Chapter 7 Bankruptcy Toledo Ohio

Are you struggling with debt that you cant pay back? Chapter 7 bankruptcy may be the solution youre looking for. Experienced Toledo Bankruptcy attorney Scott Ciolek can help you eliminate debt through liquidation of assets, while allowing you to keep most of your property. Dont let overwhelming debt control your life contact us to learn more about Chapter 7 bankruptcy and how it can help you get back on track.

Help For Michigan Residents

Account Resolution Plans are providing a vital lifeline for Michigan residents who are struggling to keep up with minimum payments, those who have fallen behind, or those who are being forced to use credit cards or personal loans to take care of personal or business expenses.

ARPs are available across a wide range of income levels. No credit approval is required.

You May Like: Can You Be Fired For Filing Bankruptcy

Bankruptcy Attorney Fees Ohio

A Chapter 7 Bankruptcy is often less expensive than Chapter 13 bankruptcy. Chapter 7 bankruptcy attorneys in Ohio can cost between $1090 – $1500. The cost may increase or decrease based on the following factors: Complexity, location, level of attorney connection, and the bankruptcy lawyer’s expertise.

Here are some of the ranges of cost in major cities in Ohio.

Don’t Miss: Is Bankruptcy State Or Federal Law

What Is An Exemption In A Bankruptcy

A lot of people think when they file for bankruptcy, they will be out on the street with nothing but the clothes on their backs, but that isnt the case. Instead, all ofyour debts and assets are held by a trustee who manages them. It is the trustees job to sell off your property to pay your debts.

Ohio law allows for exemptions when you file for a Chapter 7. That means that you will be able to keep someand sometimes allof your property because it is exempt. Whenproperty is exempt in Chapter 7, it means that the trustee cannot sell it to pay off your debt. Like many states, Ohio has a list of exemptions to make sure that you have someproperty left to live your daily life and conduct business.

When you qualify for a Chapter 7 bankruptcy, part of the trustees job is to figure out how much property you have, and what the value of the property is. The trusteewill sell any property that is not exempt and give the money from the sale to your creditors. Once your property has sold, and the money is distributed, your debts are dischargedand you start again with a clean slate.

Ohio Bankruptcy Lawyer Cost

A Chapter 7 bankruptcy in Ohio usually costs around $1,000 to $1,500. You can also use the Upsolve attorney cost estimate by state to get an estimate for bankruptcy attorney fees in Ohio. If you are dealing with a more complicated Chapter 7 bankruptcy case, it may be a worthwhile investment to have an attorney represent you.

Recommended Reading: What Is A Bankruptcy Petition Preparer

Read Also: Can You Get Student Loans If You File Bankruptcy

Toledo Bankruptcy Attorney Scott A Ciolek

Scott Ciolek grew up in Brook Park, Ohio, but has called Toledo, Ohio home for fifteen years. Scott attended The University of Toledo College of Law and has focused his practice on bankruptcy law.

Bar Admissions

- U.S. District Court Northern District of Ohio

- U.S. District Court Eastern District of Michigan

- U.S. 6th Circuit Court of Appeals

Education

Where is your office located?

Were located in downtown Toledo, Ohio at 901 Washington St., Toledo, Ohio, 43604.

Is there free off-street parking?

Yes, there is parking available at the entrance of the building and parking is free.

I’m a Michigan resident, can you help me?

Scott is licensed in the state of Michigan and the U.S. District Court of Eastern District of Michigan.

I’m an Ohio Resident, can you help me?

Scott is licensed in the state of Ohio and the U.S. District Court Northern District of Ohio.

Am I Comfortable With This Attorney

Ask yourself, does the attorney sincerely care for me and my legal problem, or am I just another case?

At Borders and Gerace are goals is to provide outstanding customer service and experienced legal services. We provide an environment where you can feel comfortable discussing your personal information in a dignified manor. Our goal is to make the bankruptcy process as smooth as possible.

You May Like: Is Bankruptcy Court Federal Or State

How The Type Of Bankruptcy Attorney Affects The Fee

Some people want to work in close collaboration with their bankruptcy lawyer, while others prefer as little contact as possible. The level of attention you require can be a factor in determining your fees.

For example, firms practicing bankruptcy law exclusively often save money by hiring paralegals to prepare your paperwork. An attorney will review your petition for accuracy but might not participate in the entire process. The benefit of using this type of firm is that you might pay attorneys’ fees of $1,000 to $1,200 for a straightforward Chapter 7 case.

Other lawyers with smaller practices might take a hands-on approach and be there to consult with you throughout the entire process. You can expect to pay more for that service: $1,500 to $2,000 for a standard consumer bankruptcy case.

To help you meet your particular needs, here are some questions you can ask during your consultation:

- Who will complete my paperwork?

- Who will answer my questions if I call the office?

- Will you or a junior attorney go with me to the 341 meeting of creditors?

What Fees Are Required To File For Bankruptcy In Ohio

Medical bills were the top cause of bankruptcy filings last year. Even with insurance, co-payments or co-insurance for treatment may pile up quickly. Combine that with time away from work while recovering and you may be left with debt you can never pay off.

In addition, the number of long-term unemployed continues to hover at 3.7 million, according to the Bureau of Labor Statistics. The long term unemployed make up about 35 percent of those looking for a job. As the economy continues to lag many people are unable to pay for their living expenses and sink deeper into debt.

A Chapter 7 or Chapter 13 bankruptcy can provide a fresh financial start by stopping creditor harassment and wage garnishment. Medical bills, credit card debts and other unsecured debt may be discharged. But if you owe child support, spousal maintenance, student loans or back taxes, bankruptcy may not provide a remedy. Before filing, you must consider how you will pay various fees.

Also Check: Can You File Bankruptcy On Disability

Read To Learn More About Bankruptcy Fees In Ohio

Dont let the fees attached to a bankruptcy deter you. There are ways to factor in these costs and discharge or reorganize your debts. The best way to find an option that works for you is to speak with an experienced bankruptcy lawyer.

If youre in Ohio and ready to talk about bankruptcy with an attorney, call Luftman, Heck & Associates at or email . We want to help you get out of debt and move on with life.

Would My Bankruptcy Cost Be Higher Columbus Than Cincinnati

You may live in a suburb in Ohio and wonder if you should hire a local attorney or an account in a bigger city like Cleveland to save on bankruptcy costs.

As Columbus has the highest population in Ohio of 895,477, you may expect that the cost of bankruptcy attorney fees may be higher in Columbus than Cincinnati.

While the cost may be higher in Columbus, there also may be more bankruptcy attorneys increasing competition and dropping prices. So, you actually could find that the total cost to file bankruptcy including bankruptcy fees could be actually much higher in your city than in Columbus.

One thing to be aware of is that most bankruptcy attorneys offer free bankruptcy consultations, so you can get multiple perspectives. Also, our bankruptcy cost calculator below takes into consideration those variables when providing you with an all-in cost estimate.

Recommended Reading: How Do You Rebuild Credit After Bankruptcy

Can One Spouse File Chapter 7 And The Other Chapter 13

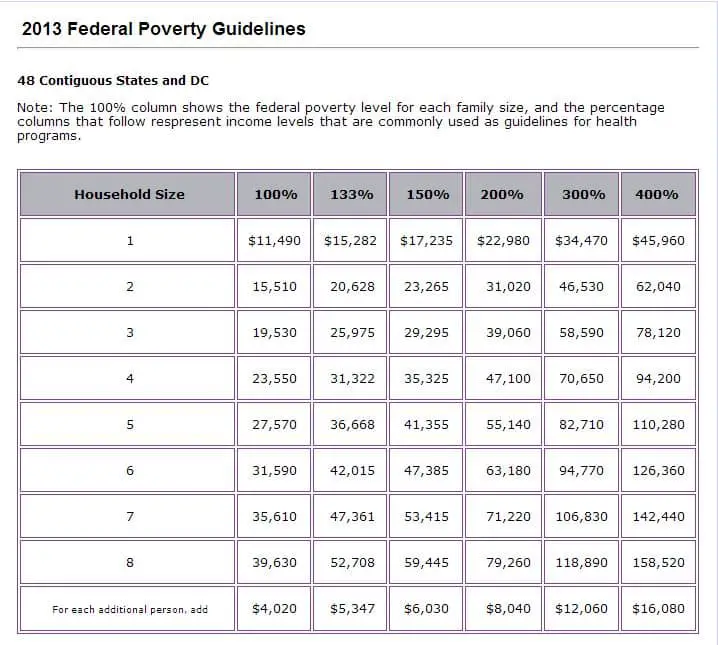

A spouse who wishes to file a Chapter 7 bankruptcy must include the other spouse’s income. Individuals filing Chapter 7 bankruptcy must meet certain income requirements based on where they live. If together, they exceed the income level, they cannot file a Chapter 7 or Chapter 13, alternately, may be an option.

How Long Does Chapter 7 Stay On Your Record

10 yearsA Chapter 7 bankruptcy can stay on your credit report for up to 10 years from the date the bankruptcy was filed, while a Chapter 13 bankruptcy will fall off your report seven years after the filing date. After the allotted seven or 10 years, the bankruptcy will automatically fall off your credit report.May 18, 2021

You May Like: How To Remove Bankruptcy From Credit Report Early

What Much Does It Cost To File For Bankruptcy In Ohio

The top cause of bankruptcy filings in Ohio was Medical bills last year. Despite of having an insurance, co-payment for the treatment can pile up. While recovering, combine that with a period of unemployment and you would be left with debts you will never be able to pay off.

According to the Bureau of Labor Statistics, the number of long-term unemployed people keeps hovering around 3.7 million. The long term unemployed people constitute about 35 percent of those who are seeking a job. As the economy carry on with the lag many people are unable to afford to pay for their living expenses and fall deeper into their debt.

One can start fresh with A Chapter 7 or Chapter 13 bankruptcy and avoid the creditors harassment and wage garnishment. Most debts including credit card debts, Medical bills and other unsecured debt may be discharged. But bankruptcy will not help save you if you owe student loans, spousal maintenance, child support or back taxes. Before filing for bankruptcy you must consider how you will bear the expenses and the fee for filing bankruptcy.

Means Test And Disposable Income

The means test requires you to calculate your income and expense information. Income includes almost all sources of income you have, including business income, interest and dividends, pensions and retirement plans, household expenses paid by others, alimony and child support, workers compensation and unemployment income, amongst others.

Allowable expenses are subtracted from your average monthly income. These expenses are based on national standard of living, car ownership and out of pocket health care costs, as well as local standards for housing and transportation. These expenses are derived from information supplied by the Census Bureau and the Internal Revenue Service.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and may file for Chapter 7. If you are over $12,475 then you do not pass the means test and must instead consider Chapter 13 bankruptcy for debt relief. If you fall in between these two values you must do additional calculations to determine if you have enough income to pay 25% of your unsecured debts over the next five years. If you dont, you qualify for Chapter 7. If you do, Chapter 13 is your only option. In addition, the court after examining the totality of your circumstances, may decide you qualify for Chapter 7. All calculations aside, if you demonstrate a need for Chapter 7 due to events like a serious family or medical matter, the court may allow you to file Chapter 7.

Don’t Miss: How Much Does An Attorney Charge To File Bankruptcy

More Financial Hot Water Can Mean Higher Attorneys’ Fees

Our survey results showed that having more debt or more types of debts typically didn’t mean higher attorneys’ fees. However, your lawyer may charge you a higher fee if you have any of the following issues that could complicate your case :

- You have a large number of creditors.

- Youve filed for bankruptcy within the last eight years.

- You want to stop an eviction, foreclosure, bank levy, or wage garnishment.

- You have liens filed against your property.

- You are involved in litigation in state or federal court.

- You anticipate being accused of engaging in fraudulent activity .

- You have nondischargeable debts .

Adversary Proceeding Toledo Ohio

The majority of personal bankruptcy cases will be straightforward. However, sometimes a bankruptcy case can become very complex when an adversary proceeding is filed. An adversary proceeding commonly arises when a creditor objects to the discharge because the creditor thinks the debtor didnt disclose assets, miscatorgized a claim, committed fraud, or believes the debtor is abusing the bankruptcy system.

