What Happens To A Judicial Lien When You File Bankruptcy

Its your responsibility to pay the entire debt. Bankruptcy wipes out your personal liability for the debt, assuming that it qualifies for the bankruptcy discharge. This means the creditor cannot later sue you to collect the debt and use the judicial lien to garnish your wages or take money out of your bank account.

Official Bankruptcy Court Records Online

We are a bankruptcy court records retrieval service. After you place your order, we will obtain your official records and send them to you by email. If your records are unavailable for any reason, we provide a full refund. The records you receive are an official copy of your bankruptcy records that are lender compliant. We provide this service for all 50 states.

What Happens To Your Pension

Most pension schemes arent included in your bankruptcy and they cant be claimed by the trustee.

The pension scheme must be a UK state pension scheme or a scheme approved or registered by HM Revenue & Customs. Approved or registered pension schemes are usually:

- occupational pension schemes approved for tax purposes

- personal pensions approved for tax purposes

- stakeholder pensions

- retirement annuity contracts

If your pension scheme is not an approved or registered scheme you may be able to exclude it from your bankruptcy by:

- applying to the court for an exclusion order, or

- making a qualifying agreement

If your pension is part of the bankruptcy, it can be used to make payments to your creditors.

Pension Payments

Payments made to you from your pension scheme, including any lump sums, before the end of your bankruptcy can be used as part of an Income Payments Agreement or Income Payments Order . This will involve you paying some of your debt with your income.

If you are able to take money from your pension following changes to the law in April 2015, but have chosen not to do so, the trustee may look at the value of your available pension fund. If this would give you access to enough money to make a different arrangement to pay your creditors, the trustee can ask the court to cancel the bankruptcy.

Death benefits

Bankruptcies before May 2000

Read Also: How To Buy A New Car After Bankruptcy

Do You Have To Disclose A Bankruptcy After 7 Years

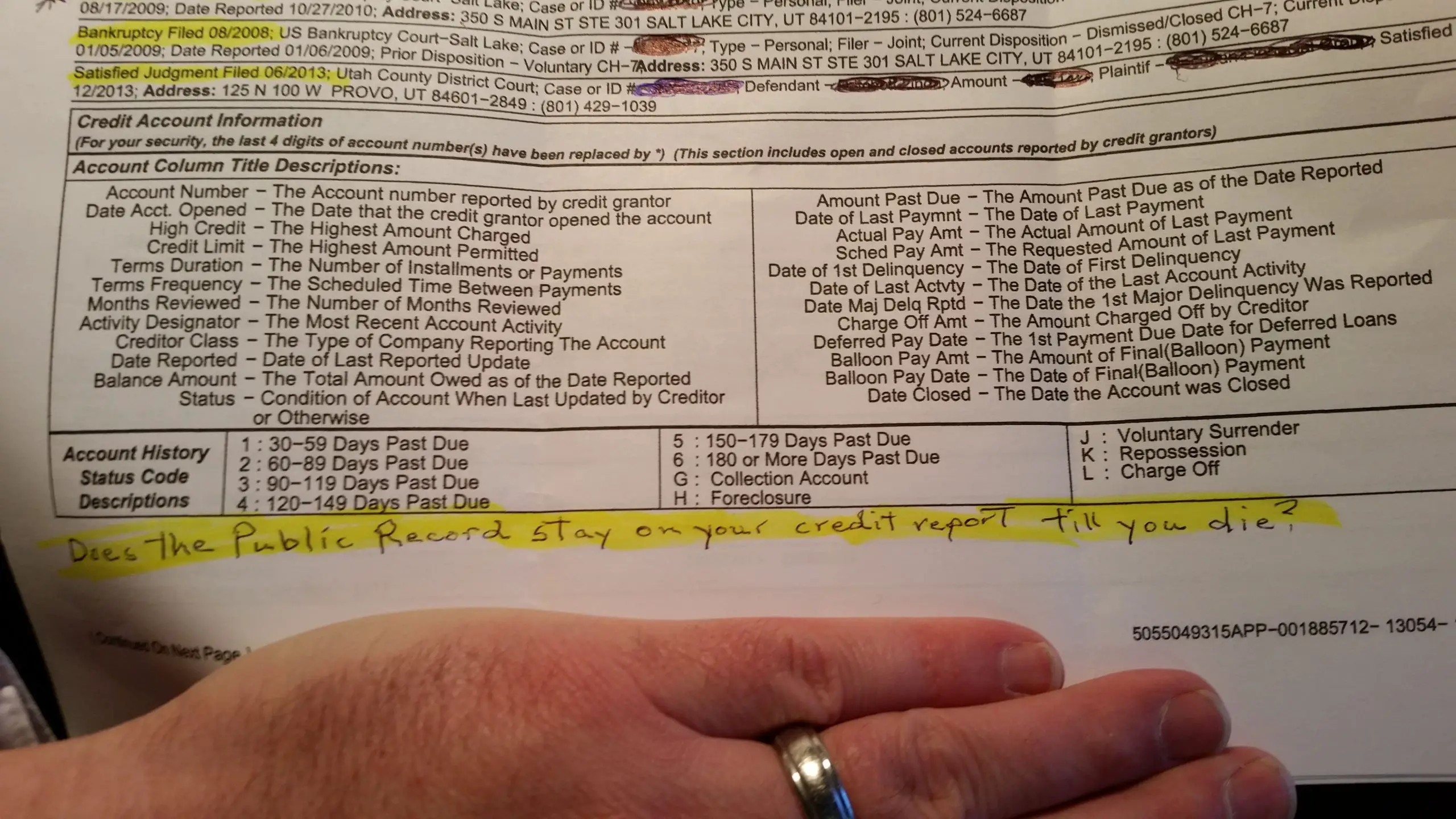

A Chapter 7 bankruptcy stays on your credit report for ten years after your filing date. A Chapter 13 bankruptcy gets removed after seven years because debtors repay at least some of their debt. While the bankruptcy information remains on your credit report, anyone who pulls your credit can learn of your filing.

What If You Dont Want To Have Your Bankruptcy Listed

If you believe you or your family are at risk of violence if your bankruptcy is made public, then you can fill in a 7.1A form. This then involves attending a court hearing to explain your situation and prevent the bankruptcy from being made public. However, you cannot simply ask that your bankruptcy is not advertised, as it is a legal requirement.

Also Check: How Do You File Bankruptcy In Oregon

Why Is A Bankruptcy Public Record

The simplest answer is that bankruptcy cases are also court proceedings, and all court proceedings are public record. Unless a judge orders your records sealed, they are public record. However, there are parts of your bankruptcy that do not fall under the umbrella of public record. Sensitive information, such as your social security number, are always redacted in order to protect both the information and you. Additionally, only your birth year is shown from your birth date. As we stated above, PACER allows the public to view federal court proceedings. Because bankruptcy courts are part of the federal court system, they are public record. Most PACER users are either bankruptcy attorneys or their colleagues.

Not long ago, newspapers included legal notices sections. These notices often included bankruptcy filings. However, as bankruptcy filings have become more common since the 1970s, these notices are increasingly rare. Except in the case of businesses filing for bankruptcy, many newspapers do not include personal bankruptcies. Even when newspapers report on these business bankruptcies, they often only report on large businesses that affect a significant number of jobs.

How Will A Bankruptcy Impact Your Credit

Your credit report is a tool to show lenders that you have responsible financial habits, thus making you a satisfactory risk for them to lend money to on the assumption that they will be paid back. With a bankruptcy on your record, you are showing them the opposite. However, bankruptcies do happen, even to conscientious people when they are going through a financial crisis. And sometimes its the best strategy for getting out from under oppressive debt.

According to FICO,a bankruptcy will cause a bigger drop in credit score for someone with a clean credit record than someone who already had some dings. And, the more accounts that are included in the bankruptcy filing, the bigger the effect on your score.

When lenders view your credit report, its possible that they will be more forgiving of a Chapter 13 bankruptcy than a Chapter 7, because at least you made the effort to repay some of your debts.

But as long as the bankruptcy is on your credit report, it will be a factor in whether lenders want to extend you credit, and they are likely going to charge you a much-higher interest rate. However, the effect will diminish over time, so its smart to start thinking about your next steps to rebuild your credit and get back on stable financial footing.

You May Like: How Many Bankruptcies Has Donald Trump Filed

Also Check: Did Donald Trump Declare Bankruptcy

Military Personnel And Security Clearances

If you want to join the military, you will typically have to disclose previous bankruptcies during the application process. Depending on the specific branch of the military you are applying to, a credit check can also be required. Because each branch of the military has its own rules about financial eligibility, talk to a military recruiter to learn more about whether filing for bankruptcy will affect your service eligibility.

If you are in the military, it’s not so much the bankruptcy that will have a negative impact on your security clearance, but your financial stability. Security clearance determinations are usually made on a case by case basis. Before filing your case, check with the necessary military personnel or department to discuss any issues that might jeopardize your security clearance or otherwise adversely affect your military career. For more information, read Special Rules for Military Members.

How Can I Update My Experian Credit Report After Filing Bankruptcy

If youve obtained a recent copy of your Experian credit report and found that the bankruptcy discharge information is not yet appearing, you can request that the information be updated. Your bankruptcy records should include a document, called a schedule, that lists all of the debts included in the bankruptcy filing.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Can You Remove Bankruptcy From Public Record

Unfortunately, there is no current way to entirely remove a bankruptcy filing from public record.

Your bankruptcy will only appear on your credit report for ten years. After that, it will generally only be available through court records. This is because your bankruptcy filing is just like any other public court proceeding.

What Is The Public Record

Anything that you and I can get access to either through a court or another government entity without first getting authorization to do so is considered âpublic record.â A common example of information that is part of the public record is real property information. If you own your home, that fact is part of the public record in your home state. An example of what is not a public record are tax returns. Even though theyâre submitted to a government agency, the information contained in your tax return canât be accessed by just anyone without proper authorization.

Recommended Reading: When Did Puerto Rico Declare Bankruptcy

Is Chapter 13 Bankruptcy A Public Record

Chapter 13 | November 23, 2020 | Christopher Ross Morgan

Most people file bankruptcy because of job loss, high medical bills, or another event which was beyond their control. Nevertheless, some people equate bankruptcy filing with financial failure. So, the fact that Chapter 13 filings are a public record, at least for the most part, deters some people from filing. However, coronavirus has changed things. 90 percent of Americans say they are experiencing severe financial stress. So, people who looked down on bankruptcy filers before might have a different attitude now.

Additionally, as outlined below, Chapter 13 filings are limited public records. That allows many debtors to fly under the radar.

Additionally, the benefits of bankruptcy are very difficult to ignore. Bankruptcys Automatic Stay immediately stops repossession, foreclosure, wage garnishment, and other adverse actions which take financial stress to the next level. Chapter 13 also protects your familys most valuable assets, like your retirement account, house, car, and personal possessions. These things could be vulnerable to creditor seizure outside bankruptcy.

An experienced Athens bankruptcy lawyer knows how to maximize these benefits while minimizing the ill effects of a bankruptcy filing. An attorney can strategically assign value to your assets and maximize the exemptions. Furthermore, a lawyer helps you recover more quickly from bankruptcy, so you get the fresh start you deserve.

When A Company Files A Chapter 11 Bankruptcy It Can Have A Plan Approved That Discharges Its Debts Once The Plan Is Confirmed As Long As The Company Continues In Business

How long to file bankruptcies. A similar approach is to file a chapter 13 case immediately after receiving a chapter 7 discharge . Know how much time you have until youre in the clear. That time period starts on the date you file the bankruptcy petition.

You can either go bankrupt voluntarily, or a lender can make you bankrupt if you owe £5000 or more and you havent agreed a way to pay. Chapter 13 and chapter 7 bankruptcies are very different for businesses. The public record associated with a chapter 7 bankruptcy will remain on your credit report for as long as 10 years.

After a year, you are discharged. Bankruptcy law does not limit the number of times a person can file only the amount of time between filings. Chapter 13 allows the proprietorship to stay in business and repay its debts and chapter 7 does not.

Since you are placed on a repayment plan, a new chapter 13 case can be filed in as little as two years. Not only is the filing process quick, but unlike a chapter 13 bankruptcy , qualified debtors don’t make monthly payments to creditors over. Bankruptcies usually last for 12 months, and youll have many financial restrictions during this time.

Featured in forbes 4x and funded by institutions like harvard university so we’ll never ask you for a credit card. How long does it take to file for bankruptcy? 5 minute read upsolve is a nonprofit tool that helps you file bankruptcy for free.

Pin auf bankruptcy

Read Also: How Many Times Has Donald Trump Filed For Bankrupcy

The Pacer System & Court Records

A bankruptcy filing becomes public record after you submit your bankruptcy petition. Someone from the court will upload your documents and bankruptcy schedule into the Pacer system.

The PACER system is a program used by the federal courts to keep track of any and all court documents. Any kind of paperwork that goes through a court will usually be added to the PACER system, and can therefore be accessed by the public. To access the system, you need to create a PACER account and pay a small fee per page that is viewed.

Consumers Can Seek Chapter 7 Or Chapter 13 Bankruptcy

There are two types of bankruptcy that consumers can choose if their financial situation warrants it: Chapter 7 or Chapter 13 bankruptcy. The type of bankruptcy you choose will ultimately determine how long it remains on your credit report.

Chapter 7 bankruptcy essentially means any unsecured debt will be wiped out with certain limits and restrictions. The other type is Chapter 13 Bankruptcy, which calls for people to continue paying their debt for several years and afterward, a portion of that debt is discharged.

Also Check: Can I Lease A Car After Bankruptcy

How Long Does Bankruptcy Stay On Public Record

A Chapter 13 bankruptcy stays on your report for 7 years after the date of filing.

A Chapter 7 bankruptcy stays on your record for 10 years after the date of filing.

It is possible, though difficult, to remove it earlier by disputing any inaccuracies in your paperwork with the three credit bureaus .

Bankruptcy And Insolvency Records Search

- basic debtor information of all bankruptcies and proposals registered in Canada since 1978

- all receiverships registered with our office since January 1993

- all petitions recorded at our office and

- all companies that have been granted protection under the Companies´ Creditors Arrangement Act since September 18, 2009.

- Date modified:

Don’t Miss: Filing For Bankruptcy In Il

How Long Does Bankruptcy Stay On The Public Register

This is when the details of your bankruptcy are normally removed from the public Individual Insolvency Register. However if the official receiver found you acted dishonestly or irresponsibly they may apply bankruptcy restriction undertakings which will mean your bankruptcy stays on the public register for longer.

How Quickly Will My Credit Score Rise After Bankruptcy

As mentioned previously, many people will notice their credit scores plunge in the months leading up to filing bankruptcy. While discharging your debts will help give you a fresh start, you shouldnt expect to see much of a credit increase until your bankruptcy is completed.

For those that file Chapter 7, this could be within six months of your completed filing. For those filing Chapter 13, it could be longer. Again, Chapter 13 usually includes a three to five-year repayment plan so it could take longer to see an increase in your score. On the other hand, sometimes there are benefits to filing that cannot be achieved by filing for Chapter 7.

You May Like: How Do You File Bankruptcy In Oregon

Recommended Reading: Trump Bankruptcies How Many

Can Creditors Report During Bankruptcy

However, creditors are not required to make any reports on your credit while you are going through the bankruptcy process, which could be anywhere from a few months for a Chapter 7 to 5 years on Chapter 13 case. Those seeking Chapter 13 Bankruptcy are only able to take on debt in the form of a refinanced mortgage.

Lawyer Job Description And Salary

According to PACER, the website includes a case locator funding which allows for searching for bankruptcy, as well as federal district and appellate cases. PACER requires registration for all users, which includes providing valid name, address, contact information, and billing information. The site charges users access at the rate of $.10 per page.

Beyond PACER, companies called Justia, BK Data Marketing, and Filings also offer access to Texas Bankruptcy records in all four district courts, though these resources are potentially less comprehensive and up-to-date than PACER.

For older bankruptcy cases before the 1990s, it may be necessary to contact or to have your lawyer contact the clerk of the Bankruptcy Court to figure out how to find bankruptcy records or how to find bankruptcy filings in Texas.

Also Check: Free Bankruptcy Software For Consumers

If You Dont Live In England Or Wales

You can declare yourself bankrupt in England or Wales if you live outside the UK, provided you lived in England or Wales or have had a business there at some point in the last three years. The Bankruptcy Order made in England and Wales may not be recognised in other countries outside the UK.

You cant declare yourself bankrupt in England or Wales if you live in Scotland or Northern Ireland.

What Does It Mean That A Bankruptcy Is Public Record

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

Anything that you and I can get access to either through a court or another government entity without first getting authorization to do so is considered âpublic record.â This article will explore what kinds of records a bankruptcy filing goes into and what it means for you.

Written by Attorney John Coble.

This article will explore what kinds of records a bankruptcy filing goes into and what it means for you.

Don’t Miss: What Is Epiq Bankruptcy Solutions Llc

View Print Or Save Details Of Your Search

CCAA records

When you choose to view CCAA records , you will be able to view, print or save your search results. There is no charge to view these records.

BIA records

Once you have paid for your search, one of three situations will occur:

Press “View details of the results” to print or save. Even when there are no matches, it is still a good idea to print the results of your search or save them to your desktop. This will be your record that, according to your search criteria, nothing was found in our records.

You now have the option of viewing and printing or saving to your desktop the details of each record, one at a time. To view the details for a record, click on the name.

After printing or saving a record to your desktop, click the “Back to the search results” link at the bottom of the page to go back to the list where you can click on another name and select another record.

Don’t forget to print the details of the results of your search or save them to your desktop.

You now have the option of viewing and printing or saving to your desktop details of each record, one at a time. To view the details of a record, click on the name.

If you finish viewing a set of 10 records and still have not found what you are looking for, you can select “Next 10” or “Previous 10.”

Tip: