Forms Of Government Borrowing

In addition to selling Treasury bills, notes, and bonds, the U.S. government borrows by issuing Treasury Inflation-Protected Securities and Floating Rate Notes . Its borrowing instruments also include savings bonds as well as government account securities that represent intergovernmental debt.

Other nations have borrowed from international organizations like the International Monetary Fund and The World Bank as well as private financial institutions.

The Types Of Presidential Decisions That Impact National Debt

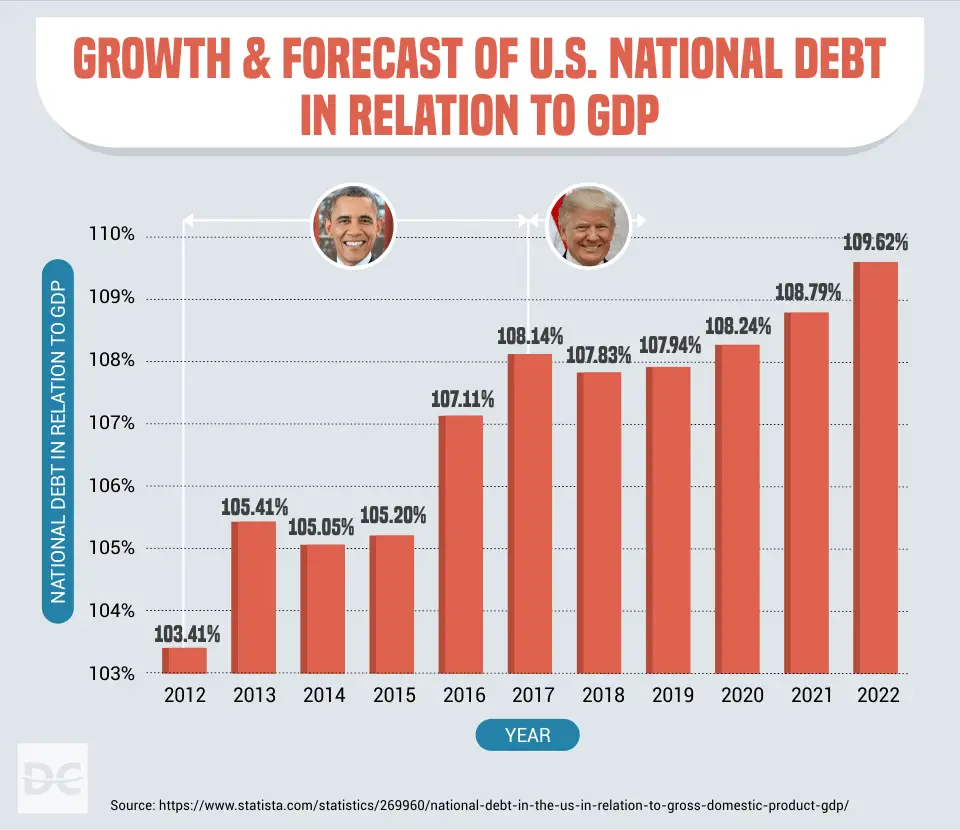

Presidents can have a tremendous impact on the national debt. They can also have an impact on the debt in another presidentâs term. When President Trump took office in January of 2017, for the first nine months of his presidency, he operated under President Obamaâs budget which didnât end until September, 2017. So for most of a new presidentâs first year in office, he isnât accountable for the spending that takes place. As strange as this may seem, itâs actually by design to allow time for the new president to put a budget together when in office.

Coronavirus And The National Debt

The U.S. government has taken efforts to offset the effects of worldwide health pandemic by borrowing money to invest in individuals, businesses, and state and local governments. Of these responses, the CARES Act has been the largest stimulus package in U.S. history. This stimulus package included $2.3 trillion towards relief for large corporations, small businesses, individuals, state and local governments, public health, and education. In order to pay for the relief fund, the government needed to expand its debt to do so, the government borrowed money from investors through the sales of U.S. government bonds.

Recommended Reading: What Are Requirements For Filing Bankruptcy Chapter 12 And 15

How Does The Federal Debt Work

The government finances the operation of the different federal agencies by issuing treasuries. The Treasury Department is in charge of issuing enough savings bonds, Treasury bonds, and Treasury inflation-protected securities to finance the government’s current budget.

Revenues generated by taxes are used to pay the bonds that come to maturity. Investors, including banks, foreign governments and individuals, can cash in on these bonds when they reach maturity. The debt ceiling is the cap that is set on what the Treasury Department can issue.

Congress keeps raising the debt ceiling to finance government spending. A deficit occurs when spending increases faster than revenues.

Doe National Laboratory Makes History By Achieving Fusion Ignition

For First Time, Researchers Produce More Energy from Fusion Than Was Used to Drive It, Promising Further Discovery in Clean Power and Nuclear Weapons Stewardship

WASHINGTON, D.C. The U.S. Department of Energy and DOEs National Nuclear Security Administration today announced the achievement of fusion ignition at Lawrence Livermore National Laboratory a major scientific breakthrough decades in the making that will pave the way for advancements in national defense and the future of clean power. On December 5, a team at LLNLs National Ignition Facility conducted the first controlled fusion experiment in history to reach this milestone, also known as scientific energy breakeven, meaning it produced more energy from fusion than the laser energy used to drive it. This historic, first-of-its kind achievement will provide unprecedented capability to support NNSAs Stockpile Stewardship Program and will provide invaluable insights into the prospects of clean fusion energy, which would be a game-changer for efforts to achieve President Bidens goal of a net-zero carbon economy.

Recommended Reading: What Does Bankruptcy Do To Your Credit

Fannie Mae And Freddie Mac Obligations Excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 “makes them even more permanent wards of the state and turns the government’s preferred stock into a permanent, perpetual kind of security”.

Social Security Trust Fund

Every president borrows from the Social Security Trust Fund. Over the years, the Fund has taken in more revenue than it needed through payroll taxes leveraged on the baby boomer generation.

Ideally, this money should have been invested to be available when members of that generation retire. Instead, the Fund was “loaned” to the government to finance increased spending. This interest-free loan helps keep Treasury bond interest rates low, allowing more debt financing. But, it must be repaid by increased taxes as more individuals retire.

Recommended Reading: What Happens When You Claim Bankruptcy In Australia

A Brief History Of Us Debt

Sabrina Jiang / Investopedia

Nearly all national governments borrow money. The U.S. has carried national debt throughout its history, dating back to the borrowing that financed the Revolutionary War. Since then, the debt has grown alongside the economy as a result of increased government responsibilities and in response to economic developments.

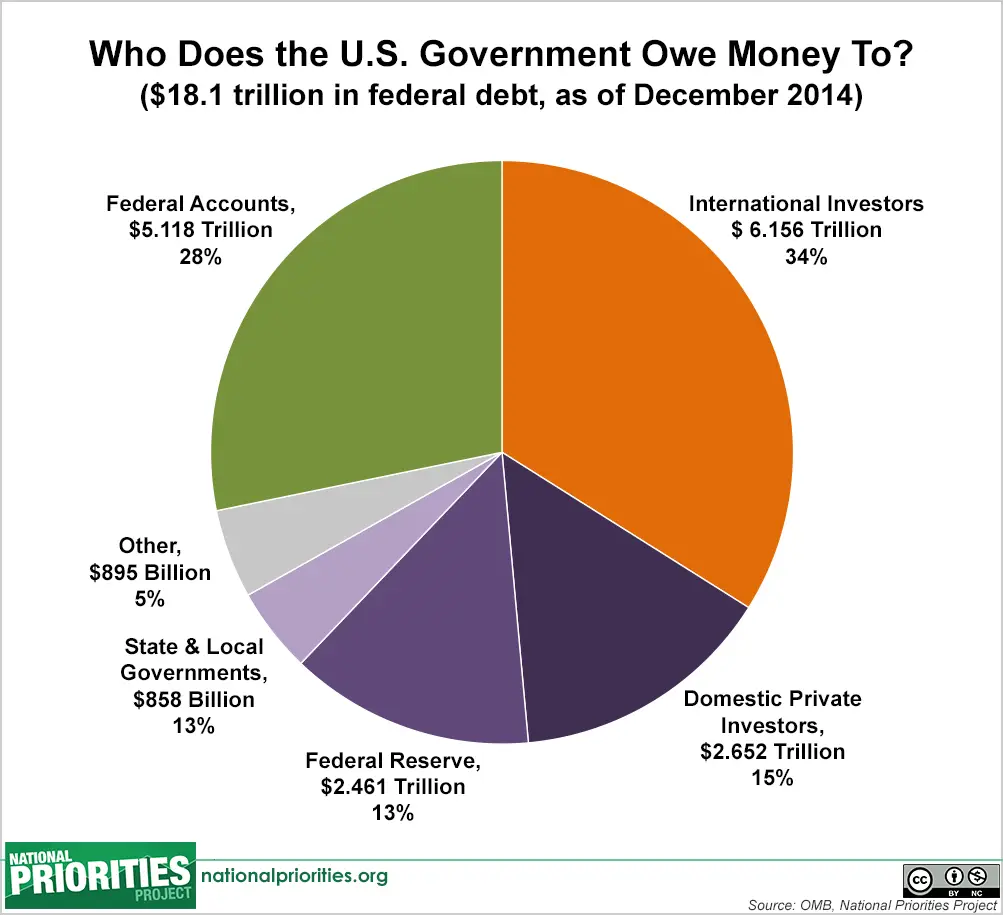

The federal debt is held primarily by the American public, followed by foreign governments and U.S. banks and investors. Note that the portion of the federal debt held by the public is considered more meaningful than the overall national debt because it excludes intragovernmental debtthat is, it only accounts for U.S. debt held by entities other than the federal government. So, while national debt totaled $31.1 trillion as of October 2022, federal debt held by the public was $24.3 trillion and intragovernmental debt amounted to $6.9 trillion. Thus, while national debt-to-GDP was at 121% as of the second quarter of 2022, the ratio of federal debt to GDP counting only debt held by the public was 95%.

Why Is The Us In Debt To China

The U.S. doesnt restrict who may buy its securities. China invests in U.S. debt because of the positive effect these low-risk, stable investments can have on its economy. By investing in dollar-denominated securities, the value of the dollar increases relative to the value of Chinas currency, the yuan. This, in turn, makes Chinese goods cheaper and more attractive than U.S. goods to buyers. That increases sales and strengthens the economy.

Recommended Reading: Debt Payoff Calculator With Extra Payments

Also Check: What Does Bankruptcy Petition Mean On Credit Report

Is Royal Caribbean A Buy

For investors who believe in the future of the cruise industry, Royal Caribbean looks like the best of the bad bunch because of its swing to profitability and faster top-line recovery compared to its rival, Carnival Corporation. That said, with a high debt load in a rising-rate environment, the company faces significant downside risk. Investors may want to wait until some of these issues are resolved before buying shares.

Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Get The Help You Need Along The Way

Say it again: Youre not in this alone. And guess what? You dont have to figure everything out on your own either. Learn the ins and outs of debt in Financial Peace University.

This nine-lesson course will teach you the plan to get outand stay outof debt, and get you pumped up to pay it off forever.

And listen: It actually works. The average debt paid off in the first 90 days of working this plan is $5,300.

When you’ve built a solid foundation of knowledge, it makes the debt-free journey quicker and easier. Thats a true win-win.

Also Check: Us Bankruptcy Court District Of Delaware

The Pandemic Impact On Debt

The less your income, the easier it is to pile up debt. That obvious lesson hit home in 2020.

The unemployment rate went from 3.5% pre-COVID to a peak of 14.8% in April 2020the highest level since 1948.

