Lower Your Monthly Debt Obligations

Temporarily prioritize debt payments over savings and investment account contributions, other than any employer-sponsored plan contributions you must make to qualify for your employer match. Throw as much money as you can at smaller debt balances that you can zero out quickly, Martucci advises. Eliminating these payments and accounts will reduce your DTI ratio.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Also Check: How To File Bankruptcy Online Free

How To Improve Your Debt

If youre thinking about purchasing a home, its a good idea to calculate your debt-to-income ratio as part of the planning process. This will help you determine if you have the 43% or less debt-to-income ratio that a majority of lenders require. If you find that your debt is too high, it might be a good idea to start tackling some of those balances or finding additional income sources in order to have the best chance of qualifying for a mortgage.Here are a few ways to get started:

-

Use credit cards sparingly. The only way to lower your monthly debts is to pay down your debt, so if you continue to use your credit cards and carry a balance, you wont be able to decrease your monthly expenditures.

-

Keep accurate records of your self-employment income. While you may have at least two years of self-employment under your belt, if you dont have the necessary tax records to back up your income earned, it can be hard to obtain a mortgage.

-

Avoid taking out other loans. If you know purchasing a home is on the horizon, carefully consider how you spend your money. It may not be the best time to purchase a new car or take out a loan for a new diamond ring, as these will be factored into your debt-to-income ratio.

-

Open a savings account. Start saving now, and those dollars will begin adding up! Putting a sizable down payment on a home will reduce the amount you need to borrow, which means a smaller mortgage payment and a lower debt-to-income ratio.

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

Read Also: Home Loans For Bankruptcies

Housing Expense Ratio Vs Debt To Income Ratio

The housing expense ratio is a useful metric as it compares your pretax income against what you will likely pay every month after purchasing a house.

But the debt to income ratio is also important. It measures how much debt you have relative to your income. Generally, lenders will only approve loans for borrowers with a debt to income ratio of 36% or less, meaning that their debts dont exceed 36% of their total income.

Both measurement tools are useful, and most underwriters will compare both ratios when determining whether to approve someone for a loan. If you want to be approved, you cant ignore DTI in favor of housing expense ratio or vice versa.

Dti Limits Used In Qualifying Borrowers

Conforming loans

In the United States, for conforming loans, the following limits are currently typical:

- Conventional financing limits are typically 28/36 for manually underwritten loans. The maximum can be exceeded up to 45% if the borrower meets additional credit score and reserve requirements.

- FHA limits are currently 31/43. When using the FHA’s Energy Efficient Mortgage program, however, the “stretch ratios” of 33/45 are used

- VA loan limits are only calculated with one DTI of 41.

Nonconforming loans

Back ratio limits up to 55 became common for nonconforming loans in the 2000s, as the financial industry experimented with looser credit, with innovative terms and mechanisms, fueled by a real estate bubble. The mortgage business underwent a shift as the traditional mortgage banking industry was shadowed by an infusion of lending from the shadow banking system that eventually rivaled the size of the conventional financing sector. The subprime mortgage crisis produced a that revised these limits downward again for many borrowers, reflecting a predictable tightening of credit after the laxness of the . Creative financing still exists, but nowadays is granted with tighter, more sensible qualification of customers.

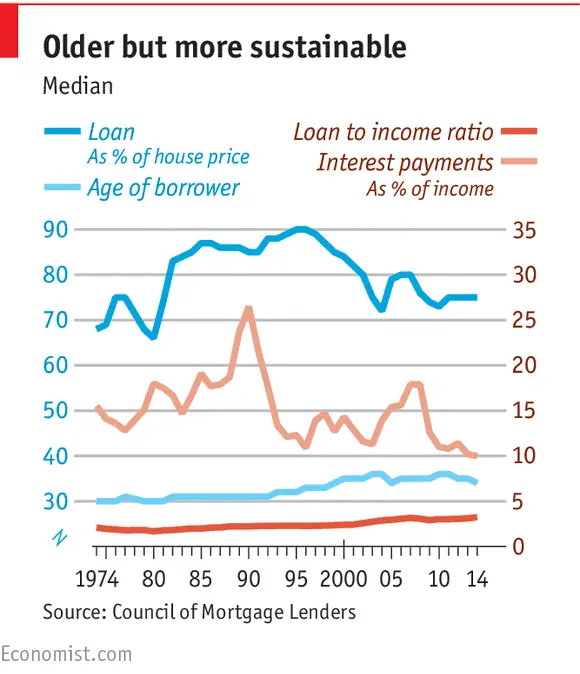

Historical limits

Recommended Reading: Us Real Time Debt Clock

How Do You Calculate Your Housing Ratio

Take your pre-tax monthly income and calculate it by your housing expenses to get your housing expense ratio. This formula is used by mortgage lenders to estimate the risk of a loan, and it is carried out by an underwriter.

Lets have a look at the calculation step by step. Well go over it with an example so you can understand how everything works together.

What Factors Make Up A Dti Ratio

Your debt-to-income ratio consists of two components: front-end DTI and back-end DTI. And, your lenders will examine both. Your front-end ratio simply looks at your total mortgage payment divided by your monthly gross income, says Cook.

- Front-end DTI: Also known as your housing ratio, this is the percentage of your monthly gross that pays for your mortgage payment, homeowners insurance, property taxes, and any HOA dues

- Back-end DTI: This is the percentage of your monthly gross that goes towards housing and your monthly debt repayment

Most lenders want to see a front-end ratio no higher than 28%. That means your housing expenses including principal, interest, property taxes, and homeowners insurance take up no more than 28% of your gross monthly income.

But in most cases, says Cook, the front-end debt ratio is not the number that matters most in underwriting. Most loan underwriting programs today primarily look at the back-end debt ratio.

You May Like: How Do I Know If I Have Bills In Collections

Applying For A Mortgage Heres What Your Debt

Finding your dream digs is a whole process in and of itself. Then, when you finally hit the housing jackpot, youre faced with the daunting task of applying for a mortgage loan. Set yourself up for success by having your debt-to-income ratio ready providing yourself with an instant advantage in a competitive market.

Find Out: 7 Florida Cities That Could Be Headed For a Housing Crisis

As the name denotes, your debt-to-income ratio is how much money you owe the world versus how much you take home before taxes Though it might seem like common sense, mortgage lenders prefer non-risky candidates which means a realistic balance between debt and income. You do not want to carry more debt in the form of credit cards, car payments, and student loans than you can afford. Otherwise, how could you add a mortgage to the mix?

To calculate your debt-to-income ratio, add up your total monthly debt and divide it by your gross monthly income. If your debt is $400 every month and your income is $3,000 then your DTI is 13%, which makes you extremely desirable. A good rule of thumb is to aim for 35% or lower is the best and 43% tops. Anything over 50% will most likely knock you out of the game.

Housing Market: Factors Retirees Should Consider Before Paying Off Mortgage or Selling

More From GOBankingRates

How Do You Lower Your Debt

If you’re worried that your high DTI may prevent you from getting your desired home loan, you can try to lower it before beginning the mortgage application process. Usually, this means either paying down your debt or increasing your income.

If you have credit card debt spread among multiple cards, using a debt consolidation personal loan can help you organize all those payments into just one monthly payment at a potentially lower interest rate. This helps you pay down the balance faster since you’re saving on interest. Select ranked the as one of the best for debt consolidation since it allows you to use the funds to pay up to 10 creditors directly.

-

6.99% to 24.99% APR when you sign up for autopay

-

Loan purpose

Debt consolidation, home improvement, wedding, moving and relocation or vacation

See rates and fees, terms apply.

Also Check: Bankruptcy Attorney Los Angeles

S To Decrease The Debt

1. Decrease monthly debt payments

Consider an outstanding $50,000 student loan with a monthly interest rate of 1%. Scenario one involves an individual who is not repaying their principal debt, while scenario two involves an individual who has paid down $30,000 of their principal debt.

As illustrated above, as an individual pays down more of their principal debt, the monthly interest payments decrease.

2. Increase gross income

Consider two scenarios with a monthly debt payment of $1,500 each. However, the gross monthly income for scenario one is $3,000, while the gross monthly income for scenario two is $5,000. As such, the debt-to-income ratio would be as follows:

DTI Ratio = $1,500 / $3,000 x 100 = 50%

DTI Ratio = $1,500 / $5,000 x 100 = 30%

How To Calculate Your Housing Expense Ratio

You dont need complex formulas or digital calculators to determine your housing expense ratio. You can take a few common metrics you should already know about your income and the price of a house you want to purchase, then use those numbers to figure this ratio out.

Lets break down the housing expense ratio calculation step-by-step.

Add together all housing expenses

Calculate your total gross salary

Divide by your pretax income

Evaluate the results

Also Check: Can Utility Bills Be Discharged In Bankruptcy

Fha Loan Requirements: What Home Buyers Need To Qualify

FHA loans, which are insured by the Federal Housing Administration, help home buyers secure financing to buy a home despite their low income, lack of savings, or poor credit scoresthe kind of things that often prevent people from getting a conventional loan.

FHA loans are a great option for a lot of home buyers, particularly if theyre buying their first home, says Todd Sheinin, mortgage lender and chief operating officer at New America Financial in Gaithersburg, MD. And while not all lenders offer FHA loans, many do, because their government backing guarantees that lenders wont lose their money if the buyer defaults. So its win-win all round!

Yet although FHA loans have looser qualification requirements than traditional mortgages, that doesnt mean they have none at all. While the exact rules and thresholds will vary a bit by lender, heres a ballpark guide to what you can expect youll need to qualify.

A Minimum Down Payment Of 35%

With conventional loans, its generally recommended that you make a 20% down payment, which would amount to a whopping $50,000 on a $250,000 home. FHA loans lower the bar to a far more realistic level, requiring as little as 3.5%. So, on a $250,000 house, you would only need to plunk down $8,750 to qualify for an FHA loan.

This is a boon, particularly for first-time home buyers, who tend to have less money socked away to put toward their dream of home ownership. In fact, a recent study from Apartment List found that more than two-thirds of millennials dont even have $1,000 saved up for a down payment. And millennials are now the largest group of home buyers.

You May Like: How To Declare Bankruptcy In Pa

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

Recommended Reading: Bankruptcy Lawyers Jacksonville Fl

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

Understanding Housing And Debt Ratios

You’ve found your dream home in the perfect neighborhood.

There’s just one problem: You do not know if you can afford the monthly mortgage payments that will come with the home.

Fortunately, there are a series of housing and debt ratios that you can use to determine whether the home you want is also one that you can afford. By studying these ratios, you’ll avoid taking out a home loan that will put you in a precarious financial situation.

Housing-expense ratio

The first of these ratios is the housing-to-expense ratio, also known as the front-end ratio. This ratio will tell you how much of your gross — or pre-tax — monthly income is available for using for your monthly mortgage payment.

In general, you want your monthly mortgage payment — which includes your home loan’s principle, homeowners insurance payments, and taxes — to take up no more than 28 percent of your monthly salary. Anything higher than that could place too much of a strain on your household finances, leading eventually even to missed housing payments and foreclosure. Simply put, you cannot afford your mortgage loan payments if they total more than 28 percent of your monthly salary.

To determine this ratio, multiply your annual salary by .28. Divide that result by 12 — representing the 12 monthly mortgage payments you make each year. This will show you the highest housing-to-expense ratio that you can afford.

Debt-to-income ratio

Loan-to-value ratio

Read Also: How To Find The Right Bankruptcy Attorney

A Guide To The Housing Expense Ratio

Your housing expense ratio, also known as the house-to-income or housing ratio, is a useful indicator to see how much you can afford on a house. Your lender will use it while underwriting your mortgage. This guide will lay out what it is, how to calculate it and what it means for you.

Read on to learn more about this important term.

Household Debt Service Payments As A Percent Of Disposable Personal Income

Observation:

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Frequency: Quarterly

Notes:

The Household Debt Service Ratio is the ratio of total required household debt payments to total disposable income.The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

Don’t Miss: File For Bankruptcy Chapter 7 Online