Can I Get A List Of Foreclosures In My Area

Every county sheriffâs office should have a web page with a list of foreclosure auctions scheduled to take place in your county, but you can also find these advertised in local newspapers.Find pre-foreclosures and bank-owned properties in your area by searching real estate websites like RealtyTrac or Zillow, or have your agent locate them on the MLS.

Who Can Buy A Pre

Typically, buying pre-foreclosed homes has been the domain of investors, Blomquist states. But anyone is able to buy them with the right funding and patience.

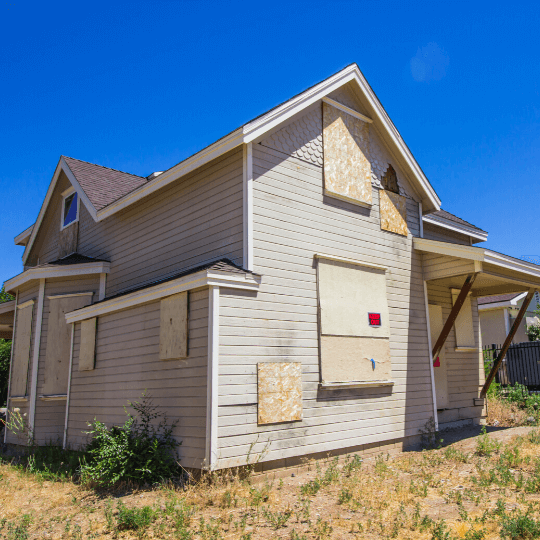

Pre-foreclosures are not for the faint of heart either. It is a higher risk property. Sometimes, they can be in bad shape either from maliciousness on the homeowners part or just because they havent had any extra money to maintain the house.

Why Foreclosed Homes Are Cheaper

The biggest selling point of a foreclosed home is, of course, its marked-down priceoften significantly lower than similar properties in the same area .

Most foreclosures are sold at a sizable discount from , with the exact amount varying from region to region. The seller may offer additional incentives such as a reduced down payment, lower interest rate, or the elimination of appraisal fees and some closing costs.

What makes these properties such a deal? If the residence is in the pre-foreclosure or short-sale stage, its owners are in a financial bind, and time is not on their side. They have to unload the property and get what they can while they can before they lose possession of it.

In short, these sellers arent negotiating from a position of strength and, while it may seem cruel to take advantage of their misfortune, a buyer can benefit.

The buyer can benefit even more if the property has been seized. The sheriffs office isnt interested in hanging onto a house, and banks dont want to be in the landlord business. Financial institutions typically want to rid themselves of foreclosed properties promptly. They need to get a reasonable price they have to answer to their investors and auditors. Still, buyers have an edge.

You should know that foreclosed homes are usually sold as is. If theres damage, repairs by the owner arent part of the equationbut, as used-car and vintage furniture aficionados know, as is translates into a discount.

Also Check: Single Family Home Auctions

What Does It Mean If A Home Is Pre

A pre-foreclosure home is a distressed property that the lender has not yet repossessed and sold at auction. Pre-foreclosure homes are generally still occupied by their owners, who have fallen behind on monthly mortgage payments. The occupants of pre-foreclosure homes will have received a default notice, but may still be working to stave off foreclosure. Thats a long way of saying that a home can be pre-foreclosure and not for sale.

Where Are The Most Foreclosures In California

As you might expect, the most foreclosure volume can usually be found in the higher-population areas around the state. A quick search on RealtyTrac shows high concentrations of foreclosures in and around metro areas like Los Angeles, San Jose, and San Diego. The highest percentage of foreclosures are in the following counties: Alpine, Yuba, Trinity, Shasta, and Lake.

You May Like: Free Listings For Foreclosed Homes

Borrow If You Can To Catch Up On Missed Payments

For borrowers who hate to ask for help, asking friends and relatives for a loan will be unappealing, but the best way to get out of preforeclosure is by catching up on all missed payments. Once the mortgage is brought current, many lenders will stop the preforeclosure process.

It may be uncomfortable, but if borrowing is possible, its better to do it before the foreclosure process begins to reduce the hit on your credit history.

How To Buy Pre

Start your search. Part of what is pre-foreclosure real estate is the trickiness of finding properties. Those wondering how to buy a pre-foreclosure home and find pre-foreclosure listings for free should be prepared to spend a significant amount of time in the research and marketing phases. First, you can search through online pre-foreclosure listing sites, including those published in the county records. In addition, some general real estate listing sites, such as Zillow, offer a pre-foreclosure specific search filter. You can also start marketing yourself as a buyer through the use of bandit signs or on Craigslist.

Get in your car. Once you have identified a property or two of interest, it is time to hop in your car and drive by the property to get an idea of its condition. However, keep in mind that the owner may still occupy the property, so be respectful.

Get status updates. When identifying pre-foreclosure listings, also make sure to write down the name of the trustee or attorney, which will often be the title company. You should contact the trustee to get status updates on the property, for it is not uncommon for homeowners to resolve their financial issues not to lose their property.

Recommended Reading: How To Find Foreclosure Records

Why Are Houses Foreclosed

Foreclosure is rarely a choice homeowners make willingly. In general, foreclosure only occurs when there are no other options. Foreclosures are most common due to job loss, serious medical conditions that prevent ongoing employment, serious maintenance issues with the home that a homeowner can’t afford to fix, divorce, or other drivers of consumer, educational, or medical debt.

Close The Sale And Pick Up The Keys

If the bank approves your offer and the inspection doesn’t turn up any serious red flags, your sale will progress as normal. There is often a lot of paperwork and back-and-forth discussion between the bank and your agent, so patience is important. Your agent will keep you updated on the process. As soon as the transaction is complete, you will receive the keys and title to the house.

Recommended Reading: How Long Does A Bankruptcy Stay On Equifax

Know The Difference Between Preforeclosure And Short Sale

At first glance, there may seem to be parallels between a home in preforeclosure and a short sale property, but the two are very different.

The nature of a short sale is that the homeowner owes more than what the home is worth. We might also say that theyre underwater, explains Fuller.

If they were to sell the property, they would have no proceeds and would in fact owe the lender or the lienholder money at the time of closing.

To avoid this deficit, short sale homes involve negotiating with the mortgage company to sell the property for less than what is owed. The seller can then typically walk away from the closing table without owing anything further.

Meanwhile, homes in preforeclosure generally have enough value to cover the outstanding mortgage.

A preforeclosure doesnt mean that the seller doesnt have any equity it simply means they are heading toward a foreclosure, notes Fuller.

Comprehend The Pre Foreclosure Process

While you, as the buyer, may not be personally affected by the pre foreclosure, its key to understand the circumstances surrounding the sale. Heres what you need to know:

When it comes to the foreclosure process, pre foreclosure is the first step. Though it varies from one state to the next, the process usually starts when the homeowner defaults on three mortgage payments consecutively. The bank will then issue a pre foreclosure notice indicating that it is getting ready to foreclose on the property.

Once the default notice is served, the property owner will be given about 2-3 months to act in order to block the foreclosure process. It could mean paying the outstanding loan balance entirely or renegotiating a new payment agreement.

Alternatively, the homeowner could choose to sell the real estate investment himself/herself in order to avoid foreclosure. The property is usually sold at a discount since the owner is highly motivated. However, it is not always true that pre foreclosure homes are distressed or located in poor neighborhoods.

Don’t Miss: How To Find Out Debt To Income Ratio

Understand What Foreclosure Is

The foreclosure process allows a mortgage lender to recover as much money as possible after the homeowner stops paying their mortgage on schedule. It all begins when the owner misses their loan payments for three to six months. The lender can then file a public notice of default, which starts the pre-foreclosure process.

