Who Can Claim Bankruptcy Exemptions

Exemption laws exist to protect people, so only individuals can claim bankruptcy exemptions. When a business files a Chapter 7 bankruptcy case, the business closes and its property is either returned to secured creditors or sold to pay unsecured creditors. Individuals and married couples don’t “go out of business” like that, so the exemption system allows them to protect certain property.

Dealing With Your Car

A lot of folks hold off on filing bankruptcy in New Hampshire because they are worried about how it will affect their car without realizing that a Chapter 7 bankruptcy actually gives them more options than they otherwise have. If your car is paid off, then as long as its current reasonable value is less than $4,000 you can keep it. If you are still paying on a car loan when your Chapter 7 bankruptcy in New Hampshire is filed, it is up to you how to deal with it. If the payment works for your budget and the loan balance does not exceed the value of the car by an unreasonable amount, you can keep everything the same by entering into a reaffirmation agreement. On the other hand, if you are struggling with the monthly payment or the car is in bad shape, filing bankruptcy in New Hampshire gives you the opportunity to surrender it and discharge the balance owing on the loan. If you like the car, but the loan balance includes negative equity from a prior trade-in, making it unreasonable to keep the loan, you can redeem the vehicle by paying the creditor the current value of your car in a lump sum after filing Chapter 7 in New Hampshire.

Louisiana Bankruptcy Lawyer Cost

Not all bankruptcies are created equal and if you feel that your case may be a little more complicated than most, hiring a lawyer can be a good investment. The average cost of a bankruptcy lawyer who helps people file a Chapter 7 bankruptcy in Louisiana ranges from about $1,450 to $1,800, though most lawyers offer a free initial consultation for potential Louisiana bankruptcy debtors.

-

Attorney cost estimate: $1,450 â $1,800

Read Also: How To File Bankruptcy In Texas Without An Attorney

Bankruptcy Exemptions For Consumers And Small

Chapter 7 is most commonly used by individuals and families. However, many businesses can make use of Chapter 7 as well. If the company is operated as a sole proprietorship, or if the owner otherwise has personal liability invested in the business, exemptions may be used to protect assets. While corporations or limited liability companies can also file for Chapter 7, none of their business assets will be exempt from seizure and liquidation.

Make Sure You Are Eligible

There are qualifying standards that must be met before you can file for either Chapter 7 or Chapter 13 bankruptcy and it makes sense to do research to see what form of bankruptcy you are eligible for.

To be eligible for Chapter 7 bankruptcy, an individual must pass a means test that determines if their income is at or below the median income for their state. If not, they may have to file additional paperwork or switch to Chapter 13 bankruptcy.

To be eligible for Chapter 13 bankruptcy, an individuals unsecured debt must be less than $419,275 and secured debts of less than $1,257,850.

Don’t Miss: How Many Trump Bankruptcies

How To Find Bankruptcy Attorney Costs In Your Area

The fees above are just averages, and fees have likely increased since the survey was conducted. In Chapter 13 cases, judges will review attorneys fees unless they fall below a so-called no-look amount, which is a baseline considered reasonable in the jurisdiction where the case is filed. But in general, its a good idea to call or meet with several attorneys before choosing one to represent you. Bankruptcy-attorney fees are public record and can be accessed through the searchable federal PACER website. Though PACER charges a small fee for downloaded information, it can be money well spent.

The cost of living where you file will also impact what you pay. Lawyers in large metropolitan areas, like everyone else, have bigger expenses than those in more rural settings. The higher cost tends to raise all professional costs, and bankruptcy representation is no exception. Also, not all lawyers were created equal. Those with many successful years in the bankruptcy field will almost certainly demand larger fees than those with little experience.

It is a good idea to consider the complexity of your case when picking a lawyer. If you have few assets and not many debts, your simple case might not demand the sort of representation that someone with a diverse source of income, a fat folder of creditors and perhaps a suspicion of fraud, might need. In other words, not all bankruptcies are the same. Remember that mulling the sort of lawyer you might need.

