Lower Returns On Your Investments

Bonds issued by the Treasury are typically seen as low-risk investments. When interest rates rise, the yield on these low-risk investments also rises, making them more attractive investments for income-minded investors over other riskier income-generating investments like corporate bonds.

This could leave companies that typically rely on bonds short on the loans they need to finance expansions and operations and translate into lower returns for equity investors when companies fail to meet revenue targets.

What Age Should You Be Debt Free

Kevin OLeary, an investor on Shark Tank and personal finance author, said in 2018 that the ideal age to be debt-free is 45. Its at this age, said OLeary, that you enter the last half of your career and should therefore ramp up your retirement savings in order to ensure a comfortable life in your elderly years.

The National Debt Affects Everyone

If that forecast were to come to pass, the incremental increase over current debt service costs would be roughly equivalent to the Social Security’s current funding needs at about 5% of U.S. GDP.

This would almost certainly force policymakers to make painful choices, with consequences that would be felt worldwide. It’s also possible this scenario won’t come to pass because of steps taken in order to avoid it, actions likely to have significant effects in their own right. Or the distant future could look more like the recent past, with investors willing to accept minimal Treasury yields based on the available alternatives.

Just as U.S. currency in circulation is a Federal Reserve liability akin to debt, Treasury obligations may be thought of as an interest-bearing currency. And if cash and Treasury debt are equivalent, then the issuance of U.S. government debt is only material to the extent it incurs future debt service costs.

Recommended Reading: Credit Card Debt America

Tracking The Federal Deficit: December 2018

The Congressional Budget Office reported that the federal government generated an $11 billion deficit in December, the third month of Fiscal Year 2019, for a total deficit of $317 billion so far this fiscal year. If not for timing shifts of certain payments, the deficit in December would have been roughly $32 billion, according to CBO. Decembers deficit is 52 percent lower than the deficit recorded a year earlier in December 2017. Total revenues so far in Fiscal Year 2019 increased by 0.1 percent , while spending increased by 9.4 percent , compared to the same period last year.

Analysis of Notable Trends in December 2018: Revenue from customs duties spiked by 83 percent from October-December 2018, relative to the same period in 2017, due to the administrations imposition of new tariffs. Conversely, corporate income tax revenue declined by 15 percent from October-December 2018 relative to the same period in 2017. This dip mainly reflects the reduction of corporate tax rates enacted in the Tax Cuts and Jobs Act of 2017. On the spending side, interest payments on the federal debt in December 2018 rose by 47 percent relative to December 2017.

Tracking The Federal Deficit: April 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $225 billion in April, the seventh month of fiscal year 2021. Aprils deficit was the difference between $439 billion of revenue and $663 billion of spending. If not for a shift in the timing of some payments because May 1 fell on a weekend, Aprils deficit would have been $165 billion.

So far this fiscal year, the federal government has run a cumulative deficit of $1.9 trillion, the difference between $2.1 trillion of revenue and $4.0 trillion of spending. This deficit is 26% greater than at the same point last fiscal year and 252% greater than at this point in fiscal year 2019.

Analysis of notable trends: In normal years, spending and revenues typically follow similar monthly patternsan influx of individual income taxes arrives in April, corporate income taxes are paid quarterly, refundable tax credits are largely paid in February and March. These patterns allow analysts to gauge changes in federal finances by comparing each months spending and revenues to the same month in the prior year.

Don’t Miss: Bankruptcy Dismissal Vs Discharge

How Much Do Other Countries Owe The Us

Public debt makes up three-quarters of the national debt, and foreign governments and investors make up one-third of public debt. As of , the countries with the most debt owed to the U.S. are Japan, China, the United Kingdom, Luxembourg, and Ireland.

Though China had been the long-standing top placeholder for the country with the most debt owed to the United States, Japan currently holds $1.3 trillion worth of U.S. debt. The second place holder, China, currently holds $1.1 trillion in Treasury holdings. Together, they hold 31% of all foreign-owned U.S. debt.

Tracking The Federal Deficit: August 2019

The Congressional Budget Office reported that the federal government generated a $200 billion deficit in August, the eleventh month of Fiscal Year 2019. This makes for a total deficit of $1.067 trillion so far this fiscal year, 19 percent higher than over the same period last year. Total revenues so far in FY 2019 increased by 3 percent , while spending increased by 7 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Trends in the major categories of revenue and spending continued from previous monthscompared to last year, individual income and payroll taxes collectively rose by 3 percent , while spending for the largest mandatory programs collectively increased by 6 percent . Revenues from customs duties increased by 72 percent , primarily due to new tariffs imposed on certain imports from China. Estate tax revenue decreased by 25 percent due to the 2017 tax cuts which doubled the value of the estate tax exemption. Additionally, Fannie Mae and Freddie Mac remitted $16 billion more in payments to the Treasury this year. Finally, net interest payments on the federal debt continued to rise, increasing by 14 percent versus last year due to higher interest rates and a larger federal debt burden.

Recommended Reading: What Are Liquidation Pallets

How The National Debt Affects You

When the national debt is below the tipping point, government spending continues and contributes to a growing economy, which means more funding for programs that you can take advantage of.

But when the debt exceeds the tipping point, your standard of living could be impacted. Interest rates may increase and that could slow the economy. The stock market could react to a lack of investor confidence, which could mean lower returns on your investments. And a recession may even be possible.

This also puts downward pressure on a countrys currency because its value is tied to the value of the countrys bonds. As the currencys value declines, foreign bond holders’ repayments are worth less. That further decreases demand and drives up interest rates. As the currencys value declines, goods and services may become more expensive and that contributes to inflation.

Concerns Over Chinese Holdings Of Us Debt

According to a 2013 Forbes article, many American and other economic analysts have expressed concerns on account of the People’s Republic of China’s “extensive” holdings of United States government debt as part of their reserves. The National Defense Authorization Act of FY2012 included a provision requiring the Secretary of Defense to conduct a “national security risk assessment of U.S. federal debt held by China.” The department issued its report in July 2012, stating that “attempting to use U.S. Treasury securities as a coercive tool would have limited effect and likely would do more harm to China than to the United States. An August 19, 2013 Congressional Research Service report said that the threat is not credible and the effect would be limited even if carried out. The report said that the threat would not offer “China deterrence options, whether in the diplomatic, military, or economic realms, and this would remain true both in peacetime and in scenarios of crisis or war.”

Read Also: How Much Do Collection Agencies Pay For Debt

What Is The Current National Debt

As of Oct. 8, 2022, the total U.S. national debt was $31.1 trillion, after crossing the $30 trillion mark for the first time in February. At the end of 2019, prior to the COVID-19 pandemic, the national debt was $23 trillion. One year later, it had risen to $27.7 trillion. Since then, it has increased by more than $2 trillion.

Tracking The Federal Deficit: December 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $20 billion in December 2021, the third month of fiscal year 2022. This deficit was the difference between $486 billion in revenues and $507 billion of spending. Decembers deficit was 85% smaller than that of December 2020. Additionally, both this year and last year, the timing of the New Years Day federal holiday shifted payments that would normally have occurred at the beginning of January into December. In the absence of these timing shifts, the federal government would have run a monthly surplus in December 2021 for the first time since January 2020, prior to the onset of the COVID-19 pandemic.

Analysis of notable trends: Through the first quarter of FY2022, the federal government has run a deficit of $377 billion, $196 billion less than at this point in FY2021. After factoring in the aforementioned timing shifts, the FY2022 deficit to date is $353 billion, or 33% smaller than FY2021the rest of this discussion accounts for these payment shifts. However, this deficit is $17 billion larger than the deficit accrued during the first quarter of FY2020, before the start of the pandemic.

You May Like: Has Donald Trump Ever Filed Bankruptcy

Tracking The Federal Deficit: June 2019

The Congressional Budget Office reported that the federal government generated an $8 billiondeficit inJune, theninth monthof Fiscal Year 2019, for a total deficit of$746 billionso far this fiscal year. If not for timing shifts of certain payments, Junes deficit would have been $57 billion, which is $28 billion larger than the adjusted deficit forJune 2018. Total revenues so far inFiscal Year 2019increased by3 percent , while spending increased by7 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Individual and payroll taxes together rose by 3 percent , reflecting an expanding economy and a low unemployment rate. Furthermore, customs duties increased by 77 percent versus last year, primarily due to the imposition of new tariffs. On the spending side, Social Security expenditures increased by 6 percent compared to last year due to increases in the number of beneficiaries and the average benefit payment. Finally, net interest payments on the federal debt continued to rise, increasing by 16 percent versus last year due to higher interest rates and a larger federal debt burden.

Tracking The Federal Deficit: March 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $658 billion in March 2021, the sixth month of fiscal year 2021. This months deficitthe difference between $267 billion in revenue and $925 billion in spendingwas $487 billion greater than last Marchs . The federal deficit has now swelled to $1.7 trillion in fiscal year 2021, 129% higher than at this point last year. While revenues have grown 6% year-over-year, cumulative spending has surged 45% above last years pacelargely a result of the COVID-19 pandemic, its economic fallout, and the federal governments fiscal response.

Analysis of Notable Trends: Adjusted for timing shifts, outlays in March 2021 were $517 billion greater than last March, an increase of 127%. Unemployment insurance, refundable tax credits, and the Small Business Administrations Paycheck Protection Program accounted for most of the increaseboth from March to March and from last fiscal year to this one. Spending on refundable tax credits was $346 billion higher in March 2021 than March 2020, mostly due to the payment of pandemic recovery rebates authorized by the Consolidated Appropriations Act and American Rescue Plan Act..

Also Check: What Does Bankruptcy Chapter 13 Mean

Current Foreign Ownership Of Us Debt

apan owned $1.23 trillion in U.S. Treasurys in June 2022, making it the largest foreign holder of the national debt. The second-largest holder is China, which owns $967.8 billion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their own currencies. This helps to keep their exports to the U.S. affordable, which helps their economies grow.

China replaced the U.K. as the second-largest foreign holder in 2006 when it increased its holdings to $699 billion.

The U.K. is the third-largest holder with $615.4 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. Luxembourg is next, holding $306.8 billion. The Cayman Islands, Switzerland, Ireland, Belgium, France, and Taiwan round out the top 10.

Tracking The Federal Deficit: January 2020

The Congressional Budget Office reported that the federal government generated a $32 billion deficit in January, the fourth month of fiscal year 2020. Januarys deficit is a $40 billion change from the $9 billion surplus recorded a year earlier in January 2019. Januarys deficit brings the total deficit so far this fiscal year to $388 billion, which is 25% higher than the same period last year . Total revenues so far in FY2020 increased by 6% , while spending increased by 10% , compared to the same period last year. (After accounting for timing shifts, spending rose by 6% or $90 billion.

Analysis of Notable Trends in This Fiscal Year to Date: Through the first four months of FY2020, revenue from corporate income taxes rose by 27% . Additionally, Federal Reserve remittances increased by 14% partly due to lower short-term interest rates that reduced its interest expenses. On the spending side, after accounting for timing shifts, total Social Security, Medicare, and Medicaid outlays rose by 6% . Outlays for the Department of Defense rose by 7% , largely for procurement and research and development.

Don’t Miss: How To Find Out When You Filed Bankruptcy

Raising Reserve Requirements And Full Reserve Banking

Two economists, Jaromir Benes and Michael Kumhof, working for the International Monetary Fund, published a working paper called The Chicago Plan Revisited suggesting that the debt could be eliminated by raising bank reserve requirements and converting from fractional-reserve banking to full-reserve banking. Economists at the Paris School of Economics have commented on the plan, stating that it is already the status quo for coinage currency, and a Norges Bank economist has examined the proposal in the context of considering the finance industry as part of the real economy. A Centre for Economic Policy Research paper agrees with the conclusion that “no real liability is created by new fiat money creation and therefore public debt does not rise as a result.”

The debt ceiling is a legislative mechanism to limit the amount of national debt that can be issued by the Treasury. In effect, it restrains the Treasury from paying for expenditures after the limit has been reached, even if the expenditures have already been approved and have been appropriated. If this situation were to occur, it is unclear whether Treasury would be able to prioritize payments on debt to avoid a default on its debt obligations, but it would have to default on some of its non-debt obligations.

What To Read Next

-

Here are the top car brands that rich Americans earning more than $200K drive most and why you should too

-

Youre probably overpaying when you shop online get this free tool before Black Friday

-

Inflation eating away at your budget? Here are 21 things you should never buy at the grocery store if you are trying to save money

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

You May Like: How To File Bankruptcy In Ohio

The Tax Cuts And Jobs Act Of 2017 Contributed To The Soaring Debt

The combination of Trumps 2017 tax cut and the lack of any serious spending restraint helped both the deficit and the debt soar, Sloan and Podkul wrote. So when the once-in-a-lifetime viral disaster slammed our country and we threw more than $3 trillion into COVID-19-related stimulus, there was no longer any margin for error.

In addition to the 2017 tax cutand, specifically, the slashing of the corporate tax rate from 35 percent to 21 percentthe ProPublica authors also attributed the deficit increase to the inefficacy of Trumps tariffs to cut down the debt. The tariffs on aluminum, steel, and other products raised only $36 billion, less than 1/750th of the national debt.

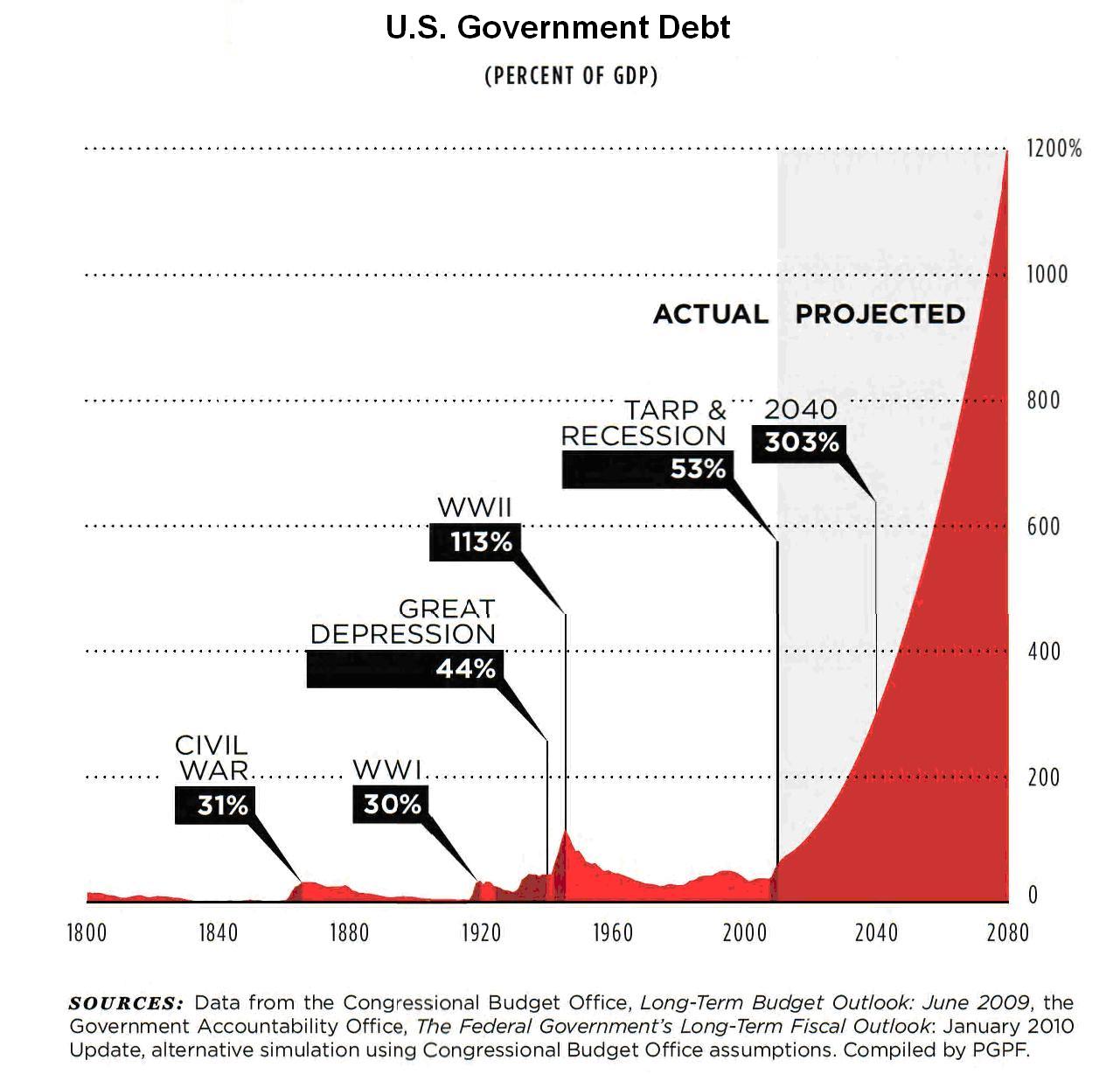

What Are The Primary Drivers Of Future Debt

The main drivers are still mandatory spending programs, namely Social Securitythe largest U.S. government programMedicare, and Medicaid. Their costs, which currently account for nearly half of all federal spending, are expected to surge as a percentage of GDP because of the aging U.S. population and resultant rising health expenses. Yet, corresponding tax revenues are projected to remain stagnant.

Meanwhile, interest payments on the debt, which now account for nearly 10 percent of the budget, are expected to rise, while discretionary spending, including programs such as defense and transportation, is expected to shrink as a proportion of the budget.

President Trump signed off on several pieces of legislation with implications for the debt. The most significant of these is the Tax Cuts and Jobs Act. Signed into law in December 2017, it is the most comprehensive tax reform legislation in three decades. Trump and some Republican lawmakers said the bills tax cuts would boost economic growth enough to increase government revenues and balance the budget, but many economists were skeptical of this claim.

The CBO says the law will boost annual GDP by close to 1 percent over the next ten years, but also increase annual budget shortfalls and add another roughly $1.8 trillion to the debt over the same period. In addition, many of the provisions are set to expire by 2025, but if they are renewed, the debt would increase further.

Read Also: Free Debt Snowball Calculator Excel

Read Also: Bankruptcy In The Us