An adversary proceeding is similar to regular litigation, except that the entire matter takes place in bankruptcy court. Similarly, there are strict deadlines and rules that must be followed.

Many bankruptcy lawyers do not represent clients in adversary proceedings because they can be complicated and time consuming. Its very common for debtors to sign a fee agreement in which adversary proceedings are specifically excluded from the services from the bankruptcy attorney. Contact Bankruptcy Attorney Scott Ciolek today to discuss your adversary proceeding situation.

Don’t Miss: Can Dismissed Bankruptcy Be Removed From Credit Report

How Much Does It Cost To File For Bankruptcy In Ohio

As we noted, the filing fees are standard. What will vary is how complicated your case is. The more work that your attorney has to do on your behalf the more he will need to charge.

This is where having an experienced bankruptcy attorney at your side is critical. An experienced attorney will be able to deal more rapidly and efficiently with your financial issues, help you make the right choices regarding how to file and how to plead your case. This all results in less money paid to the attorney and a much greater likelihood of success in your quest for financial relief.

To talk to a competent, experienced bankruptcy attorney who will listen to your situation and do everything possible to help, call David A. Bhaerman at today.

How Much Does It Cost To File Chapter 7 Bankruptcy In Ohio

One of the most commonly asked questions relating to bankruptcy is, how much does it cost? This is understandable given that those seeking bankruptcy are in difficult financial situations and are turning to bankruptcy for some relief. Here, we will discuss the expenses associated with filing for Chapter 7 bankruptcy in Ohio.

You May Like: What Happens At A Bankruptcy Confirmation Hearing

Chapter 7 Bankruptcy Ohio Exemptions

Bankruptcy exemptions protect a certain amount of your property during a bankruptcy. Essentially, they prevent creditors from taking and selling certain things to pay off the debt you owe them. While some states allow you to choose between federal and state exemptions, Ohio is not that way. In Ohio, you must follow Ohios bankruptcy exemptions. Some common exemptions include:

- Homestead Exemption

- Vehicle Exemption

- Wildcard Exemption

Its important that you speak with a knowledgeable Mentor chapter 7 bankruptcy attorney who can help you understand what exemptions you qualify for.

Also Check: How To File Bankruptcy In Wisconsin

Why Do Some Attorneys Charge Higher Chapter 7 Bankruptcy Fees

You may compare prices from two different bankruptcy attorneys in Cleveland, and find attorney costs vary between two attorneys.

The Chapter 13 bankruptcy attorneys often charge the same amount regardless in Cincinnati due to the no-look fee . That said, the Chapter 7 bankruptcy attorney fee can vary greatly, so it’s important to understand what you are getting for the additional cost.

The bankruptcy lawyer cost is often based on the following attributes:

For example, lets say you make $10,000 above the median income for Ohio and still want to file a Chapter 7 bankruptcy. The attorney may then have to spend additional time looking over your expenses to see whether you would qualify for a Chapter 7 even though you are above the median. Additional attorney time generally means a higher overall bankruptcy cost.

If you are interested to learn more, please visit this article: Understanding Bankruptcy Lawyer Fees.

Read Also: Will Filing Bankruptcy Stop Irs Debt

Ohio Chapter 7 Bankruptcy Exemptions

Listed below are some of the most commonly used Ohio bankruptcy exemptions. If you are married, then you should know that married couples are allowed to double. Doubling means that each of the amounts listed below can be applied up to its maximum for the property each spouse. For example, you and your spouse may each exempt your own car up to the full exemption amount.

These amounts refer to the equity value of the asset. The equity value is the amount that the piece of property is worth in liquidation. The liquidation value of an asset is the amount that the asset is worth after any liens on the asset are subtracted. For example, if a home worth $100,000 has a $25,000 lien on it, then the homes liquidation value is $75,000.

Note that some of these rules change over time. Below are the most recent Ohio bankruptcy exemptions, so contact your bankruptcy lawyer to learn if these amounts have been updated: