Can A Bankruptcy Be Expunged In California

Expungement is a legal process by which court records are erased or destroyed. The expungement procedure is more commonly seen in the criminal justice system to give certain ex-offenders access to housing, credit, immigration, and employment. Though bankruptcy is not a criminal act and the federal bankruptcy code does not explicitly state expungement procedures, judges have the right to issue orders at will in the fulfillment of their duties and the law. This includes an order of expungement. Although parties can file motions to expunge with the courts, it is mostly granted in limited situationswhen a bankruptcy case occurs because of fraud or identity theft, or when the debtor did not consent to the filing .

The judges also have the authority to remove certain materials classified as scandalous or defamatory from the public record to protect a party or prevent access to trade secrets and confidential business information.

How Do I Find Out If My Bankruptcy Case Is Closed In California

When a bankruptcy case is closed in California, it means that all activities and proceedings of the case have been concluded. However, it does not mean that the court discharged the petitioner’s debts. This non-discharge can occur because of a failure to comply with court procedures, submit certain financial documents, or complete a financial course.

Usually, when a case is closed, the debtor or the debtor’s attorney will receive a notice from the court by mail regarding the closing order. A principal party can also determine if a case has been closed from the PACER and McVCIS databases. Furthermore, the Clerk’s office can provide this information.

How To Find California Bankruptcy Records

There are several ways to obtain a bankruptcy record in California:

- Online through the Public Access to Court Electronic Records or Courts Case Management/Electronic Filing System

- Telephone via the Multi-Court Voice Case Information System, or McVCIS

- In-person or mail request to the Clerk’s office

- From the National Archive and Records Administration

Obtaining bankruptcy records through Public Access to Court Electronic Records and CM/ECF:

PACER provides members of the public with access to bankruptcy case information and court documents. To use this web-based records system to obtain bankruptcy information, requesters must have a PACER account.

There are fees required to search or download records. The PACER fee schedule provides information on service costs. Some persons and groups may be exempted from paying fees, including academic researchers and other parties .

To search for court records on PACER, a requester must have a party’s name, the case number, a tax identification number, or a social security number .

Note that it is not possible to obtain sealed court records through PACER. Also, documents filed before December 1, 2003, and which have been closed for over a year cannot be accessed through PACER by members of the public. However, everyone still has access to the docket sheets and information. Persons authorized to access the pre-2003 cases are the case participants. These parties can do so through the court’s CM/ECF or at a court’s public computer terminal .

Also Check: How Much To File Bankruptcy In Va

Are The Bankruptcy Or Corporate Insolvency Records Deleted

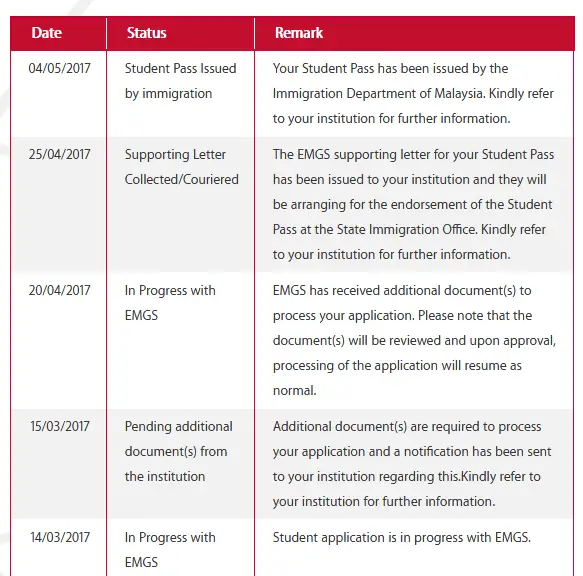

Bankruptcy orders that have been annulled or discharged for 5 years or more will be deleted. Undischarged bankrupts will continue to remain in the public search database.

An individual who is discharged from bankruptcy despite not paying their target contribution in full after 7 years or after 9 years will have their name on the bankruptcy record permanently.

Corporate insolvency records are not removed and will continue to remain accessible in a public search.