What Affect Will Bankruptcy Have On My Credit

Chapter 7 bankruptcy and Chapter 13 bankruptcy will stay on your credit report for seven years. Another misconception about bankruptcy is that this means you will not receive credit for ten years. If you are currently contemplating bankruptcy, it is likely that your current credit rating has already been affected. Being legally liable for debt which you cannot repay will lower your credit score progressively over time. Ironically, a bankruptcy may help restore your credit faster rather than letting chronic debt continue to go into default. The lower your credit score goes before you file a bankruptcy the longer it may take to restore it once a bankruptcy is completed. It is quite common for people to be offered credit cards shortly after completion of a bankruptcy and for people to purchase homes within several years of completing a bankruptcy. Lenders will tell you that it is easier to secure a major loan after a bankruptcy if your credit report reflects steady, regular payments on your accounts. If you want to obtain a mortgage within two years of discharge and have reestablished your credit, the size of your down payment and the stability of your income may be more important factors to your loan officer than the fact that you filed bankruptcy. Once your bankruptcy has been discharged, your creditors have to report to credit agencies that your accounts now need to read as zero balances.

Also Check: How Many Bankruptcies Has Donald Trump Filed

How Bankruptcy Works In New Hampshire

In most respects, filing for bankruptcy in New Hampshire isn’t any different than filing in another state. The bankruptcy process falls under federal law, not New Hampshire state law, and it works by unwinding the contracts between you and your creditorsthat’s what gives you a fresh start.

But New Hampshire’s laws come into play, too, in a significant way. They determine the property you can keep in your bankruptcy case. You’ll also need to know other filing information, which we explain after going over some basics.

What Happens To Non

The bankruptcy trustee liquidates – or sells – nonexempt property to the highest bidder. The sales proceeds are then used to pay unsecured creditors who claim an interest in your bankruptcy estate.

In some cases, a trustee may allow you to âpurchaseâ the non-exempt equity in the property. In that case, the dollar amount you have to pay to keep your property is based on the value of the asset minus the exemption amount.

So, if your property is worth $8,000 and the exemption is $6,000, you may buy back your non-exempt equity for $2,000. The trustee may allow you to do this to avoid the cost of conducting a sale of the property.

If the trustee sells the property, youâll receive $6,000. The remaining funds are used to pay a portion of your unsecured debts, like credit cards and medical bills.

Non-Exempt Assets and Chapter 13 Bankruptcy

As long as the unsecured creditors get the value of the nonexempt assets through the Chapter 13 repayment plan, the filer is able to keep all non-exempt property.

Recommended Reading: Can You Rent An Apartment After Filing For Bankruptcy

Do People Usually Lose Property In A Chapter 7 Bankruptcy Case

Not at all. Most Chapter 7 cases filed in the United States are no-asset cases and the filer is able to obtain debt relief without giving up any of their property. In some cases, a filer may choose to get the much-needed debt relief by filing Chapter 7 bankruptcy even though they may lose certain property. After all, filing bankruptcy and eliminating tens of thousands of debt provides a much greater benefit than keeping a $2,000 piece of real estate that hasn’t increased in value in a decade.

If youâre worried about your state’s exemptions or specific types of property and whether they’re protected, consider speaking to a bankruptcy attorney. Most law firms offer free consultations for Chapter 7 bankruptcy cases, so the most you have to lose is an hour of your time.

File on your own with Upsolve

If you donât have anything that isnât protected by an exemption and canât afford to hire a law firm to help you file Chapter 7 bankruptcy, know that you donât have to hire a bankruptcy attorney to file your case. If youâre eligible, you can use Upsolveâs free web app to prepare your bankruptcy forms. See how it works in our 10-step guide on how to file bankruptcy for free.

How Chapter 7 Works

A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal assets. In addition to the petition, the debtor must also file with the court: schedules of assets and liabilities a schedule of current income and expenditures a statement of financial affairs and a schedule of executory contracts and unexpired leases. Fed. R. Bankr. P. 1007. Debtors must also provide the assigned case trustee with a copy of the tax return or transcripts for the most recent tax year as well as tax returns filed during the case . 11 U.S.C. § 521. Individual debtors with primarily consumer debts have additional document filing requirements. They must file: a certificate of credit counseling and a copy of any debt repayment plan developed through credit counseling evidence of payment from employers, if any, received 60 days before filing a statement of monthly net income and any anticipated increase in income or expenses after filing and a record of any interest the debtor has in federal or state qualified education or tuition accounts. Id. A husband and wife may file a joint petition or individual petitions. 11 U.S.C. § 302. Even if filing jointly, a husband and wife are subject to all the document filing requirements of individual debtors.

Also Check: Can You Get A Personal Loan After Bankruptcy

Why Do Bankruptcy Exemptions Exist

Bankruptcy exemptions level the playing field. Every bankruptcy filer is able to protect certain exempt property so getting a fresh start doesnât require them to start from scratch. In the United States, more than 95% of all Chapter 7 bankruptcy filers are able to protect all of their property using bankruptcy exemptions.

