Confirmation Of Bankruptcy Filing Qualification

After the meeting of creditors, the bankruptcy trustee will have enough information to decide whether you will qualify for Chapter 7 bankruptcy. The trustee will look for nonexempt assets and will decide whether its worth it to liquidate nonexempt assets. The trustee may do this by understanding the retail value of the asset and whether it will sell.

The secured debts such as a vehicle will need to be dealt with around this point in the process. You can often reaffirm the debt as an asset, which is very common for vehicles.

Attend Your 341 Meeting

Itâs important to dress semi-professionally for your 341 meeting and to bring both an official photo ID and an official copy of your Social Security card to this meeting. Your aim during this meeting with your Trustee is to tell the truth while under oath, but a strong first impression wonât hurt either. Although the meeting will probably only last 10-20 minutes and your creditors likely wonât show up for it, itâs a good idea to treat the Trustee with respect. By dressing semi-professionally and having your necessary identification documents ready, youâll make a good first impression. Be prepared to answer questions about why youâre filing bankruptcy in Hartford and about your finances generally. Donât leave out any information, lie or respond in misleading ways as you may get in trouble for such responses given while youâre under oath.

Take Credit Counseling Course

You have to take two mandatory credit counseling courses to complete your Chapter 7 bankruptcy. The Chapter 7 trustee may request the certificate of completion in the meeting of creditors. The first course is a pre-bankruptcy course, and the second is the pre-discharge course.

If you are filing with an attorney, your attorney may have suggestions for both the credit counseling and debt education course. If not, you can see the list of approved credit counseling courses in Connecticut.

Recommended Reading: Can You File Bankruptcy And Keep Your House

The Automatic Stay In Chapter 7 Bankruptcy

The filing of a bankruptcy petition creates a stay, automatically, of collection activities and legal proceedings against you. Technically, this is a temporary injunction under federal law, and it is a very powerful tool for providing blanket relief from the pressure brought by your creditors until your chapter 7 case can be fully administered and a discharge enters, ridding you of personal liability for good. As the name indicates, the stay is automatic, which means that nothing need be done to obtain it, other than filing a bankruptcy petition. The stay is also comprehensive, prohibiting all attempts to collect debts as your personal liabilities. This means that dunning calls, letters from collection agents, the initiation or continuation of lawsuits, and post-judgment wage and bank executions all must stop. Any judgment obtained in violation of the stay is void. With few exceptions, creditors scrupulously observe the automatic stay, because there are stiff penalties under federal law for violating it. This gives you breathing room early in the case. Even before we file, while we are preparing your chapter 7 petition, we will handle creditor inquiries for you. We are better equipped for dealing with them than you are. You will get relief from their pressure right away.

Is There An Income Limit For Chapter 7 Bankruptcy

To automatically qualify for Chapter 7, your disposable income must be below the median level for your state. That number varies from state-to-state. If your disposable income exceeds the median in your state, you still may be able to qualify through a means test that includes looking at your income and reasonable expenses to see if you can get that number under the median income for your state.

Recommended Reading: How Long Does Bankruptcy Take From Start To Finish

Bankruptcy Is An Opportunity To Start Fresh

Most people do carry debt it is one of the ways in which our economy functions. However, if your debt has become unmanageable with more and more bills piling up each month, you may be wondering whether bankruptcy can help you obtain a fresh start.

Job loss, health problems and divorce are just some of the unforeseen circumstances that you might be experiencing. Even if you began with a hefty savings account, it can soon be depleted. You may be experiencing harassment from creditors, wage garnishment, threats of foreclosure, or vehicle repossession. Our law firm can help you crawl out from under these problems and eliminate your debt. To find out more, please call us at .

Mail Documents To Your Trustee

Every bankruptcy thatâs filed in Connecticut is assigned to a bankruptcy trustee. The court clerk will give you a notice with your trusteeâs name and contact information when you file your case. If you filed by mail or lockbox, the court will mail the notice to you. The trusteeâs job is to look over your bankruptcy forms and make sure nothing is missing or incomplete. Theyâre also required to verify that the information listed on your forms is accurate, especially information about your income and expenses.

The Bankruptcy Code and the District of Connecticutâs Local Rules require you to send copies of certain documents to your trustee at least seven days before your scheduled 341 meeting . These documents allow the trustee to verify your information. They include:

-

Your two most recently filed federal income tax returns.

-

A bank statement that includes the date you filed your bankruptcy case. For instance, if you filed your case on August 16, use the statement for August 1-31. If you have more than one bank account, you need a statement for each account.

-

Pay information or pay stubs for the 60 days before the date you filed your case.

Depending on your case and your trustee, the trustee may request other documents in addition to the ones listed above. Usually, your trustee will send you a letter shortly after your case is filed telling you exactly what documents they need and where you should send them.

Read Also: How Long Does Bankruptcy Take To Complete

Cost Of Chapter 7 And Chapter 13 In Connecticut

Any important question that you are probably asking yourself is what is the cost of attorney fees, filing fees and whatever other costs are associated with bankruptcy.

- Attorney Fee: Often different cities and counties in Connecticut will have different attorney costs, including variability of cost based on experience. You may want to check out a Connecticut bankruptcy cost calculator to estimate the cost for your zip code.

- Filing, Admin and/or trustee surcharge fee: The fee for Chapter 7 is $335 and the fee for Chapter 13 is $310 .

File Your Forms With The Connecticut Bankruptcy Court

Only licensed attorneys can use the Connecticut bankruptcy courtâs electronic filing system. Youâll need to file your forms by taking them or mailing them to the correct court clerkâs office. The court encourages in-person filing whenever possible, but you may mail your petition and filing fee if necessary.

The District of Connecticut Bankruptcy Court has three locations throughout the state. If you live in Litchfield or Fairfield counties, you should use the Bridgeport location. If you live in Hartford, New London, Tolland, or Windham counties, you should use the Hartford location. If you live in New Haven or Middlesex counties, you should use the New Haven location. Youâll need to bring either your full filing fee or an application for a waiver or installment payments. The clerkâs office is open to the public Monday through Friday from 9:00 a.m. to 12:30 p.m. and from 1:30 p.m. to 4:00 p.m.

During the COVID-19 pandemic, you may file your forms, together with your filing fee or application for waiver or installment payments, in a lockbox located outside the clerkâs office. Put your payment in an envelope together with your other paperwork. Donât leave loose checks or documents in the lockbox. Forms submitted in the lockbox may not be processed until the next day. The court may continue to take other temporary measures as necessary due to COVID-19.

Recommended Reading: How To Claim Bankruptcy In South Carolina

How To Get Connecticut Bankruptcy Records

Requesters can access bankruptcy records filed in Connecticut by contacting the clerk of the appropriate court. Connecticut has one U.S. bankruptcy court with branches in 3 different locations:

Hartford Location 450 Main Street, 7th FloorHartford, CT 06103

Bridgeport Location 915 Lafayette Boulevard

New Haven Location 157 Church Street, 18th FloorNew Haven, CT 06510

Interested persons will need to provide certain details such as a case number or debtor’s name to access records. A record search costs $32 unless the file is accessible through the public access terminals. Record seekers can also obtain Connecticut bankruptcy records online through the Public Access to Court Electronic Records . Requesters will be required to register with a unique login and password to retrieve records. To search for or view a record, the requester will need to provide some case details, including the court where the case was filed and the case number.

- The name of the court that handled the case

- The name of all persons involved in the case

- The case number

- The time when the case was filed.

- The box number, transfer number, and location number

The clerk at the court where the case was filed can provide details on the case’s box, location, and transfer number. However, if the transfer number cannot be retrieved because of the case’s age, the individual should note it in the request. Requests to NARA can also be made via phone at 268-8000 or .

Hartford Ct Bankruptcy Lawyer Costs

The cost to file bankruptcy in Connecticut varies greatly. How much does it cost to file bankruptcy in Connecticut depends on whether you file Chapter 7 bankruptcy or Chapter 13 bankruptcy, and also on how complicated your case is. At our Farmington, CT bankruptcy practice, we only file Chapter 7 bankruptcy petitions. We do this for the simple reason that we want people to have an affordable option for Connecticut bankruptcy. By limiting our services to the straightforward cases, we help more people get rid of more debt as economically as possible.

There is a filing fee for a Chapter 7 of $335.00 The filing fee goes to the Clerk of the court. When we quote you a fee to file your bankruptcy, our quote includes all filing fees for your Hartford, CT Chapter 7 bankruptcy case including court costs, entry fees, and trustee fees. The fee we quote is what you will pay.

Bankruptcy attorneys will charge a fee for their services in the bankruptcy proceeding. The range of bankruptcy attorney fees charged is almost as varied as the complexity of cases. Fees can be as high as $10,000 in a complex Chapter 7 or as low as $1,000 for a very simple Chapter 7. My goal is to always provide the most economical attorney prepared Chapter 7 bankruptcy in Connecticut. No tricks, no scams. Just an honest low cost, all inclusive Connecticut bankruptcy.

Filing for bankruptcy is stressful and scary enough already. Be careful out there. If it sounds too good to be true, it usually is.

Recommended Reading: How To Obtain Copies Of Bankruptcy Papers

Connecticut Bankruptcy Exemptions And Law

By J.P. Finet, J.D. | Reviewed by Bridget Molitor, J.D. | Last updated April 14, 2021

If you are a Connecticut resident and in debt over your head, bankruptcy could protect you from creditors while you pay off or eliminate your debt. Bankruptcy offers people an option for ridding themselves of overwhelming debt and starting over without worrying about being harassed or sued by bill collectors. Additionally, Connecticut has state laws in place that let residents protect some of their assets from creditors during bankruptcy.

Chapter 7 And Chapter 13 Bankruptcy In Connecticut

In the vast majority of cases, individuals filing for bankruptcy in Connecticut will file under Chapter 7 or Chapter 13. In some respects, Chapter 7 is the easiest type of bankruptcy if you qualify for it but it can also be the most traumatic. Indeed, under Chapter 7 you will have to relinquish ownership of many of your possessions, investment and cash to the court. The court will liquidate these assets and use the proceeds to repay as many of your debts as it can.

Fortunately, in Chapter 7, you will not have to relinquish all of your assets. A lot of them will be exempt from bankruptcy and a skilled attorney will exempt as many of your assets as possible. To qualify for Chapter 7 in Connecticut, your monthly income must be at or below Connecticut’s median monthly income, or you will have to pass the stringent criteria of a special means test.

Those who cannot qualify for Chapter 7 will likely need to complete the Chapter 13 process, also known as reorganization. However, others may also wish to file for Chapter 13 depending on their debt situation. Under Chapter 13, the court will help you negotiate with creditors to reduce your debts and create a debt repayment schedule. The repayment schedule will typically be subjected to a 36-month time frame for those who fall under Connecticut’s mean monthly income, but in limited circumstances payment plans are extended to as long as 60 months. For those over Connecticut’s mean, a 60-month repayment plan will generally apply.

Read Also: Income And Mortgage Ratio

Tax Debt Treatment In Bankruptcy

All personal taxes, whether they are federal, state or local, are subject to modification in bankruptcy. This means that you will be able to eliminate or create payment plans and payment restructuring for all types of taxes. As skilled practitioners, we can help you develop a plan to get your tax debt under control. In addition to all the options available under Bankruptcy Law, we have assisted clients with offers in compromise, installment agreements and other tax solutions at every level.

Why Choose Us To File For Bankruptcy

At The Law Offices of Neil Crane, we offer an attorney-driven debt relief program that has provided solutions for thousands of Connecticut residents since 1983. With six attorneys and a combined experience of over 100 years, our dedicated professionals know what has worked in the past and the current status of the most recent developments in consumer debt protection. Put our knowledge and experience to work for you and your family. Weve provided financial futures for thousands of families since 1983 and it will work for you, too.

We employ a program of careful and complete analysis with industry-best preparedness and persistent advocacy on behalf of our thousands of Connecticut success stories since 1983. Based on our state-wide reputation and experience, your creditors will immediately respond with a new and more negotiable attitude from the first moment we become involved on your behalf. We use our experience to create a customized program based on Analysis, Preparation and Advocacy before we file for bankruptcy.

Don’t Miss: Which Of The Following Is Not Forgiven Under A Bankruptcy

Estimate Whether You Will Qualify For Chapter 7 Bankruptcy In Connecticut

As stated above, you often have to qualify to file Chapter 7 bankruptcy. Qualification is based on US means testing. The means testing is based on the household income and size of the household for Connecticut.

Bankruptcy Means Test In Connecticut

The bankruptcy means test in Connecticut often changes every 6 months. To help, we built the following bankruptcy means test calculator to help you estimate qualification, understand the cost and compare bankruptcy alternatives.

Connecticut Chapter 7 Bankruptcy Income Limits

| # of People |

|---|

| $181,530 |

What Is Involved In The Bankruptcy Process

- In order to file bankruptcy, our firm collects information from clients , prepares a budget and prepares paperwork which is reviewed and signed by you. Under the new bankruptcy laws, credit counseling is required. This involves two sessions which are usually completed over the phone and take approximately one hour each.

