plan.

- Your credit score will take a massive hit.

- Bankruptcy debtors lose their credit cards which exist on the date they file.

- Like Chapter 7, Chapter 13 cannot get you out of student loan debt .

- Chapter 13 bankruptcy debtors still have to make payments for domestic obligations, such as alimony and child support.

Don’t Miss: Telephone Number For Overstock Com

Pros And Cons Of Credit Counseling

-

Non-profit credit counselors are regulated, and their fees are restricted.

-

Consolidating debt into a DMP simplifies your payments.

-

Reducing your interest rate can help you pay your debts off faster.

And here are the cons:

-

Debt management plans dont work if the payment is unaffordable.

Debt management plans and credit counseling are good solutions for people who are not in serious debt trouble.

How Many Times Can You File For Bankruptcy

Theres no specific limit on the number of times you can file for bankruptcy, though you can receive debt relief from bankruptcy only once every several years.

For example, if you filed for Chapter 7 bankruptcy, you cannot discharge debts again via Chapter 7 for eight years. If you used Chapter 7 previously, you must wait four years to try to discharge more debts via Chapter 13.

Don’t Miss: Us National Debt Gdp

Chapter 13 Bankruptcy And Debts

Chapter 13 bankruptcy helps you reorganize debt and hold onto your personal property. This bankruptcy filing doesnt eliminate debt, but it will reduce your financial burden.

Both parties will agree to a debt repayment plan. The court will then mandate it. You can hold onto your house and car if you make payments within the predetermined deadline .

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: When Does A Bankruptcy Come Off Your Credit

Bankruptcy Vs Debt Consolidation

Time to go head to head: bankruptcy vs. debt consolidation. Debt consolidation and debt settlement are related, but distinct, ways to deal with debt. People tend to explore debt consolidation or debt settlement prior to considering bankruptcy. We get asked questions comparing bankruptcy to debt settlement or debt consolidation all the time: Bankruptcy or debt settlement? Bankruptcy or debt consolidation? Here well breakdown common myths and misconceptions that show you the pros and cons of bankruptcy versus debt settlement.

First, lets explain the differences between debt settlement and debt consolidation. In debt settlement, you are typically paying a company to settle your debt for less than the total amount you owe. In debt consolidation, you are typically paying a company to manage your debt payments to third party creditors. This allows you to pay one company versus paying several.

To the untrained eye, both sound like reasonable options until you realize the problems. In most cases, you end up in a far worse position than if you had simply filed a bankruptcy.

Both debt consolidation and debt settlement come with a number of issues.

Debt Settlement Success Rate

According to the FTC, Completion rates range from 35% to 60%, with the average around 45% to 50%. While most companies defined a completion as having all debts settled, there were two that considered a client completed if they had settled at least 80% of the debt and one if they had settled at least 50% of the debt.

Debt settlement enjoys a higher success rate than Chapter 13 bankruptcy or credit counseling. The FTC explains that the higher rate is likely because the consumer has more control over the process. The consumer debtor is in the best position to determine the feasibility of and likelihood of compliance with a repayment plan. By empowering the debtor with this ability and combining that with the constant hand-holding of the debt settlement companys customer service representative, there is a greater likelihood of completion with a debt settlement program.

Also Check: High End Liquidation Pallets

Trust Our Team To Guide You Through Bankruptcy

To learn more about the benefits of bankruptcy or other debt relief options, call, email or chat with us today. We offer convenient morning, afternoon and evening appointments. Our offices are located in Greensburg, Latrobe, and Johnstown, Pennsylvania. We offer free personalized debt consultations at our convenient office locations and by phone.

If you are experiencing a financial setback and need debt relief, its imperative to contact an experienced lawyer.

Con: Bankruptcy Is Complex

Bankruptcy is a complex process and is hard to do without a lawyer. A mistake during the bankruptcy process can have serious consequences. For example, it can result in you losing assets or property that you did not realize you would lose, it can result in the dismissal of the bankruptcy, or it can even result in the denial of your discharge . The process becomes more complex if your income is higher than the median , or if you are doing a Chapter 13 bankruptcy. In short, in order to successfully file for bankruptcy, you will almost always need legal assistance.

You May Like: When Does Foreclosure Start