Need More Bankruptcy Help

Did you know Nolo has been making the law easy for over fifty years? It’s trueand we want to make sure you find what you need. Below you’ll find more articles explaining how bankruptcy works. And don’t forget that our bankruptcy homepage is the best place to start if you have other questions!

|

Our Editor’s Picks for You |

|

More Like This |

What Happens When You File For Bankruptcy: What Bankruptcy Can Do

Bankruptcy allows people struggling with debt to wipe out certain obligations and get a fresh start. The two primary bankruptcy types filedChapter 7 and Chapter 13 bankruptcyeach offer unique benefits and, in some cases, treat debt and property differently. The chapter that’s right for you will depend on your income, property, and goals.

Here are things you can expect in both Chapters 7 and 13.

Bankruptcy Vs Credit Counseling

Bankruptcy should be your last option if you face debt that has gotten out of control. There are other possibilities for dealing with debt. For example, you could talk to your creditors, and they might be able to work out a plan for you to catch up. You could also locate a credit counseling service, an organization that assists people with burdensome debt. Bankruptcy and credit counseling both have their place, so it’s wise to know what each one can do for you.

| Bankruptcy |

|---|

Read Also: Can An Employer Fire You For Filing Bankruptcy

Types Of Personal Bankruptcy

In the case of individuals, as opposed to businesses, there are two common forms of bankruptcy: Chapter 7 and Chapter 13. Here is a brief description of how each type works:

Chapter 7. This type of bankruptcy essentially liquidates your assets in order to pay your creditors. Some assetstypically including part of the equity in your home and automobile, personal items, clothing, tools needed for your employment, pensions, Social Security, and any other public benefitsare exempt, meaning you get to keep them.

But your remaining, non-exempt assets will be sold off by a trustee appointed by the bankruptcy court and the proceeds will then be distributed to your creditors. Non-exempt assets may include property , recreational vehicles, boats, a second car or truck, collectibles or other valuable items, bank accounts, and investment accounts.

At the end of the process, most of your debts will be discharged and you will no longer be under any obligation to repay them. However, certain debts, like student loans, child support, and taxes, cannot be discharged. Chapter 7 is generally chosen by individuals with lower income and few assets. Your eligibility for it is also subject to a means test, as explained bellow.

Chapter 13 Compared To Chapter 7 Bankruptcy

There are two main ways to file personal bankruptcy under the U.S. Bankruptcy Code: Chapter 7 and Chapter 13 bankruptcy.

Chapter 7 essentially erases most of your debts in a liquidation bankruptcy. Typically, if you have assets that arent exempt from liquidation under state or federal law, you must give them away to be sold. Chapter 7 doesnt include a repayment plan because the money from selling items covers debt, and the rest of what you owe is dismissed.

Chapter 13 does not sell your property and uses your current income to repay debt. You can still lose some nonexempt property if you cannot afford to pay it through your repayment plan, however.

Also Check: Can You Refinance While In Bankruptcy

Impact On Financial Situation

Filing for Chapter 13 bankruptcy can have a significant impact on an individualâs financial situation. For example, the individual may have to give up some of their assets in order to pay back their creditors. Additionally, they may have to make monthly payments for up to five years in order to repay their debt.

A Long Time Ago Bankruptcy Was Considered A Shameful Last Resort But Today It Is An Acceptable Method Of Resolving Serious Financial Troubles

A record one million individuals filed for bankruptcy protection in the United States in the peak year of 1992, and between 1984 and 1994 the number of personal bankruptcy filings doubled. In just one year there were 1,484,570 total bankruptcy filings. 2013: 1,137,978 2014: 1,000,083 2015: 879,736 2016: 819,159 2017: 796,037. Corporate bankruptcies are commonplace, particularly when corporations are the target of lawsuits, and even local governments seek debt relief through bankruptcy laws.