Don’t Miss: Foreclose House For Sale

Understand The Costs Of Filing Bankruptcy In Connecticut

When you file for bankruptcy, you need to understand the cost and affordability of bankruptcy. The costs primarily consist of the filing fee and the attorney fee . Firstly, most attorneys offer payment plans. Some also offer $0 down payment options. The cost of the attorney can be variable based on such factors like your location and the difficulty of the case.

We built this Connecticut attorney fee calculator to help you estimate costs based on your specific zip code.

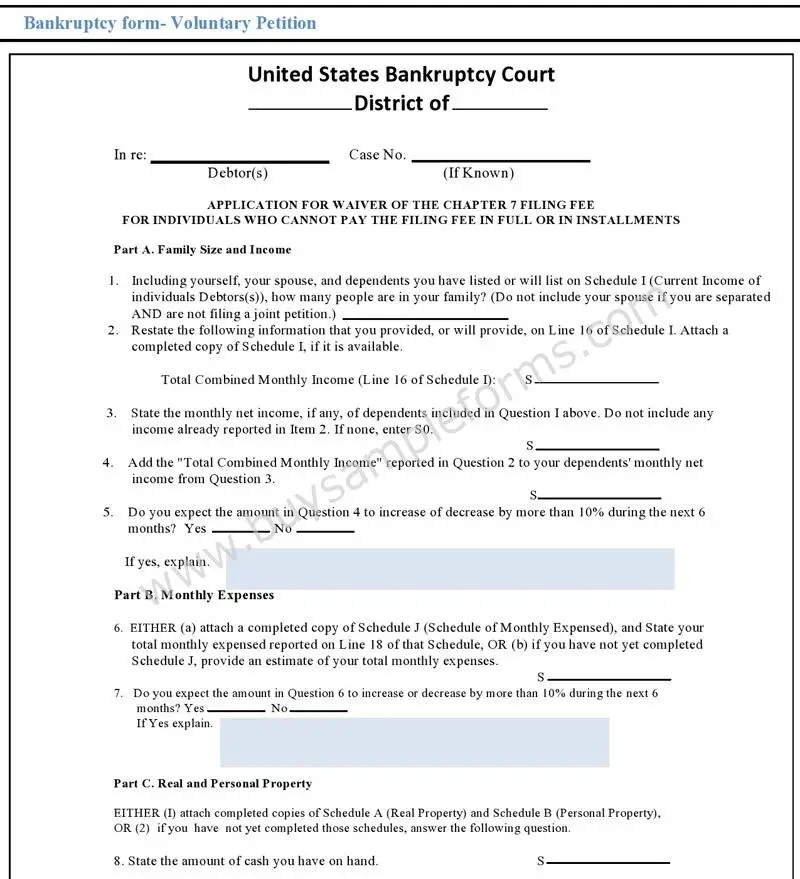

If you cannot afford a payment plan, you may also look at the legal aid options in your state and also how the filing fee waiver works.

Legal Aid In Connecticut

There are certain situations where you could get help through legal aid. Please note that each legal aid may have criteria set for who they will help. Here are legal aid option in Connecticut.

Filing Fee Waiver in Connecticut

Theres a filing fee to file bankruptcy. You can check the Connecticut filing fee waiver requirements to see whether you may be eligible for the filing fee waiver.

What Is Chapter 7 Bankruptcy In Connecticut

Chapter 7 bankruptcy in Connecticut is a form of bankruptcy that uses the proceeds of a debtors assets and properties to settle off the creditors debts. The process is known as liquidation. Under Chapter 7, the bankruptcy court in the District of Connecticut appoints a trustee who handles the sale of the debtors properties and assets not covered by exemptions. The trustee is charged with distributing the proceeds to the creditors. Chapter 7 bankruptcy does not offer debtors options to develop a repayment plan, unlike Chapter 11.

Interested persons, businesses, and partnerships can file for Chapter 7 in Connecticut. Under Chapter 7, interested parties are required to take a Mean Test to determine if they are eligible or not. The Mean Test takes into consideration the debtors secured and unsecured debts, expenses, incomes in comparison with the states median income. Debtors under the states median income can file for a Chapter 7 bankruptcy.

This type of bankruptcy affords debtors a fresh start with the exempted properties and assets. Chapter 7 bankruptcy allows some of the debts to be discharged. Debts such as income tax debts, personal loans, automobile loans, medical bills, and mortgage loans are eligible for discharge. However, court fees and penalties, student loans, alimony, and personal injury debts may not be discharged.

Recommended Reading: What Does Declaring Bankruptcy Do For Me