Trump Ice Natural Spring Water

Trump Ice was a bottled water brand. The winner of The Apprentice Season 2, Kelly Perdew, served as executive vice president of the organization.

The companys website no longer exists, and the product can no longer be found in national grocery chains or stores but some can still be found on eBay and other auction sites.

The company was used as a gimmick in the shows first season when contestants marketed and sold the product.

How Often Has Donald Trump Declared Bankruptcy

Donald Trumps business record seems riddled with unfortunate events. Despite never having filed for personal bankruptcy, reports state that he filed for business bankruptcy at least four times. But, according to Trump, businesses file for bankruptcy often, and it was a financially intelligent move. He added that hundreds of companies have done the same thing he did.

Admirably Tough Or Downright Slimy Your Call

Donald Trump has ticked off a whole lot of different groups during his outspoken and unconventional run for the presidency. Few small business owners are among them.

Back during the primaries when he was an unlikely challenger to a slew of other more mainstream Republican candidates, Trump managed to attract the support of a whopping 41 percent of small business owners despite the crowded field. Even after a year of gaffes and controversy, more recentpolls suggest small business owners remain among Trumps most stalwart supporters.

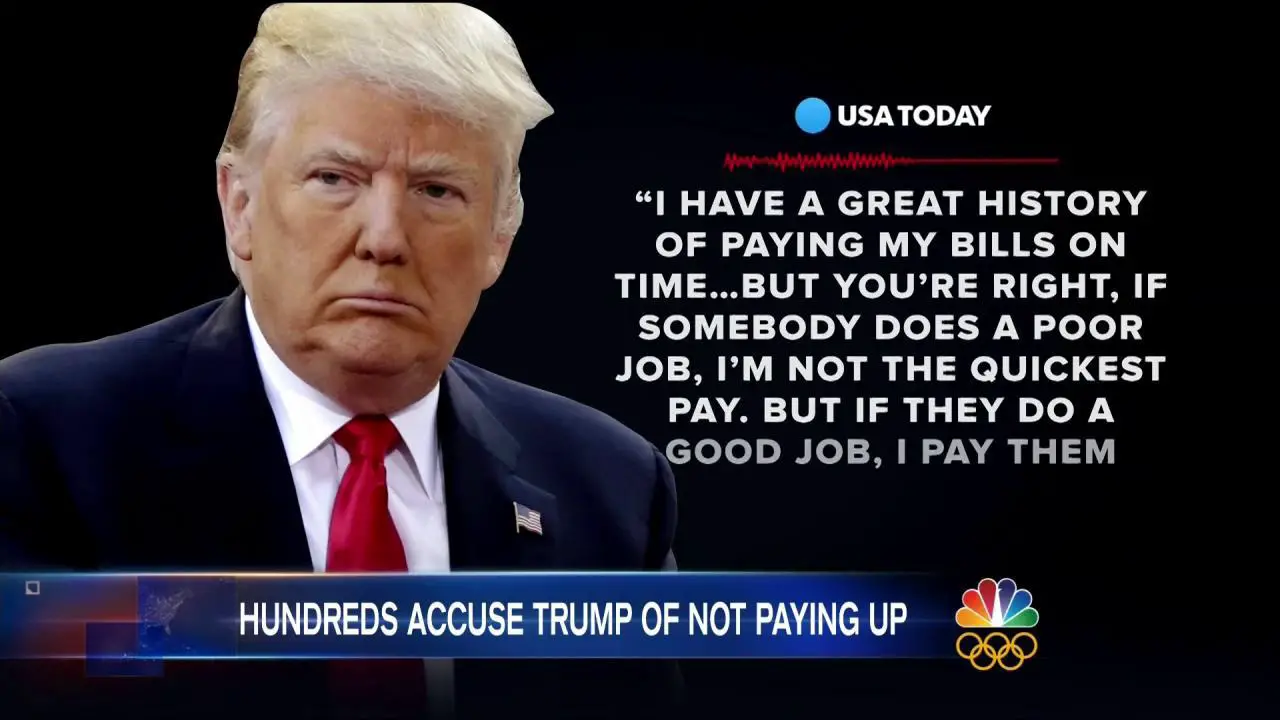

But there are some interesting and very vocal exceptions the many small business owners Donald Trump has stiffed in his long career as a real estate tycoon.

Recently several media outlets have dug up a handful of business owners with worrying tales to tell of Trumps bullying, unfairness, and failure to pay. And while their numbers arent huge, there are enough of them to suggest a pattern of behavior that raises questions about whether pre-politics Trump was much of a friend to small business in practice. Here are a few of their stories:

Recommended Reading: Can I Buy A Car After Filing Bankruptcy

How Is Donald Trump Able To File For Bankruptcy So Many Times

Prior to the 2016 presidential election, when people discussed then-candidate Donald Trump, they often focused on his personal finances and how he had run his businesses. One of the common refrains had to do with his bankruptcies. According to pundits and critics, Trump had been unsuccessful in business, having to file bankruptcy several times in order to get by. Some people may have seen those stories and read the reports only to wonder how a person can declare bankruptcy so many times. For someone with the wealth of Donald Trump, how is it possible to keep declaring bankruptcy?

Donald Trump and personal bankrtupcyTo understand Donald Trump and bankruptcy, one must first understand the distinction between personal finances and business finances. Businesses are separate entities according to the law. In particular, corporations have their own legal personhood. They are specifically created so that people can avoid personal financial liability if things happen to go wrong. With this in mind, Donald Trump has actually never declared personal bankruptcy. In each instance, his bankruptcy has been a result of a business failure rather than a personal failure.

There have been many other business bankruptcies. Most of those have involved casinos. While Trump has tried hard in the casino business, he has had a number of failures there. On top of that, his Trump Plaza Hotel had to declare bankruptcy in order to seek ample protections.

We Have A Company Thats Really Got Great Potential 2005

Though he has acknowledged mistakes in piling crippling debt on Trump Hotels and Casino Resorts, Donald Trump has steadfastly maintained that his resorts were the best-run and highest-performing casinos in Atlantic City.

The casinos have done very well from a business standpoint, he told Playboy magazine in 2004. People agree that theyre well run, they look good and customers love them.

In reality, the revenue at Mr. Trumps casinos had consistently lagged behind their competitors for a decade before larger forces ravaged the industry. Beginning in 1997, his share of the Atlantic City gambling market began to slip from its peak of 30 percent.

Revenues at other Atlantic City casinos rose 18 percent from 1997 through 2002 Mr. Trumps fell by 1 percent.

Competition grew more intense in 2003, when the Borgata Hotel Casino and Spa opened. The $1.1 billion, 40-story resort redefined the concept of an Atlantic City luxury casino. Revenues at Trump casinos dropped another 6 percent in a little more than a year.

Had Mr. Trumps revenues grown at the rate of other Atlantic City casinos, his company could have made its interest payments and possibly registered a profit. But with sagging revenues and high costs, his casinos had too little money for renovations and improvements, which are vital for hotels to attract guests. The public company never logged a profitable year.

I think the biggest thing is, it understates his compensation, Mr. Cox said.

- Save Story

Save this story for later.

Read Also: How To File For Bankruptcy In Massachusetts

Early Years And Daniel Coit Gilman

The trustees worked alongside four notable university presidents of , of , of and of . They each vouched for to lead the new University and he became the university’s first president. Gilman, a -educated scholar, had been serving as president of the prior to this appointment. In preparation for the university’s founding, visited and other German universities.

Gilman launched what many at the time considered an audacious and unprecedented academic experiment to merge teaching and research. He dismissed the idea that the two were mutually exclusive: “The best teachers are usually those who are free, competent and willing to make original researches in the library and the laboratory,” he stated. To implement his plan, Gilman recruited internationally known researchers including the mathematician the biologist the physicist , the and Charles D. Morris the economist and the chemist , who became the second president of the university in 1901.

Gilman focused on the expansion of graduate education and support of faculty research. The new university fused advanced scholarship with such professional schools as medicine and engineering. Hopkins became the national trendsetter in programs and the host for numerous scholarly journals and associations. The , founded in 1878, is the oldest American in continuous operation.

Procedure To Sell Assets Approved

In a setback to the arguments of hold-out creditors, primarily made up of investment firms, Judge Gonzalez on May 5, 2009 approved proposed bidding procedures that would likely lead to Chrysler’s sale of assets to an entity in which Fiat is a major owner. The lawyer for the dissident creditors holding US$300 million of a total US$6.9 billion of secured debt in Chrysler argued that proposed sale procedures preclude other potential bidders. The plan is for several major Chrysler assets to be sold to a new entity jointly owned by the United Automobile Workers Union health care trust fund, Fiat, and the United States and Canadian governments.

Read Also: How Many Bankruptcies Has Trump Filed

Time Limits Apply To Discharges Not Bankruptcy Filings

Bankruptcy law doesnt set a minimum period that you must wait before filing for bankruptcy a second time. However, theres a catch. If you file too soon after wiping out debt in a previous case, you wont be eligible for another debt discharge .

Although there are times that it makes sense to file for bankruptcy even though you wont receive a discharge, these situations are rare . Because a bankruptcy filed too soon will end up being a waste of time and money in most cases, its essential to know how to time your bankruptcy filing.

Recommended Reading: What Does Dave Ramsey Say About Bankruptcy

Trump Hotels And Casino Resorts

A holding company for three casinos, Trump Hotels and Casino Resorts went bankrupt in November 2004. The casino was under a $1.8 billion debt, and the association decided to sell some stake to the bondholders. However, the holding company emerged from bankruptcy within a year in 2005 with a new name- Trump Entertainment Resorts Inc. However, the company was still in debt, which pushed Trump to give up his CEO title and sell most of the stocks to the bondholder.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

We Are Watching Trumps 7th Bankruptcy Unfold

Donald Trump was a businessman who ran six businesses that went bankrupt because they couldnt pay their bills. Trump, who is running for president again, repeats some of his business mistakes and risks the demise of another venture: his political operation.

Trump, a charismatic real-estate investor and swashbuckler in the 1980s, bet big on Atlantic Citys rise after New Jersey legalized gaming. Trump acquired three casinos that couldnt pay off their debts by 1991. In 1991, the Taj Mahal, Trump Plaza and Trump Castle declared bankruptcy.

Trump transferred his casino assets to a new company, which went bankrupt in 2004 after the lenders restructured the debt. In 2009, the company that emerged from this restructuring declared bankruptcy. Trumps sixth bankruptcy was the Plaza Hotel which he purchased in 1988. It was declared bankrupt in 1992.

Trumps 2016 surprise win mirrors the 30-year-old arrival of Atlantic Citys brash young man. Trumps presidency is now in its fourth year. He gets poor marks from voters for his handling of the coronavirus crisis. The outbreak exacerbated this at Trumps White House.

Democrat Joe Biden is winning in most swing states, and an Election Day blowout could be possible. Trump has suggested he wont leave office if he loses, threatening a constitutional crisis and political legacy.

Trumps bankruptcies are an essential reason for the Trump campaigns current turmoil.

These are five similarities:

Many Tech Companies Have Moved To Curtail President Trump Online Since He Urged On A Violent Mob Of His Supporters At The Capitol Last Weekcreditdoug Mills/the New York Times

Cenk uygur, host of the young turks, breaks it down. It is long past time that we acknowledge how partisan they are. President trump claims he has paid ‘millions’ in federal income taxes. Says donald trump was forced to file for bankruptcy not once, not twice, four times. read more. You see these generals lately on television?

You May Like: How Many Bankruptcies For Donald Trump

The Untold Truth Of Michael Bloomberg

Every day, Bloomberg News updates its Bloomberg Billionaires Index, which purportedly ranks “each of the world’s 500 richest people.” Yet every day, eponymous billionaire Michael Bloomberg is conspicuously missing from the list. As of this writing, he boasts a net worth of $55.5 billion, according to Forbes. He just doesn’t boast it on Bloomberg News because it doesn’t cover its parent company, Bloomberg LP, or the father of that company, Michael Bloomberg. If included on his index, he would currently rank as the 16th wealthiest person on Earth.

As Biography details, Bloomberg amassed his humongous fortune with the game-changing computer terminals he started selling to investment banks in the early 1980s. As business boomed, the company “branched into” the news industry. Bloomberg would make his own headlines as mayor of New York, even spearheading legislation that allowed him to serve a third term.

Mayoralty Of Michael Bloomberg

The mayoralty of Michael Bloomberg began on January 1, 2002, when Michael Bloomberg was inaugurated as the 108thmayor of New York City, and ended on December 31, 2013.

Bloomberg was known as a political pragmatist and for a managerial style that reflected his experience in the private sector. Bloomberg chose to apply a statistical, results-based approach to city management, appointing city commissioners based on their expertise and granting them wide autonomy in their decision-making. Breaking with 190 years of tradition, Bloomberg implemented a “bullpen” open plan office, reminiscent of a Wall Streettrading floor, in which dozens of aides and managerial staff are seated together in a large chamber. The design was intended to promote accountability and accessibility. At the end of Bloomberg’s three terms, the New York Times said, “New York is once again a thriving, appealing city where the crime rate is down, the transportation system is more efficient, the environment is cleaner.”

Read Also: How To File Bankruptcy In Wisconsin

Michael Bloomberg Worked In A Vault

Michael Bloomberg entered the business world in an unglamorous fashion. In a sense, there was almost no fashion because he worked in his underwear with other scantily clad guys. While that might read like the description of a film called Magic Mike Bloomberg, this story is more about making money than shaking a moneymaker. As recounted by , after graduating from Harvard Business School in 1966, Bloomberg applied to work at Goldman Sachs and the family-run bond trading firm, Salomon Brothers & Hutzler, where he forged a firm bond with managing partner William Salomon.

New hirees were tasked with counting billions of dollars of bonds and stock certificates in a stuffy vault, and Bloomberg was no exception. He said of the experience, “We slaved in our underwear, in an un-air-conditioned bank vault, with an occasional six-pack of beer to make it more bearable.” This was a different time, when casual Fridays were presumably way too casual. On top of that, back then , people copied documents using carbon paper, and when papers had to be delivered between floors in short order, they were placed in a basket and lowered on a rope through a window. As technology evolved and Bloomberg rose through the corporate ranks, he increasingly advocated using computers.

About Cibik & Cataldo Law Firm

Our company is in the business of offering debt relief to our clients. Bankruptcy often includes shame, fear, and anxiety. We understand how you feel because we have helped so many in getting through what is a stressful time. We know how to confront the issues involved in individual and small business consumer bankruptcy, here in Philadelphia and surrounding areas.

Our most important desire to share our compassion and respect with you, our clients. Our lawyers are well-versed in providing bankruptcy services which include:

- Mortgage foreclosure assistance

- Medical debt cases

- Small business bankruptcy claims

When you call us, we will make an appointment for a free consultation if you are considering bankruptcy. Our no-pressure environment will allow you to share with us your financial situation, your options, and come up with the right solution for you. Once we have met, we will guide you in the areas of:

- The types of bankruptcy

Also Check: Can You Get A Personal Loan After Bankruptcy

Portable Bloomberg: The Wit And Wisdom Of Michael Bloomberg

Portable Bloomberg: The Wit and Wisdom of Michael Bloomberg| Personal sayings and business advice | |

| Publisher | White Mountain Press |

|---|---|

| Publication date |

Portable Bloomberg: The Wit and Wisdom of Michael Bloomberg is a 1990 booklet that contains sayings, maxims, comments, and other thoughts of Michael Bloomberg. The 32-page publication compiles quotes attributed to Bloomberg, while he was leading Bloomberg L.P., and prepared by the company’s chief marketing officer, Elisabeth DeMarse. The book, which calls itself an “unauthorized collection of unauthorized sayings”, was a gift to Bloomberg on his 48th birthday and contains a total of 121 quotes.

Agreement With Labor Unions

By mid-April, as talks intensified between the two automakers to reach an agreement by a government-imposed deadline of April 30, Fiat’s proposed initial stake was reported to be 20% with some influence on the structure of top management of the company.

However, Fiat had warned that there would be no agreement if Chrysler failed to reach an agreement with the UAW and the Canadian Auto Workers’ Union. On April 26, 2009, it appeared as if Chrysler had reached a deal with the unions which would meet federal requirements, though details were not made available. Chrysler said the union agreement “provides the framework needed to ensure manufacturing competitiveness and helps to meet the guidelines set forth by the U.S. Treasury Department.”

Chrysler filed for chapter 11 bankruptcy protection at the Federal Bankruptcy Court of the Southern District of New York, on April 30, 2009, and announced an alliance with Fiat.

A new company will be formed to acquire the assets of Chrysler, which will be known as New CarCo Acquisition LLC.

Don’t Miss: How Many Times Has Trump Declared Bankruptcy

Smart Annual Subscribe Now And Get 12 Months Free

Note: Subscription will be auto renewed, you may cancel any time in the future without any questions asked.

- Unlimited access to all content on any device through browser or app.

- Exclusive content, features, opinions and comment hand-picked by our editors, just for you.

- Pick 5 of your favourite companies. Get a daily email with all the news updates on them.

- Track the industry of your choice with a daily newsletter specific to that industry.

- Stay on top of your investments. Track stock prices in your portfolio.

Donât Miss: Diy Bankruptcy Chapter 13

Move To Homewood And Early 20th Century History

In the early 20th century, the university outgrew its buildings and the trustees began to search for a new home. Developing Clifton for the university was too costly, and 30 acres of the estate had to be sold to the city as public park. A solution was achieved by a team of prominent locals who acquired the estate in north Baltimore known as . On February 22, 1902, this land was formally transferred to the university. The flagship building, Gilman Hall, was completed in 1915. The relocated in Fall of 1914 and the followed in 1916. These decades saw the ceding of lands by the university for the public Wyman Park and Wyman Park Dell and the , coalescing in the contemporary area of 140 acres .

Prior to becoming the main Johns Hopkins campus, the Homewood estate had initially been the gift of Charles Carroll of Carrollton, a Maryland planter and signer of the , to his son Charles Carroll Jr. The original structure, the 1801 , still stands and serves as an on-campus museum. The brick and marble style of Homewood House became the architectural inspiration for much of the university campus versus the style of other historic American universities.

In 1909, the university was among the first to start adult programs and in 1916 it founded the US’ first .

Since the 1910s, Johns Hopkins University has famously been a “fertile cradle” to ‘s .

Presidents of the universityRead Also: Epiq Bankruptcy Solutions Llc Ditech