What Conditions Should Be Met To Discharge Tax Debt

Do you want to discharge your tax debts? If you do, filing for Chapter 7 bankruptcy will be your best option. But you should make sure that the tax debt will be qualified for discharge, making you eligible to file for Chapter 7. With that said, here are the conditions you must meet in order to discharge your tax debt through Chapter 7 bankruptcy:

Furthermore, aside from the conditions mentioned, some jurisdictions have also additional requirements. For example, in the Ninth Circuit, filing for tax returns promptly is a must, and filing late automatically precludes a discharge.

There are other complications if you are a dual-status alien with tax debt and want to file for bankruptcy.

Moreover, it is also applicable in Chapter 7 that if you have paid off non-dischargeable taxes through a credit card, the credit card balance will be subject to a non-dischargeable debt too.

Does Bankruptcy Clear Irs Debt The Simple Answer

The simple answer here is:

Sometimes.

If a Chapter 7 bankruptcy is discharged, the IRS tax debt listed will likely be erased if all the criteria are met.

If a Chapter 13 bankruptcy is discharged, the IRS tax debt may be reduced greatly if the criteria are met. In this case, the remaining debt will be placed on a payment plan with the bankruptcy court.

If it is not discharged or placed in a Chapter 13 payment plan or you stop paying on the plan, the collection can continue. The IRS will still be there waiting.

They dont forget about an owed tax debt.

A chapter 7 will be the better option to clear or erase a tax debt with the IRS.

You Must Have Filed Your Tax Return At Least Two Years Ago

The tax return for the debt you wish to discharge must have been filed at least two years before filing for bankruptcy. The time is measured from the date you actually filed the return, not when it was due.

Additionally, if the IRS filed the return for you called Substitute for Return you never officially filed. Therefore, you do not meet this test.

Read Also: How To File For Bankruptcy In Florida Without A Lawyer

You May Like: Listing Of Foreclosures For Free

Chapter 11 And 13 Bankruptcy

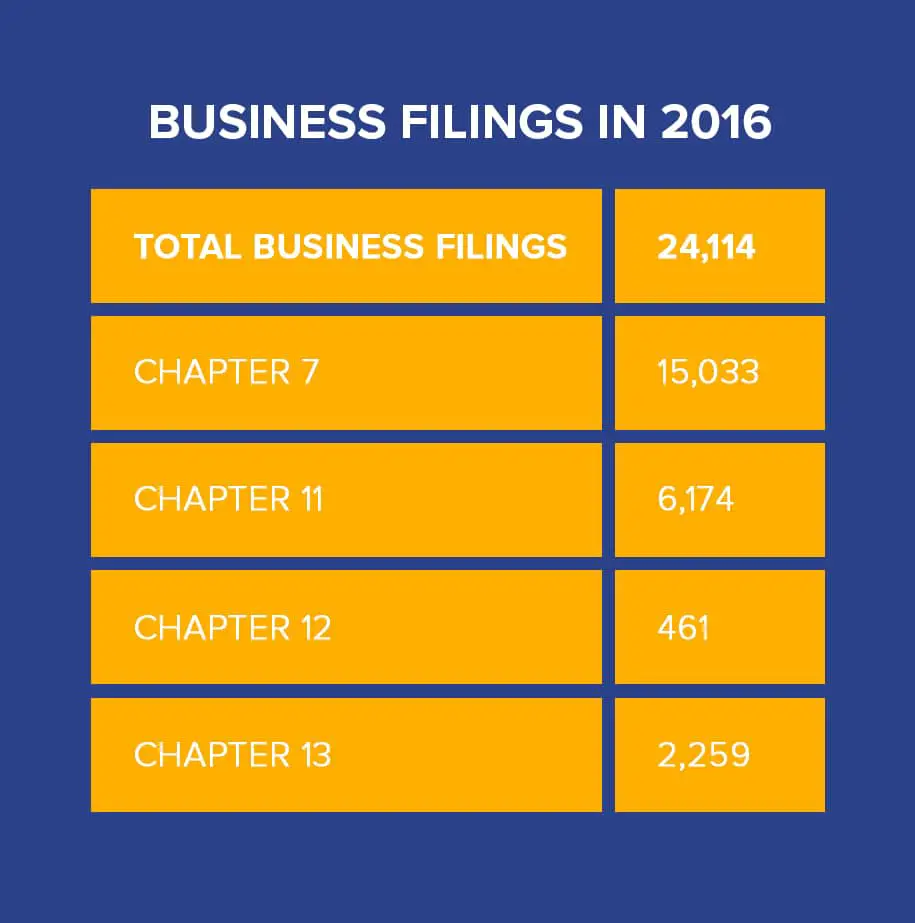

Filing Chapter 11 for business is often referred to as a plan of reorganization where creditors like the IRS are paid back a portion of what they are owed over a period of up to 60 months. A portion of the balance will be paid through the repayment plan, and any unpaid amount could be forgiven by the IRS. Recent rules have been changed to include penalties and interest as a priority claimant however, so the appeal of filing Chapter 11 and 13 on taxes has diminished in recent years.

