Preventing Bankruptcy Exemption Problems

Exempt your property carefully. The bankruptcy trusteethe court-appointed official assigned to manage your casewill review the exemptions. A trustee who disagrees with your exemptions will likely try to resolve the issue informally. If unsuccessful, the trustee will file an objection with the bankruptcy court, and the judge will decide whether you can keep the property.

Example. Mason owns a rare, classic car worth $15,000, but the state vehicle exemption doesn’t cover it entirely. Believing that the car qualifies as artat least in his mindMason exempts it using his state’s unlimited artwork exemption. The trustee disagrees with Mason’s characterization and files an objection with the court. The judge will likely decide the vehicle doesn’t qualify as art.

Purposefully making inaccurate statements could be considered fraudulent. Bankruptcy fraud is punishable by up to $250,000, 20 years in prison, or both.

Filing Bankruptcy In Georgia: 8 Things You Need To Know

You may have experienced a financial hardship and now are deciding whether to file bankruptcy in Georgia. We are sorry to hear that you are needing to read this article right now, but our goal is to explain how everything works, so you can decide whether bankruptcy is right for you. Heres what well cover:

Take A Debtor Education Course

You have to complete a second bankruptcy course before you can get your Georgia bankruptcy discharge. This financial management course is similar to the credit counseling course you completed before you filed. Youâll receive quite a few advertisements from companies that offer the second course shortly after signing up for the first one. Itâs important to take the course from a provider thatâs approved to offer it in Georgia and to take it within 60 days after your 341 meeting.

Once youâre done with the class, youâll receive a certificate of completion. You or the course provider need to file it with the bankruptcy court within 60 days of your 341 meeting.

Don’t Miss: Will Bankruptcy Affect Me Renting An Apartment

Types Of Bankruptcies In Georgia

Georgia bankruptcy laws vary and provide lots of different types of bankruptcies in the state. At the state level, the different resolutions that are offered all fall under federal law and are designed to offer a fresh financial start by repaying whatever one is able to, either through a repayment plan without additional interest or a liquidation plan. The way in which the debt obligation is handled is divided into chapters. Each chapter refers to a different type of bankruptcy law or bankruptcy plan.

Northern District Of Georgia Filing Requirements

The Northern District covers 56 counties and is the largest judicial district in Georgia. If you live in the Northern District, your case will be assigned to one of its four divisions. The county you live in will determine whether your Georgia bankruptcy case will be heard in the Atlanta, Gainesville, Newnan, or Rome division.

Since it covers so many counties, the Northern District makes figuring out your division easy with a color-coded map. The Northern District requires certain local bankruptcy forms that are the same in all divisions. If youâre filing without a bankruptcy attorney, make sure to file the Pro Se Affidavit required in this district.

As of Oct. 15, 2020, anyone filing in the Northern District of Georgia can pay the court filing fee with a debit card or PayPal using this online system. Cashierâs checks and money orders are also accepted. If youâre applying to pay in installments you can choose the payment increments, but they need to be approved by the court.

Information on any procedural changes due to COVID-19 can be found here.

Also Check: Foreclosures House For Sale

Our Bankruptcy Lawyers Can Help You Determine If Bankruptcy Is Right For You

Filing for bankruptcy is not easy, but sometimes it is the only option to avoid losing your home and other assets. However, its wise to ensure that you have explored other methods before filing for bankruptcy. If bankruptcy is the only choice you have, do not hesitate to reach out to a professional bankruptcy lawyer.

They will hold your hand, guide you on how to file the bankruptcy forms, and help you navigate the court systems. Once you file your case in a Georgia Bankruptcy Court, your lawyer will fight for you until you reach a favorable resolution. From there, you will get the financial relief you need to start rebuilding your life without mounting debts and aggressive creditors breathing down your neck.

Ready to get started? Reach out to our law firm and begin your road to debt relief today.

Should I File For Bankruptcy

Filing for bankruptcy should not be made lightly or without thorough investigation. This is a decision greatly influenced by the amount of debt you owe and your ability to make payments to your creditors. Anyone considering filing for bankruptcy protection should investigate all possible options that may be available before deciding on bankruptcy. Our Coweta County bankruptcy attorneys are eager to assist you in making this important decision.

Read Also: America’s Debt Count

How To File For Bankruptcy In Georgia Step By Step

Once DebtStoppers has customized a debt relief plan for your family, the steps for filing are relatively straightforward. First, you’ll need to satisfy a few conditions:

- Completion of credit counseling with a qualified credit counselor. These classes are offered online, and DebtStoppers can make all the arrangements.

- Participation in a debtor instruction or financial management course.

