How To Improve Your Debt

Improving your DTI comes down to doing one of two things : Increasing your income or reducing your debt.

On the income side, there are some things you can do try to raise your gross pay. The options include:

- Negotiating a raise at work

- Taking a second job or part-time job

- Starting one or more side hustles

You can also generate income through investments. For example, investing in dividend-paying stocks could help you to create a passive income stream. Real estate can also provide passive income if youre earning dividends from a real estate investment trust . Investing in rental property can also provide monthly income but it can be more hands-on than owning REITs or real estate ETFs in your portfolio.

If youre interested in reducing debt, you could start by making it more affordable. Refinancing a mortgage or student loans or consolidating high-interest credit card debt, for example, could allow you to pay more toward the principal each month and less in interest. That could help you to pay back what you owe at a faster pace.

A positive side effect of reducing your debt is that it may also raise your credit score. That can be a win-win if youre hoping to get approved for a mortgage or another loan and youre angling for the best interest rates.

How To Use Our Debt

Your DTI ratio is an important part of the how much house can I afford decision. Knowing your DTI provides a good indication of what to expect from the mortgage preapproval process.

For example:

-

If your housing-related monthly debts are below 28%, you may qualify for a larger loan amount than originally expected

-

If your total debts are above 36%, it may explain why you werent approved despite good credit

-

If your DTI is 50% or above, you may have to pay down a substantial portion of your debts before you can purchase a home

Add Up Your Monthly Debt Payments

Once you’ve determined your monthly gross income, you can focus on your monthly debt payments. This is the money that’s taken out of your paycheck each month. Expenses like groceries and utilities generally are not included. Once you’ve figured out all of your monthly debts, take the sum of each value.

Example: You owe $1,000 in rent, $300 in student loans and $100 for a credit card payment. You would then add 1,000, 300 and 100. This would result in monthly debt payments of $1,400.

$1,000 + $300 + $100 = $1,400

Read Also: Forclosed Homes For Sale

How To Calculate Dti Ratio

Calculating your debt-to-income ratio will help you and potential lenders determine your financial standing. To perform this calculation, you need to know your gross income and how many monthly debt payments you’re making. For example, your rent, student loan payments or child support payments would fall into this category. Use these to calculate your DTI ratio with the following steps:

Add Up Your Monthly Debts

The first step toward calculating your debt-to-income ratio is adding up all your monthly debt payments. For fixed-payment loans like rent, an auto loan or a personal loan, you will use your regular monthly payment. Use your minimum monthly payment for variable payments such as credit card payments or a home equity line of credit. Your monthly debts will include any debts listed on your credit report.

For your mortgage payment, you will calculate with the full PITI . This will be your regular monthly payment if you escrow your taxes and insurance. If you dont escrow, your lender will likely take your annual tax and insurance payments, divide them by 12 and include them as part of your mortgage payment for purposes of DTI calculation.

Here is an example of what it could look like after considering these monthly debts:

- Mortgage: $1,600

- Minimum credit card payments: $300

- Student loan: $200

You May Like: Consumer Financial Protection Bureau Debt Collection

Why Is My Debt

Your debt-to-income ratio can affect your ability to qualify for a loan or a mortgage. It seems daunting but lenders do use it as a preliminary measurement to make sure youre not pushing yourself too far. The goal is to borrow money to improve your life, not put you at risk of deep debt. Similar to those with a bad credit score, lenders see those with a high debt-to-income ratio as more likely to run into trouble making monthly payments.

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Recommended Reading: Did Toys R Us File Bankruptcy

What Is A Debt To Income Ratio

This figure is used by creditors, lenders, and credit reporting agencies as part of the formula to determine your creditworthiness. This is not the only criteria they use, but it is taken into account. Someone with a high debt-to- income ratio may be seen as a high risk, and may have trouble obtaining credit or a loan. If they do get approved, the terms may not be as favorable as someone with a lower debt to income ratio.

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

Recommended Reading: How To Find A Good Bankruptcy Lawyer

Wells Fargo Credit Score Standards

760+, Excellent

You generally qualify for the best rates, depending on debt-to-income ratio and collateral value.

700-759, Good

You typically qualify for credit, depending on DTI and collateral value, but may not get the best rates.

621-699, Fair

You may have more difficulty obtaining credit, and will likely pay higher rates for it.

620 & below, Poor

You may have difficulty obtaining unsecured credit.

No credit score

You may not have built up enough credit to calculate a score, or your credit has been inactive for some time.

Pay More Than The Minimum

Pay off your debt and save on interest by paying more than the minimum every month. The key is to make extra payments consistently so you can pay off your loan more quickly. Some lenders allow you to make an extra payment each month specifying that each extra payment goes toward the principal. Before you begin, check the terms of your loan to determine whether additional fees or prepayment penalties may apply.

Don’t Miss: How To File For Bankruptcy In Oregon

What Is Considered A Good Dti Ratio

What counts as a good DTI will depend on what type of loan you want. Some lenders allow a higher DTI, while others require a lower cut-off.

In general, lenders prefer that your back-end ratio not exceed 36%. That means if you earn $5,000 in monthly gross income, your total debt obligations should be $1,800 or less. However, some lenders might make an exception if you have excellent credit. In fact, its possible to qualify for a loan with up to a 50% DTI as long as youre an otherwise highly qualified borrower.

Mortgage lenders, in particular, tend to have more hard-and-fast rules. They typically prefer a front-end DTI of 28% or less. That means your mortgage payments cant be any higher than 28% of your gross monthly income. So if you take home $5,000 per month, your mortgage payments shouldnt be any higher than $1,400.

On the other hand, conventional mortgage lenders, as well as FHA and USDA lenders, will typically allow a back-end DTI of up to 43%, giving your budget a little more wiggle room. VA loans usually require a back-end DTI of 41% or less.

Knowing your front-end and back-end DTI can help you figure out how much house you can afford. If you apply for a mortgage and the payments would cause you to exceed either of these DTI requirements, you may have to go with a smaller loan or could be denied a loan altogether.

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

Recommended Reading: What Does Bankruptcy Dismissed Mean On A Credit Report

Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

How To Use Debt

Your debt-to-income ratio or DTI represents the amount of your income that goes to debt repayment each month. So why does that matter? For one thing, debt to income can be an important factor in determining whether you qualify for certain loans. If youre trying to buy a home, for instance, lenders will calculate your DTI when determining mortgage approval. For another, a lower debt-to-income ratio means you may have more money to save and invest for the future. If youre not sure how much of your income goes to debt each month, heres how to calculate it.

Working with a financial advisor could help you create and execute a financial plan for your needs and goals.

Also Check: Auto Loans For People With Bankruptcy

Tuesday Tip: How To Calculate Your Debt

Do you know what your debt-to-income ratio is? Do you know why its an important figure? Well, lenders and credit reporting agencies will use this figure as part of the criteria for determining your creditworthiness. Our advice is for you to work towards making it as low as possible. It could mean the difference between obtaining credit or not.

American Consumer Credit Counseling is here to de-mystify the debt-to-income ratio.

Read Also: How To File For Bankruptcy In Virginia Without A Lawyer

How Can I Get A Better Dti Ratio Fast

Think of your DTI ratio as a literal fraction with your debt on top and your income on the bottom. The only way to get a better DTI is to either increase the bottom number or reduce the top . Getting a raise or paying off debts in big chunks are great ways to improve your DTI ratio as fast as possible.

Also Check: Liquidation Stores Charlotte Nc

The Factors That Make Up A Debt

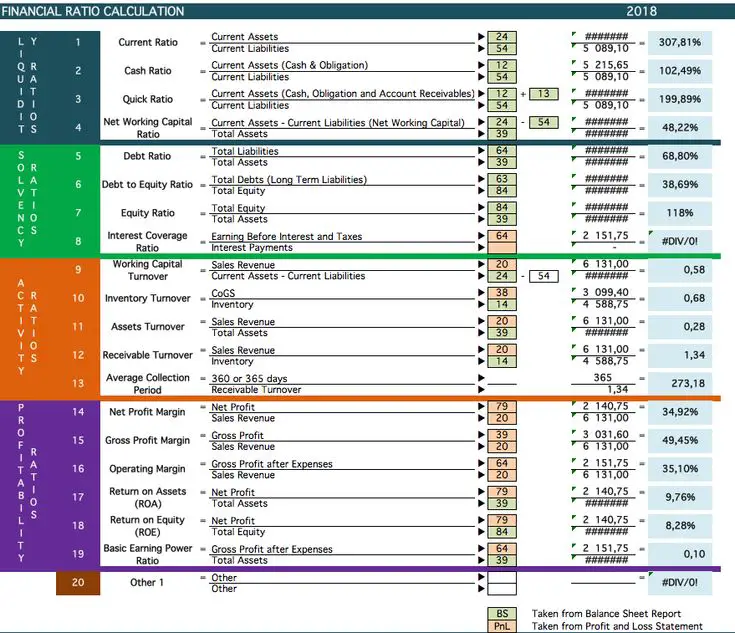

The debt-to-income ratio is made up of two factors: the front-end ratio and the back-end ratio.

-

Front-End Ratio This is also called the housing ratio. This shows what percentage of your monthly income goes to your housing expenses. This ratio includes your monthly mortgage payment, property taxes, homeowners insurance, and homeowners association dues.

-

Back-End Ratio This ratio is all about your other debt typesyour other monthly debt obligations. This includes credit card or car loans, ongoing student loans, child support or alimony, or any other monthly debt that shows up in your credit report.

Also Check: Why Did Pg& e Filed Bankruptcy

Should I Apply For A Home Loan With A High Dti

In limited instances, high debt-to-income ratios mean lenders may be less willing to give you a mortgage loan or may ask you to pay a higher interest rate for the loan, costing you more money. While you can still apply for and receive a mortgage loan with a high DTI, its best to look for ways to lower the ratio if possible so you can get a better interest rate.

Read Also: How Does Bankruptcy Affect Tax Filing

How To Improve Your Dti

If the calculator shows a DTI over 36%, dont be too discouraged: you may still have options. And knowing where you stand before filling out a mortgage application can save you a lot of time, money and heartache.

Achieve a lower debt-to-income ratio by:

-

Avoiding new debt

-

Increasing your income with a side hustle

-

Reducing expenses and using the extra cash to pay off debts

Debt-to-income ratio is different than , which measures how much credit youre using versus how much is available to you. But reducing credit utilization will typically improve your DTI.

What Factors Make Up A Dti Ratio

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

Also Check: When Will My Chapter 7 Bankruptcy Be Discharged

Multiply That Number By 100 To Get A Percentageand Thats Your Debt

Lets look at an example:

Bob pays $600 a month in minimum debt payments plus $1,000 per month for his mortgage payment. Before taxes, Bob brings home $5,000 a month. To calculate his DTI, add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 0.32. Multiply that by 100 to get a percentage.

So, Bobs debt-to-income ratio is 32%.

Now, its your turn. Plug your numbers into our debt-to-income ratio calculator above and see where you stand.

How Lenders View Your Debt

Now that you know how a debt-to-income ratio is calculated, you might be wondering what lenders think of your score.

The criteria can vary from lender to lender, but heres a general breakdown of the industry standards:

DTI less than 36%Lenders view a DTI under 36% as good, meaning they think you can manage your current debt payments and handle taking on an additional loan.

DTI between 3643%In this range, lenders get nervous that adding another loan payment to your plate might be challenging, especially if an emergency pops up. You wont necessarily get turned down for another loan, but lenders will proceed with caution.

DTI between 4350%When your DTI gets to this level, youre almost too risky for lenders, and you may not be able to get a loan.

DTI over 50%At this point, youre in the danger zone, and lenders probably wont lend you money. With a DTI ratio over 50%, that means over half of your monthly income is going to pay debt. Add in normal living expenses, like groceries and insurance, and theres not much left over for saving or covering an emergencyand another loan could tip you over the edge.

Read Also: How To File For Bankruptcy Chapter 7 In Ny

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

Our Standards For Debt

Once youve calculated your DTI ratio, youll want to understand how lenders review it when they’re considering your application. Take a look at the guidelines we use:

35% or less: Looking Good – Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

Youre managing your debt adequately, but you may want to consider lowering your DTI. This may put you in a better position to handle unforeseen expenses. If youre looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action – You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

You May Like: Auctions Close To Me

How To Get Your Credit Report And Credit Score

You can request your credit report at no cost once a year from the top 3 credit reporting agencies Equifax®, Experian®, and TransUnion® through annualcreditreport.com. When you get your report, review it carefully to make sure your credit history is accurate and free from errors.

It is important to understand that your free annual credit report may not include your credit score, and a reporting agency may charge a fee for your credit score.

Did you know? Eligible Wells Fargo customers can easily access their FICO® Credit Score through Wells Fargo Online® – plus tools tips, and much more. Learn how to access your FICO Score. Don’t worry, requesting your score or reports in these ways won’t affect your score.