Bankruptcy Laws In New Hampshire

Bankruptcy can affect any New Hampshire resident, regardless of income level or their profession. At the Law Offices of Christopher W. Kelley, we know bankruptcy often happens to hardworking people who have just fallen on hard times. Unemployment, divorce, and medical issues are some common reasons people file for bankruptcy, yet there is still a stigma attached. Despite the stigma, it is a resource many New Hampshire residents have had to utilize in recent years. There is no reason to let that stigma keep you from finding out the facts about bankruptcy and how bankruptcy may help you get a fresh start.

Also Check: Toygaroo Failure

What Assets Can I Keep If I File For Bankruptcy

Bankruptcy is a powerful tool designed to provide debt relief to individuals, families and businesses who otherwise do not have the means to meet their financial obligations. However, for individuals, bankruptcy also comes with stipulations. In some cases of bankruptcy, one of those terms is the seizure and liquidation of nonexempt assets.

Talk To Your Landlord

If you receive an eviction notice, you should first try talking to your landlord. You may be able to come to an agreement without going to court. An eviction will cost both of you money , and your landlord may be willing to stop the eviction if you agree to certain terms, such as paying rent you owe or stopping behavior that violates the lease. If you can’t come to an agreement that prevents you from moving out, perhaps you can agree on a certain date and time for when you will move out of the rental unit.

If you and the landlord are able to agree on anything, be sure to get the agreement in writing, signed and dated by both of you.

Read Also: How Many Times Did Donald Trump Filed For Bankruptcy

Mail Documents To Your Trustee

Once your Chapter 7 bankruptcy in New Hampshire has been filed with the court, a trustee will be assigned to administer the case. It is the trustee’s job to make sure that you are complying with all federal and New Hampshire bankruptcy laws and procedures. As part of doing their due diligence, the trustees are entitled to a copy of your most recent federal income tax return it’s your job to submit it to them no less than 7 days before your 341 meeting. The trustees all operate independently from one another, so each one of them has developed a different process for administering their cases. You will find out who the trustee handling your case is when you receive an official notice like this one from the court shortly after filing Chapter 7 in New Hampshire. The trustee that is assigned to your case may send you a letter asking you to submit certain other information or documentation to their office before your 341 meeting. Since one of the duties you have as a debtor in bankruptcy is to cooperate with your trustee, make sure to keep an eye out for any such requests, so you can make sure to submit everything timely.

Print Your Bankruptcy Forms

At this time, only people filing bankruptcy in New Hampshire with the help of a lawyer are able to have their bankruptcy forms filed electronically. If a lawyer does not represent you, you will have to submit the original signed hardcopy of your bankruptcy forms to the court. If you are working with Upsolve, you will receive a single PDF file to print, making this part of the process as easy as finding a printer. Even though filing bankruptcy in New Hampshire is a legal proceeding, all documents are printed on regular size, 8.5″ x 11″ white paper, so any home or office printer can handle it without issue. If you have completed all the forms on your own and you have them saved on your computer as a number of different files, make sure to give yourself enough time for this step. All the forms needed for a Chapter 7 bankruptcy in New Hampshire look very similar, making it very easy to get confused about what has been printed already versus what you still have to print. Finally, although the court only needs a single copy of your signed forms for the purpose of filing Chapter 7 in New Hampshire, you have to bring a full set of signed forms to your 341 meeting after the case is filed. Rather than having to stress about getting everything printed and signed again when it’s time for your 341 meeting, it is best to print a second set now. Alternatively, if you have access to a copy machine, you can sign everything on one set, then simply make a photocopy.

Recommended Reading: Has Mark Cuban Ever Filed For Bankruptcy

How Much Does Bankruptcy Cost In New Hampshire

It will cost you $338 to file for Chapter 7 bankruptcy in New Hampshire and $313 to file under Chapter 13. The fees are the same whether you represent yourself or hire an attorney. If you can’t afford the filing fee, you can ask to pay in installments over 120 days. If you earn less than 150% of the poverty line you can request that the fee be waived.

Most people who file for bankruptcy choose to be represented by a lawyer. While each bankruptcy case is unique and fees can vary depending on where you live in the state, most New Hampshire bankruptcy lawyers will charge between $1,200 to $1,500 for a fairly straightforward Chapter 7 case. Since Chapter 13 cases are usually more complex, most attorneys will charge more to represent you in those cases.

