National Debt Vs Budget Deficits

As we delve into the consequences of the national debt, it’s important to keep in mind that it’s different from the federal government’s annual budget deficit.

The federal government runs a budget deficit whenever its spending exceeds tax collections and other revenue. To make up the difference, the U.S. Treasury sells treasury bills, notes, and bonds.

The national debt is the aggregate of the federal government’s annual budget deficits, minus the rare surpluses.

What Will Happen To Our National Debt

U.S. spending is currently at an all-time high to combat the effects of COVID-19. The current level of debt-to-GDP is comparable to the period immediately after World War II. Despite the effort to reduce the national debt, it is apparent and crucial for the government to take on the debt during times of crisis. Being able to adequately and successfully respond to emergencies is one of the many reasons why the national debt should be reduced governments should respond to events in an appropriate and timely manner with its citizens in thought.

Lesson From Across The Pond

The market turmoil in the UK and sudden collapse of the Truss government could prove to be a cautionary tale. Bond yields spiked in the UK after former Prime Minister Liz Truss unveiled a budget proposal that unnerved investors.

The UK bond market had a hissy fit. With interest rates going up, the sovereign bond bubble is unwinding, Boockvar said.

Of course, the United States is still the worlds largest economy and remains a top destination for foreign investment. And the US dollar is the worlds reserve currency.

Read Also: What Percent Of Net Income Should Go To Mortgage

Why Do Countries Accumulate Foreign Exchange Reserves

Any country that trades openly with other countries is likely to buy foreign sovereign debt. In terms of economic policy, a country can have any two but not three of the following: a fixed exchange rate, an independent monetary policy, and free capital flows. Foreign sovereign debt provide countries with a means to pursue their economic objectives.

The first two functions are monetary policy choices performed by a countrys central bank. First, sovereign debt frequently comprises part of other countries foreign exchange reserves. Second, central banks buy sovereign debt as part of monetary policy to maintain the exchange rate or forestall economic instability. Third, as a low-risk store of value, sovereign debt is attractive to central banks and other financial actors alike. Each of these functions will be discussed briefly.

You May Like: Southwest Credit Systems Debt Collection

Under Which Program Does The Us Government Spend The Most Money

As Figure A suggests, Social Security is the single largest mandatory spending item, taking up 38% or nearly $1,050 billion of the $2,736 billion total. The next largest expenditures are Medicare and Income Security, with the remaining amount going to Medicaid, Veterans Benefits, and other programs.

You May Like: What Is The Current Us Debt

Don’t Miss: Where To Pay Collections

What Us State Has The Most Debt

While New York leads the country in terms of per capita government debt, at $18,411 per person, California, the most populous state, has the largest amount of total debt, at $507 billion. Conversely, Wyoming has both the lowest amount of total and per capita debt, at about $2 billion or $3,437 per person.

Which President Created The Most Debt

In terms of percentages, President Franklin Delanor Roosevelt added the most debt with a 1,048% increase in national debt from his predecessor President Herbert Hoover. With $236 billion added to the national debt, President Roosevelt served as president during the time of the Great Depression which largely depleted the countrys revenue. To combat this, he set up the New Deal which included relief programs and government spending to address unemployment, severe droughts and agriculture disruptions, and bank failures. The largest part of the addition to the national debt was World War II – the war cost the country $209 billion from 1942 to 1945.

Don’t Miss: When Will My Bankruptcy Be Removed From My Credit Report

When You Should Invest Rather Than Pay Off Debt

Lets say this is your debt situation:

Type of debt

| $300,000 | 5% |

This scenario is simple because you might have a large loan, such as a mortgage, with a relatively low interest rate. All you basically have to do from a money-making standpoint is stand to earn more on your investments than youre paying in interest on your debt. And at that point, it might make sense to invest rather than pay off debt.

This doesnt mean you shouldnt make your required minimum payments. But if you have extra cash beyond making the standard monthly payments, it might make sense to invest that money rather than putting it toward your debt.

Theres no way to know for sure that youd earn more on your investments than the interest on your debt, but historic returns are in your favor. The annualized return rate of the S& P 500 over the last 10 years is 11.24% as of 2022. Thats more than double the 5% interest rate on your hypothetical loan.

Recommended Reading:

How Much Debt Is Enough To File Bankruptcy

There is no specific amount of debt that you need to have in order to file for bankruptcy relief. However, it is important to consider the type of bankruptcy that you are eligible for and the cost of the process. For example, if you have a relatively small amount of debt, such as $5,000, you could file for bankruptcy relief under Chapter 7 bankruptcy.

However, if you have a high income and do not meet the income requirements for Chapter 7, you may need to file under Chapter 13, which is a bankruptcy repayment plan. In this case, you may need to pay higher filing fees and attorneys fees, as well as administrative fees and ongoing payments while in the repayment plan.

Additionally, you should consider whether you have the financial means to pay off your debt within a reasonable time frame and whether you would be better off exploring other debt relief options. If you have a high level of disposable income and few assets, bankruptcy may not be the best option for you. On the other hand, if you have a low level of disposable income and a large amount of debt, bankruptcy may be a viable option for relieving your financial burden.

You May Like: How Much Is It To File Bankruptcy In Nj

Taking National Debt Personally

While voters are not fans of national debt on principle, the debt-to-GDP ratio makes for a lackluster rallying point in practice, since even economists cant agree on what percentage is too high.

Hence, efforts follow to frame the national debt burden in easily understood terms. One popular tactic is to divide national debt by the population to determine debt per capita. Dividing the U.S. national debt of $31.1 trillion as of Q3 2022 by an estimated U.S. population of 333.2 million in 2022 yields national debt per capita of more than $93,337, which sounds like a lot.

Fortunately, the per capita apportionment of government debt ignores the fact that no individual, not even a child, can hope to repay debt in a currency that they create, like the U.S. government and many other sovereign borrowers do.

The improbability of default by a sovereign borrowing in its own currency is what marks out such debt as a safe asset relative to credit issued to private borrowers. In this sense, the national debt can be thought of as an interest-bearing currency supplementing interest-free banknotes. Like currency, the national debt is a government obligation serving as an asset and store of value for its owners.

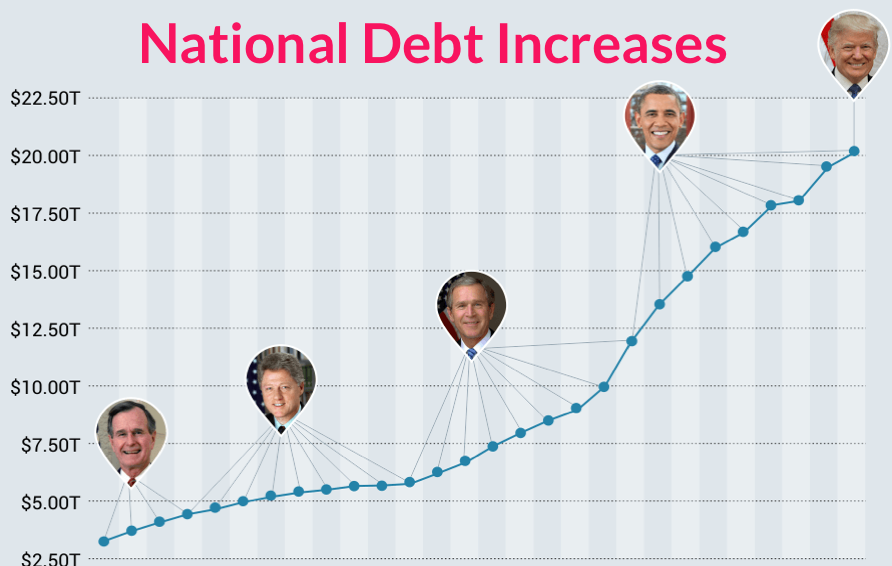

Which Presidents Are To Blame

Of course, each political party points to the other. The fact is there’s no easy answer, because there are different ways to measure the situation.

The most popular method is to simply compare the debt level from when a president enters the White House to the debt level when he leaves.

After all, it’s your debt, too. You’re paying for this debt when you pay taxes.

Don’t Miss: Can You File Bankruptcy On Titlemax

Who Decides How Much Interest The Us Pays On Its Debt

Supply and demand doin other words, the marketplace. When the government needs to raise debt financing, it sells debt securities in an auction. Bidders offer to buy the debt for a specific rate, yield, or discount margin, and all successful bidders receive the highest yield or discount that the Treasury accepts. Government debt buyers may include central banks, though their goal is typically to foster sustainable economic growth rather than to finance deficit spending.

The Pandemic Impact On Debt

The less your income, the easier it is to pile up debt. That obvious lesson hit home in 2020.

The unemployment rate went from 3.5% pre-COVID to a peak of 14.8% in April 2020the highest level since 1948.

The total U.S. consumer debt balance grew $800 billion, according to Experian. That was an increase of 6% over 2019, the highest annual growth jump in over a decade.

Student loan debt increased the most , followed by mortgage debt and personal loan debt .

But dropped $73 billion, a 9% decrease from 2019 and the first annual drop in eight years.

A November 2020 Experian survey showed that 66% of consumers were spending the same or less during the pandemic than they had in 2019. About 33% of those surveyed said they put more in savings in 2020 than they did in the last year.

Recommended Reading: Cedar Rapids Bankruptcy Lawyer

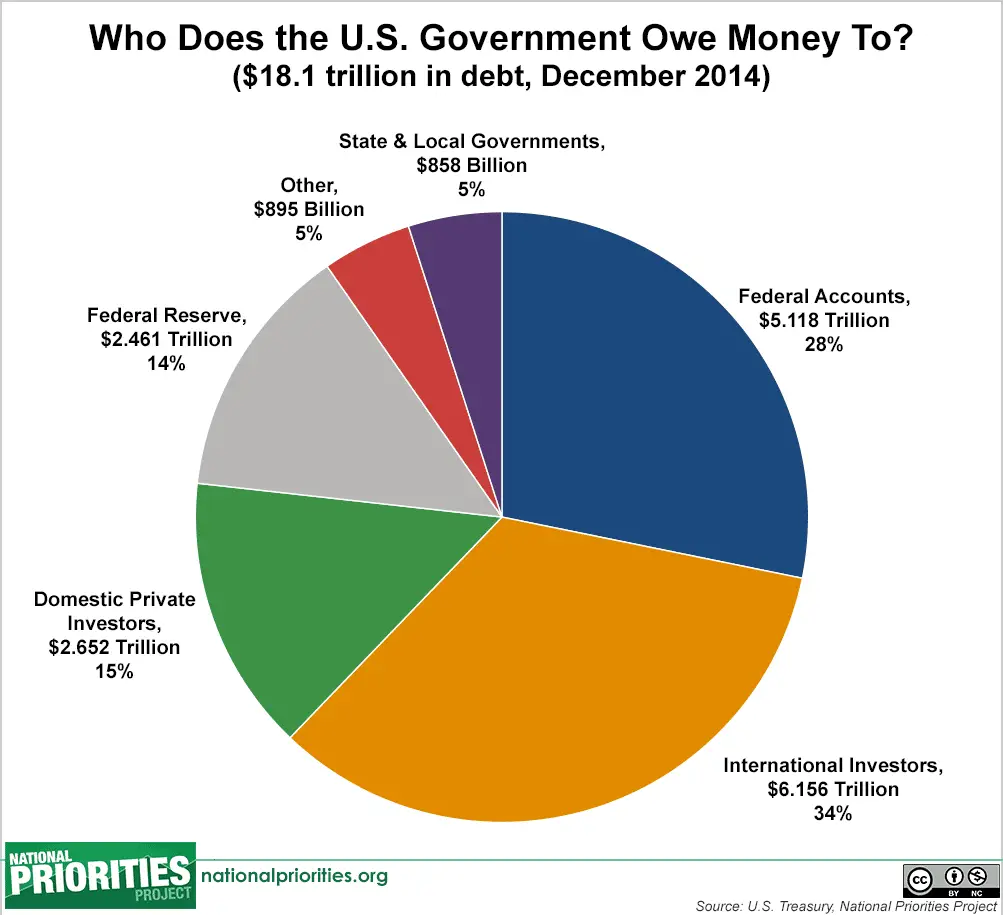

Who Owns The Us Debt

The short answer: A big chunk of it is held by the US government itself. The rest is held by private investors and foreign governments. Foreign governments hold about 30% of US public debt.

The following data was taken from a US Treasury Department website. It shows the ownership of Americas national debt, in billions of dollars, at the end of 2018:

- Federal reserve and government accounts 8,095

- Total privately held 13,879

- US savings bonds 156

- Other investors 2,794

What is public debt and how is it accrued? Why is debt split into two categories? Do foreign governments that hold debt pose a threat to the US economy?

Keep reading to find out.

Confidence Isn’t Always About The Numbers

Ask yourself this: Do you feel confident that the economy is healthier in 2021 than it was during the Great Depression of the 1930’s?

You almost certainly do because the economy is healthier today. But when unemployment had reached 25% and middle class Americans were relying on soup kitchens to stay alive, the Debt-to-GDP ratio was only 44%.Today it’s 129%.

The president of the United States makes tough financial decisions every day. Each move invites half the country to praise and the other to criticize.

If you want to feel confident about which side of the argument to join, you need context. Decisions aren’t made in a vacuum and neither should your opinions.

Here’s our break down the last 6 POTUS. Judge or forgive away.

Don’t Miss: What Are The Different Types Of Bankruptcies

Current Foreign Ownership Of Us Debt

apan owned $1.23 trillion in U.S. Treasurys in June 2022, making it the largest foreign holder of the national debt. The second-largest holder is China, which owns $967.8 billion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their own currencies. This helps to keep their exports to the U.S. affordable, which helps their economies grow.

China replaced the U.K. as the second-largest foreign holder in 2006 when it increased its holdings to $699 billion.

The U.K. is the third-largest holder with $615.4 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. Luxembourg is next, holding $306.8 billion. The Cayman Islands, Switzerland, Ireland, Belgium, France, and Taiwan round out the top 10.

Women And Millennials Stress Most

In terms of gender and age brackets, women and the 30- to 44-year-old group are the most stressed about debt.

Campos said the survey found that women have more student loan debt, carry credit card balances more often and report more personal loans than men.

In addition, 50% of millennials have credit card debt.

They have lived through the 2008 recession with many of them graduating into it or recently employed when it hit and they are wary about taking on debt during a time of economic turmoil, Campos said. The average American household has more debt than savings and investments combined.

The data highlights that, while monitoring credit scores is important, Americans want better outcomes and to feel smarter about their debt, Campos said.

This means saving money, planning, refinancing and more, he said. There is a pressing need for tools to help Americans organize and prioritize how they tackle debt of all kinds.

More From GOBankingRates

Recommended Reading: How To See If Bankruptcy Is Discharged

What Makes The Debt Bigger

The current leading federal spending categories, which include Social Security, Medicare/Medicaid, and defense, are the same as they were in the 1990s. Thats when the U.S. national debt was much lower relative to GDP. The U.S. remains the worlds largest economy and one of the richest countries. How, then, did the debt situation deteriorate? Numerous factors are in play.

Wheres Our Money Going

We cant talk about debt without talking about budgeting. As we see the amount of money we owe grow and grow, we must ask ourselves where is our money going? Most Americans couldnt really answer that question only about 1 in 3 people keep a household budget. Whats more alarming is that almost half of US families report living paycheck to paycheck. Sadly, 19% of Americans also report that they have $0 set aside to cover an unexpected financial emergency.

There are several factors to consider when looking at your personal budget. The first step is to see where the money is going. According to a survey done by Northwestern Mutual, almost 40% of our income is spent on discretionary spending. Our spending habits indicate that almost half our money on things such as dining out, nightlife, entertainment & hobbies. While there is nothing inherently wrong with spending money on these things, we are treading dangerous waters when we continue to live beyond our means and spend money we dont have.

The problems with debt in the US will only continue to rise as more people are spending beyond their means. While some debt might be unavoidable, there really is no reason to keep up with the Joneses.

You can be free from the burden of debt, just start with a simple written budget. Look at your bank accounts, add it all up and actually see where your money is going. Really look at the reality of your situation, and dont be afraid to make changes.

Dont Miss: United States Gdp To Debt Ratio

Recommended Reading: How Long Does Filing Bankruptcy Affect Your Credit

Health Disability And Medical Debt

Differences in health status and hospital stays or having adisability may also contribute to medical debt.

About 31% of households with a member in fair or poor healthhad medical debt compared to 14.4% of those with no members in fair or poorhealth .

The share of households with medical debt was almost doublefor those with any member experiencing a hospital stay than for thosewith no members with a hospital stay .

More than 1 in 4 households with at least one memberwith a disability had medical debt compared to 14.4% of households with nomembers with disabilities.

1. New York

New York has the highest debt of any state, with total debt of over $203.77 billion. New Yorks total assets are around $106.61 billion, giving the state a debt ratio of 273.8%. The main culprit for New Yorks towering debt is overspending on Medicaid. New York has attempted to fill budget gaps by cutting school aid and health care costs in recent years.

2. New Jersey

New Jersey has the second-highest amount of debt in the country. The states total liabilities total $222.27 billion, surpassing its assets by $198.67 billion. New Jerseys debt ratio is 441.7%. The largest source of debt is the states unfunded pension and benefits system for public employees. New Jersey legislators are looking toward tax increases because of the states debt and the growing pressure to fund other priorities such as infrastructure and education.

3. Illinois

Also Check: What Is It Like To Be Debt-free

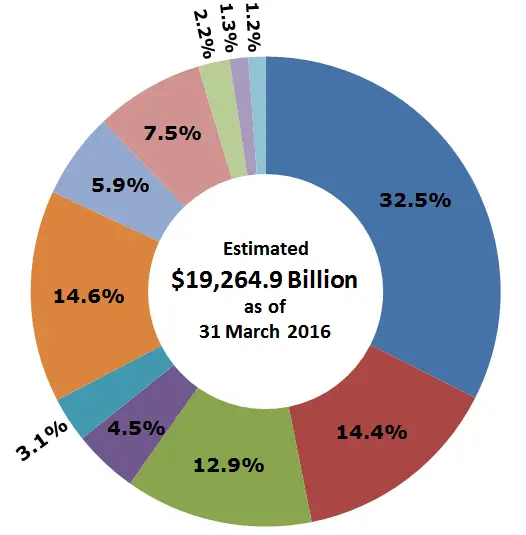

Public And Government Accounts

As of July 20, 2020, debt held by the public was $20.57 trillion, and intragovernmental holdings were $5.94 trillion, for a total of $26.51 trillion. Debt held by the public was approximately 77% of GDP in 2017, ranked 43rd highest out of 207 countries. The CBO forecast in April 2018 that the ratio will rise to nearly 100% by 2028, perhaps higher if current policies are extended beyond their scheduled expiration date.

The national debt can also be classified into marketable or non-marketable securities. Most of the marketable securities are Treasury notes, bills, and bonds held by investors and governments globally. The non-marketable securities are mainly the “government account series” owed to certain government trust funds such as the Social Security Trust Fund, which represented $2.82 trillion in 2017.

The non-marketable securities represent amounts owed to program beneficiaries. For example, in the cash upon receipt but spent for other purposes. If the government continues to run deficits in other parts of the budget, the government will have to issue debt held by the public to fund the Social Security Trust Fund, in effect exchanging one type of debt for the other. Other large intragovernmental holders include the Federal Housing Administration, the Federal Savings and Loan Corporation’s Resolution Fund and the Federal Hospital Insurance Trust Fund .

Also Check: How Does Bankruptcy Affect Tax Return