Information For Bankruptcy Professionals

All bankruptcy related correspondence, including notices of the filing of a bankruptcy case and related motions, and the submission of tax returns for pre-petition periods, should be forwarded to:

Alabama Department of RevenueP.O. Box 320001Montgomery, AL 36132-0001

If you have questions about the pre-petition tax liabilities of your client, please contact the Bankruptcy Section at 334-242-9690. Unless a statutory exception applies, to obtain this information, you will need to submit a Power of Attorney executed by you and your client. Please submit the completed form to the address above or via facsimile to 334-242-9782.

You May Like: Us Gov Mortgage Relief

What Are California Bankruptcy Records

California bankruptcy records contain the personal and financial details of individuals or companies filing for bankruptcy. They provide details of the creditors and other essential case information. Per 11 U.S.C. § 107, the federal courts create public records with each filing made. The bankruptcy courts allow any member of the public to examine or duplicate records through a federal online records service , via telephone, by mail, or at the courts’ physical locations through the Clerk of Court’s office, provided the desired record is not sealed from public access. Nevertheless, non-governmental websites still offer online access to bankruptcy information and records.

Are Bankruptcies Public Record

A bankruptcy order is issued, whether on the petition of a creditor or the petition of a debtor, and as soon as it is issued, the fact of the bankruptcy becomes a matter of public record. Insolvency and bankruptcy notices are required to be published in the Official Public Record, which is the Gazette, according to the legislation.

Read Also: What Is Chapter 11 Of Bankruptcy

Your Responsibilities Aren’t Over After You Receive Your Bankruptcy Discharge

Complex bankruptcy casesthose involving significant property sales or ongoing lawsuits called adversary proceedingsremain open for quite a while after the court grants your discharge. The court won’t close your case until the trustee administers all bankruptcy estate property and files a final accounting.

Here’s the kickeruntil the court closes your case, you must cooperate with the trustee. Some of the things you might have to do could include:

- turning over property you couldn’t protect with a bankruptcy exemption

- responding to discover or appearing at 2004 examination , or

- testifying in or defending yourself in a motion hearing or adversary proceeding.

What Is The Downside Of Filing For Bankruptcy In California

One of the immediate downsides to filing for bankruptcy is its impact on the subjects credit report. More often than not, filing for bankruptcy in California will result in a lower credit score*. Just how steep the drop is will depend on the individuals original credit score. A person with an average credit score of 680 could lose as much as 150 points, while people with an above-average score may lose almost 240 points. This effect can last for years. Depending on the type of claim, bankruptcy remains on a credit score for 7 to 10 years. Some of the other downsides to filing for bankruptcy include:

- Loss of real estate and personal property

- Difficulty getting new lines of credit or credit cards in California

- Difficulty securing mortgage

- May negatively affect the ability to secure new employment

- Possible denial of tax refunds for cases not covered by Californias Bankruptcy Exemptions Code

For people with low credit scores , filing for bankruptcy may result in a slight increase by boosting their debt-to-credit ratio.

You May Like: How Long Is Chapter 13 Bankruptcy

What Is The Npii

The National Personal Insolvency Index is a publicly available and permanent electronic record of most personal insolvency proceedings in Australia.

See National Personal Insolvency Index for more information.

Note: The NPII does not include records of company insolvencies. The NPII records are for individuals only.

Information about corporate insolvencies is available from the Australian Securities & Investments Commissions website. You can also search to see if a business name is registered and, if so, to whom.

Where an individual operated a sole trader business, there is no record of a business insolvency. Instead, you may wish to search the NPII for any records for the individual.

What Is Exempted Under California Code Section 703

Some of the items permitted under Californias 703 exemptions include:

- Homestead Exemption: Debtors may exempt up to $29,275 in interest for property used as a residence

- Tools of the trade: California allows for the exemption of professional books, implements, or other tools of the trade up to $8,725.

- Wild card exemption. Debtors may protect assets in any class up to a total of roughly $30,000 .

