How Does A Foreclosure Impact Your Credit

Besides bankruptcy, foreclosure is one of the worst things that can happen to your credit. That impact doesnt last forever, though. These are some of the ways a foreclosure plays a role in your credit:

- Lower credit score: The appearance of a foreclosure on your credit report can bring down your credit score. How much your score drops depends on several factors, such as what you score was before foreclosure and how many other negative marks show up on your credit report. The missed payments leading up to foreclosure also will have a negative effect on your credit.

- Limited access to credit: For several years after a foreclosure, your ability to qualify for a credit card, loan or other lending product may be restricted.

- Long-term negative impact on credit report: Missed mortgage payments and foreclosure will be reflected on your credit report for seven years. After the seven-year period ends, the foreclosure will be removed from your credit report and will no longer affect your scores.

- Difficulty securing another mortgage loan: Even if your credit score has recovered in the time since your foreclosure, its presence on your credit report could disqualify you from getting a mortgage loan in the future. Some lenders wont consider approving a borrower if theres a recent foreclosure in their credit history. If you are approved, expect to pay higher interest rates or extra fees.

Dont Miss: What Dti For Mortgage

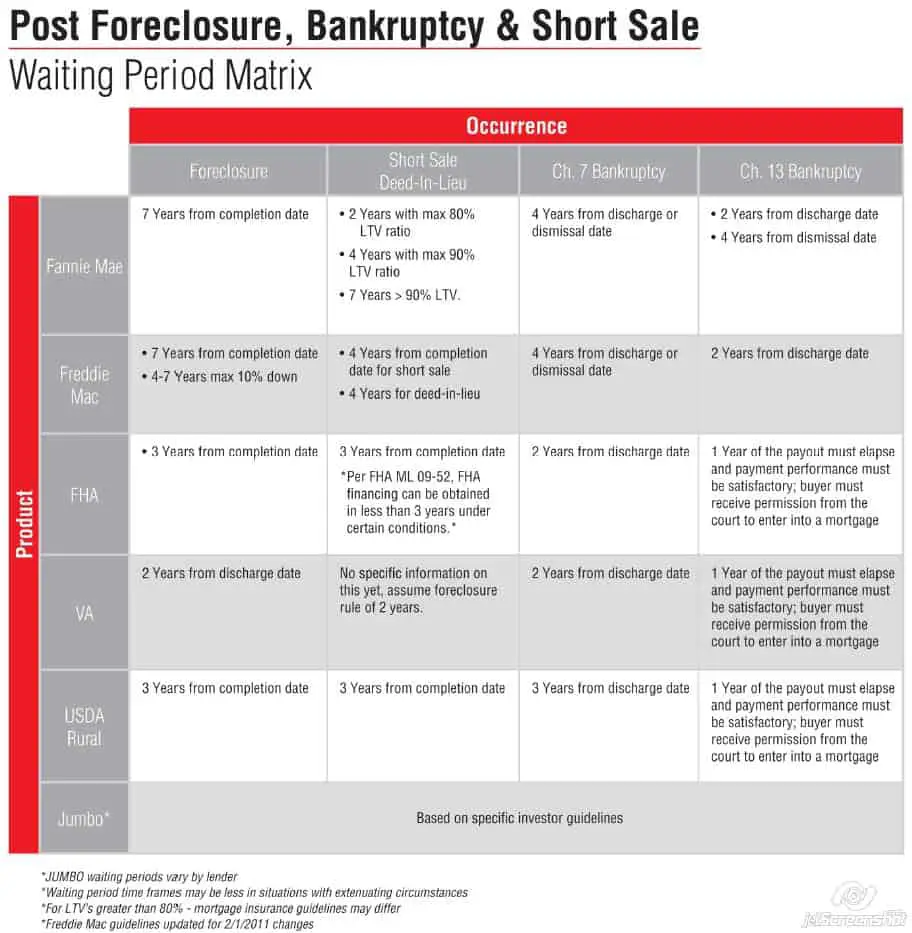

Buying A Home Using Conventional Loans After Bankruptcy

Conventional loansthose made by banks and mortgage companies without government backingare often sold to the Federal National Mortgage Association or the Federal Home Loan Mortgage Corporation . Fannie Mae and Freddie Mac set borrower guidelines for the mortgages they’re willing to purchase. Although a lender might be more lenient in its qualification criteria, most private lenders will respect the guidelines to make their mortgages sellable. Here are the waiting periods after bankruptcy.