The total U.S. consumer debt balance grew $800 billion, according to Experian. That was an increase of 6% over 2019, the highest annual growth jump in over a decade.

Student loan debt increased the most , followed by mortgage debt and personal loan debt .

But dropped $73 billion, a 9% decrease from 2019 and the first annual drop in eight years.

A November 2020 Experian survey showed that 66% of consumers were spending the same or less during the pandemic than they had in 2019. About 33% of those surveyed said they put more in savings in 2020 than they did in the last year.

Raising Reserve Requirements And Full Reserve Banking

Two economists, Jaromir Benes and Michael Kumhof, working for the International Monetary Fund, published a working paper called The Chicago Plan Revisited suggesting that the debt could be eliminated by raising bank reserve requirements and converting from fractional-reserve banking to full-reserve banking. Economists at the Paris School of Economics have commented on the plan, stating that it is already the status quo for coinage currency, and a Norges Bank economist has examined the proposal in the context of considering the finance industry as part of the real economy. A Centre for Economic Policy Research paper agrees with the conclusion that “no real liability is created by new fiat money creation and therefore public debt does not rise as a result.”

The debt ceiling is a legislative mechanism to limit the amount of national debt that can be issued by the Treasury. In effect, it restrains the Treasury from paying for expenditures after the limit has been reached, even if the expenditures have already been approved and have been appropriated. If this situation were to occur, it is unclear whether Treasury would be able to prioritize payments on debt to avoid a default on its debt obligations, but it would have to default on some of its non-debt obligations.

Read Also: How Does Chapter 13 Bankruptcy Work

The Company Still Faces Big Challenges

While Royal Caribbean looks good compared to its peer, the company isn’t out of the woods yet. While the worst of the COVID-19 pandemic may be over, it will take years to undo its damage.

As of the third quarter, Royal Caribbean reports $19.4 billion in long-term debt compared to just $1.6 billion in cash. Over the long term, this will be a huge drain on cash flow because it will have to be paid back and generate interest expense — which totaled a jaw-dropping $352.2 million in the period .

With the Federal Reserve hiking interest rates, the outflow will increase, and it will become more expensive for companies to kick the can down the road by taking on new loans to refinance existing debt.

Image source: Getty Images.

But rising rates are not the only major economic challenge. According to Bloomberg, some Federal Reserve staff believe the U.S. economy has a 50% chance of entering a recession next year. And an economic downturn could dramatically erode demand for luxury expenditures like Royal Caribbean’s vacation cruises. The company may find itself in another crisis before it has fully recovered from the first one.

American Medical Debt In 2022

Medical debt can be difficult to track. However, it’s clear that it’s a growing problem.

According to The Urban Institute, 13% of Americans — over 43 million people — had medical debt in collections in 2011. That number is higher in communities of color, at 15%.

Some states have significantly higher numbers, too. For example, 24% of West Virginians have medical debt in collections.

The median debt also varies quite a bit. In the United States overall, the median medical debt in collections is $703. In Wyoming, Utah, Wisconsin, and Florida, that number is over $900.

While statistics are scarce, it seems likely that rising healthcare costs — especially during a pandemic — have pushed these numbers higher in recent years.

| STATE |

|---|

| 2.11 |

Charge-offs and delinquencies were down across all categories in Q1 2022 compared to Q1 2021 and are below rates experienced after 2007.

The delinquency and charge-off rate for consumer loans was 1.63% in Q1 2022, while the overall rate, which includes real estate and commercial loans, was 1.24%.

You May Like: How Long Does Bankruptcy Discharge Take

What Is The National Debt

The national debt is the debt that the federal government holds – this includes public debt, federal trust funds, and various government accounts. In simpler terms, the national debt includes both what the government owes others and owes itself. This is the total amount of deficit that the government has accumulated over the years.

The national debt today stands at more than $30.2 trillion. Here are some facts to give you an idea of how big this number really is:

- With $23.8 trillion held by the public, the government could give $71,000 per U.S. citizen.

- From 2000 to 2019, the federal debt increased 297%.

- $23.8 trillion is about the size of the economies of China, Japan, and Germany combined – the three largest economies in the world after the united States.

- $23.8 trillion is enough to cover a four year college degree for every American high school graduate for the next 57 years.

Which President Created The Most Debt

In terms of percentages, President Franklin Delanor Roosevelt added the most debt with a 1,048% increase in national debt from his predecessor President Herbert Hoover. With $236 billion added to the national debt, President Roosevelt served as president during the time of the Great Depression which largely depleted the countrys revenue. To combat this, he set up the New Deal which included relief programs and government spending to address unemployment, severe droughts and agriculture disruptions, and bank failures. The largest part of the addition to the national debt was World War II the war cost the country $209 billion from 1942 to 1945.

You May Like: How To Calculate Front End Debt To Income Ratio

What Does The Rest Of The Budget Look Like

Emergency spending aside, most of the federal budget goes toward entitlement programs, such as Social Security, Medicare, and Medicaid. Unlike discretionary spending, which Congress must authorize each year through the appropriations process, entitlements are mandatory spending, which is automatic unless Congress alters the underlying legislation. In 2019, only 30 percent of federal spending went toward discretionary programs, with defense spending taking up roughly half of that.

Inflation Supply Chain Issues And Americans’ Finances In 2022

The economy has roared back from the COVID-19 pandemic, bringing with it supply chain issues and inflation that have stressed Americans’ wallets.

The rate of inflation has reached levels not seen since the late 1970s, adding to the cost of goods already pushed higher by global supply chains snarled by shortages and the ongoing COVID-19 pandemic.

The result: average debt is up in nearly every category compared to 2020. This includes total household debt, credit card debt, mortgage debt, and auto loan debt.

The percentage of personal loans and auto loans in hardship are also above 2020 levels.

Despite turning the corner on the COVID-19 pandemic, stress remains on the finances of American households.

Recommended Reading: Pallets Returns For Sale

How Did The Us National Debt Get So Big

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The Balance / Julie Bang

The U.S. debt is the sum of all outstanding debt owed by the federal government. On Feb. 1, 2022, it surpassed $30 trillion for the first time, and soon after it set another record on Oct. 4, 2022 by passing the $31 trillion mark. The U.S. Treasury Department tracks the current total public debt outstanding and this figure changes daily. The debt clock in New York also tracks it.

The majority of the national debt is debt held by the public. The government owes it to buyers of U.S. Treasury notes including individuals, companies, and foreign governments.

The remaining portion is intragovernmental debt. The Treasury owes this debt to its various departments that hold Government Account Series securities. The biggest owner is the Social Security Trust Fund.

These Government Account Series securities have been running surpluses for years, and the federal government uses these surpluses to pay for other departments. They will come due as people born from 1946 to 1964 retire over the next two decades.

Average American Household Debt In 202: Facts And Figures

By: Jack Caporal and Dann Albright |Updated Sept. 20, 2022

Image source: Getty Images

How much debt does the average American household have? How is that debt split between mortgages, auto loans, credit cards, and other types of loans? What about the COVID-19 pandemic and its effects on Americans’ jobs and income?

The answers to questions like these can give us insight into the financial state of the average American household. We pulled together as much data as we could find on Americans’ average household debt in 2022 to give you a snapshot of how we handled our debt this year.

Keep reading for more detailed statistics on each type of debt, including comparisons of average debt over time and breakdowns by race, age, and more.

Recommended Reading: How To File For Bankruptcy In California Without A Lawyer

Is The National Debt A Problem

Economists and lawmakers frequently debate how much national debt is appropriate. Most agree that some level of debt is necessary to stimulate economic growth and that there is a point at which the debt can become a problem, but they disagree about where that point is. If the debt does get too big, it can result in cuts to government programs, tax hikes, and economic turmoil.