Why The 28/36 Rule Of Thumb Generally Works

The 28/36 rule of thumb provides a pretty good guide for lenders to determine how much home you can afford.

As a mortgage lender, one of our jobs is to assess risk and the 28/36 rule is a big part of that, Edelstein said. You can be approved for a mortgage with ratios higher than 28/36, as high as 50% on the back-end. However, risk goes up and in order to be approved with higher ratios, you will have to have a strong credit score and possibly a larger down payment.

So, what is included in the DTI ratios calculation of your monthly debt obligations? Any of the following payments could be factored into your DTI:

- Future mortgage payment

- Alimony and child support payments

- Loans you co-signed for

Your DTI doesnt include utilities, cable, cellphone, and insurance bills.

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

How To Improve Your Dti

The key to determining how much mortgage you can afford is knowing your debt to income ratio. This is a vital aspect which underwriters take into consideration to see how well you can handle a loan. Bearing in mind its significance in the lending industry, it is imperative to understand how you can improve it.

The good news is that DTI can be improved, unlike other areas of financial life. If you pay off some of your excess debt like students loan, you can lower it to a healthier level. Before you start making mortgage payments, check with your lenders as requirements can differ significantly.

Also Check: Can You Declare Bankruptcy And Keep Your House

Should You Worry About Your Dti

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means youre treading on the slippery slope to fiscal collapse. It says youre making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, its easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but thats still a goal worth setting. Use the following tips to put your best foot forward for lenders.

How Much House Can I Afford With An Fha Loan

To calculate how much house you can afford, weve made the assumption that with at least a 20% down payment, you might be best served with a conventional loan. However, if you are considering a smaller down payment, down to a minimum of 3.5%, you might apply for an FHA loan.

Loans backed by the FHA also have more relaxed qualifying standards something to consider if you have a lower credit score. If you want to explore an FHA loan further, use our FHA mortgage calculator for more details.

Conventional loans can come with down payments as low as 3%, although qualifying is a bit tougher than with FHA loans.

Recommended Reading: How To Claim Bankruptcy In Illinois

How Much Does Your Debt

Your DTI never directly affects your or . may know your income but they dont include it in their calculations. Your is still factored into your home loan application. However, borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score. Lowering your credit utilization ratio will help boost your credit score and lower your DTI ratio because you are paying down more debt.

How Is A Debt To Income Ratio Determined

Are you worried that your financial position cannot allow you to purchase a house? Take a close look at what mortgage lenders think is the ideal the ideal income to debt ratio.

To calculate the DTI ratio, divide your recurring monthly debt payments by your gross monthly income. The resulting quotient is your potential mortgage burden. It gives a clear picture of how you will manage the loan and allows the lender to predict if you can complete the mortgage bill payments. Note that the gross income means the amount of money earned before taxation or other deductions. The DTI ratio doesnt put into account the money you pay for daily expenses e.g. car insurance premiums or grocery expenses. Other monthly bills that count include , child support, rent, and student loan. If you think you are ready for a mortgage, you must figure out how it is going to affect your budget.

Suppose you have an auto loan that requires $900 per month, a $500 per month for a personal loan, and $1,100 for a mortgage. Your overall monthly debt burden is $2,500. If your monthly gross income is $5,000, your DTI ratio is *100 = 50%.

Also Check: Is A Judgment Dischargeable In Bankruptcy

Are You In Good Shape To Secure A Mortgage

Your debt-to-income ratio is one of the factors that mortgage lenders will use to assess your creditworthiness. This ratio measures the size of your monthly debt against your monthly income. Lenders look at this ratio to determine whether you are capable of taking on another loan. But what exactly do lenders consider the ideal debt-to-income ratio? Read on to find out.

Calculating Your Debt-to-Income Ratio

You can calculate your debt-to-income ratio by dividing your recurring monthly debt obligations by your gross monthly income. The corresponding percentage is your debt-to-income ratio.