- Household and furnishing goods: Residents may protect goods, furnishing, appliances, or apparel up to $725 per item

- Retirement accounts

Also Check: How Soon After Bankruptcy Can You Buy A House

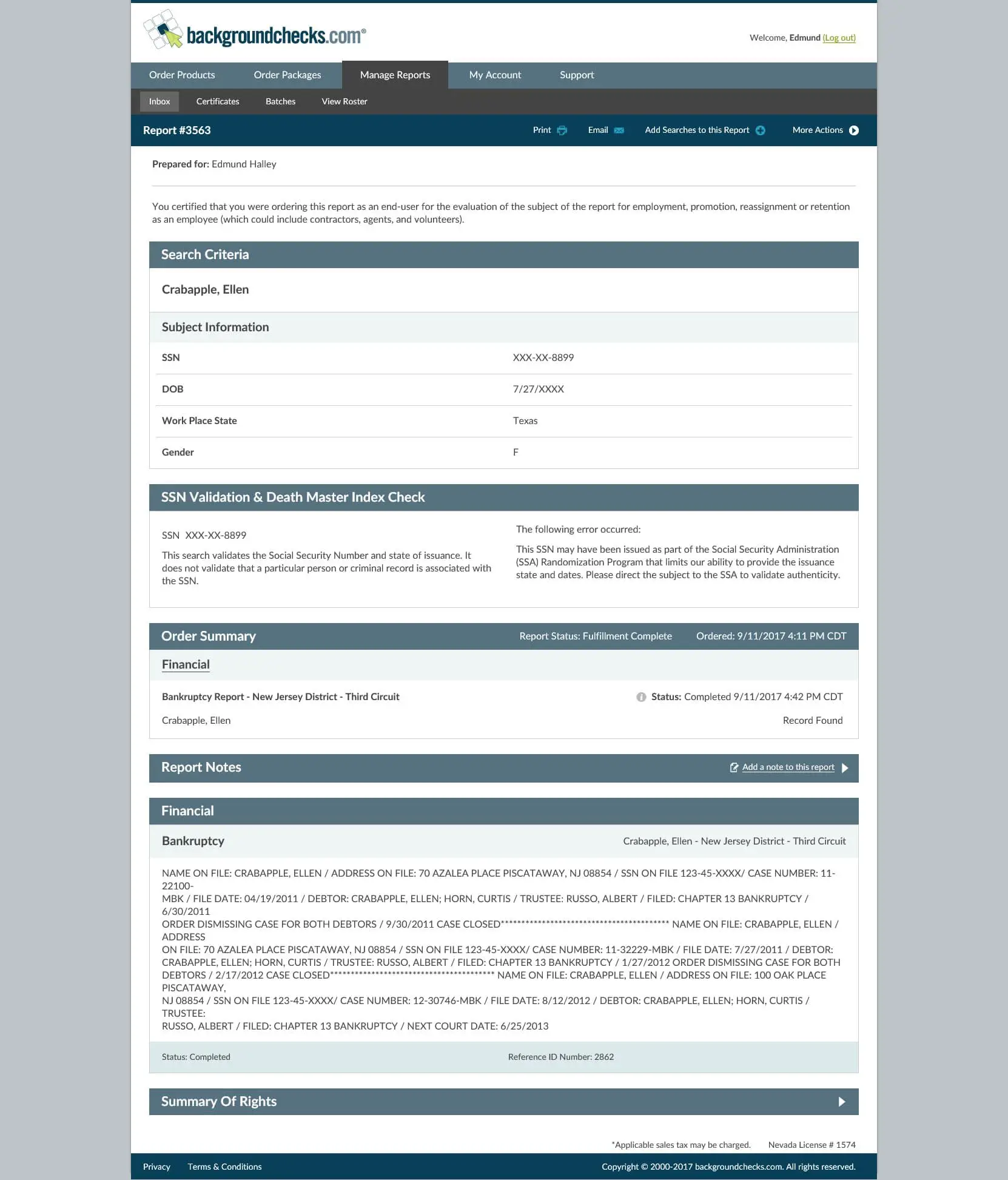

What Is A Bankruptcy Insolvency And Credit Check

A bankruptcy, insolvency and credit check is a broad search and check of the financial solvency and credit history of an individual or company. These checks provide information about the financial viability of the individual or company, including whether they have been declared bankrupt or insolvent in the past, or had any major credit issues. These checks can therefore provide insight into the way that this person or company manages their finances to inform your decision making process.

Bankruptcy is a situation where an individual or entity has been legally declared as unable to pay their debts to creditors. Insolvency refers to the state of an individual or entity being unable to pay their debts owed within the given timeframe.

In some circumstances, individuals who have been declared bankrupt may not be allowed to hold positions of responsibility. A person can also be disqualified from taking any direct or indirect roles in the management of a company due to bankruptcy. Our bankruptcy and insolvency search confirms whether a candidate is disqualified under these provisions.

Our credit check search reveals details of a candidates negative credit history that may provide insight into a candidates sense of financial integrity and financial responsibility, and reveal potential risks to your organisation.

Hireright Federal Bankruptcy Search Benefits

The HireRight Federal Bankruptcy Search can help provide peace-of-mind to organizations hiring high-profile positions, positions with access to funding and positions with access to sensitive-information. In addition, the search:

- Is a single, comprehensive search across all bankruptcy courts in the U.S.

- Helps protect against negligent hiring

- Helps identify candidates who may be risky hires due to the nature of the jobs they are applying for

Read Also: What Does Declaring Bankruptcy Do For You

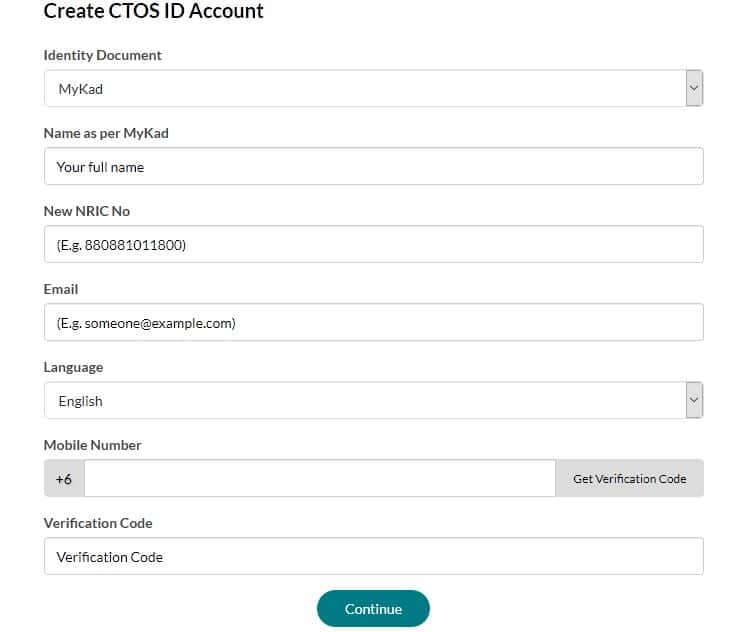

Bankruptcy Individual Voluntary Arrangement And Compulsory Winding

The online search service on bankruptcy, individual voluntary arrangement and compulsory winding-up records enables users to find out quickly whether –

- A person is bankrupt or is facing a bankruptcy petition.

- A person is or has been subject to an individual voluntary arrangement.

- A company is wound-up or is facing a compulsory winding-up petition.

Notes:

This service is for the use of the general public subject to fee payment. You can use the service at home, in the office, or any time, anywhere with a computer connected to the Internet. You can save valuable resources in conducting the searches and obtaining the search reports quickly via the Internet.

Jul Bankruptcy Basics: How Do I Check On The Status Of My Bankruptcy

The first way to check on your bankruptcy is to call your attorney!!!

Okay, so you dont have an attorney. There are a couple other ways to check on the status of your bankruptcy.

1. Open every single letter from the U.S. Bankruptcy Court or the Trustee for your case. Often, there are deadlines in the mail and not opening the letter is not a good excuse.

2. Call the Court and ask a Clerk. This is not recommended. The Clerks are very busy people and you may wait on hold for a long time and not get the information you want.

3. Call the Trustee assigned to your case and ask the Trustee. This is really not recommended. The Trustee is a very busy person and you may not get the information that you want.

Remember, .08 a page adds up quickly!!!

No Comments

Don’t Miss: What Are The Fees For Filing Bankruptcy

Reopening Your Bankruptcy Case After It’s Over

You, the trustee, or your creditors can ask the court to reopen your bankruptcy case. But why would someone want to reopen it?

You might want to reopen it if you accidentally forgot to list a debt or if a creditor is violating your discharge. You could ask the court to reopen your case and address these issues in these situations.

Or, suppose someone suspects that you provided false information on your bankruptcy papers or didn’t disclose all of your property. The court could reopen your case to evaluate the claim and, if necessary, instruct the trustee to administer those assets. The court could even revoke your discharge.

Can A Bankruptcy Discharge Be Revoked

Fraud or failure to comply with bankruptcy laws can result in your bankruptcy discharge being revoked by the court, and your debts will no longer be discharged. However, if you are not totally truthful in your bankruptcy filings or fail to follow all of the procedures, the court might revoke your discharge even after your case has been closed.

Read Also: How Do You File For Bankruptcy In Ohio

Bankruptcy Will Also Protect Some Assets

Earlier on, we stated that bankruptcy will result in having your assets seized and sold.

But there are some assets which are protected by law which you will be allowed to keep, such as:

- Property held by you as a trustee for someone else

- Money in your CPF account

- Life insurance policies held in express trust for your spouse or children

- Any items/equipment required for the personal use in your employment, business or vocation

- Equipment/furniture required for your familys needs

- The remainder of your monthly income after deduction of the monthly contribution

- Any annual bonus or annual wage supplement paid as part of your income

These items listed above will be excluded from the bankruptcy estate, and thus protected from distribution to your creditors.

Recommended Reading: Can You Be Fired For Filing Bankruptcy

Determining The Date A Bankruptcy Discharge Took Effect

In the world of bankruptcy, there are many different dates to keep track of. For many debtors, one of the most important is the date the bankruptcy was actually filed. Thefiling date creates a number of powerful protections, including the bankruptcy stay which prevents creditors from attempting to collect on a debt they are owed.

Other dates include the 341 creditor meeting date, the date by which motions must be filed, and of course the discharge date. The bankruptcy discharge date is the date on whichall of your qualifying debts are officially wiped away. After that, creditors cannot attempt to collect on those debts that were the subject of the bankruptcy discharge.

If you recently went through a bankruptcy, and you need to know the date of your bankruptcy discharge, there are a few different things you can do.

You May Like: How To Claim Bankruptcy In Massachusetts

Recommended Reading: How To File For Bankruptcy In California Without A Lawyer

Does The Debtor Have The Right To A Discharge Or Can Creditors Object To The Discharge

In chapter 7 cases, the debtor does not have an absolute right to a discharge. An objection to the debtorâs discharge may be filed by a creditor, by the trustee in the case, or by the U.S. trustee. Creditors receive a notice shortly after the case is filed that sets forth much important information, including the deadline for objecting to the discharge. To object to the debtorâs discharge, a creditor must file a complaint in the bankruptcy court before the deadline set out in the notice. Filing a complaint starts a lawsuit referred to in bankruptcy as an âadversary proceeding.â

The court may deny a chapter 7 discharge for any of the reasons described in section 727 of the Bankruptcy Code, including failure to provide requested tax documents failure to complete a course on personal financial management transfer or concealment of property with intent to hinder, delay, or defraud creditors destruction or concealment of books or records perjury and other fraudulent acts failure to account for the loss of assets violation of a court order or an earlier discharge in an earlier case commenced within certain time frames before the date the petition was filed. If the issue of the debtorâs right to a discharge goes to trial, the objecting party has the burden of proving all the facts essential to the objection.

You May Like: How To File For Bankruptcy In Wi

Request For Tax Transcript

Taxpayers can obtain a tax transcript from the Mississippi Department of Revenue which is a certification by the DOR of whether or not the taxpayer filed a tax return for each of the prior four years. The fee for this service is $10.00. To obtain a tax transcript, a “Request for Tax Transcript Form” should be downloaded from the DOR website, completed by the taxpayer, and then mailed to our office along with the required fee. Tax transcripts will be provided within approximately ten business days from the date the request is received by the DOR.

Also Check: When You File Bankruptcy Do You Lose Your Car

Bankruptcy Is Designed To Protect The Debtor

The popular image of a bankrupt is someone who has been stripped bare of every single possession but their clothes, doomed to slog away for the rest of their lives shackled to a never-ending mountain of debt.

But the truth is a lot less dramatic. And in bankruptcys case, sensible.

You see, the purpose of bankruptcy is to help settle debts. Since a candidate for bankruptcy is someone who is unable to pay back their debts under the original lending terms, the way out would be to alter the terms to make them more favourable.

Bankruptcy achieves this in three ways: