How To Find Bankruptcy Attorney Costs In Your Area

The attorney fees above are just averages, and, as we noted, fees quite possibly have increased since the Martindale-Nolo survey was conducted. Plus, they differ from region to region so it might be difficult to get a sense for a fair going rate where you live.

Given the consequences of bankruptcy, its wise to weigh the following considerations and steps to make finding bankruptcy attorney costs more clear.

Remember, not all bankruptcies are the same. Those with complicated cases might benefit from an experienced bankruptcy lawyer. If creditors challenge your financial statements and allege fraud, having an attorney able to navigate a complex case would benefit you. The same would be true for cases springing from medical debt, a fairly common culprit in bankruptcy filings.

When Bankruptcy Attorneys Charge Higher Fees

Most lawyers charge a “flat” or fixed fee that will cover the preparation of your Chapter 7 bankruptcy petition and attendance at your court appearance. When quoting the flat fee amount, many attorneys consider the difficulty of your case to estimate how much work they’ll have to do on your behalf. Here are some issues that might increase the amount of time needed for your caseand therefore, the amount of the flat fee the lawyer will charge.

Chapter 7 Federal Exemptions

In New York State, debtors filing for Chapter 7 bankruptcy are entitled to choose between the Federal Exemptions and the New York State Exemptions.

Below is a list of properties that an individual may protect under Federal Exemptions:

- In a home, condo, or mobile home that you live in, per debtor, up to $21,625 may be exempted. This doubles to $43,250 for those who are married and own the property jointly.

- Household goods that are valued up to $500 per item, with the maximum total value of $11,525

- Equity in a vehicle up to $3,425

- Tools that are required for your business or trade up to $2,175

- Valid retirement savings accounts such as 401, 403, IRA accounts, and other ERISA qualified retirement savings accounts up to $1,095,000 per debtor

- Benefits such as pension, social security, or workers compensation

- Jewelry that are valued up to $1,450

- Support payments for child or spouse to the extent needed to support the debtor and their children

- Recovery from a personal injury action, except for pain and suffering or for pecuniary loss up to $21,625

- Wildcard exemption, which allows a debtor to protect up to $1,150 of any property and any unused portion of a homestead up to $10,825 per debtor

Don’t Miss: How To File Bankruptcy Without An Attorney

Attorney Fees Are Public Record

Thats right your attorney has to disclose her fees and theyre available to the public. You can research any bankruptcy law firms fees on the federal PACER website. PACER costs $0.10 per page viewed and you can search either by bankruptcy district to get a general sense of the fees in your area of by specific law firm to get an idea of what a particular attorney will charge. Local rules may require additional disclosure, but at a minimum attorneys must list their fees on the Statement of Financial Affairs, which requires a list of:

all payments made or property transferred by or on behalf of the debtor to any persons, including attorneys, for consultation concerning debt consolidation, relief under the bankruptcy law, or preparation of a petition in bankruptcy within one year immediately preceding the commencement of this case.

What Does It Cost To File For Bankruptcy

The cost of bankruptcy varies significantly depending on the type, size and complexity of the case. Chapter 7 liquidation bankruptcies, which can erase many types of debt, may cost as little as the filing fee, if you dont use an attorney.

Chapter 13 bankruptcies, in which you cut a deal with creditors to pay them back over time, often require an attorney and may cost significantly more. Chapter 11 bankruptcies, commonly used by businesses, are the most expensive, with high court fees and typically much steeper legal costs.

Some bankruptcy fees are nearly inescapable. The federal courts that handle all bankruptcies charge standard fees, including administrative fees just for accepting the cases. Filers may pay other court fees as a case winds its way through the legal process, though courts can modify or waive some fees in cases of financial necessity.

Filers may also pay fees for professional helpfrom attorneys, accountants or appraisersbut these costs can be avoided in some cases. For instance, state legal aid societies and pro bono attorneys may provide assistance to low-income individuals.

Obviously, the cost of repaying creditors in Chapter 13 and Chapter 11 cases can be high, too. But while Chapter 7 bankruptcy calls for the filer to sell off assets to pay debts, nearly all Chapter 7 cases involve no assetsso there is no liquidation, and the filer pays nothing to creditors to discharge the debts.

Don’t Miss: Bankruptcy Attorney In Maryland

Bankruptcy Petition Filing Fees

All bankruptcies in the United States are heard in the U.S. Bankruptcy Court. The good news about that is the filing fees for a bankruptcy case are uniform across the country.

For a Chapter 7 case, the cost is a flat fee of $335. For Chapter 13 cases, the cost is also a flat fee of $310. Although an incidental cost, credit counseling and financial management course fees are required. Those should run between $50 and $100 apiece.

How Valuable Is A Free Consultation

One thing that wont cost money, however, is your first free consultation with Scura. At Scura, we want to make sure your first consultation to discuss your bankruptcy options is completely free. We can discuss which bankruptcy chapter is right for you, as well as what is best suited for your needs.Ultimately, the choice between Chapter 7 and Chapter 13 Bankruptcy is not one that you should make lightly. You need to take into consideration all your assets and property before making a decision, as well as consulting a Bankruptcy Attorney. You need someone on your side to help you through the complicated process of filing for relief. This is where we come in. The attorneys at Scura, Wigfield, Heyer, Stevens & Cammarota LLP can help. Please call our offices to schedule a free consultation and hear your options.

Recommended Reading: How Much Money Can You Have When Filing Bankruptcy

Bankruptcy Court Filing Fee

Every individual that aims at filing under a Chapter 7 bankruptcy discharge is mandated to pay the sum of $335 as the filing fee. Beyond this, theres an additional charge ranging between $15 to $20 thats to be paid to the Bankruptcy Trustee.

The filing fee charged by the bankruptcy court is uniform to all bankruptcy cases, irrespective of the case complexity, the amount involved, and whether its a business, joint, or individual case. The total sum of a Chapter 7 bankruptcy fee is $335, out of which $15 is the Trustee fee, while the administrative fee is $75.

Chapter 13 Attorney Fees

Attorney fees for a Chapter 13 bankruptcy tend to be more expensive than attorney fees for a Chapter 7 bankruptcy case. There’s a much greater workload associated with filing a Chapter 13 case.

Unlike Chapter 7 bankruptcies, which usually take around four months to complete, Chapter 13 cases are open for 3 to 5 years. Plus, Chapter 13 bankruptcies are more complex and must include a proposed repayment plan specifying which creditors will be repaid and by how much, which requires court approval.

It isn’t necessary to pay all of the attorney fees upfront in a Chapter 13 case as it is in a Chapter 7 case. Usually, a Chapter 13 bankruptcy lawyer will require a portion of the attorney fees be paid before filing the case. The remaining attorney fees will get paid through the Chapter 13 plan. The filer will make a monthly payment to the trustee, who will then make payments to the filer’s creditors â including their attorney who filed the case. Outstanding attorney fees at the time of filing are not paid in addition to the plan payment, they’re part of the plan payment.

Lawyers can ask for priority to receive full payment before certain other creditors. This helps attorneys be more willing to file Chapter 13 cases before full payment of attorney fees because it minimizes the risk of not being paid if the filer later stops making plan payments.

Also Check: What Will My Credit Score Be After Bankruptcy

How Much Bankruptcy Costs And How To Pay For It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Its a classic catch-22: Youre in rough financial shape and need to file for bankruptcy. But between filing fees and the cost of hiring the right bankruptcy attorney, you could end up paying hundreds or even thousands of dollars to do so.

Heres what bankruptcy costs and how to pay for it.

Work On Paying Off Your Debt

Although bankruptcy is a form of debt relief, it may not remove all your debts. There are a couple of key strategies to consider when youre learning how to pay off debt. Each of these strategies has its pros and cons:

- Debt avalanche: You can work on paying the minimum amount on every debt. Youd then make an additional payment toward the debt with the highest interest rate. This approach makes the most financial sense because you reduce the most costly debt first. Once that debt is fully paid off, you can move to the debt with the second-highest interest rate and so on. While using this approach, make sure to continue making the minimum payment on all your debts each month.

- Debt snowball: Alternatively, you can work on paying off as many debts as possible. Start with paying the minimum on all your credit accounts. Then put any extra money toward paying off your smallest debts first. Once the smallest one is paid off, you can move on to the second smallest and so on. If you have several small credit card debts, this can be a good strategy.

Regardless of the strategy you choose, make sure you put aside enough cash for your debt payments. Establishing and sticking to a clear budgeting plan can help you meet your financial obligations.

Read Also: Who Has Filed The Most Bankruptcies

What Factors Can Increase Fees

Certain factors can increase your Ohio bankruptcy costs regardless of where you are located in the state, the attorney you hire, or the complexity of your case. These factorsinclude:

- Cases involving both personal and business bankruptcies at the same time

- If you have more than one source of income.

- You are earning anything higher than Ohios average income for your households size.

- An individual with a large number of creditors.

- You had filed for other bankruptcy cases in the last eight years.

- Stopping a legal action such as a bank levy, eviction, and repossession of property that was used as loan collateral.

- You are being suspected or accused of fraud.

- You have debts such as student loans, past-due taxes, child support, or any other non-dischargeable debts.

More Financial Hot Water Can Mean Higher Attorneys’ Fees

Our survey results showed that having more debt or more types of debts typically didn’t mean higher attorneys’ fees. However, your lawyer may charge you a higher fee if you have any of the following issues that could complicate your case :

- You have a large number of creditors.

- Youve filed for bankruptcy within the last eight years.

- You want to stop an eviction, foreclosure, bank levy, or wage garnishment.

- You have liens filed against your property.

- You are involved in litigation in state or federal court.

- You anticipate being accused of engaging in fraudulent activity .

- You have nondischargeable debts .

Recommended Reading: Declare Bankruptcy What Happens

Bankruptcy Filing Fee Waivers

Your bankruptcy filing fee will be one of the larger costs you have to pay for bankruptcy in Illinois unless you get it waived. To do that, you have to fill out an application and meet strict income qualifications.

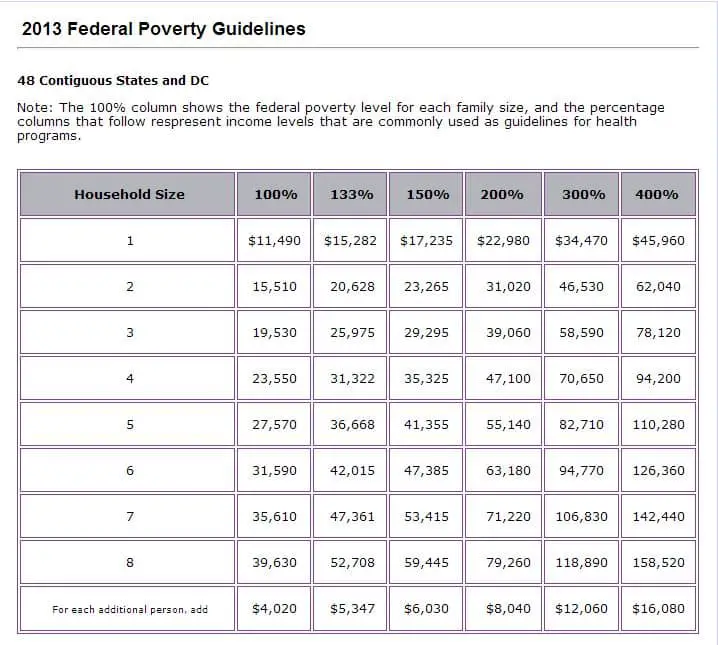

Put simply, you have to make less than 150 percent of what the federal government considers poverty-level monthly wages. The poverty level varies for different household sizes. Here is the monthly income breakdown:

- One-person household: $1,610.00

- Additional monthly income for each family member over eight: $567.50

Chapter 7 Vs Chapter 13

The most common type of bankruptcy for individuals is Chapter 7, which effectively wipes the slate clean after certain assets are liquidated, and cash from the liquidation is distributed to creditors.

The second most common type of bankruptcy for consumers is Chapter 13 bankruptcy, which allows the debtor to keep some valuable assets by agreeing to a three- to five-year payment plan. For example, if the debtor wants to keep their house, Chapter 13 would allow them to make payments through a trustee, and they would be protected from any legal action that creditors could take.

Read Also: Returns Pallets For Sale

How Much It Costs To File Bankruptcy In New York In 2022

The cost to file bankruptcy in New York is $338 for a Chapter 7 bankruptcy and $313 for a Chapter 13 bankruptcy, but the answer becomes more nuanced if you decide to file with a bankruptcy attorney and if you are trying to get the filing fees waived.

If you are like me, you probably wonder how you can afford the cost of bankruptcy in New York when its difficult to pay bills, especially in 2022 as inflation runs rampant. Many bankruptcy costs such as the filing fee and the credit counseling courses are relatively similar. That said, the cost of bankruptcy attorney fees may range dramatically whether you are in New York City or Buffalo.

The purpose of this article is to provide you with estimated all-in costs:

Filing Fees And Required Courses

First off, bankruptcy filers must pay a filing fee. For a Chapter 7 case, the fee is $335. For a Chapter 13 case, the fee is $310. The Bankruptcy Trustee may charge a fee of $15 to $20 when you file, as well. You may request to pay the filing fees in installments most courts will allow it if you can show it would be a financial hardship to pay all at once.

If you file under Chapter 7 and later convert to Chapter 13 , you wont have to pay any extra fee. However, if you file under Chapter 13 and later convert to Chapter 7 youll have to pay a conversion fee of $25.

Aside from the filing fees, youll be required to obtain credit counseling and take a personal financial management course. That generally costs anywhere from $20 to $100, depending on where you file.

Don’t Miss: Can You Get Car Loan After Bankruptcy

How Much Does It Usually Cost To File Bankruptcy

Filing for bankruptcy comes with a multitude of processing fees that can really add up. Moreover, trying to wade through the possible fees and forms can leave most people confused about not only what to file but how much it is going to cost to file it. DoNotPay can help you to choose the type of bankruptcy that you need to file and also determine what your total cost will be when filing for bankruptcy. There are several typical types of fees when filing for bankruptcy. Those fees can be typically be broken down in the following manner according to :

Chapter 7 :

| Filing Fee |

Bankruptcy Discharge: Different Results For Different Debts

In Chapter 7 bankruptcy, you can usually wipe out almost all qualifying debts. Qualifying debts usually include credit card balances, medical and utility bills, and personal loans. You can even wipe out “secured” debt like mortgages and car loans, but you’ll have to return the property to the lender. Learn about keeping your house or retaining your car in bankruptcy.

“Priority” debts, like taxes and unpaid child or spousal support, are “nondischargeable” and don’t go away in bankruptcy. Student loans, debts incurred through fraud, and wrongful death and injury obligations resulting from intoxication are also examples of nondischargeable debts.

Our readers had great results getting their qualifying debts wiped out, mixed results on some debts with special rules , and poor results with student loan debt.

Discharge Rates for Debt Types

Also Check: How Often Can You File Chapter 7 Bankruptcy In California

How Much Does It Cost To File Bankruptcy In Illinois

When youre thinking about filing bankruptcy, you are more than likely dealing with some financial problems. Bankruptcy is often a good solution to those problems, but there is a cost to filing for bankruptcy. You may have to round up some money if you want to file bankruptcy.

How much does it cost to file bankruptcy in Illinois, exactly? The cost can vary widely and depends on a large number of factors. In this post, we take a deep dive into Illinois bankruptcy costs and ways to control them. Read on to learn more, or reach out to A Bankruptcy Law Firm, LLC, for the legal help you need.

Additional Fees And Costs When Filing Bankruptcy

Here are a few other expenses youll likely have to pay for when you file Chapter 7.

Filing fees.In addition to the fees you pay your attorney, youll have to pay the bankruptcy courts filing fee of $338 unless you qualify for a waiver because you earn no more than 150% of the national poverty guidelines.

Bankruptcy counseling course fees. Everyone filing for Chapter 7 bankruptcy must take two bankruptcy counseling courses: one before filing and another afterward. These courses should cost about $60 or less. Discounted courses are available for low-income people.

Litigation fees and costs. If your bankruptcy case ends up in litigation, you’ll owe your attorney more money. According to our survey, the vast majority of Chapter 7 bankruptcy cases moved through the process without incident. However, not all cases do. In a small percentage of cases, a creditor will object to the bankruptcy court’s discharging a debt on the grounds of fraud .

If a creditor files an adversary proceeding for fraud , youll need to pay your bankruptcy attorney additional fees to oppose the adversary proceeding on your behalf. Your regular bankruptcy fee does not include representing you in this type of litigation.

Don’t Miss: How To Get Credit After Bankruptcy Discharge