The Ideal Ratio

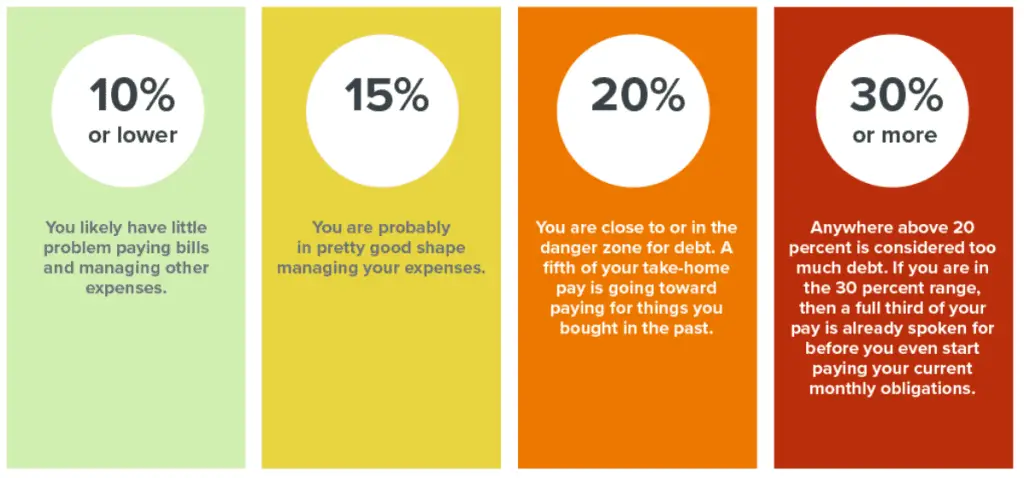

The ideal debt-to-income ratio is 36% or lower. Banks want to lend to homebuyers with lower ratios in general, as those with higher ratios are considered riskier borrowers. Those with low ratios have a better chance of qualifying for low mortgage rates.

Currently, the maximum debt-to-income ratio that a homebuyer can have to take out a qualified mortgage is 43%. Qualified mortgages are home loans with certain features that ensure buyers can pay back their loans. For instance, qualified mortgages dont have excessive fees and they help homebuyers avoid loan products that can negatively affect their finances. If your ratio exceeds 43%, mortgage lenders will refuse to lend to you due to the high chance that you will default on your payments.

Your Credit Is Key When Buying A House

There are a lot of moving parts in the mortgage process, and lenders will review a lot of variables to determine whether you qualify for a mortgage and how much you can afford. Your credit score is one of the most important of these variables, so it’s crucial that you take time to improve it before you apply for a mortgage loan.

Start by checking your and to see where you stand and which areas you need to address. Then start taking the necessary steps to do so.

This may include getting caught up on past-due payments, paying down credit card debt, disputing inaccurate credit report information and more. Use your credit report as a guide to decide how to build your credit score.

Also Check: Can You Keep Your Car If You File Bankruptcy

How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

How To Lower Your Monthly Mortgage Payment

Your monthly mortgage payment is going to take up a good chunk of your overall debt, so anything you can do to lower that payment can help. Consider some options, like:

- Find a less expensive house. While your lender might approve you for a loan up to a certain amount, you donât necessarily have to buy a home for the full amount. The lower the home price, the lower your monthly payments will be.

- Boost your down payment. The higher your down payment, the lower your monthly payment will be. So, if you can, save up so you can secure that lower payment.

- Get a lower interest rate. Most of the time, your interest rate is based on your credit score and DTI. Try to pay down outstanding debt, like credit cards, car loans or student loans. This not only lowers your DTI, but could also improve your credit score. A higher credit score means you could get a lower interest rate offered by your lender.

You May Like: What’s The Difference Between Chapter 7 And Chapter 13 Bankruptcy

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

How Much Of Your Income Should You Spend On A Mortgage

The amount can spell the difference between living comfortably and struggling financially

One of the most important things to consider when buying a house is how much mortgage you can reasonably afford to pay off. This is because knowing how much you can allocate to your monthly repayments very often spells the difference between living comfortably and struggling to make ends meet.

Expert opinion varies on the exact amount, but the consensus is you should have enough left over to meet other financial obligations after making a home loan payment. So, what percentage of your monthly income should you dedicate to your mortgage? Lets take a closer look.

Read Also: Do You Lose Everything When You File For Bankruptcy

Are There Any Other Factors Outside Of The Dti Ratio That Can Influence Your Mortgage Approval

Though DTI plays a big role in the mortgage approval process, its not the only factor. As mentioned, your credit score is one of the biggest influences on whether youre approved.

Your down payment also plays a significant role. Putting down a larger down payment can lower your DTI. But, at a minimum, you should aim to put down 20% of your homes purchase price. This means that your mortgage represents 80% of your homes equity. If you put down less than 20%, you will typically have to carry PMI insurance until the principal balance of your mortgage is below 80% of the homes original value. Most lenders require at least 5% down, though some will go as low as 3% if youre a qualified borrower.

How Does Your Debt

An important metric that your bank uses to calculate the amount of money you can borrow is the DTI ratio comparing your total monthly debts to your monthly pre-tax income.

Depending on your , you may be qualified at a higher ratio, but generally, housing expenses shouldnt exceed 28% of your monthly income.

For example, if your monthly mortgage payment, with taxes and insurance, is $1,260 a month and you have a monthly income of $4,500 before taxes, your DTI is 28%.

You can also reverse the process to find what your housing budget should be by multiplying your income by 0.28. In the above example, that would allow a mortgage payment of $1,260 to achieve a 28% DTI.

Also Check: How To Apply For Bankruptcy In Michigan

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

What Is An Ideal Debt

Quick Answer

In this article:

Lenders have different definitions of the ideal debt-to-income ratio the portion of your gross monthly income used to pay debtsbut all agree that a lower DTI is better, and a DTI that’s too high can tank a loan application.

Lenders use DTI to measure your ability to take on additional debt and still keep up with all your paymentsespecially those on the loan they’re considering offering you. Knowing your DTI ratio and what it means to lenders can help you understand what types of loans you are most likely to qualify for.

Recommended Reading: How To File Bankruptcy Without A Lawyer In Mississippi

What Happens When Things Go Wrong

Professor Ong ViforJ’s research found that older Australians who struggled to meet their mortgage repayments reported lower scores of mental health and higher levels of psychological distress.

So what can you do? If you have a good income, a stable job and decent savings, you might be able to keep saving or shop around to find something you can afford.

What If You Just Dont Have Enough For A Down Payment

If you dont have enough savings for a 20 percent down payment, then you need to keep saving, Sethi says. If you are struggling to save, he advises creating a sub-savings account.

A sub-savings account is an automated account that directly deposits small amounts from your paycheck into a savings account, so you dont even have to think about it, he says.

A lot of people say Hey, Im cut to the bone, I cant really save, he says. Well, it turns out when you automate this money you never even see it. It actually adds up pretty quick.

And dont underestimate the power of the side hustle, he says.

You May Like: What’s The Difference Between Chapter 7 And Chapter 11 Bankruptcy

How Does Your Down Payment Affect Mortgage Affordability

Your down payment plays a big role in your mortgage’s affordability. The size of your down payment affects the amount of the monthly payment you’ll be making to cover the rest of the mortgage amount a bigger down payment decreases your monthly payment and vice versa. So, if you’re worried about your DTI affecting your mortgage eligibility, coming up with a larger down payment can help you qualify.

For example, if you’re buying a $250,000 home with a 4% interest rate over 30 years, a $20,000 down payment would give you a monthly principal-and-interest payment of $1,098. But if you put down $40,000, your monthly payment would drop to $1,003and you’d also save nearly $35,000 in interest over the life of your loan.

While a 20% down payment is a standard recommendation from mortgage experts, it’s not a requirement. In fact, many lenders allow down payments as low as 3% or 5% of the loan amount.

If you don’t have a lot of cash for a down payment and you’re a first-time homebuyer, there are several programs and grants that can provide you with down payment assistance or even loans with no down payment requirement.

Consider more than just your monthly payment as you decide how much money to put down. For example, if you drain your savings for a down payment, you could experience some difficulties if you have a financial emergency in the near future.

Increase Your Credit Score

The higher your credit score, the greater your chances are of getting a lower interest rate. To increase your credit score, pay your bills on time, pay off your debt and keep your overall balance low on each of your credit accounts. Don’t close unused accounts as this can negatively impact your credit score.

Also Check: How Will Bankruptcy Affect My Job