Read Also: Damaged Freight For Sale

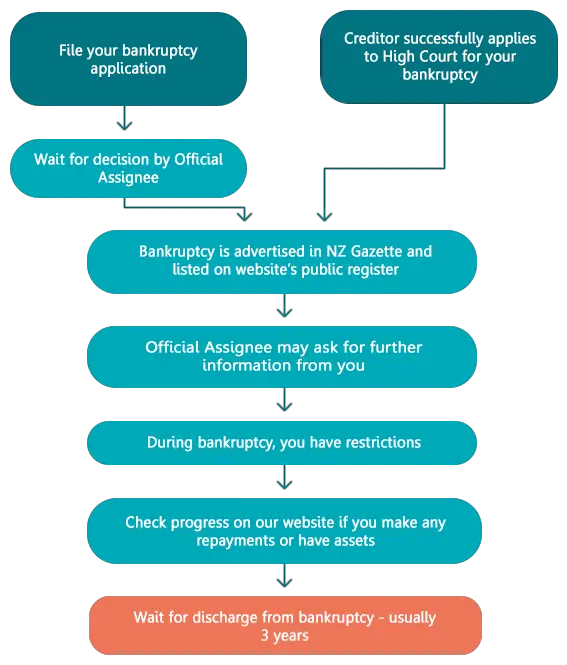

Who Can Be Made Bankrupt

A bankruptcy order can be made for one of three reasons:

- you cannot pay what you owe and want to declare yourself bankrupt

- your creditors apply to make you bankrupt because you owe them £5000 or more

- an insolvency practitioner makes you bankrupt because youve broken the terms of an individual voluntary arrangement

The Difference Between Chapter 7 And Chapter 13 Bankruptcies

Chapter 7 bankruptcy is a form of liquidation bankruptcy that requires individuals to surrender their assets to the court in exchange for a discharge of their debt. In contrast, Chapter 13 bankruptcy does not require individuals to surrender their assets. Instead, it allows them to reorganize their debt into a repayment plan that is approved by the court. Additionally, Chapter 13 bankruptcies tend to take longer than Chapter 7 bankruptcies.

Read Also: Did Toys R Us File Bankruptcy

Overview: What Is Bankruptcy

Bankruptcy is a legal process for individuals or companies that are unable to pay their outstanding debts. You can go bankrupt in one of two main ways. The more common route is to voluntarily file for bankruptcy. The second way is for creditors to ask the court to order a bankruptcy.

If you decide to file for bankruptcy yourself, there are several ways to do so. You may want to consult a lawyer before proceeding so you can figure out the best fit for your circumstances.

Which Debts Are Not Discharged In Bankruptcy

The following debts are not forgiven in personal bankruptcy:

If you have luxury item purchases or cash advances received immediately prior to the bankruptcy filing, creditors can challenge that, saying these were premeditated transactions, and have them excluded.

Another consideration: A bankruptcy discharge is personal and protects you. But it does not eliminate the debt itself. For example, if you had a co-signer on a home loan and you file for bankruptcy, the lender can still seek to collect the debt from the person who co-signed the loan. This is important to remember if you have family members or friends co-sign a loan, but are not going to file for bankruptcy.

Don’t Miss: How To File Bankruptcy In South Carolina

What Is Bankruptcy And How Does It Work

Introduction to Bankruptcy

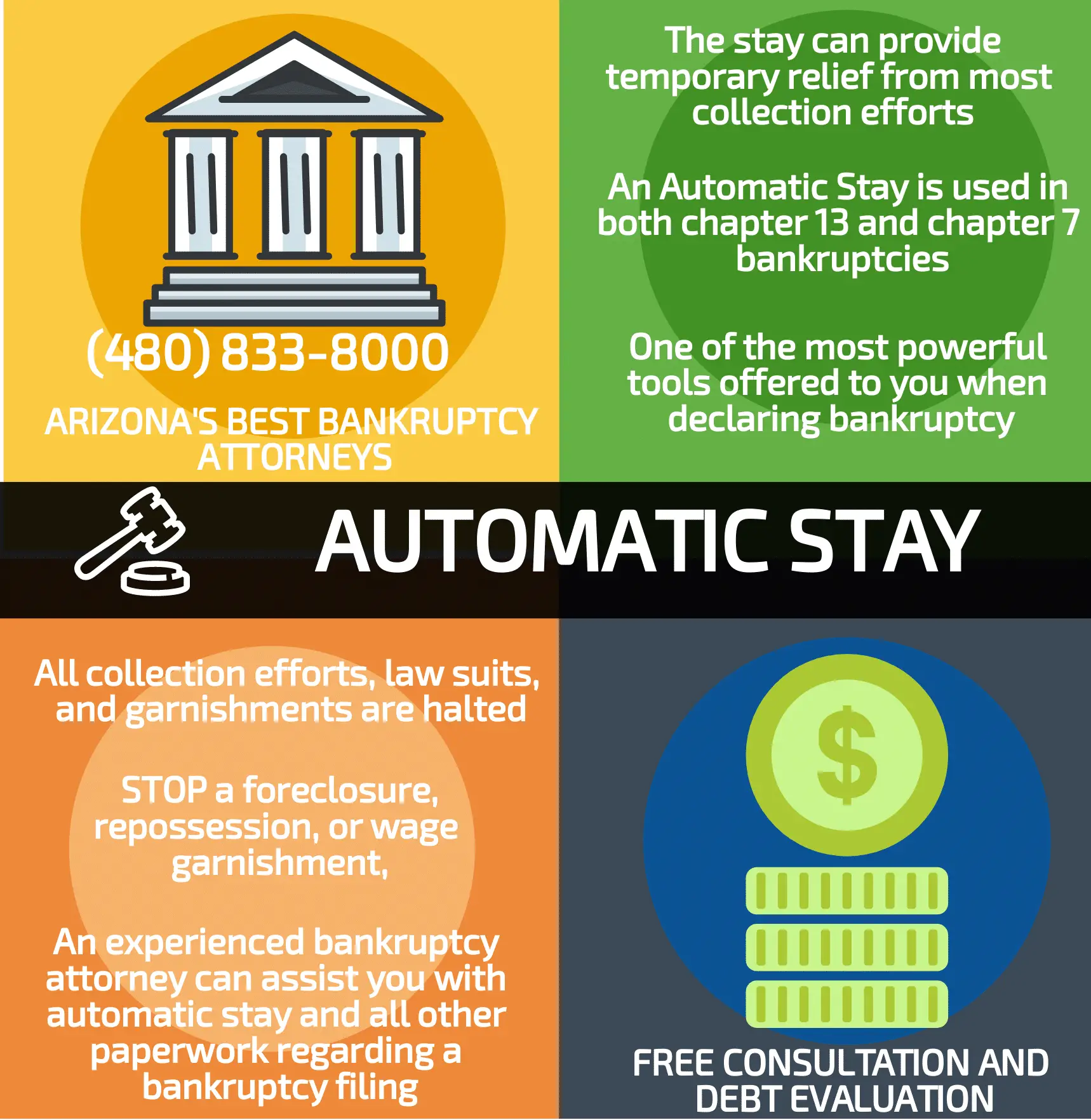

Bankruptcy is a legal process by which consumers and business can eliminate or repay some or all of their debts. The Federal Rules of Bankruptcy Procedure, 11 U.S.C Bankruptcy Code, and Local Rules of Bankruptcy Practice govern bankruptcy procedures. Federal Courts have exclusive jurisdiction over bankruptcy cases. Therefore, a bankruptcy case cannot be filed in a state court. A bankruptcy case normally begins by the debtor filing a voluntary bankruptcy petition with the bankruptcy court. Petitions may be filed by individuals, corporations, or other entities. Additional documentation is required listing assets, income, liabilities, and names and addresses of creditors and how much they are owed. The filing of the petition will, in most instances, automatically prevent or stay debt collection actions against the debtor and the debtors property.

Should I Declare Bankruptcy

There is a reason bankruptcy is called the nuclear option for debt relief. It should only be considered if you already have tried and failed to make a dent in your debt obligations using other debt-relief options.

If thats the case, consider the pros and cons before deciding to push the button.