If youre interested in learning how to buy a foreclosed home, its important to know that doing so works differently depending on the stage of foreclosure the home is in. Youll also want to know how to find them: you can use filters on your Trulia search to surface foreclosed homes, and the results will tell you which stage of foreclosure the property is in.

How To Find Foreclosed Properties

Often, you can browse foreclosed properties in your area using the same methods you would to buy a regular home, such as online listing sites like Zillow. You can also look at homes that are in pre-foreclosure or are being sold as a short sale.

Foreclosed properties owned by the government-sponsored enterprises Fannie Mae and Freddie Mac can also be found online. Some of these homes may have had certain repairs completed in order to make them eligible for financing.

Fannie Mae’s program for Fannie-owned foreclosed properties is called HomePath, while Freddie Mac’s is called HomeSteps.

To view for-sale foreclosures owned by HUD, you can visit the HUD Home Store.

You can also check your local newspaper for notices of foreclosure auctions.

Don’t Miss: Can You Get Student Loans If You File Bankruptcy

Find The Right Real Estate Agent

Buying a bank foreclosure home for sale isn’t the kind of venture you can take on solo. Before getting started, find a great agent experienced in foreclosures who understands the process in your area. Even if you have a good working relationship with an agent, success in purchasing a foreclosure means finding an expert.

Can You Get A Mortgage On A Pre Foreclosure

The long and short of it is yes, you can get a mortgage on a pre-foreclosure property. However, if there is competition for the home and another buyer has cash, they will more than likely seal the deal. Banks are usually open to giving loans on properties that arent for sale yet, so if this is the route you choose, its a good idea to get pre-qualified first. This will show the seller that youre able to get the funds and are a serious buyer.

However, hard money loans are a more common way of getting funding for pre-foreclosure homes. This is because the approval process is quicker, you can be issued with a Proof of Funds letter within a day or 2, and the lending criteria are less stringent. Consider New Silvers options if youd like to use a hard money loan for your pre-foreclosure deal, and you could be approved conditionally within minutes.

Don’t Miss: How Soon After Bankruptcy Can You Get A Car Loan

Overview Of Buying A Foreclosure

You could buy a home in pre-foreclosure, at a foreclosure auction, or from the mortgage lender.

Buying a foreclosure can seem like a no-brainer. Who could pass up a rock-bottom price for a new home? If youre looking to rent or flip a property, the lower the price you pay, the more profit you make. Whats not to like?

Well, buying a foreclosure property can work out well for the buyer if not the previous owner, for whom its usually heartbreaking. But even if you can take advantage of the opportunity, buying a foreclosure requires some extra effort, research and patience.

Get An Appraisal And Inspection

Inspections and appraisals are both crucial when it comes to buying a foreclosure. An appraisal is a lender requirement that lets you know how much money a property is worth. Lenders require appraisals before they offer home loans because they need to know that they arent lending you too much money.

A home inspection is a more in-depth look at a property. An expert will walk through the home and write down everything that needs to be replaced or repaired. Because foreclosures usually have more damage than homes for sale by owner, you should insist on an inspection before buying a foreclosed home.

Sometimes, you dont get the chance to order a home inspection or appraisal before you buy. You should only consider buying these types of foreclosed properties if youre advanced at home repair.

Don’t Miss: Selling Your Right Of Redemption

Do Your Due Diligence

Make sure that the owner is in fact in pre-foreclosure and hasnt resolved their financial issues.

Ensure that you have the funds for the down payment as well as the monthly mortgage. If you need funding, a hard money lender is the common way to get a loan because itss fast, and easy to get a larger amount.

Get a copy of the utility payments, tax history and other expenses.

Check the public records to figure out what the outstanding balance owed on the property is and if there are any liens on the house.

Hire a title company to check that the title is clear of any issues, so that nothing crops up later.

Ways To Find Pre Foreclosure Homes In 2022

Smart investors look for pre foreclosure homes to make a quick profit. Heres how you can pull this off.

Most successful real estate investors take pains to discover means to optimize their profits. The more savvy ones have unearthed the brilliance of using off market properties as investment vehicles. They have adopted the option of scouring through pre foreclosure homes listings as a part of their roster of real estate investment strategies.

Pre foreclosure homes attract many investors because of the low purchase price and the immediate returns. However, if you focus only on finding a house sold at a bargain, you may end up with a dismal yield. You need to have adequate knowledge on where to find the right property and the striking features that will make it attractive to the market whether you rent it out or sell it. You should also have the insight to determine if the pre foreclosure is caused by an unfortunate circumstance of the owner or something that may be bigger in scope and has influenced the real estate market.

Pre foreclosure investing has its intricacies, making experts believe that this strategy is not for amateur investors. However, the lack of experience should not deter you from trying this out for the first time.

To equip you with the right knowledge and tools for your pre foreclosure home hunting, weâve put together the following blog post to explain the following:

You May Like: How To Get A Car Loan After Bankruptcy Discharge

At A Glance: State Of The New Jersey Foreclosure Market

- 1,860 foreclosure filings out of more than 3.7 million housing units

- Counties with highest foreclosure rate : Burlington, Cumberland, Gloucester, Camden, and Ocean

- Counties with high foreclosure volume: Bergen, Camden, Essex, Gloucester, Ocean

|

âï¸ Editorâs take: New Jersey has a consistent track record of high foreclosure rates. Being a judicial state with a redemption period â both discussed below â creates some obstacles for investors and homeownersalike trying to scoop up these properties for undermarket value, but the opportunities are still there. You just need to be patient, disciplined, and well-informed on how the process works. We recommend all buyers try to get to properties during the pre-foreclosure stage to avoid the additional requirements and risks inherent in the foreclosure auction stage. |

What Is A Short Sale

If a pre-foreclosure home is listed for sale, it will be considered a short sale, not a pre-foreclosure. Most pre-foreclosure homes are not for sale.

However, not every short sale is a pre-foreclosure. Some sellers can be current on their mortgage payments and still do a short sale. Sellers who are current on their payments would not fall into the pre-foreclosure category.

You May Like: Houses Foreclosed For Sale

Buying Homes At New Jersey Foreclosure Auctions

|

â¡ï¸ Key takeaways

|

When a borrower fails to repay their debt or file for bankruptcy prior to the date of the foreclosure sale, then an auction is held to sell the property.

These auctions are held by the county sheriff, usually in person at the courthouse or another government-owned building.

Prior to the sale, these auctions are publicly listed in newspapers, websites like Zillow or RealtyTrac, and on county sheriff websites, such as:

Auctions require 20% deposits to be paid on the day of the auction with a certified check or money order. If you submit a winning bid, you have 30 days to pay in full, BUT you may be charged interest if you wait too long â the day interest beginsto accrue varies by county , so check your county sheriff website to determine when interest starts to accumulate.

If no one submits a winning bid at the auction, the bank or government will take possession of the property and attempt to sell it themselves.

Where to find New Jersey foreclosure auctions

Auctions are also sometimes listed on popular websites like Auction.com or Hubzu.com.

How to purchase a New Jersey foreclosure at auction

Find Preforeclosure Listing Leads & Narrow Down Property Options

Knowing how to buy a preforeclosure home becomes more complicated when locating preforeclosure homes for sale, which is often the most difficult part of the purchase process. Unlike typical property listings, preforeclosure listings do not appear in abundance on popular listing websites. In fact, there were only 90,139 U.S. properties with foreclosure filings in the second quarter of 2022 compared to 619,305 active properties listed in June 2022.

There are several methods to find preforeclosure homes with or without the assistance of a real estate agent:

Read Also: What To Know Before Filing Bankruptcy