- Chapter 7 bankruptcy. If the bankruptcy were due to your financial mismanagement, you’d have to wait 48 months, but if the bankruptcy were out of your control, you’d be eligible after 24 months.

- Chapter 13 bankruptcy. You must wait 24 months after discharge. If the court dismisses your case without a discharge, the waiting period will increase to 48 months. If, however, you can show that you filed the case under extenuating circumstances, you’ll only have to wait 24 months.

- Multiple bankruptcy cases. If you’ve filed more than one bankruptcy in the last seven years, it will be five years before you’re eligible, or three years if you can show extenuating circumstances. But this is still shorter than the seven years Fannie Mae requires after a foreclosure.

Also, keep in mind that Fannie Mae expects you to work toward rebuilding your credit during the waiting period.

One Day Out Of Failing Date Bankruptcy

You can qualify for an FHA or any other loan when you got your bankruptcy chapter 13 or chapter 7 discharged yesterday but your filing bankruptcy date was in the example 4 years ago. We can do these by comparing other mortgage brokers or banks when they have strict rules related to lender overlays. At FHA Lend we specialize in these types of loans, following with Non-QM loans and any other products we offer.

Also Check: Does A Bankruptcy Trustee Check Records

Can You Get An Fha Loan After Foreclosure

When a borrower has a foreclosure on their credit history, getting approved for an FHA loan depends on the time that has elapsed since the foreclosure and whether the borrower has worked to re-establish good credit.

The HUD Handbook 4000.1 directly addresses the question of whether a borrower with a foreclosure on their credit report can get approved for a FHA loan or not.

Heres what the HUD Handbook says:

A Borrower is generally not eligible for a new FHA-insured Mortgage if the Borrower had a foreclosure or a Deed-in-Lieu of foreclosure in the three-year period prior to the date of case number assignment.

Therefore, while generally a borrower is not eligible for an FHA loan, there are exceptions that will allow a borrower with a past incident of foreclosure to qualify for this type of loan.

After the 3-year waiting period and if the borrower has established good credit and has shown financial responsibility, they can qualify for an FHA loan.

The 3-year waiting period starts on the date of the DIL or the date that the Borrower transferred ownership of the Property to the foreclosing Entity/designee.

If the borrower can demonstrate extenuating circumstances that were beyond the control of the Borrower and the borrower has re-established good credit since the foreclosure, the 3-year waiting period can be overlooked by the lender.

What Happens To My Mortgage After Chapter 13 Discharge

Chapter 13 bankruptcy does not affect your home mortgage. You continue to make your mortgage payments during and after the bankruptcy. If you are behind in mortgage payments, you can pay off the arrears through your Chapter 13 repayment plan .

Can I get a Heloc after Chapter 13 discharge?

Yes, if you have kept your credit clean, and if you have enough equity in your home, you will be able to get a HELOC after Chapter 13 bankruptcy. The conventional lenders who provide HELOC loans are not all the same. You will also need to wait until 2 years after the bankruptcy has been discharged to apply for a HELOC.

How long after Chapter 7 Can I get an FHA loan?

two yearsYou are eligible for an FHA loan after Chapter 7 two years after discharge . During those two years, you must have re-established good credit and avoided taking on additional debt.

How long do I have to wait to buy a house after Chapter 13?

If you want to buy a house after Chapter 13 discharge, theres no waiting period for an FHA, VA, or USDA loan . For a conventional loan, theres a 2-year waiting period after Chapter 13 discharge.

Can you get a FHA loan after Chapter 13?

A person in a Chapter 13 can qualify for an FHA loan after making 12 on time bankruptcy payments. The court handling the bankruptcy must also provide approval for a purchase of a new home.

Read Also: What Is The Foreclosure Process

Respond To Lender Inquiries

Once you submit your preapproval application, the rest is in your lenders hands. Your lender will review your income, assets, debt and credit to see if you qualify for a mortgage. If you seem like a good candidate, your lender will send you a preapproval letter. You can use your letter to start shopping for a home.

Your lender might need to contact you to ask questions about items on your credit report. This is especially common after an adverse financial event like bankruptcy. Be honest and respond to your lenders inquiries quickly to improve your chances of approval.

You May Need A Credit Score Of 500 Or Higher To Buy A House

The waiting period and loan approval are essential factors, but some loan officers will not consider you until you rebuild your credit score. Credit scores typically range from 300 to 850.

For each type of loan, you need a credit score of the following:

- VA loan: no minimum credit score

- USDA loan: 640+

- Fannie Mae or Freddie Mac: 620-640 is the lowest they will accept

If your bankruptcy was years ago, but no one will loan to you, you may have options. There could be misinformation on your record or an outdated credit score.

Talk to a bankruptcy attorney about the issues you face in the home buying process to learn about your options. A new home is attainable within one to two years after bankruptcy if you take the right steps and seek legal guidance during the bankruptcy journey.

Don’t Miss: Liquidation Pallets Fort Worth

Benefits Of An Fha Loan With Chapter 13

FHA loans have easier credit requirements than other mortgage programs and are especially attractive to first-time home buyers.

The Federal Housing Administration, which insures these loans, only requires a 580 credit score and 3.5% down payment. You might even get away with a credit score of 500-579 if you can put 10% down. But youll have a harder time finding a willing lender.

- The loan is within current FHA loan limits

- You have steady employment and income

Most mortgage lenders are approved to do FHA loans, so first-time home buyers can shop around for a good deal. If one lender doesnt approve you because of your Chapter 13, but youre past the 12-month mark and meet loan requirements, try again with a different mortgage company. You might have more luck.

Learn How Long It Takes To Get An Fha Va Usda Or Conventional Mortgage Loan After Chapter 7 Or Chapter 13 Bankruptcy

Filing for bankruptcy doesn’t have to put a damper on your home buying dreamat least not for long. Lenders have eased requirements, opening the door for bankruptcy filers to get back into a home sooner than in the past.

Currently, the average waiting period is two years. In this article, you’ll learn about common mortgage loans and the respective eligibility requirements for bankruptcy filers.

You May Like: How To File Bankruptcy On Federal Student Loans

Tips To Qualify For A Mortgage With Chapter 13

Just meeting the 12-month requirement for a government loan doesnt guarantee youll qualify. But here are some tips to increase your chances of mortgage approval after a Chapter 13 bankruptcy filing:

- Re-establish your good credit. Take steps to build new credit by paying down debts and making on-time payments for utilities, credit cards, and car loans

- Meet standard lending guidelines. These include requirements for credit score, income, employment, and down payment, among other things. Having a stable income and plenty of savings may help you qualify if you have past credit issues

- Supply extra documents due to your Chapter 13. Lenders will likely require copies of your bankruptcy petition and discharge or dismissal documents

- Make sure youve budgeted correctly for new debt. Remember that your mortgage payment will include taxes and insurance as well as loan principal and interest. If you put less than 20% down, it will also include private mortgage insurance or FHA mortgage insurance. These added costs can increase a mortgage payment substantially

Before you jump into the application process, set aside some time to think about your maximum budget for payments and how the cost of homeownership will fit in with your debt repayment plan.

Cu Tr Li Chnh Xc: Hai N Ba Thng

Phá sn là thut ng dùng ch tình trng các cá nhân không có kh nng thanh toán các khon n và các khon vay trc ó tìm kim s cu tr bng cách cho mt s hàng hóa và thc th ca h và không c yêu cu tr tt c các khon n. Các thm phán ch yu áp t phá sn theo lnh ca tòa án và con n bt u các công vic khác.

Mc lc

Trong hu ht các trng hp, nu bn ã chn cách np n xóa tt c các khon n ca mình, thì s có mt s gii hn v thi im bn có th np n xin li. Trong trng hp bn ã s dng Chng by phá sn c th là thanh toán các khon n ca bn trong quá kh, thì bn phi i ít nht tám nm trc khi có th np li mt trng hp Chng by khác.

Also Check: When Can You Refinance After Bankruptcy

Is It Hard To Buy A House After Bankruptcy

Getting a loan will be very difficult for a few years immediately following a bankruptcy, says Reggie Graham, branch manager for Silverton Mortgage. He notes that home buyers applying after Chapter 7 and Chapter 13 bankruptcy can often expect bigger down payment requirements and higher interest rates.

Your focus should be on rebuilding your credit to prepare for applying for a mortgage loan when youre ready, says Graham.

He also suggests the wait time to buy a home may be shorter if you file a Chapter 13 bankruptcy rather than Chapter 7. Chapter 13 involves paying back an agreed-upon portion of your debt, which lenders look more kindly upon, Graham explains.

The Homeowners Bill Of Rights: When You Can Sue

Because of the implementation of the Home Owner Bill of Rights in California, homeowners can sue the servicer or lender for violations made under certain sections of this law. Relief includes injunctive relief or relief for actual damages if the trustees deed has been recorded.

Moreover, if the court finds that a violation was reckless, intentional, or resulted from willful misconduct by the servicer of the loan or the lender, the court has, in its power, the right to award the borrower the greater of three times the actual damages or statutory damages in the amount of $50,000.

Do You Meet the Criteria for the HBOR?

The safeguards given to homeowners through the Homeowners Bill of Rights or HBOR apply to first lien mortgages for properties that meet the following requirements:

- Owner-occupied residences

Dont Miss: How To Find If Someone Filed Bankruptcy

Also Check: Wholesale Pallets Houston Tx

Which Lenders Will Approve A Loan During Chapter 13

VA, USDA, and, sometimes FHA loans are available during Chapter 13 bankruptcy. Most major lenders are authorized to do FHA and VA loans. USDA mortgages are a little harder to find. Remember that mortgage lenders can set their own lending rules and some will be more amenable to borrowers with Chapter 13 than others.

In addition, youll have better luck if your finances are currently stable. A better credit score or higher income can work in your favor when you have past credit issues. If youre right on the edge of qualifying for instance, if your score is exactly 580, you have low income, and you want an FHA loan it could be tougher to get approved.

Youll also need to shop around and compare your options. All mortgage borrowers should shop for their best interest rate. But for borrowers with Chapter 13 this is doubly important. Youre not just shopping for a good deal youre shopping for a lender thats willing to approve you.

Can You Buy A House After Chapter 13 Bankruptcy

Its definitely possible to buy a house after Chapter 13 bankruptcy. In some cases, mortgage lenders will approve your loan application while you are still working through a Chapter 13 repayment plan.

Most lenders are easier on applicants who file for Chapter 13 than those who file for Chapter 7 bankruptcy. Thats because Chapter 13 filers have made an effort to repay at least some part of their unsecured debts, including credit cards and medical bills.

This is reflected in the minimum waiting period to get a loan after each type of bankruptcy:

- Mortgage after Chapter 7 bankruptcy: Two to three years after discharge

- Mortgage after Chapter 13 bankruptcy: 12 months after filing

Of course, youll still have some extra hurdles to clear if you want to buy real estate while in Chapter 13. A lender needs to see youve taken meaningful steps to improve your credit and debt management before it will approve you for a home loan.

The requirements to buy a house during or after Chapter 13 depend on the type of mortgage you hope to use. Government-backed loans are more lenient about Chapter 13 on your credit report, while conforming loans impose longer waiting periods.

Also Check: Formula For Debt To Income Ratio

Two Types Of Bankruptcy

- Chapter 7 Also called a liquidation bankruptcy, its the traditional route many people take. A chapter 7 bankruptcy discharges many kinds of loans while selling your assets to pay for a portion of your debt. You are not required to liquidate all your assets, though you may lose a large portion of it. A chapter 7 bankruptcy remains in your credit record for 10 years.

- Chapter 13 This bankruptcy is a payment plan option. It allows you to restructure your debts so you can pay them down within three to five years. This helps you create a workable payment plan to get out of debt while keeping your assets. However, if you fail to make payments, your lender is entitled to seize your assets. A chapter 13 bankruptcy stays on your record for 7 years.

Bankruptcies are generally more damaging to credit scores compared to foreclosures or short sales. This is because they impact multiple accounts. Defaulting on several loans takes longer to repair a borrowers credit history, which makes it harder to improve your credit score. It also requires a longer waiting period before you can apply again for credit.

Only consider bankruptcy as a last resort. Filing for bankruptcy incurs great damage on your credit history. Furthermore, bankruptcy does not discharge debts such as taxes, student loans, as well as child support and alimony. It also does not cover credit card purchases for luxury products and services.

How To Improve Your Chances Of Buying A House After Bankruptcy

To get approved for any type of mortgage loan after bankruptcy, you need to demonstrate to lenders that you can manage your finances responsibly and that you will be able to reliably make mortgage payments. That will require establishing good credit habits and ensuring that youre not over-utilizing credit, says Puricelli.

To rebuild bad credit more quickly, follow these tips:

- Pay all your bills on time and in full

- Check your free credit reports with the three major credit bureaus often and dispute anything inaccurate

- Dont take on unsecured debt, like personal loans or credit cards, which will most likely come with high interest rates

- Get a secure line of credit, such as a secured credit card, that is backed with a deposit you pay beforehand

Having a friend or relative cosign on new credit lines can also help you qualify more easily and start building new credit. But this strategy comes with a lot of risk, because the co-signer is agreeing to take over your new debts if you cant pay them. And if the loan goes bad, their credit will take a hit, too.

Read Also: Pender County Tax Foreclosures