Lower Your Monthly Debt Obligations

Temporarily prioritize debt payments over savings and investment account contributions, other than any employer-sponsored plan contributions you must make to qualify for your employer match. Throw as much money as you can at smaller debt balances that you can zero out quickly, Martucci advises. Eliminating these payments and accounts will reduce your DTI ratio.

What Is A Good Dti Ratio

A good target for a front-end DTI ratio is below 28%, and a good target for a back-end DTI is below 36%.

But you can qualify for a mortgage with a higher DTI. The requirement will vary by the lender and type of mortgage.

Ideally, though, youll want to keep your DTIs as low as possible, regardless of lenders limits. Paying down debt will help improve your, and a higher credit score and lower DTI ratio will help you get a better mortgage interest rate.

» MORE:The best lenders for low credit score borrowers

Loans Which Dont Use Dti For Approval

Mortgage lenders use DTI to see whether homes are affordable for a U.S. home buyer. They verify income and debts as part of the process.

However, there are several high-profile mortgage programs which are more flexible about the DTI calculation. These include loan options from the FHA, the VA, and Fannie Mae and Freddie Mac.

Also Check: Can You File Bankruptcy On State Taxes

How We Got Aimee’s Mortgage Approved

Buying our first home had been a priority for us for a while, but my partners debts and history of bad credit prevented us from getting approved on the high street. Online Mortgage Advisor grabbed my attention after seeing loads of great reviews about how they have helped people in similar circumstances to us. I filled out a form to be matched with an advisor and thats exactly what happened.

They told me I would be able to borrow just in my name but would need more deposit, which gave me my focus for the next 12 months. Once I had saved the extra deposit, I didnt have to lift a finger and, before I knew it, was offered two mortgage lenders to choose from.

Weve now got our three-bed semi-detached house and couldnt have done it without the continued support of Online Mortgage Advisor and their network of experts.

How Do You Lower Your Debt

If you’re worried that your high DTI may prevent you from getting your desired home loan, you can try to lower it before beginning the mortgage application process. Usually, this means either paying down your debt or increasing your income.

If you have credit card debt spread among multiple cards, using a debt consolidation personal loan can help you organize all those payments into just one monthly payment at a potentially lower interest rate. This helps you pay down the balance faster since you’re saving on interest. Select ranked the as one of the best for debt consolidation since it allows you to use the funds to pay up to 10 creditors directly.

-

6.99% to 24.99% APR when you sign up for autopay

-

Loan purpose

Debt consolidation, home improvement, wedding, moving and relocation or vacation

See rates and fees, terms apply.

You May Like: Where To Buy A Car After Bankruptcy

Calculating Debt For A Mortgage Approval

For most mortgage applicants, calculating debt is more complex than calculating income. Not all debt on a credit report should be included in your DTI, and some debt which is not listed on a credit report should be used.

Lenders split debts into two categories: front-end and back-end.

- Front-end ratio: Includes debts that relate to housing expenses: your mortgage payment, property taxes, and homeowners insurance premiums, for example

- Back-end ratio: Includes minimum payments to your credit card companies, car payments, and student loan payments as well as your total monthly housing payment

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

You May Like: How To Find Out If A Company Filed Bankruptcy

What Is The Max Debt

The maximum debt-to-income ratio differs from lender to lender.

- Non-bank lenders: Non-Australian Deposit-taking Institutions do not always apply DTI limits, because they are unregulated by the Australian Prudential Regulation Authority . However, they will often take DTI ratio limits into consideration when assessing loans. Our Home Loan Experts have all the tools regarding our large panel of lenders.

- ANZ: Applications where the DTI ratio is greater than 7.5 will no longer be considered home loans by ANZ.

- Commonwealth Bank: They monitor applications with a DTI higher than 4.5, while applications that are 7 DTI or higher need to be manually approved by their credit department.

- National Australia Bank: Their DTI ratio cap is 8 for all home loan applications.

- Westpac: For a DTI ratio of 7 or greater, your application will be referred to their credit department for further review.

- Other lenders: Other major and smaller banks and lenders set their own DTI ratio benchmarks, and are broadly in line with major banks.

Call us on 1300 889 743 or fill in our to learn more about your DTI.

We know how to get your home loan approved in this new debt-to-income ratio environment.

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

Also Check: What Is The Usa’s National Debt

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

How Do You Increase Your Credit Rating For Ruoff Home Mortgage

Unless your credit is flawless , spend some time cleaning it up.

Your credit scores are not included in your credit reports. Getting a free copy of your credit score is pretty simple. For instance, many leading credit card companies offer your fico score without charge.

You can view your vantage score on other websites, but you should know lenders use this scoring model far less frequently than fico and can vary significantly from your fico score.

Most conventional lenders consider 620 to 640 to be the minimal credit score required for a mortgage. If you meet additional requirements, certain government-backed loans can let you borrow with a credit score as low as 500. However, your loan will be more reasonable with a higher credit score.

Making on-time, complete payments on your debts is one of the best strategies to raise your credit score. The most strongly weighted component, payment history, accounts for 35% of your credit score.

Another 30% of your credit score depends on how much debt you have compared to the total amount of credit provided to you. Therefore, it is advisable to keep your debt as low as possible.

Finally, wait a few months before you plan to make any large purchases on credit or establish additional lines of credit.

Check out: Rocket Mortgage Fieldhouse Review 2023: What you need to know

You May Like: Debt Of Average American

What Goes Into A Debt

Debt-to-income ratios come in two forms: the front-end DTI and the back-end DTI. Lenders look at both of these when considering your loan application.

Heres how those break down:

- Front-end DTI: Also called a PITI ratio , this number reflects your total housing debt in relation to your monthly income. If you take home $6,000 per month and are trying to buy a home that would require a $1,500 monthly payment, your front-end DTI would be:

- Back-end DTI: Your back-end DTI encompasses all your monthly debts in relation to your income. For example, if you make $6,000 a month, have a $600 car payment, a $400 student loan payment, and an expected $1,500 mortgage payment, your back-end DTI would look like this:

For most lenders, the back-end DTI is most important, as it more accurately reflects what you can afford each month.

What Debts Are Included In A Mortgage Debt To Income Ratio Calculation

The sort of relevant debts can include lots of different things:

- Loans and credit cards.

- Debt Management Plan repayments.

Having debt doesn’t necessarily mean you won’t be approved for a mortgage – and you can even look at remortgaging as a way to consolidate other debts and streamline your outgoings.

The impact will depend on what sort of debt you have, how substantial the repayments are, and what your net disposable income looks like.

You May Like: Do You Lose Your Vehicle In Bankruptcy

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

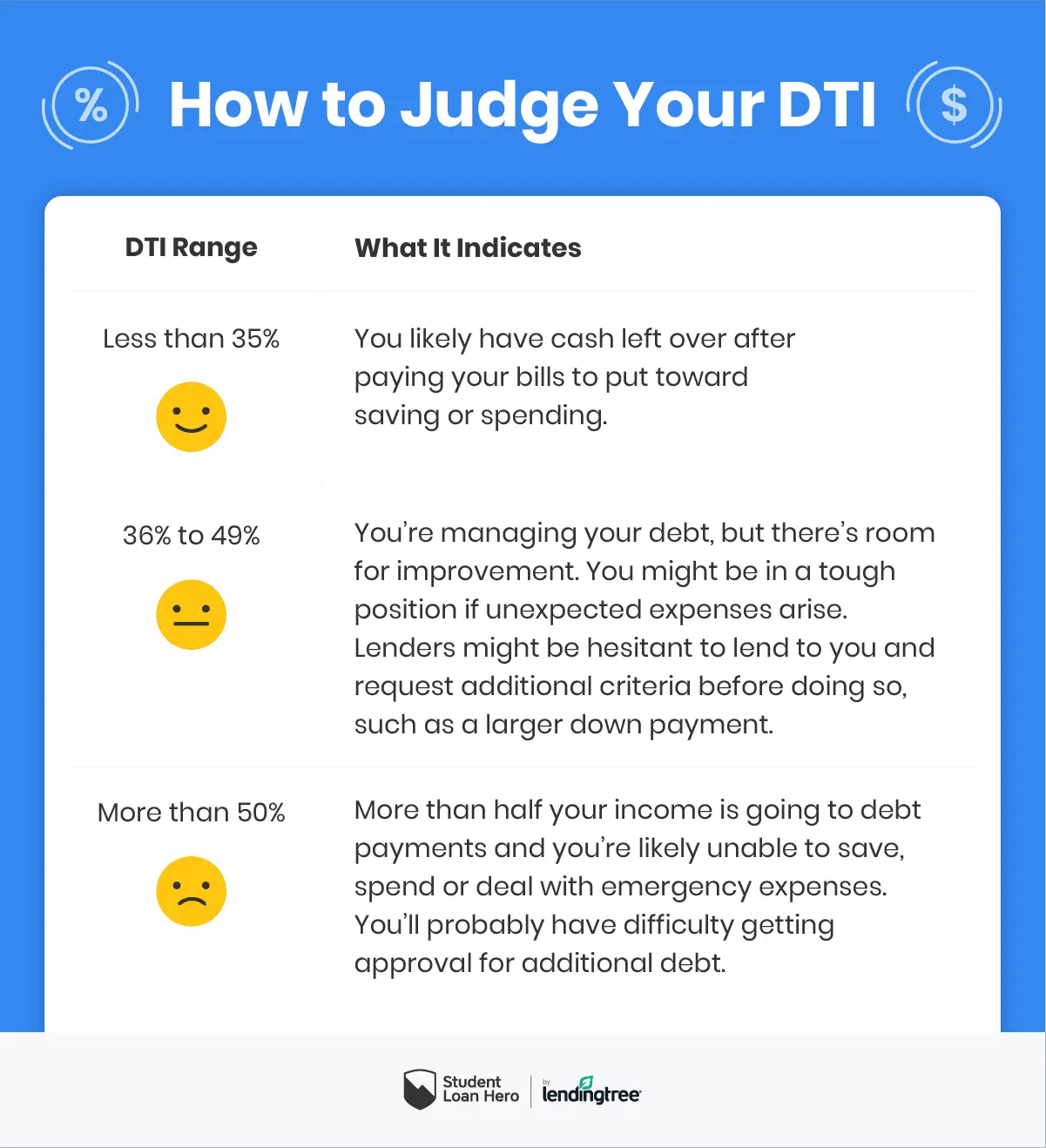

If Your Dti Is Less Than 36%

Youre in great shape. Approval for most loans, including car loans and consolidation loans should be easy. Even mortgage approval should go smoother with a DTI in the optimal range. However, a great DTI ratio does not guarantee the best loan terms . As such, in addition to ensuring that your debt-to-income percentage stays low, make sure your credit score is healthy by maintaining a low credit utilization rate, making on-time payments, and keeping credit inquiries to a minimum.

Recommended Reading: What Are The Different Bankruptcies

Calculating Income For A Mortgage Approval

Mortgage lenders calculate income a little bit differently than you may expect. Theres more than just the take-home pay to consider, for example.

Lenders also perform special math for bonus income give credit for certain itemized tax deductions and apply specific guidelines to part-time work.

The simplest income calculations apply to W-2 employees who receive no bonus and make no itemized deductions.

For W-2 employees, the lender will typically look at your pay stubs and use the year-to-date average to determine your gross income and your monthly household income.

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Don’t Miss: What To Wear To Bankruptcy Court

How Can I Improve My Debt

If youre having trouble getting approved for a mortgage or simply want a better rate, there are a few ways to improve your DTI:

- Pay off debt. The simplest way to lower your DTI is to reduce your debt. You can do this by paying down your current debts faster which will raise your DTI initially, but significantly reduce it in the long run.

- Postpone large purchases. If you know youll be applying for a mortgage soon, try to postpone any large purchases, as theyll increase your DTI.

- Refinancing. Refinancing high-interest debts reduces your interest rate, meaning more of your money goes towards the principal and the debt will be paid off sooner.

- Increase your income. A part-time job, pay raise, or any other increase to your monthly earnings reduces your debt relative to your income.

- Consolidate. If you have debts, consider consolidating to reduce your monthly minimum payment.

Dont apply if your DTI is high

Your DTI is the most important factor when determining your mortgage rate but your credit score and other expenses matter, too. DTI calculations dont include monthly obligations such as insurance and utility payments, or food and entertainment costs. A high DTI could mean struggling to cover your mortgage payments and monthly expenses. So wait until your have a lower DTI ratio to get a good rae and avoid taking out a loan you cant afford.

How Do You Calculate Debt

The formula for calculating your DTI is actually pretty simple: You’ll just need to add up your total monthly debt payments and divide it by your total gross monthly income.

Let’s say you have a student loan payment, a car payment and a credit card payment that total to $1,000 per month. Your gross monthly income is $5,000. When we divide 1,000 by 5,000 , we get 0.2, which is 20%. So in this case, your DTI is 20%.

Also Check: Chapter 13 Bankruptcy Conventional Loan

What Is A Debt To Income Ratio And Why Does It Matter

A debt to income ratio looks at how much you need to pay each month towards debts, compared to what you earn. The earnings figure is gross, so before taxes and any other deductions.

In essence, this ratio shows a lender how much debt you are in, compared to what you earn to assess how risky your application is.

To calculate your debt to income ratio:

- Add up your monthly recurring debt repayments.

- Add up your monthly gross income and wages, including benefits.

- Divide the debts by the income, and then multiply by 100 to get a percentage.

As an illustration, if you pay debts of £1,000 a month and earn £2,500, then your debt to income ratio is 40%.

How Is Your Dti Ratio Calculated

To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income the total amount you earn each month before taxes, withholdings and expenses.

For example, if you owe $2,000 in debt each month and your monthly gross income is $6,000, your DTI ratio would be 33 percent. In other words, you spend 33 percent of your monthly income on your debt payments.

Don’t Miss: Can Private Student Loans Be Discharged In Bankruptcy

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

Read Also: How Long Does Bankruptcy Last In Australia

What Do Your Dti Results Mean

A high debt-to-income ratio means that a significant portion of your income goes towards paying down your debts, leaving you with little leftover cash to put towards other expenses or set aside for savinga red flag to potential lenders. Having less disposable monthly income can lead to a greater reliance on credit cards and thus, more debt. Plus, having a significant chunk of your income claimed by bills limits your ability to cover unexpected expenses like an ill-timed car accident or medical emergency.

A low debt-to-income ratio, on the other hand, indicates financial stability. It shows youre not debt-burdened or bogged down with other financial obligations. Lenders view this positively because it means you have greater discretionary income and the financial means to take on more debt while also being able to afford other expenses that may arise.

How To Lower Your Debt

To improve yourDTI ratio, the best thing you can do is either pay down existing debt or increase your income.

While paying down debt, avoid taking on any additional debt or applying for new credit cards. If planning to make a large purchase, consider waiting until after you’ve bought a home. Try putting as much as you can intosaving for a down payment. A larger down payment means you’ll need to borrow less on a mortgage. Use aDTI calculator to monitor your progress each month, and consider speaking with a lender toget pre-qualifiedfor a mortgage.

Also Check: How Many Years Between Chapter 7 Bankruptcy