Once you’ve qualified, you or your lawyer will initiate proceedings by submitting a petition in the bankruptcy court nearest to you.

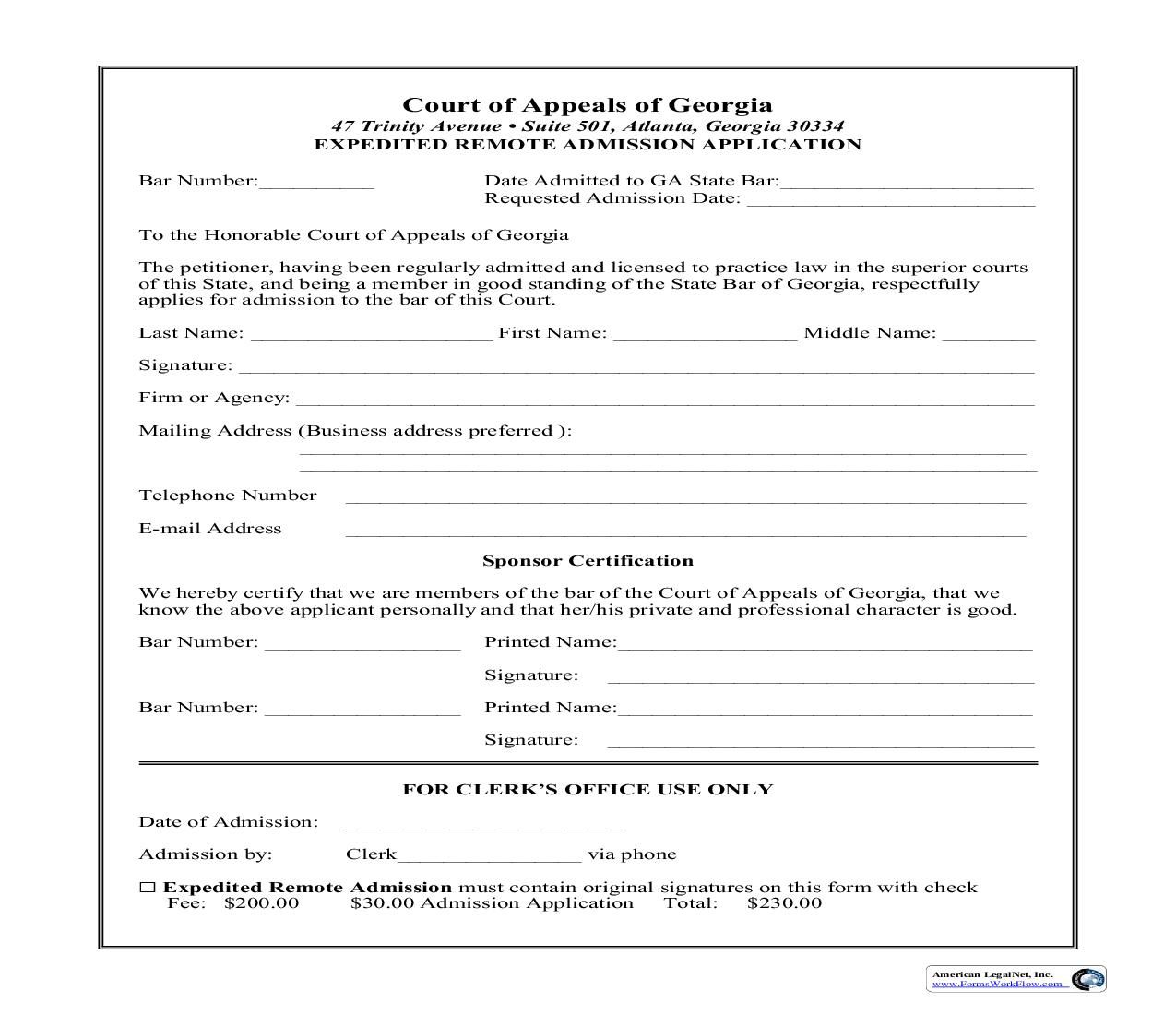

Northern District: Required Local Forms

The Northern District requires filers to submit a combination of federal and local forms. Local forms required for Chapter 7 filers are as follows:

-

All pro se filers must submit a Pro Se Affidavit.

-

If you donât have 60 days of payment advices , you must submit a Statement Regarding Payment Advices form explaining why.

-

If you want to apply for an installment payment plan, you need to fill out and submit a local application form with your bankruptcy petition.

Youâll also need to submit a list of creditors , which needs to be formatted per the courtâs requirements. The court also has an example document you can view to see the proper formatting.

Don’t Miss: Help With Credit Debt

How To File Bankruptcy In Georgia For Free

One of your biggest questions about the bankruptcy process is probably how much it will all cost. A bankruptcy attorney is the biggest ticket item when it comes to filing bankruptcy . The good news is, itâs absolutely possible and common to file for bankruptcy without an attorney. This guide walks you through the process in 10 steps.

-

Middle District: Debtors are encouraged to submit via email or fax.

-

Southern District: Mail, dropbox, and email are currently offered. The dropbox option may be used to have someone else drop off your petition for you.

Once youâve submitted your papers, take a deep breath and a moment to celebrate. As soon as your case is filed, the automatic stay protects you from your creditors.

What Is The Purpose Of Bankruptcy Law

The purpose of bankruptcy law is to help people find a solution. When an individual or a company or even a municipality is unable to repay their debt, bankruptcy law helps them find solutions that can make the most out of a bad financial situation.This can include l liquidating physical assets, like selling off company property or vehicles in order to repay part of the debt. It can also include setting up an installment plan for situations where the debt is too large to pay off in its current form, but can be better managed with monthly payments.

Read Also: How Do You Know When Your Bankruptcy Is Discharged

Chapter 1: Large Reorganization

Designed more for companies, chapter 11 is for reorganization, which means a business can reorganize the debt that they have, stay in operation, and keep the business running while they work with their creditors to negotiate a plan for repayment. The business might also change the way the company is operated in order to provide money for repayments.

Bankruptcy In Georgia: An Overview

According to the United States Bankruptcy Court for the Middle District of Georgia, there were approximately 503 bankruptcy filings in this area in August 2022 alone. That is actually a fairly significant increase from the 418 bankruptcy filings that took place just one month prior.

If you add up all the bankruptcy filings that have happened since the beginning of 2022, youre looking at over 3200 and that doesnt include the four months from September through the end of the year.

In the Northern District of Georgia, the situation is similar. There were 11,122 bankruptcy filings in September 2022. That, too, was a significant increase from the 9.721 just a month prior. Overall, there have been tens of thousands of people who have filed for bankruptcy this year alone a trend that shows no signs of slowing down anytime soon.

Note that the Northern District of Georgia is larger than the aforementioned Middle District, which is part of the reason for such a discrepancy in numbers. That, and the former has numbers available for September while the latter does not.

Recommended Reading: When Can You File Bankruptcy Again

Collect Files & Get Your Bankruptcy Credit Counseling Certificate

First and foremost, collect all the required documents for filing bankruptcy in Georgia. Then, focus on completing a credit counseling course aimed at revealing all your debt relief possibilities. Youll need to get your bankruptcy credit counseling certificate if you want to file a petition for relief in the United States. Planning to file bankruptcy in about 6 months? Nows the best time for completing the course.

Chapter 7 Vs Chapter 13 In Georgia

Chapter 7 bankruptcy: In Chapter 7, you are at risk of your nonexempt property being sold and used to pay off debts. Its generally meant for those who cannot afford to pay little to any of your debt. Its often less expensive than a Chapter 13 bankruptcy, and you can receive a discharge within 120 days. It stays on your credit report for 10 years.

Chapter 13: In Chapter 13, you reorganize your debts similar to a debt settlement program. Your property above the exemption is often not sold as you may be able to protect your assets. Its often more expensive than a Chapter 7 bankruptcy, and you generally will receive a discharge in 3 or 5 years. It stays on your credit report for 7 years.

When your debt is discharged, this means that you are not required to pay that debt back.

Don’t Miss: Can You Get A Car If You File Bankruptcy

The Chapter 13 Bankruptcy Process Explained

The bankruptcy filing and automatic stay. With Chapter 13 bankruptcy, your first step is to file a petition and a payment plan with the court. Youll get an immediate stay of collection from creditors as soon as you file.

The Meeting of Creditors. As with Chapter 7, youll attend a Meeting of Creditors where a trustee goes over your finances in detail to determine whether your payment plan makes sense.

You have to prove that you can both make your proposed payments and pay your household expenses during this time.

The confirmation hearing. Unlike with Chapter 7, those filing Chapter 13 bankruptcy will have a hearing before a judge. This generally takes place about 60 days from your date of filing. The judge will assess your case and hear any objections from creditors.

The court issues a confirmation. This happens after your Meeting of Creditors and confirmation hearing, and after any objections from your creditors have been resolved.

The confirmation will determine the terms of your bankruptcy, ideally based on the payment plan you developed. However, if there is a reason for the court not to grant you bankruptcy, your case will be dismissed.

Your continuing education. Filers are required to complete two financial management training courses and file certificates of completion with the court. The last one has to take place before your case is closed at the end of your three-to-five-year plan.

How Do I See Who Is Filing For Bankruptcy In Ga

When you file for bankruptcy in Georgia, your name becomes public in court records. Therefore if you access the court records, you will see the names of those filing for bankruptcy.

However, their personal information is not on public records, so you cannot get specific details about their bankruptcy case. This fact can be reassuring for many who are considering filing for bankruptcy.

Georgia bankruptcy law makes sure the secrecy of individuals who are filing for bankruptcy.

Recommended Reading: What Debts Are Not Covered By Bankruptcy

What Is A Discharge Of Debts

Basically, a discharge of debts is the elimination of a debtors personal obligation to pay the debt. There are some debts that generally cannot be discharged, or eliminated. Non-dischargeable debts can include: student loans, domestic support obligations, child support and alimony and recent income taxes, paytoll taxes, criminal fines or penalties, and DUI claims. A discharge will give the debtor a chance to start over financially.

Additional Considerations About Bankruptcy In Georgia

All of this is to say that filing for bankruptcy in the state of Georgia is a lot more common than people might realize. This is part of the reason why the act doesnt really have the negative reputation that it used to people have seen first-hand how it can give them a more stable financial foundation from which to work from.

Indeed, filing for bankruptcy does offer a number of distinct advantages like the fact that you get to keep any future income that you earn. You dont have to worry about a significant amount of money from each hard-earned paycheck going to pay back old debts like you would with other potential solutions to this issue. The only exceptions are things that are acquired within 180 days of the time you file for bankruptcy, including things like inherited property, property that you got in a divorce or in some type of settlement agreement, and death benefits.

Not only does bankruptcy help you discharge your applicable debts quickly, but you also dont have a debt repayment plan that you will have to worry about in a lot of cases. Yes, only individuals are eligible to file for Chapter 7 bankruptcy. But based on some advantages outlined above, its easy to see why its become such a common choice in Georgia over the last several decades in particular.

Or have us contact you by filling out the form below:

You May Like: Can Evictions Be Included In Bankruptcy

Attend Your 341 Meeting

The 341 meeting, also known as the meeting of creditors, is a meeting with the trustee that takes place about 30â40 days after you file your Georgia bankruptcy. You can find the exact date and time on Form 309A. One purpose of the meeting is for the trustee to verify your identity, so make sure youâre prepared and bring a valid picture ID and proof of your Social Security number. This is usually the one time all debtors are required to come to court in person, but due to COVID-19 all 341 meetings are currently being held via video conference or phone.

In most cases, the 341 meeting takes only a few minutes and most folks walk out of the meeting relieved that it’s over but also surprised about how straightforward everything was. Your creditors have the right to attend the 341 meeting to ask questions about your petition, but this rarely happens. Itâs totally normal to feel nervous and think about what could go wrong, but you can also take a minute to think about how good youâll feel when itâs over.

Middle District Of Georgia Filing Requirements

The Middle District of Georgia has offices in Columbus and Macon. Even though there are only two offices for this district, you can file your Georgia bankruptcy forms in several locations, depending on the county you live in. If youâre filing in this district and donât have an attorney, youâll find a detailed overview of what you need to know on the court’s website.

If youâre in the Middle District of Georgia a local court rule makes the filing fee due on or before the date of your 341 meeting, which is generally about 30â40 days after your filing date. Fees can be paid by certified check or money order. The installment amounts for an installment fee payment plan can be chosen by the debtor.

Changes to court operations due to COVID-19 can be found here.

Read Also: Us National Debt By Year Chart

Qualifying For Bankruptcy In Georgia

You’ll meet the initial requirement if you’ve never filed for bankruptcy before. Otherwise, check whether enough time has passed to allow you to file again. The waiting period varies depending on the chapter previously filed and the chapter you plan to file. Learn more about multiple bankruptcy filings.

You’ll also need to meet specific chapter qualifications.

You’ll qualify for Chapter 7 bankruptcy if your family’s gross income is lower than the median income for the same size family in your state. Add all gross income earned during the last six months and multiply it by two. Compare the figure to the income charts on the U.S. Trustee’s website .

Want an easy way to do this online? Use the Quick Median Income Test. If you find that you make too much, you still might qualify after taking the second part of the “means test.” If, after subtracting expenses, you don’t have enough remaining to pay into a Chapter 13 plan, you’ll qualify for Chapter 7.

Qualifying for Chapter 13 can be expensive because the extra benefits come at a hefty price, and many people can’t afford the monthly payment. To qualify, you’ll pay the larger of:

- your priority nondischargeable debt

- the value of nonexempt property, or

- your disposable income.