If You Earn Too Much To Qualify

Bankruptcy wont always be the right choice. To discharge your debts through bankruptcy which means your debts will be forgiven you must prove that you cant make the payments to your creditors.

As a result, people with high incomes may not get the debt relief they want through bankruptcy. Instead, they may have to file a form of bankruptcy that allows them to restructure their debts, making it easier for them to make payments but not erasing the debts altogether.

How Much Will My Chapter 13 Plan Payment Be

Wutwhanphoto / Getty Images

There are three different kinds of bankruptcy that an individual can file: Chapter 7, Chapter 11, and Chapter 13. Each is designed to provide relief to a distressed debtor, but each does so in a different way and with different goals in mind.

A Chapter 7 case is designed to allow the debtor to discharge debt in exchange for property that the debtor does not need for a fresh start. Sometimes, the debtor has debts that cannot be eliminated as easily, or they owe back payments on a house or car loan.

In a Chapter 13 case, instead of surrendering property that will be sold to pay debts, the debtor makes a payment each month for three to five years to a trustee who distributes it to the debtor’s creditors. This process gives the debtor a mechanism to get caught up on the past due house or car payments or to pay out non-dischargeable debt over the life of the plan.

Calculating those payments isn’t just a matter of adding up your bills and dividing by 60 months. The calculation is a lot more complicated and sophisticated. It takes into account your:

- Income and expenses

- The total amount of your debts

- The types of debts

- Value of your property

Priority Debtspay In Full

These are the “important” obligations your plan must pay in full. Add up the entire amount owed for these common priority debts:

- recently-incurred federal and state taxes

- back spousal and child support owed to an ex-spouse or child

- personal injury and wrongful death awards from driving under the influence, and

- fraud-related court judgments.

You’ll divide the total amount by sixty. That’s the monthly amount you’ll pay. Here’s where you can find more priority debt categories .

Don’t Miss: How Many Months Behind On Mortgage Before Foreclosure

Chapter 13 Attorneys Fees Vary By Geographical Area

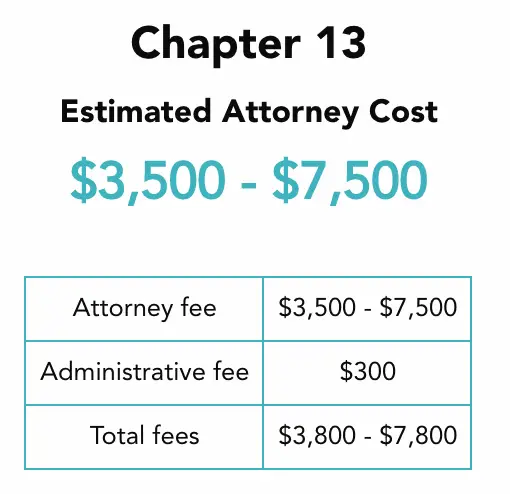

Bankruptcy lawyers usually charge a flat feea set amount that covers their basic services from start to finish. Because the court has to approve all of your financial expenditures in Chapter 13 bankruptcyincluding your lawyers feethe judge will decide whether that fee is reasonable. Many courts streamline this approval process by establishing a presumptive fee amount for their area. If your lawyer agrees to represent you for that amount or less, the court will automatically approve the fee without looking at the specific circumstances of the casewhich is why its also called a no look fee. Presumptive fees vary by geographic region and the services they cover.

Where bankruptcy courts have established presumptive limits, most attorneys use them to set their own fees. However, a presumptive fee isnt an absolute maximum. Lawyers can request a higher fee for cases that will require more work than usual . Also, if a case becomes more complicated than originally expected, the attorney can ask the court to approve additional fees.

Some bankruptcy courts dont use presumptive fees instead, the judge reviews each case to decide whether the attorneys fee is reasonable, based on the amount of work the case will probably require.

How To Save Money On Bankruptcy Costs

Although everyone who files for bankruptcy protection has unmanageable debts, some applicants are worse off than others. Be sure to fully document your financial situation before consulting a bankruptcy attorney. If you are unemployed, a low-wage earner, disabled or elderly, you might be able to use these low cost bankruptcy options.

Bankruptcy is a hard step to take and recovering from it isnt easy. Though a successful Chapter 7 petition will discharge your debts, it will remain on your for 10 years, affecting your ability to get a loan or any type of credit. A Chapter 13 resolution might not be as damaging, but it will require that you stick to a repayment plan for three to five years, even if the court reduces your debts.

Given the consequences of bankruptcy, an open discussion with an attorney about his or her fees can help. Obviously, if there are impediments to rebuilding your finances after bankruptcy such as a disability or your advanced years, that is relevant, and an attorney might be willing to reduce fees to mitigate the damage bankruptcy is certain to cause.

As we noted earlier, in most Chapter 7 and Chapter 13 instances, bankruptcy attorneys charge a flat fee, meaning they will tell you before starting work on your case what it will cost. In Chapter 7 cases, theyll want the money up front in Chapter 13, they often demand just a portion of the fee to start the case and will take the remainder through the court-approved Chapter 13 plan.

Read Also: Can A Title Loan Be Included In Bankruptcy

What Are The Normal Fees For A Bankruptcy Attorney

You can file pro se, but the success rate is not good. In the Los Angeles area, for example, nearly twice the number of pro se Chapter 7 cases were dismissed as attorney-represented cases in 2014 and attorneys filed nearly four times as many cases as self-represented parties. With an attorney, the success rate of a chapter 7 bankruptcy case is over 95%.

For Chapter 13, pro se filers do even worse than their Chapter 7 counterparts. The attorney-represented success rate for Chapter 13 in the Los Angeles area is over 55%, while the pro se success rate is only 0.04%, or 1 in 2,500. Less than half of all chapters filed pro se in 2014 received a discharge, while over 82 percent of attorney-represented cases were discharged.

Most people file pro se because either they think they dont need an attorney or they think cant afford an attorney. You probably know that attorney fees make up the majority of the cost of filing for bankruptcy. Youre already short on cash and you dont have much to spare for a lawyer. Youre looking for the best rate you can find. So, what can you expect to pay?

How Upsolve Can Help

Upsolve is a non-profit legal aid organization that helps low-income individuals reach financial freedom by filing for bankruptcy. Our services are completely free for qualified individuals. Our free online tool helps you prepare all the forms you will need for your bankruptcy and guides you through the process step by step.

If you arenât eligible for our free services, we still want to help! We can connect you with a bankruptcy attorney in your area that is transparent about their fees and services. Most of them will meet with you for free to discuss your situation, your options, and ways you might be able to afford to pay for their services even though it may not seem like it from where youâre sitting.

You May Like: Will Bankruptcy Affect Renting An Apartment

The Chapter 7 Income Limits And The Bankruptcy Means Test

The bankruptcy means test is a calculation laid out in the Bankruptcy Code. The starting point for this calculation is your stateâs median household income. Median income can be part of the Chapter 7 income limits. If your household income is less than the median household income for the same household size of the state youâre filing in, you make less than the income limit. This means you pass the Chapter 7 means test and qualify for Chapter 7 bankruptcy.

If your household income is greater than the median, you may still qualify for Chapter 7 bankruptcy if your household expenses under the means test calculation donât leave you with any disposable income. More on that in Part 2, below.

What Happens To Your Assets After Discharge

Assets that are part of the bankruptcy stay under the trustees control when your bankruptcy ends. It can take time for all assets to be dealt with.

You must keep making any payments agreed under an IPA or IPO.

Your family home

If your family home has not been dealt with 3 years after the bankruptcy order, the interest may be given back to you.

If the interest in your family home is returned to you, the Land Registry will be told that the property is no longer part of your bankruptcy estate. The trustee will send notice to the Land Registry and the restrictions will be removed.

Your business

The restrictions on your business end when bankruptcy ends, unless the official receiver feels youve been dishonest. They can then apply to extend the restrictions

Also Check: Can They Take Your Home If You File Bankruptcy

Calculating A Chapter 13 Bankruptcy Plan Payment

As stated above, each Chapter 13 bankruptcy case is unique. The amount a debtor will pay through their bankruptcy plan depends on their household income, the type of debt, their assets, and their financial goals. The best way to understand how a Chapter 13 payment is calculated is through an example:

John and Jane Smith are a married couple residing in Philadelphia who wish to save their home, which is currently in foreclosure. They also owe the Internal Revenue Service some back taxes and have a substantial amount of credit card debt. In addition, they are two payments behind on their car payment.

These kinds of debts are quite common. Bankruptcy cases often involve credit card debt, and many people use bankruptcy to save a house from foreclosure.

Both the husband and wife work and have a combined monthly gross income of $6,000. They have no children.

They have come to Young, Marr, Mallis & Associates to file for Chapter 13 to save their home and address their other debt. They are concerned about what their monthly bankruptcy payments will be.

Now that we have an example of a common financial situation, we will work to calculate what the bankruptcy payments might look like for that family.

When The Bankruptcy Order Is Made

The early stages of a bankruptcy are normally handled by an official receiver. An official receiver works for the Insolvency Service and is attached to the court. They will also be your trustee unless an insolvency practitioner is appointed to take over that role. The trustee will realise any assets .

The official receiver will write to you within 2 weeks of the bankruptcy order being made, explaining what you need to know and what you must do.

Also Check: Who Will Give Me A Credit Card After Bankruptcy

Can The Trustee Take My Tax Refund After Filing Chapter 13

Can a Bankruptcy Trustee Take Your Tax Refund After a Discharge? There are two types of bankruptcy for individuals, Chapter 7 and Chapter 13. The bankruptcy trustee can keep your tax refund in both, though with Chapter 7 it will happen only once. With Chapter 13, it can happen every year of your repayment plan.

Working On Your Debt Repayment Plan

Under relevant bankruptcy laws, a debtor who wishes to keep the property and avoid foreclosure must pay off their real or personal property arrearages. This is especially applicable to keep a secured asset, such as a home or a vehicle. Some bankruptcy courts will require mortgage payments to be made directly to lenders, while others need you to include them in your debt repayment plan.

In general, bankrupt individuals are often given 36 or 60 months to pay back what is owed, with higher income filers usually paying more per month. The actual time will depend on the median income and your monthly income six months before filing a bankruptcy petition. Additionally, electricity, phone, tax, and child support payments are often made outside the payment plan.

It is highly recommended to seek legal assistance early to avoid mistakes that could complicate your filing. Our dedicated and hands-on Jackson bankruptcy lawyers will assist you on how to file, explain relevant state law, and help you have a successful bankruptcy filing.

You May Like: Do Private Student Loans Go Away With Bankruptcy

Paying Mortgage Arrears And Other Secured Debt Through Chapter 13 Bankruptcy

The primary reason the Smiths need to file for bankruptcy is to save their home. When debtors file for bankruptcy to cure a mortgage delinquency, they will have to pay that default back over three to five years. Once the bankruptcy case is filed, the mortgage lender will submit a proof of claim with the court. This document details the exact amount due at the time of filing and provides documentation of what they owe and that the Smiths were the ones who signed the mortgage.

The Smiths home has a fair market value of $450,000, and the proof of claim filed by the mortgage company indicates a mortgage balance of $380,000 with an arrearage of $15,000.

They are also behind in their car payments. At the time of filing, they had missed two $250 payments.

The bankruptcy plan will directly address the mortgage arrearage. For this example, the length of the plan will be 60 months. Therefore, paying back $15,000 over 60 months will require a payment of $250 a month. This portion of the monthly trustee payment only addresses the mortgage arrears.

Similarly, their car loan is a secured debt. If the Smiths wish to keep their vehicle, they must pay that default as well. They are behind $500, so dividing that over the length of the plan will add $8.33 to the plan payment.

At this point, the Smiths monthly trustee payment is $258.33.

When You Might Pay More For Chapter 13 Attorney’s Fees

You will probably pay more than the average if your attorney has to spend extra time strategizing on your behalf. That can happen for different reasons, but here are some examples.

Special requests. If you want to wipe out your student loans or one of the mortgages on your house , youll need to file a separate lawsuit or motion within the bankruptcy case. Your lawyer will charge more for this.

Involvement in a lawsuit. If youre involved in litigation when you file for bankruptcy, it could turn the initial meeting with creditors from a routine step into a hornets nest. An experienced attorney will charge more to protect you, but its probably worth it.

Business owners. If youre the sole proprietor of a business, your attorney will need to prepare financial documents for both you and your business, as well as develop a strategy to maintain the cash flow for your business that will be satisfactory to the creditors, the trustee, and the court. All of this takes time.

Get multiple free case evaluations before deciding which lawyer you will use.

Karen, 52, New Jersey

Don’t Miss: States That Are In Debt

Determine Your Disposable Income In A Chapter 13 Bankruptcy Filing

Once you deduct your expenses from your income, youre left with your disposable income. Your disposable income gets applied to your debts according to priorities. To calculate your Chapter 13 monthly payment amount, you compare your disposable income to your debts. Creditors file a Proof of Claim document that verifies the amount they believe that you owe them.

Can I Stop Making Payments On My Debt Once I Meet With A Bankruptcy Lawyer

Depending on your circumstances, it may make sense to stop making payments once you start the bankruptcy process, but you could face consequences for doing this incorrectly. For example, if you’re filing for Chapter 13 bankruptcy, it wouldn’t make sense to stop making payments on priority debt because you will have to repay that money even after filing for bankruptcy. A bankruptcy lawyer will know the most about your situation and can help you decide which debts to stop paying.

Recommended Reading: Can Bankruptcy Affect My Job Uk

Determining The Median Income For Your Household Size

The income limit for your state and household size is based on data from the Census Bureau, and it changes multiple times per year.

To find the most up-to-date information, go to the means testing page from the United States Trustee and choose the current option in the drop-down menu titled âData Required for Completing the 122A Forms and the 122C Forms.â This will bring you to a new page on the Justice Departmentâs website that provides a link titled âMedian Family Income Based on State/Territory and Family Sizeâ provided by the Census Bureau. From there, you can pull up a table showing median incomes by household size, for each state.

Cost And Benefit Considerations

Introduction:

There is cost and there is benefit. Cost is what we charge. You look at the Benefits to determine whether the value of the benefits you will receive is worth the cost. If the “benefits” are worth the cost, you hire us. If not, you dont.

So, it only makes sense for us to show you not only the cost of filing bankruptcy with us, but also all the benefits you get for the cost.

The following information explains in detail all the elements of the “cost” you would be charged and the “benefits” you will receive if you hire the Law Offices of John T. Orcutt to file your bankruptcy case.

Our goals:

To provide, up front, full “transparency” in terms of what we charge and why,

To show you the tremendous benefits you will receive, and

To show you how we get your creditors to, in effect, pay for the entire “cost”.

Our products:

- Chapter 7 bankruptcy case filing,

- Chapter 13 bankruptcy case filing,

- Free advice on what to do if filing bankruptcy is not right for you.

Chapter 7 and Chapter 13: Similar But Different.

To begin, there are only 2 versions of bankruptcy that apply to most people: Chapter 7 and Chapter 13.

Chapter 7 and Chapter 13 are similar in certain fundamental ways. For example, they both kill off debt. Both put your creditors under control. Both allow you to keep and protect most, if not all, of your money and property.

Recommended Reading: Credit Card Debt Forgiveness Mental Illness