Why You Need To Work On Your Credit Asap

If you have a 550 credit score, borrowing is going to be challenging. A credit score of 550 or lower is usually too low to qualify for a mortgage. However, youre not that far off from the score you need to qualify for this good debt. With FHA financing options, you only need a 560-600 to qualify. Of course, if you want to use traditional financing options, you generally need at least a 600 credit score.

However, besides loan approvals there are other concerns that come with a low score:

So, is bankruptcy bad for your credit? Yes. But it might not be as bad as you think. And there are financing options specifically designed to help people in your situation. For instance, there are solutions for buying a car after bankruptcy.

Contact Our Experienced New York Firm

The Law Offices of Allen A. Kolber, Esq. effectively represent clients facing bankruptcy in Rockland County and all of New York State. Our firm understands the stress one can feel when facing a difficult financial future. Our compassionate staff will work to ease your fears and help you make a new start. If you need quality legal support, contact The Law Offices of Allen A. Kolber, Esq.

How Soon Will My Credit Score Improve After Bankruptcy

By FindLaw Staff | Reviewed by Bridget Molitor, JD | Last updated June 30, 2021

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can’t remove bankruptcy from your credit report unless it is there in error.

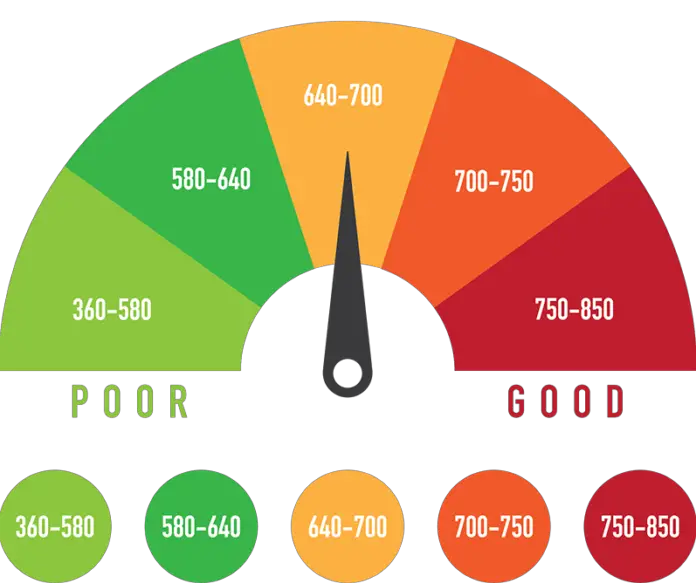

Over this 12-18 month timeframe, your FICO credit report can go from bad credit back to the fair range if you work to rebuild your credit. Achieving a good , very good , or excellent credit score will take much longer.

Many people are afraid of what bankruptcy will do to their credit score. Bankruptcy does hurt credit scores for a time, but so does accumulating debt. In fact, for many, bankruptcy is the only way they can become debt free and allow their credit score to improve. If you are ready to file for bankruptcy, contact a lawyer near you.

Also Check: Do Married Couples Have To File Bankruptcy Together

Make Sure The Right Accounts Were Reported

After your debts are discharged, review your credit reports to make sure that only the accounts that were part of your bankruptcy are reported by the as discharged or included in bankruptcy on your reports. If you find mistakes, notify the credit bureaus and dispute the errors on your credit reports .

How Bankruptcy Affects Your Credit Score

There are a variety of organisations that can help you cope with debt, offering practical solutions, legal advice and counselling. However, sometimes you may find yourself in a position where advice is no longer enough and you need to take more serious action to deal with your debt. In this case you may need to declare personal bankruptcy. Going bankrupt can give you relief from debts, but it can also carry long-term ramifications for your finances, including your credit history.

Also Check: What Does Dave Ramsey Say About Bankruptcy

Bankruptcy Affects High Credit Scores More Than Low Credit Scores

The higher your FICO score is before a bankruptcy filing, the more it will affect your credit rating:

| Score | |

| Note: Scores do not go lower than 300 | 130-150 points |

You will likely drop to a poor credit score no matter what score you started with. Your credit history already shows you filed for bankruptcy, but credit bureaus want to ensure you take steps to improve your bad credit before you take on more debt and new credit.

The sliding scale system will generally knock your credit points however much it takes to show you have poor credit. Your score may barely change if you already have bad credit . It is not common to see credit scores lower than 500 even after a bankruptcy filing.

How Does Bankruptcy Affect Your Credit Score

Many people who file for Chapter 13 or Chapter 7 bankruptcy are anxious about the effects it may have on their credit score. However, bankruptcy is often an effective plan to be debt-free and improve your credit score. Although bankruptcy does initially hurt your credit, you get a fresh start. Below we’ll explore the effects of bankruptcy on your credit score.

What Happens to Your Score After Filing for Bankruptcy?

Bankruptcy appears on your credit report, and you’re likely to drop to a lower credit score. The length of time that the bankruptcy lingers on your record depends on the kind of bankruptcy you file. A chapter 7bankruptcy, where you don’t repay debts, stays on your record for ten years. A chapter 13 bankruptcy stays for seven years, and you pay some owed debts.

While bankruptcy affects everyone’s credit score, you have more to lose if you have good credit. Your score may only show a slight change if you previously had bad credit. Keep in mind that FICO scores go down to 300,but it’s unusual to see scores below 500.

What Are the Benefits?

While bankruptcy damages your credit score, it also offers you a new chance to rebuild your credit. When you declare bankruptcy, it can be the first step to improve your score and gain trust with lenders.

Will I Have High-Interest Rates After Filing?

When Will My Credit Improve After Bankruptcy?

Talk to us at The Madden Law Firm today for questions about bankruptcy.

Read Also: What Is Epiq Bankruptcy Solutions Llc

Bankruptcy Affects Your Credit Score

Whenever you fail to repay your debts, or under any circumstance, fail to service your bank loan, your debtor bank normally forwards the customers details to the bureau.

When listed with these bureaus, it becomes difficult to access any credit facility from any traditional financial institution until you are cleared.

With the declaration of your bankruptcy, things might take a different turn. You may be relieved by the recovery agents. You will have ample time and a friendly repayment plan to settle your debt.

However, your credit report will read negatively, and you cant qualify for any personal loan with bad credit. Financially, you will have several mountains to climb as it may take at least ten years to be otherwise considered for a loan.

Are All Bankruptcies The Same

FICOs example doesnt differentiate between Chapter 7 and Chapter 13 bankruptcy, the two types of bankruptcy available for personal debts.Chapter 7 bankruptcy will be over quickest, with discharge happening a few months after you file . It takes years to complete a Chapter 13 bankruptcy since youd be on a three- to five-year repayment plan.

Read Also: How Many Bankruptcies Has Donald Trump Filed

How Corporate Bankruptcy Can Affect Your Personal Credit

As mentioned above, there are special circumstances in which filing for corporate bankruptcy could affect your personal credit. These circumstances include making personal guarantees on loans or credit and the companys tax liabilities.

Personal Guarantees

Its possible that when you apply for a loan or credit, the lender or creditor will require the corporate business owner to sign a personal guarantee for the credit. This is an agreement that you, as an individual, will take full responsibility for the payments.

Should you file for corporate bankruptcy, this debt then becomes your financial responsibility. If the debt is unpaid, it affects your personal credit.

Business Taxes

Unpaid business taxes are not typically cleared through corporate bankruptcy. This includes any taxes withheld from employee salaries or sales tax . You are personally responsible if you collect these taxes but fail to forward them to the taxing authority. This unpaid debt will directly affect your personal credit.

