Nominal Gdp Sector Composition

Nominal GDP sector composition, 2015 at 2005 constant prices

| No. |

|---|

There were approximately 160.4 million people in the U.S. labor force in 2017, the fourth largest labor force in the world behind China, India, and the European Union.The government employed 22 million in 2010. Small businesses are the nation’s largest employer, representing 37% of American workers. The second-largest share of employment belongs to large businesses employing 36% of the U.S. workforce.White collar workers comprise 44% of the workforce as of 2022, up from 34% in 2000.

The nation’s private sector employs 85% of working Americans. Government accounts for 14% of all U.S. workers. Over 99% of all private employing organizations in the U.S. are small businesses. The 30 million small businesses in the U.S. account for 64% of newly created jobs . Jobs in small businesses accounted for 70% of those created in the last decade.

As of December 2017, the unemployment rate in the U.S. was 4.1% or 6.6 million people. The government’s broader U-6 unemployment rate, which includes the part-time underemployed, was 8.1% or 8.2 million people. These figures were calculated with a civilian labor force of approximately 160.6 million people, relative to a U.S. population of approximately 327 million people.

Energy Transportation And Telecommunications

Road

The U.S. economy is heavily dependent on road transport for moving people and goods. Personal transportation is dominated by automobiles, which operate on a network of four million miles of public roads, including one of the world’s longest highway systems at 57,000 miles . The world’s second-largest automobile market, the United States has the highest rate of per-capita vehicle ownership in the world, with 765 vehicles per 1,000 Americans. About 40% of personal vehicles are vans, SUVs, or light trucks.

Rail

Mass transit accounts for 9% of total U.S. work trips.Transport of goods by rail is extensive, though relatively low numbers of passengers use intercity rail to travel, partially due to the low population density throughout much of the nation. However, ridership on Amtrak, the national intercity passenger rail system, grew by almost 37% between 2000 and 2010. Also, light rail development has increased in recent years. The state of California is currently constructing the nation’s first high-speed rail system.

Airline

The civil airline industry is entirely privately owned and has been largely deregulated since 1978, while most major airports are publicly owned. The three largest airlines in the world by passengers carried are U.S.-based American Airlines is number one after its 2013 acquisition by U.S. Airways. Of the world’s thirty busiest passenger airports, twelve are in the United States, including the busiest, HartsfieldJackson Atlanta International Airport.

Notable Companies And Markets

According to Fortune Global 500 2011, the ten largest U.S. employers were Walmart, U.S. Postal Service, IBM, UPS, McDonald’s, Target Corporation, Kroger, The Home Depot, General Electric, and Sears Holdings.

Apple Inc., , IBM, McDonald’s, and Microsoft are the world’s five most valuable brands in an index published by Millward Brown.

A 2012 Deloitte report published in STORES magazine indicated that of the world’s top 250 largest retailers by retail sales revenue in fiscal year 2010, 32% of those retailers were based in the United States, and those 32% accounted for 41% of the total retail sales revenue of the top 250. is the world’s largest online retailer.

Half of the world’s 20 largest semiconductor manufacturers by sales were American-origin in 2011.

Most of the world’s largest charitable foundations were founded by Americans.

American producers create nearly all of the world’s highest-grossing films. Many of the world’s best-selling music artists are based in the United States. U.S. tourism sector welcomes approximately sixty million international visitors every year. In a recent study by Salam Standard, it has been reported that the United States is the biggest beneficiary of global Muslim tourism spend, enjoying 24 percent share of the total Muslimtravel spend worldwide or almost $35 billion.

Recommended Reading: Who Can File Chapter 7 Bankruptcy

Definition Of Public Debt

Economists also debate the definition of public debt. Krugman argued in May 2010 that the debt held by the public is the right measure to use, while Reinhart has testified to the President’s Fiscal Reform Commission that gross debt is the appropriate measure. The Center on Budget and Policy Priorities cited research by several economists supporting the use of the lower debt held by the public figure as a more accurate measure of the debt burden, disagreeing with these Commission members.

There is debate regarding the economic nature of the intragovernmental debt, which was approximately $4.6 trillion in February 2011. For example, the CBPP argues: that “large increases in can also push up interest rates and increase the amount of future interest payments the federal government must make to lenders outside of the United States, which reduces Americans’ income. By contrast, intragovernmental debt has no such effects because it is simply money the federal government owes to itself.” However, if the U.S. government continues to run “on budget” deficits as projected by the CBO and OMB for the foreseeable future, it will have to issue marketable Treasury bills and bonds to pay for the projected shortfall in the Social Security program. This will result in “debt held by the public” replacing “intragovernmental debt”.

Is There A Connection Between National Debt And Inflation

In the first half of 2022, the U.S. inflation rate was around 8.3%. That was up from 3.4% in the first half of 2021, and 1.2% in the first half of 2020.

With inflation increasing at such a rapid rate, many Americans worry about the relationship between inflation and the U.S. national debt. Some Americans may suspect that the national debt is exacerbating the sizable price increases theyâre seeing for food, gas and other necessities.

But experts are divided on whether there is a causal relationship between the national debt and inflation.

âThereâs not a lot of good evidence to suggest government spending has driven much inflation,â says Nicholas Creel, assistant professor of business law at Georgia College and State University.

Jeanette Garretty, chief economist and managing director at Robertson Stephens, believes that inflation may exacerbate the deficit, and therefore the national debt.

âHigh inflation leads to higher interest rates, and higher interest rates will make financing the debt more expensive for the federal government,â says Garretty.

While the jury is out on whether the national debt worsens inflation, rising prices and higher interest rates make servicing the national debt more expensive, and this could potentially lead to higher taxes down the road.

You May Like: Can You File Bankruptcy On Government Debt

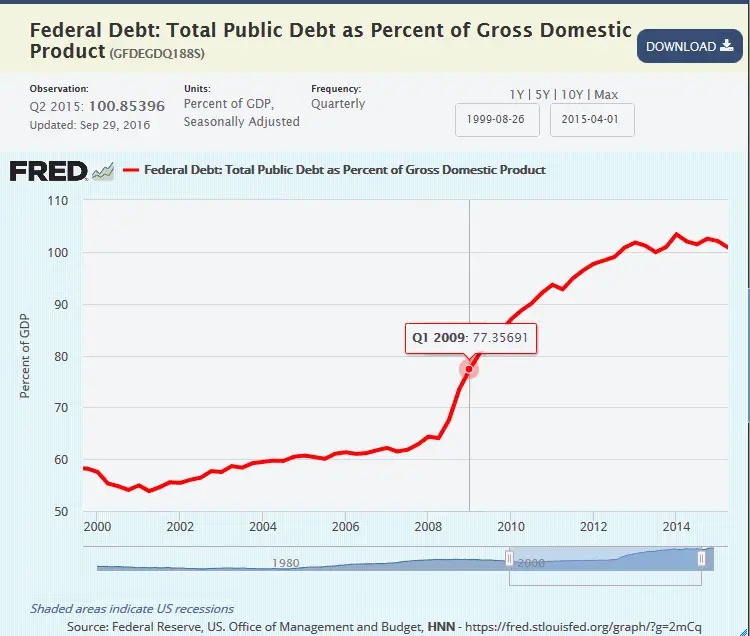

Federal Debt: Total Public Debt As Percent Of Gross Domestic Product

Observation:

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Release: Debt to Gross Domestic Product Ratios

Units: Percent of GDP, Seasonally Adjusted

Frequency: Quarterly

Notes:

Federal Debt: Total Public Debt as Percent of Gross Domestic Product was first constructed by the Federal Reserve Bank of St. Louis in October 2012. It is calculated using Federal Government Debt: Total Public Debt and Gross Domestic Product, 1 Decimal :GFDEGDQ188S = /GDP)*100

Concerns Over Chinese Holdings Of Us Debt

According to a 2013 Forbes article, many American and other economic analysts have expressed concerns on account of the People’s Republic of China’s “extensive” holdings of United States government debt as part of their reserves. The National Defense Authorization Act of FY2012 included a provision requiring the Secretary of Defense to conduct a “national security risk assessment of U.S. federal debt held by China.” The department issued its report in July 2012, stating that “attempting to use U.S. Treasury securities as a coercive tool would have limited effect and likely would do more harm to China than to the United States. An August 19, 2013 Congressional Research Service report said that the threat is not credible and the effect would be limited even if carried out. The report said that the threat would not offer “China deterrence options, whether in the diplomatic, military, or economic realms, and this would remain true both in peacetime and in scenarios of crisis or war.”

Don’t Miss: Wholesale Pallets Merchandise Houston Tx

United States Government Debt To Gdp Analysis

United-states government debt to GDP measures a countrys public debt to its gross domestic product . By comparing what United-states owes with what it produces, the debt-to-GDP ratio reliably indicates United-statess ability to pay back its debts. Often expressed as a percentage, this ratio can also be interpreted as the number of years needed to pay back debt, if GDP is dedicated entirely to debt repayment. If a country is unable to pay its debt, it defaults, which could cause a financial panic in the domestic and international markets. The higher the debt-to-GDP ratio, the less likely the country will pay back its debt and the higher its risk of default. Explore MacroVar financial knowledge base structured by professional fund managers and economists.

Research Spending By Multinational Corporations

The federal government and most of the 50 states that make up the United States offer tax credits to particular industries and companies to encourage them to engage in research and development . Congress usually renews a tax credit every few years. According to a survey by The Wall Street Journal in 2012, companies do not factor in these credits when making decisions about investing in R& D, since they cannot rely on these credits being renewed.

In 2014, four U.S. multinational corporations figured in the Top 50 for the volume of expenditure on R& D: Microsoft, Intel, Johnson & Johnson and Google. Several have figured in the Top 20 for at least ten years: Intel, Microsoft, Johnson & Johnson, Pfizer and IBM. Google was included in this table for the first time in 2013.

Global top 50 companies by R& D volume and intensity, 2014* R& D intensity is defined as R& D expenditure divided by net sales.** Although incorporated in the Netherlands, Airbus’s principal manufacturing facilities are located in France, Germany, Spain and the UK.Source: UNESCO Science Report: towards 2030 , Table 9.3, based on Hernández et al. EU R& D Scoreboard: the 2014 EU Industrial R& D Investment Scoreboard. European Commission: Brussels, Table 2.2.

Also Check: How Soon After Bankruptcy Can You Purchase A Car

Composition Of Economic Sectors

The United States is the world’s second-largest manufacturer, with a 2013 industrial output of US$2.4 trillion. Its manufacturing output is greater than of Germany, France, India, and Brazil combined.Its main industries include petroleum, steel, automobiles, construction machinery, aerospace, agricultural machinery, telecommunications, chemicals, electronics, food processing, consumer goods, lumber, and mining.

The U.S. leads the world in airplane manufacturing, which represents a large portion of U.S. industrial output. American companies such as Boeing, Cessna , Lockheed Martin , and General Dynamics produce a majority of the world’s civilian and military aircraft in factories across the United States.

The manufacturing sector of the U.S. economy has experienced substantial job losses over the past several years. In January 2004, the number of such jobs stood at 14.3 million, down by 3.0 million jobs since July 2000 and about 5.2 million since the historical peak in 1979. Employment in manufacturing was its lowest since July 1950. The number of steel workers fell from 500,000 in 1980 to 224,000 in 2000.

Products include wheat, corn, other grains, fruits, vegetables, cotton beef, pork, poultry, dairy products, forest products, and fish.

Negative Real Interest Rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low. Between 1946 and 1974, the U.S. debt-to-GDP ratio fell from 121% to 32% even though there were surpluses in only eight of those years which were much smaller than the deficits.

Read Also: What Is Debt To Income Ratio For Conventional Mortgage

Us National Debt To Gdp Ratio By Year

The national debt to GDP ratio therefore measures a countrys debt vs its total output. Economists disagree where the ideal range for this ratio is. Ideally this ratio would be as close to zero as possible . However, most economists agree that some public debt is necessary to spur growth and investment.

The ideal range for this ratio is typically cited to be somewhere between 40-80%. Where a country falls on that scale depends on how developed they are, and what kind of debt is owed. After 80%, countries usually face a risk of adverse effects from the high levels of debt.

However, some debt is much more risky than others. For instance, foreign owed debt is much worse than internal debt Internal debt can be held by public citizens, but also can be held by social programs designed to pay citizens back .

As you can see in the chart, the US ratio has varied greatly over the last century. During World War II the ratio skyrocketed due to higher government spending as well as efforts to rebuild Europe such as the . In the years following the ratio lowered due to spending cuts, as well as the US economys postwar boom.

In recent years the US ratio has greatly increased once again due to the 2008 global financial crisis and COVID-19 pandemic relief. This would suggest that in future years, taxes will need to increase, or spending lowered to help bring the ratio down to more reasonable levels.

United States Government Debt To Gdp Momentum

United States government debt to gdp momentum is monitored by calculating its long-term year over year return and its short-term month on month return.

Free Monitor of United States Financial Markets & Economic trends

MacroVar monitors global financial markets and economies using advanced Data Analytics. Sign up Free to manage your investments, trading & business strategy using MacroVar data analytics tools and historical data access.

Don’t Miss: What Happens If You Claim Bankruptcies

How Do You Calculate The Debt

To get the debt-to-GDP ratio, you divide a nations debt by its GDP.

You can use several sources to find the information you need to calculate a countrys GDP. For example, you can use the U.S. Treasurys Debt to the Penny website, which gives a complete breakdown of how much the government owes.

You can also use the Bureau of Economic Analysis National Income and Product Accounts to find GDP for recent periods.

Mapping The Impact Of Excessive Debt Onto The United States And China

Because the United States and China are the worlds two largest economies and the two most commonly comparedand because the structures of their economies, their financial systems, and their debt are so differentit might make sense to compare the two on these points to show just how different the adverse impact of too much debt in different countries can be.

Before making such a comparison, it is worth noting that there are many reasons, which are usually ignored, unfortunatelythat can make direct comparisons of debt levels between two countries of very limited use. These include income levels, debt structure, and underlying economic volatility.

On the subject of income levels, if a group of countries are graphed by their debt levels versus their income levels , it becomes obvious that the relationship has a positive slope. This means that the richer a country is, the higher the debt level it is able to sustain. That being the case, comparing the debt level of a rich country with that of a middle-income or poor country understates the riskiness of the latter.

These various conditions all work by exacerbating the four consequences of excessive debt discussed in this essay. It is instructive to compare China and the United States according to each of the consequences: transfers, financial distress, bezzle, and hysteresis.

Transfers

Financial Distress

Bezzle

Hysteresis

Read Also: How To Get Approved For A Car Loan After Bankruptcy

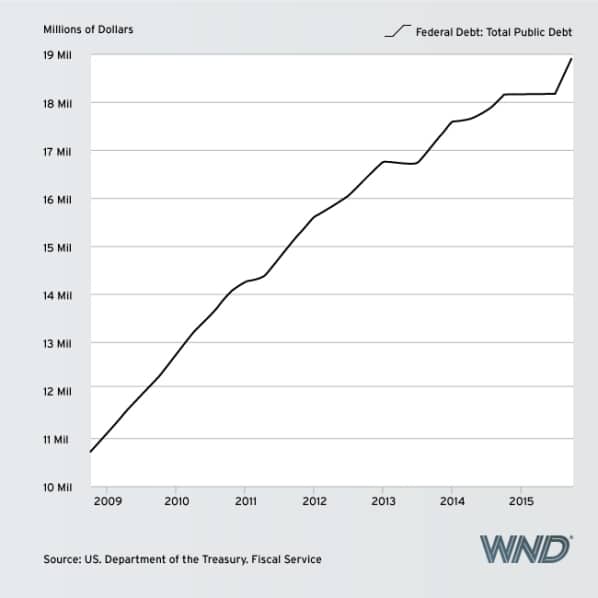

Public And Government Accounts

As of July 20, 2020, debt held by the public was $20.57 trillion, and intragovernmental holdings were $5.94 trillion, for a total of $26.51 trillion. Debt held by the public was approximately 77% of GDP in 2017, ranked 43rd highest out of 207 countries. The CBO forecast in April 2018 that the ratio will rise to nearly 100% by 2028, perhaps higher if current policies are extended beyond their scheduled expiration date.

The national debt can also be classified into marketable or non-marketable securities. Most of the marketable securities are Treasury notes, bills, and bonds held by investors and governments globally. The non-marketable securities are mainly the “government account series” owed to certain government trust funds such as the Social Security Trust Fund, which represented $2.82 trillion in 2017.

The non-marketable securities represent amounts owed to program beneficiaries. For example, in the cash upon receipt but spent for other purposes. If the government continues to run deficits in other parts of the budget, the government will have to issue debt held by the public to fund the Social Security Trust Fund, in effect exchanging one type of debt for the other. Other large intragovernmental holders include the Federal Housing Administration, the Federal Savings and Loan Corporation’s Resolution Fund and the Federal Hospital Insurance Trust Fund .