Wondering whether bankruptcy will end all your tax problems? Get a free consultation with BBB Accredited A+ rated Larson Tax Relief. With 15 enrolled IRS Agents on staff, they can help you with wage garnishments, tax levies & liens, stop IRS collections, resolve back taxes and more.

Navigating Your Bankruptcy Case

Bankruptcy is essentially a qualification process. The laws provide instructions for completing a 50- to 60-page bankruptcy petition, and because the rules apply to every case, you can’t skip a step. We want to help.

Below is the bankruptcy form for this topic and other resources we think you’ll enjoy. For more easy-to-understand articles, go to TheBankruptcySite.

|

More Bankruptcy Information |

Don’t Miss: Can You Refinance While In Bankruptcy

What Are The Requirements For Tax Discharge

There are a number of pre-requisites that have to be met before you can solve your bankruptcy tax debt. In order to be cleared of all income tax debt , the following minimum requirements have to be met:

- 3 years need to have passed since your returns were last due to be filedthis includes any extensions that you may have received.

- The returns were filed in a timely manner or its been at least 2 years since the returns were filed.

- There was no fraud or attempts to avoid and evade paying the IRS .

- The taxes havent been assessed in the last 240 days.

Sometimes, there are occasional exceptions and ways to get around the above requirements. You shouldnt give up on filing for bankruptcy to absolve yourself of tax debt until you have a qualified professional take a look at your files first. Even if you cant completely get rid of your tax debt through bankruptcy, you may be able to get a partial tax bankruptcy discharge for some of itand set up a payment plan for the rest.

The Automatic Stay And The Irs

The moment you file a consumer bankruptcy, a mechanism called the âautomatic stay,â or auto-stay, stalls most legal proceedings and prohibits your creditors from continuing collection efforts. This means creditors canât sue, garnish, bill, or call you, or otherwise attempt to collect a debt you owe. The auto-stay applies to the IRS as well. While the automatic stay is in place, the IRS cannot send you collection notices, garnish your wages or bank accounts, or even offset your tax refund.

The automatic stay expires when your bankruptcy discharge is entered or your case is closed or dismissed, whichever happens first. If you owe tax debt to the IRS, it might hold your refund until the automatic stay expires, so that it can collect by taking back some of your refund. Also, while the IRS is not allowed to collect for itself while the automatic stay is in effect, it may offset your refund to pay back persons to whom you owe child support â because child support collections are not stopped by the automatic stay.

Recommended Reading: How Do Taxes Work On Doordash

Recommended Reading: Debt Settlement Vs Bankruptcy

Can You Declare Bankruptcy On Cra Debt

rebuild your worth, book a free consultation todayBook Now

Owing money to the CRA can be very stressful. There are many ways you can wind up in tax debt, such as not filing your personal income tax returns, failing to pay taxes on business income, HST payments for the self-employed, or inadequate payroll deductions from your employer if you work multiple jobs.

When you owe the CRA money, they will charge penalties and interest on unpaid amounts. This also includes a late filing penalty of 5% plus 1% of your balance owing each month. If youre afraid that you are going to owe the government money, dont delay filing your taxes. As you could incur harsher penalties, and end up paying more in the end.

Given the collection powers of the CRA, that include: garnishing your wages, seizing your bank accounts, or even registering a lien on your home the quicker you act on CRA debt, the better. Fortunately, filing for bankruptcy in Canada allows you to include tax debt, thereby stopping CRA collection actions.

Managing Taxes With Chapter 7 Bankruptcy Filing

Also known as straight bankruptcy or liquidation, Chapter 7 is the most basic kind of bankruptcy for anybody. Here, a court-delegated trustee will supervise the liquidation of your assets to pay off the people, organization, and companies that you owe money to.

Typically, any unsecured debt such as medical bills and credit cards will be erased by filing Chapter 7. However, there are certain debts that are not forgiven through bankruptcy, these include taxes and student loans. That said, student loan debt is not automatically discharged under this type of bankruptcy. As such, in order for a student loan to be subject to discharge, you may file a complaint to determine qualifications for discharge, which initiates adversary proceedings.

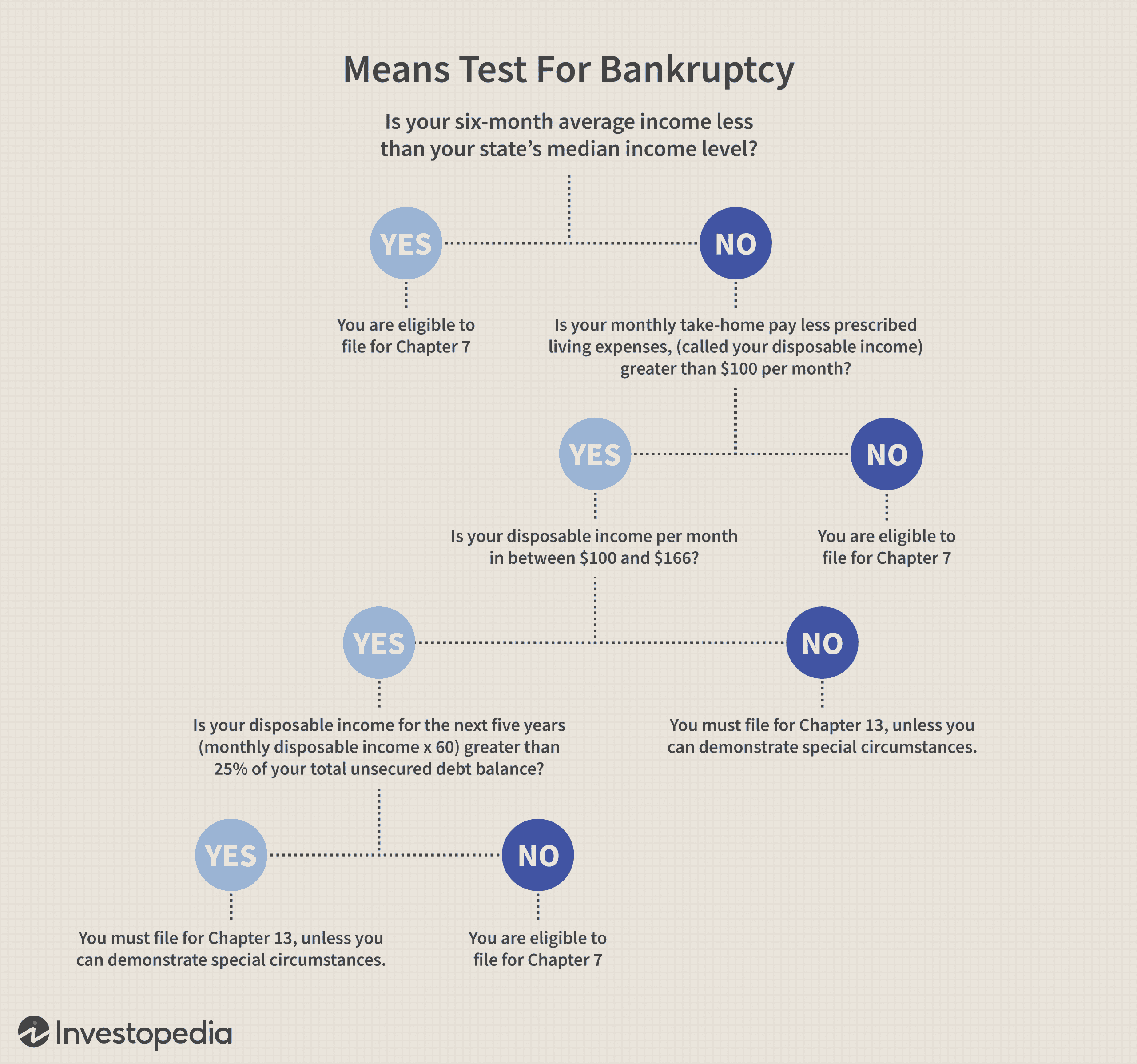

Furthermore, you can only file this type of bankruptcy if the court decides that you dont have enough source of income to pay creditors. This matter can be determined based on the means test which examines your income to the state average and reviews your finances to see whether you have enough money to pay back what you owe to your creditors or you dont.

Individuals including Sole Proprietors who earn under the average income for their state may file for Chapter 7 bankruptcy. Why? Simply because they pass the means test based on the bankruptcy law. Furthermore, here are some signs that now is the right time to file for Chapter 7 bankruptcy:

Also Check: How Do You Calculate Dti

How To Avoid Future Tax Debt Problems

To avoid debt problems in the future, it is important that you understand how you arrived at your current situation, in which you owe a great deal of money to Canada Revenue Agency.

Do you owe taxes because you cashed in the last of your RRSPs to pay your debts? This cant happen again soon, because any remaining RRSPs will be liquidated in your bankruptcy.

On the other hand, if you are self-employed, you can easily find yourself with a tax debt at the end of the year. It is important to prepare for such an eventuality and to make sure that you make payments throughout the year.

We recommend that at the beginning of each year, self-employed individuals estimate the amount of income taxes they will owe and then remit one twelfth of this amount to the tax authorities even if the tax authorities do not require such frequent payments. Then, at the end of the year, tax time will actually be enjoyable as you will have minimal or no accumulated income tax debt. You might even receive a refund!

Finally, make sure you have realistic expectations concerning your lifestyle and your expenses . When do we accumulate tax debt? When we dont feel we can afford to pay it. Proper budgeting and business management can eliminate the monthly deficit that often contributes to serious tax arrears.

Federal Tax Liens And Bankruptcy

A federal tax lien is a government sanction. Its a legal claim against your property when you fail to pay a tax debt, protecting the governments interest in personal property, real estate and financial assets.

The federal tax lien can be discharged from the person, but not from the property, said Jasmine DiLucci, Principal at DiLucci CPA Firm and JD Tax Law. Due to bankruptcy, the IRS wont be able to pursue you for any additional amount above and beyond the value of the property.

Even under circumstances where your tax debts qualify for being discharged in a Chapter 7 filing, that wont change the status of a prior recorded tax lien. It doesnt go away.

You can continue to live in a house with a lien on it, but you cant sell that property without first paying off the lien.

Tax liens are not typically wiped away with filing bankruptcy, Martin said.

A lawyer may be able to get a lien removed if there was an error in the filing of it or if the lien is at least 10 years old.

But again, dont count on it.

You May Like: How To File For Bankruptcy In Ca Without A Lawyer

Notify Us About Your Bankruptcy To Stop Collections

Let us know once you have successfully filed for bankruptcy. Once we know you filed for bankruptcy, we will stop collections on your tax debt .

We will not stop collections just because you hired an attorney. You need to file for bankruptcy through the courts.

Provide us with your bankruptcy case number or a copy of your petition.

- Phone

- Business Entity Bankruptcy MS A345 PO Box 2952

When Tax Debt Can Be Discharged In Bankruptcy

Here are the criteria to get a tax debt discharged in bankruptcy:

- The tax debt to be discharged was filed and assessed by the IRS at least three years prior.

- The balance due cannot be associated with a fraudulently-filed tax return or willful attempt to evade taxation.

- The tax returns for the applicable tax debt were filed at least two years before the bankruptcy filing .

- The tax debt is at least 240 days old.

Also Check: How Long Does Bankruptcy Take Once You File

Tax Debt And Chapter 7 Options

In a Chapter 7 case, all property owned by a Debtor becomes the property of the bankruptcy estate upon initiation of the case. The Debtor is permitted to keep all exempt property, and all other property is turned over to the Bankruptcy Trustee for sale and distribution of the sale proceeds to Creditors. Debtors with the non-exempt property they desire to retain should file Chapter 13 bankruptcy to preserve their assets as Debtors are permitted to keep all property in a Chapter 13. In Chapter 7, almost all of a Debtors debts are completely eliminated, and the Debtor emerges from Chapter 7 debt free. Certain debts, however, are not dischargeable in bankruptcy, including tax liabilities. Certain tax liabilities, however, may be discharged in bankruptcy.

The above time periods are extended based on certain specific actions such as a prior bankruptcy filing, pending Offer in Compromise, and other limited actions.

TIP: Timing can be important in attempting to discharge old tax liabilities. Consult with a bankruptcy attorney to evaluate the proper time for you to file bankruptcy to enable you to take advantage of the Chapter 7 discharge.

DISCLAIMER

For more information on Tax Debt & Bankruptcy In Utah, a free initial consultation is your next best step. Get the information and legal answers you are seeking by calling 501-0100 today.

You May Like: Look Up Employer Ein

Does Bankruptcy Clear Tax Debt In Missouri And Kansas

Tax debt is not quite the same as other consumer debts, and cannot always be discharged through bankruptcy. However, in some cases, particularly with old taxes, bankruptcy can provide debt relief. You can discharge tax debt in either Chapter 7 bankruptcy or Chapter 13 bankruptcy if:

- The debt is for income taxes. Property and other types of taxes are not eligible for discharge.

- The tax debt is at least three years old and returns were filed. New taxes are generally nondischargeable for this reason. However, the statute of limitations on tax collection is 10 years, so if you have older overdue taxes, bankruptcy can help.

- You filed tax returns for eligible debt at least two years before filing bankruptcy. If you do not file, the IRS may complete a return for you. However, this substitute return is not sufficient if you wish to file bankruptcy. You must file a tax return for each year yourself, even if you miss the deadline. We often tell clients that being unable to pay your taxes is not a crime, however, not filing a return is a crime!

- Your debt passes the 240-Day Rule. If the IRS has assessed your tax debt, it must be at least 240 days prior to the day you file bankruptcy. In an assessment, the IRS considers what you owe and tries to negotiate a solution with you.

Also Check: What Happens If Your Bankruptcy Case Gets Dismissed

Receiving Both Unemployment Benefits And Social Security

In most states today, workers can collect unemployment insurance benefits at the same time that they are drawing Social Security. It wasnt always this way, though. In the early 2000s, 20 states plus the District of Columbia had rules stating that if you received both benefits at the same time, then you would have to partially offset your unemployment benefits by as much as 50%. After Illinois repealed this requirement in 2015, Minnesota became the only state left with this provision.

Minnesotaâs offset law currently stipulates that only some residents must reduce their unemployment insurance benefits by up to 50% of their Social Security benefits. The key factors that determine whether this is necessary are the date that the resident began collecting Social Security and the length of time between that date and the date they began collecting unemployment benefits. The Minnesota Department of Revenue website has more information on this.

Can The Bankruptcy Court Deny A Petition

Yes. Bankruptcy filings are not frivolous procedures, and the court can and will deny a petition if the debtor does not comply with rules and procedures. Federal judges and bankruptcy is a federal jurisdiction take a dim view of perjury, failure to account for assets, hiding or destroying records, or hiding property with the intent to defraud ones creditors. Even if your debts are dischargeable, the judge may decide to deny the petition. The US trustee, the bankruptcy trustee, and your creditors may also object which will cause the judge to consider denying a discharge.

Van Horn Law Group has a decade of experience in helping to engineer positive outcomes with all sorts of debt issues including but not limited to bankruptcy. Our experienced staff and attorneys will have your back from the day you walk in the office door until the day you walk out of bankruptcy court with the successful discharge. We understand the many factors that lead people into debt and into filing bankruptcy. We are here to help with offices in West Palm Beach and in Fort Lauderdale, open Monday through Saturday. We welcome walk-ins and will even open on Sunday if you have an appointment with us. Get the help you need to leave your debts behind and get a fresh start.

Don’t Miss: Types Of Debt Relief

Getting Started With Bankruptcy

Rosenblums advice deserves repeating. Bankruptcy isnt a fender bender easily resolved with an accident report and a call to the insurance agency.

Its also nothing to rush into without first exhausting other avenues of debt relief, including debt management programs. A DMP is a strategic plan to eliminate unsecured debt such as credit cards and medical bills.

Understanding the pros and cons of specific debt relief strategies may help you solve debt issues without the short-term and long-term challenges of filing bankruptcy.

The reason bankruptcy is likened to a lifeline, after all, is that usually time is running out and the waters are getting choppier for those already swimming in so much debt they cant see their way clear.

If thats you and a consultation with an experienced bankruptcy attorney confirms it the next step is understanding the impact of bankruptcy.

Beyond the critical questions about the security of home, car and other assets in a bankruptcy, theres the damage to your credit score.

A Chapter 7 bankruptcy filing impacts your credit report for 10 years. In Chapter 13, its seven years, but smart debt management can help you rebuild your credit while waiting for the bankruptcy filing to be cleared from your report.

Whether you hire an attorney or try to file bankruptcy on your own, there are filing fees involved. Youre basically paying the court for its trouble, and the cost of bankruptcy isnt cheap.

Advertiser Disclosure