Will I Lose Everything I Own If I File Bankruptcy

It is a popular misconception that bankruptcy necessarily leads to the loss of all property, no doubt propagated by the lending industry. People frequently keep their homes, cars and other assets in bankruptcy cases as long as they continue to repay their loans. Each state has a limit on allowable property values and you want to make sure your property is within these guidelines. You will be best served by a qualified and certified bankruptcy lawyer who understands what those limits are and who can advise you accordingly.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

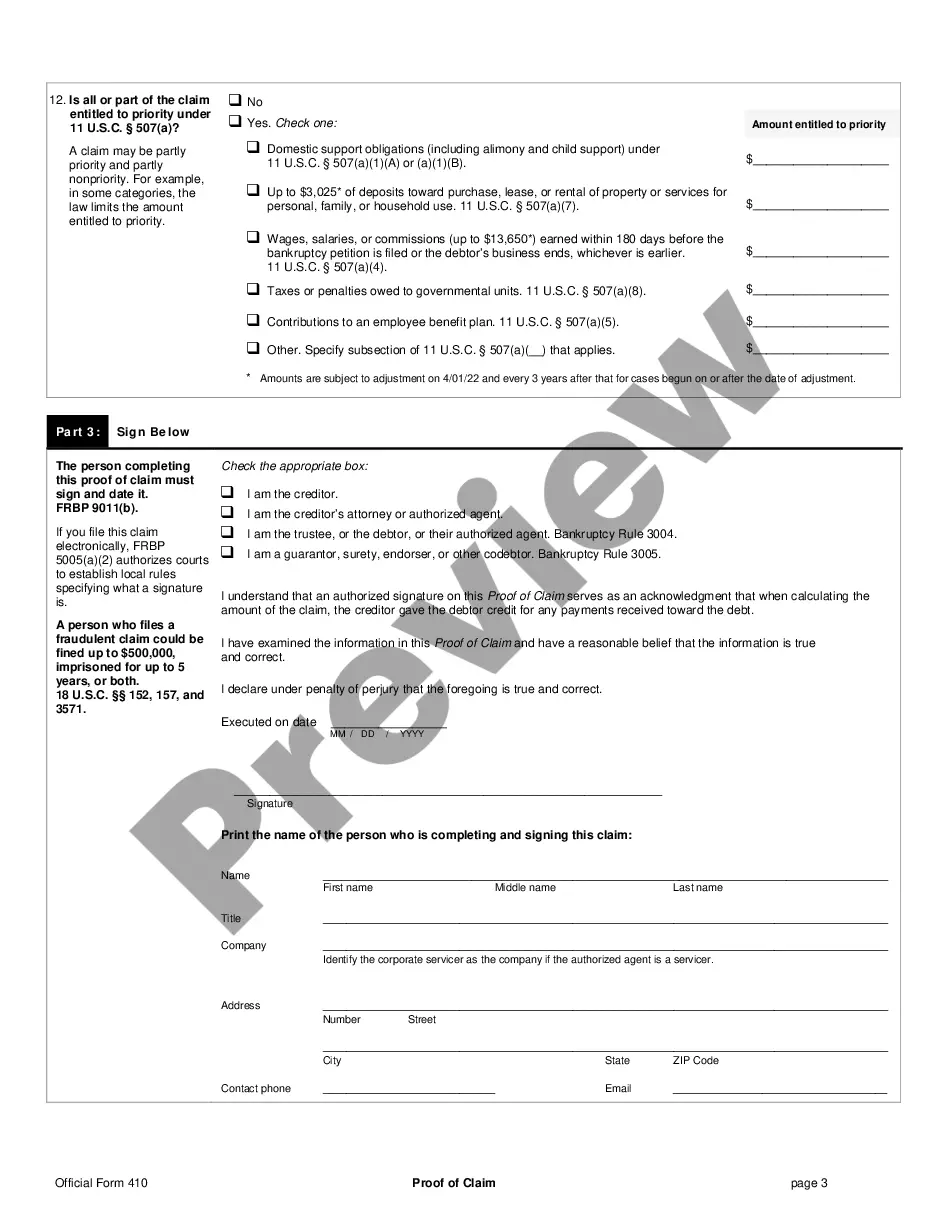

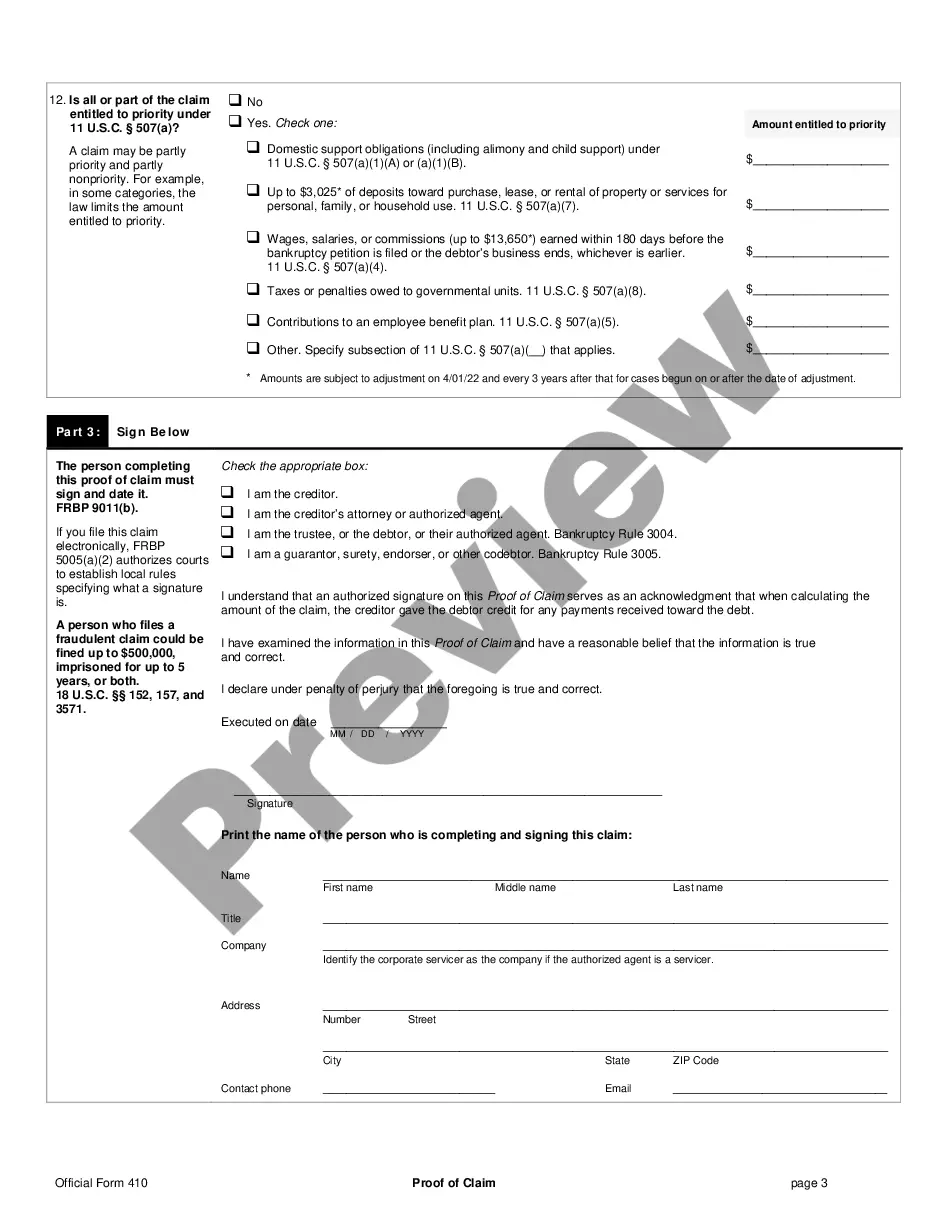

Who Can Object To A Chapter 7 Bankruptcy Claim

Only a “party in interest” can object to a claim in a Chapter 7 bankruptcy case. A “party in interest” is a person or entity that has a financial stake in the outcome of the claim at issue.

Generally, in a Chapter 7 bankruptcy case, the Chapter 7 trustee will object to proofs of claim. But a Chapter 7 debtor might need to object to a claim, too. A Chapter 7 debtor will do so if the existing claims, as they stand, will cause the debtor to lose more property than necessary or cause the debtor to owe more than the debtor should after the closure of the bankruptcy case. This will usually happen only if an issue exists with a nondischargeable priority claim, such as taxes or a domestic support obligation.

Additionally, the majority of bankruptcy courts have held that a Chapter 7 debtor can object to claims if he or she shows:

- the debtor had a financial interest in the result because there is likely to be money left over once all claims are paid

- the trustee unjustifiably failed or refused to object to the claim or claims in question, or

- the debt owed by the debtor is not dischargeable.

The objecting party has the burden of presenting sufficient evidence that demonstrates the creditor’s claim should not be allowed. If the objecting party produces such evidence, the burden of proof shifts back to the creditor to prove their claim.