Recommended Reading: Distress Homes For Sale

The Bottom Line On Bankruptcy

The U.S. Bankruptcy Code exists for a reason — to protect individuals who get in over their heads on the debt front and need relief. Filing for bankruptcy could be the best solution for dealing with your outstanding debt, or it could end up being a mistake you regret. If youre even considering filing for bankruptcy, consulting with a bankruptcy attorney is a good idea because a lawyer can walk you through your options and help you weigh the pros and cons involved.

What Happens If I Declare Bankruptcy

Home » Frequently Asked Questions » What Happens If I Declare Bankruptcy?

When you declare bankruptcy, you will file a petition in federal court. Once your petition for bankruptcy is filed, your creditors will be informed and must stop pursuing any debt you owe. The court will then request certain information from you, including:

- The total amount of debt you owe

- A complete list of all your creditors

- An accounting of your total income

- An accounting of your outgoing expenses

You are permitted to represent yourself in bankruptcy court. You are also allowed to hire a bankruptcy lawyer who can serve as your advocate and help you navigate the complicated process of what happens if you declare bankruptcy.

Having your debt discharged or reorganized in bankruptcy court can take a lengthy period of time. Should you get a lawyer, your lawyer can help you understand the relevant timeline in your bankruptcy case.

Recommended Reading: Can You Stop Bankruptcy Proceedings Once Started

What Happens To Credit Scores If You Dont Pay Your Bills On

If you file for bankruptcy, it means that your finances are not in order. Your credit score will suffer. Surprisingly though, the more damage your credit score suffers the longer it isnt. Youll feel less of an impact if your credit score isnt great. If your credit score is 700 or more, you may see your credit score drop by 200 points. You may lose less than 150 points if your score is lower.

Debt That Can’t Be Forgiven

While bankruptcy can eliminate a lot of debt, it can’t wipe the slate completely clean if you have certain types of unforgivable debt. Types of debt that bankruptcy can’t eliminate include:

- Most student loan debt .

- Court-ordered alimony.

- A federal tax lien for taxes owed to the U.S. government.

- Government fines or penalties.

Also Check: Liquidation Pallets New York

Yes But This Is A Deceptively Simple Question

Great care must be given to analyzing if the debts and/or are community. It is important to know the law of the state where the spouses lived in when incurring debts or receiving assets.

Under the bankruptcy laws a husband and wife may file a joint bankruptcy petition, using the same set of forms. Only one filing fee is charged for a joint petition, so it costs no more to file a joint petition than to file a single petition. The law does not require that both husband and wife file bankruptcy. Extreme care must be taken whether or not spouses should file a separate bankruptcy.

Under what conditions should both spouses file a joint bankruptcy?

First, the expectation is that both husband and wife will file a joint bankruptcy. If they do not, then they must explain the deviation from the norm. Both husband and wife should file when some of the debts are owed jointly by both the husband and the wife. If both husband and wife owe the debts and only the husband files bankruptcy, the creditors may try to force or harass the wife into paying the debts, even if she is unemployed. Citizens of Arizona have both a burden and protection of the community property laws. So, under Arizona law it may not be appropriate for the creditors to collect from the non-filer, but it depends on the specific circumstances surrounding the debt.

The Truth About Bankruptcy

If youre reading this, youre probably thinking about bankruptcy. The world may tell you this route is a fresh start . . . or a horrible ending. But whats the truth about bankruptcy?

In simple terms, bankruptcy is a legal process a person can go through to clear some of the debts theyre unable to pay.

If youre so overwhelmed by debt that bankruptcy feels like your only option, know these three things: 1) There is hopeand you will be okay. 2) There are other optionsand you should try every single one before jumping into bankruptcy. 3) Bankruptcy does not define you and will not be the end.

Keep these three things in mind as you read through the rest of this article and learn the truth about bankruptcy, including a breakdown on these specific topics:

You May Like: How To Buy Foreclosed Homes In Ohio

Are Debt Collectors In Canada Allowed To Keep Calling Me If I Declare Bankruptcy

Once a bankruptcy claim is filed, all creditors and collection agencies are required by law to stop contacting you. Additionally, a creditor cannot garnish your wages.

You can continue to receive calls from secured creditors. This applies to a mortgage, lien on a car, or debt for alimony or maintenance.

How Long Bankruptcy Lasts For

Bankruptcy normally lasts for one year. After this time, you’ll be ‘discharged’ from your bankruptcy regardless of how much you still owe.

Your discharge could happen earlier if you co-operate fully with the Official Receiver. In some cases and if you’ve behaved irresponsibly , bankruptcy can last for more than one year.

Also Check: How Much Are We In Debt

How To Know When To File Bankruptcy: Tips And Considerations

Bankruptcy is an option if you have too much debt. Find out if bankruptcy protection is right for you, the differences between types of bankruptcy, when to file, and what to expect.

It can be confusing to distinguish between the different types of bankruptcy and to know when it’s appropriate to file for it.

In this guide, we’ll cover Chapter 7 and Chapter 13the two most common types of bankruptcyand will explain what happens when you declare bankruptcy, how to do so, and questions you should ask yourself to determine whether bankruptcy is right for you.

Typical Chapter 13 Bankruptcy Case

What does a successful Chapter 13 applicant look like?

Consider Bill and Kathy, a married couple with a home that carries a $150,000 mortgage. Bill works, Kathy doesnt, but they file jointly for Chapter 13 protection. The couple also owes $7,000 on a car loan and has nearly $20,000 in credit card debt.

Two weeks after filing a petition, they submit a Chapter 13 repayment plan that shows how Bills income can be used to make mortgage and car payments, and it can repay part of the unsecured credit card debt. Their plan includes three categories of debt: priority, secured and unsecured.

Priority claims must be fully paid. They include the bankruptcy filing cost, some taxes and child support. Secured debts with collateral, like a house or a car, also must be paid in full in most cases.

Unsecured debts, like credit cards, are negotiable. The judge will review your income and repayment plan and rule how much youll owe your unsecured creditors. The range is everything to nothing, so dont prop your feet on the judges desk during the proceedings.

Bill and Kathy had to repay court costs and back taxes they owed. They had to become current on their mortgage and car payments. The judge discharged half their credit card debt.

The couple then began making payments to their trustee, who conveyed the money to creditors and monitored Bill and Kathys progress.

Don’t Miss: What Does Bankruptcy Do To Student Loans

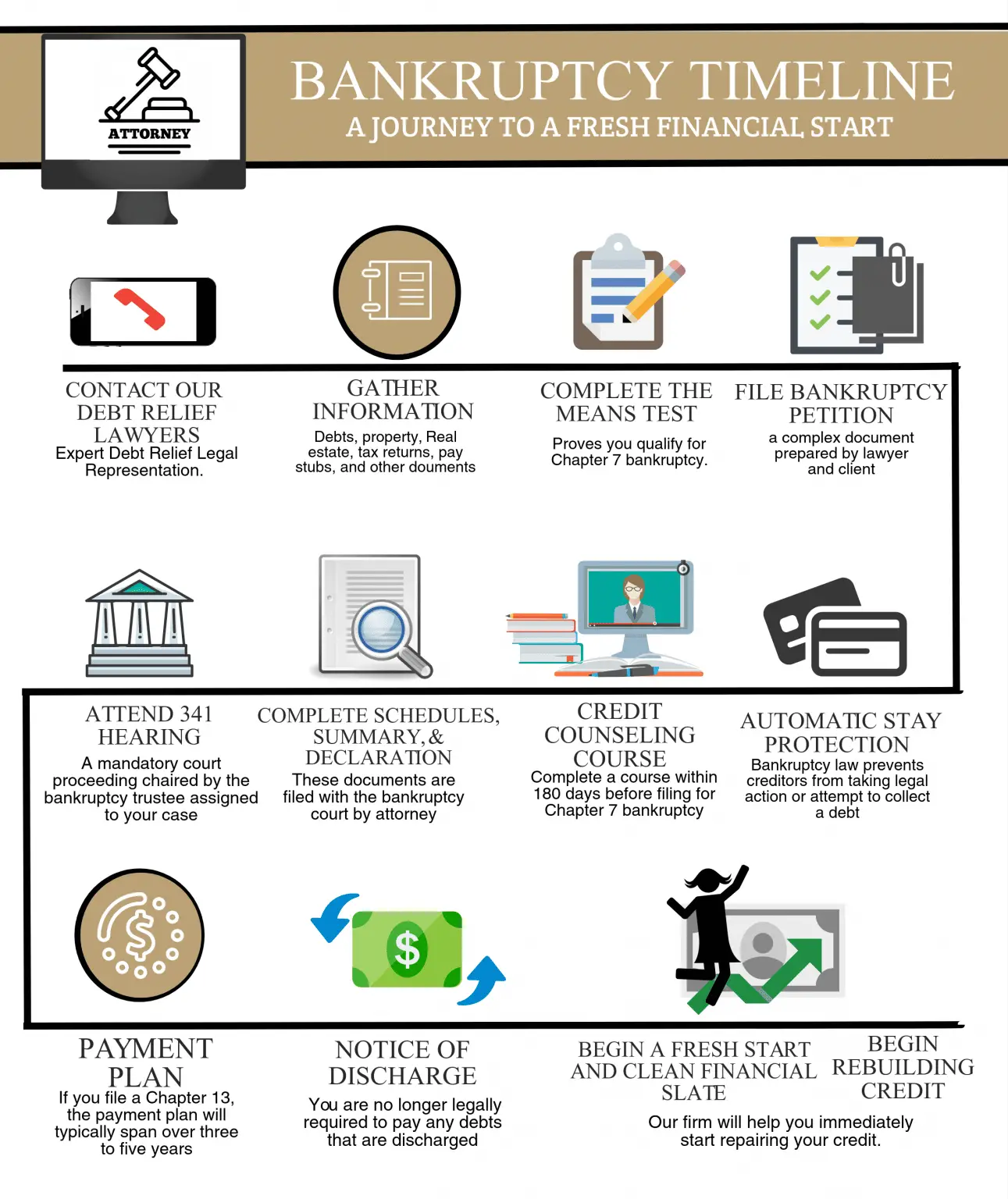

Outlining The Steps Involved In Chapter 13 Bankruptcy

The Chapter 13 bankruptcy process involves several steps that must be completed in order for the court to approve the repayment plan. These steps include credit counseling, filing the petition, meeting with creditors, developing a repayment plan, obtaining court approval of the repayment plan, making payments, and receiving the discharge.

What Are The Best Times To File Bankruptcy

If your obligations are so overwhelming that it is impossible to make your payments on time, you might consider declaring bankruptcy. Bankruptcy is designed to give individuals, businesses and governments the opportunity to either wipe away a portion of their debts or start over.

It is not a good idea to consider bankruptcy if you have a lot of debt or are in a temporary financial crisis. Filing bankruptcy can have serious consequences and you will not be able to get out of jail. If you have tried to pay your debts but are still finding yourself in a financial bind, bankruptcy should be considered as an option.

Read Also: How Much Debt You Need To File Bankruptcy

Payments From Your Income

If you can afford it, the trustee will ask you to make regular payments towards your debts from your income through an income payment agreement . You enter an IPA voluntarily, but theres a written binding agreement between you and the trustee.

If your main or only income is state benefits, the trustee will not normally try to get an IPA.

If you cannot agree on payment amounts for an IPA, the trustee can apply for an income payment order . If you do not meet these payments, the trustee can then apply to extend your bankruptcy.

The payments will come from surplus income .This is money you have left after paying your living expenses. Normally you will have to pay all of this surplus income as your IPA payment.

Payments normally last for 3 years . The court will not make an IPO if it leaves you without enough money to meet everyday needs.

The official receiver may use private debt collection agencies to collect the payments.

A fee will be charged in all bankruptcy cases where an IPA or IPO is set up. The fee is set at £150 which will cover the specific costs incurred by the Official Receiver of arranging and setting up your IPA or IPO and will be collected from the first payments you make into the arrangement. This fee is only chargeable on cases where a bankruptcy application was made or a petition presented on or after the 21 July 2016.