Budgeting After Chapter 7 Bankruptcy

Many people file for bankruptcy due to no fault of their own after experiencing an unexpected event, such as an illness, job loss, or divorce. Even so, everyone can benefit from cutting unnecessary costs and building a nest egg to fall back onnot just those who filed for bankruptcy to wipe out credit card balances.

Reviewing your spending habits and making a comfortable budget is a commonsense place to start. Avoid buying items on credit that you can’t afford to pay for in cash. If you take out new credit cards, pay off most, if not all, of your account balance each month so that you don’t accrue interest.

You May Like: Can You Rent An Apartment After Filing For Bankruptcy

Can A Bankruptcy Come Off My Credit Report Early

A legitimate bankruptcy record cannot be removed from your credit report, but a bankruptcy can come off your report if it is inaccurately entered or otherwise incorrect.

The FCRA makes provisions for challenging anything on your credit report that is incorrect, has remained on your credit report beyond the maximum time allowed, or cannot be substantiated by the creditor who reported it.

In the case of bankruptcies especially because they remain on the credit report for so many years its not uncommon for errors to creep in.Some of the most common errors we find include:

- Debts that were discharged in the bankruptcy are still showing a balance.

- Individual accounts included in the bankruptcy are still appearing on the report after seven years. In both Chapter 7 and Chapter 13 bankruptcies, the individual affected accounts can only impact your report for seven years starting from original delinquency date, not the filing date of the bankruptcy in which they were discharged.

- The bankruptcy is still showing up on a report more than 10 years after the filing date.

- Any sort of material error in how the bankruptcy was reported, from the spelling of names to accurate addresses, phone numbers, dates, etc.

If any of these or other errors appear on your credit report, you have the right to challenge those errors. The reporting agency must remove them if the reporting agency cannot substantiate the item.

Can I Get Credit While In A Consumer Proposal

You may wish to ask your Trustee about this. While in a consumer proposal, you can apply for a secured credit card through select financial institutions. With a secured card, you make a small security deposit, and then utilize the credit card to make purchases and then promptly pay them off. By doing this, the credit card company will report that you are utilizing the credit and paying as agreed and note the account as an R1. Check the cost of the card, as service charges are greater than with standard cards. Also, do not confuse secured credit cards with pre-paid VISAs and MasterCards prepaid cards have no effect on your credit report and do not help you rebuild.

Using a secured credit card and making regular payments on it while in a consumer proposal can cause a slight improvement in your credit rating, but you will see quicker improvements once your consumer proposal is paid off. Also, you will have access to better interest rates on borrowed money after your consumer proposal is completed. Becoming debt-free by successfully completing your consumer proposal will have a significant impact on your capacity to obtain credit.

You May Like: Toygaroo

Will I Be Able To Get Loans Or Credit After I File For Bankruptcy

Whether you can get loans or credit immediately after bankruptcy depends on what kind of credit you’re seeking.

Many bankruptcy filers are bombarded with credit card offers after the bankruptcy is over. Credit card companies know you can’t file again for several years , so they might be eager for your business. But bewarethe credit card offers will likely have very high interest rates, annual fees, and other high charges.

Car loans. Most likely you’ll be able to get a car loan right away. But you’ll be dealing with subprime lenders, which means high interest rates and other unfavorable loan terms.

Mortgages. How long it will take to qualify for a mortgage depends, in large part, on the mortgage lender. You might qualify for an FHA-insured mortgage even before you complete a Chapter 13 plan and two years after a Chapter 7. For conventional loans, if your lender sells its loans to Fannie Mae, for example, you’ll have to wait at least two years from the discharge date after a Chapter 13 bankruptcy and four years after a Chapter 7 bankruptcy discharge or dismissal date . If your lender doesn’t sell its loans to Fannie Mae, you might have to wait even longer.

These are minimum wait periodsit might take longer to qualify for a mortgage. Other factors that affect your qualification include your income, your debt load, how large your down payment will be, and more.

How Does Filing For Bankruptcy Affect Your Credit Score

Many a time, you may find yourself in this challenging situation. You want to make ends meet, but overwhelmingly, you are faced with several debts to settle. When multiple agents start calling for debt recovery, things may become a nightmare, and yet you are still in financial jeopardy.

Perhaps, this could be the best time to file for bankruptcy to save your peace of mind. If you struggle to repay your debts, you will have to follow the legal process to find relief. Filing for bankruptcy will stop these agency collection calls, salary garnishment, and debt lawsuits.

However, while you might feel relief from debtors headaches, declaring bankruptcy can taint your credit score. It is also likely to affect your relationship with future lenders. A poor credit score exposes your inability to finance and service any credit facility.

Recommended Reading: How Many Times Did Donald Trump File For Bankruptcy

Affects Your Future Borrowing

Your immediate financial future will be at stake because it will be more expensive or impossible to acquire credit from the known traditional institutions. With this fact, you will be exposed to the extreme loan facilities tied to costly fees and inflated interest rates.

You will only have a few options to attain your financial goals concerning poor credit performance and bankruptcy declaration.

These options will compel you to deposit security or collateral to obtain a credit loan. As they say, cheap is expensive most available online credit platforms are brutal regarding interest charges and repayment time.

Prev Post

How Long Does It Take To Rebuild Credit After Chapter 7

A bankruptcy stays on your credit report for 10 years. However, former bankruptcy attorney Kevin Chern says that when a person files Chapter 7 liquidation bankruptcy, the debtor immediately and dramatically reduces their debt-to-income ratio, which could set the stage for a rising credit score a year or two down the line.

You also eliminate your ability to qualify for Chapter 7 for another eight years, says Chern, who is the CEO of Help Path, a resource for individuals to receive a free consultation from a bankruptcy attorney. In the eyes of a potential lender, you may actually appear to be a better risk immediately.

Read Also: Did Dave Ramsey File Bankruptcy

How Will Bankruptcy Affect My Credit

People often believe that filing for bankruptcy will ruin their credit for the rest of their life. That is not true. There is a lot of misinformation about how bankruptcy will affect a persons credit rating or credit score. Under Fair Credit Reporting Act, the bankruptcy case will appear on your credit report for ten years. Accounts included in bankruptcy will be listed as Included in Bankruptcy for seven years.

However, the impact of these items on your credit report have a temporary impact. The effect of any negative item on your credit report will diminish over time. In the short run, bankruptcy will significantly lower your credit score and prevent you from getting credit on favorable terms. However, about two years after filing for bankruptcy, most consumers are able to seek credit on normal terms. This is because they have discharged most or all of their debt, and are now living on a budget they can afford.

Filing bankruptcy has serious and long lasting consequences, including how it affects your credit, your credit score, and your credit rating. However, the affect on your credit score is temporary and is often the lesser of two evils when compared to defaulting on accounts. This article discusses the various ways in which filing for bankruptcy can affect your credit.

Public Records.

Accounts Discharged in Bankruptcy.

Will I Qualify for Credit after Bankruptcy.

Comparison to Not Filing for Bankruptcy.

Should I Declare Bankruptcy

Before you choose to declare bankruptcy, take a closer look at your debts. Determine which debts could possibly be discharged via bankruptcy. Think about a realistic repayment timeline with your current strategy. Look into getting very serious about repaying your debt through either the avalanche or snowball method.

If repaying your debt will take years or decades, you should consult with a financial professional or bankruptcy attorney. They may be able to help you determine whether or not bankruptcy is a good idea for you.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Are You Eligible For A Credit Card After Filing For Bankruptcy

A popular misconception about personal bankruptcies is that its impossible to be approved for a credit card or loan after going through one. Some people after going through bankruptcy will consider secured cards to help them begin the credit recovery process. Secured cards require you to make a cash deposit upfront in exchange for a credit limit. Before applying for new credit products to help build back your credit, you should examine the factors that led you to bankruptcy in the first place and make sure youre not setting yourself up for failure.