What Is The Debt

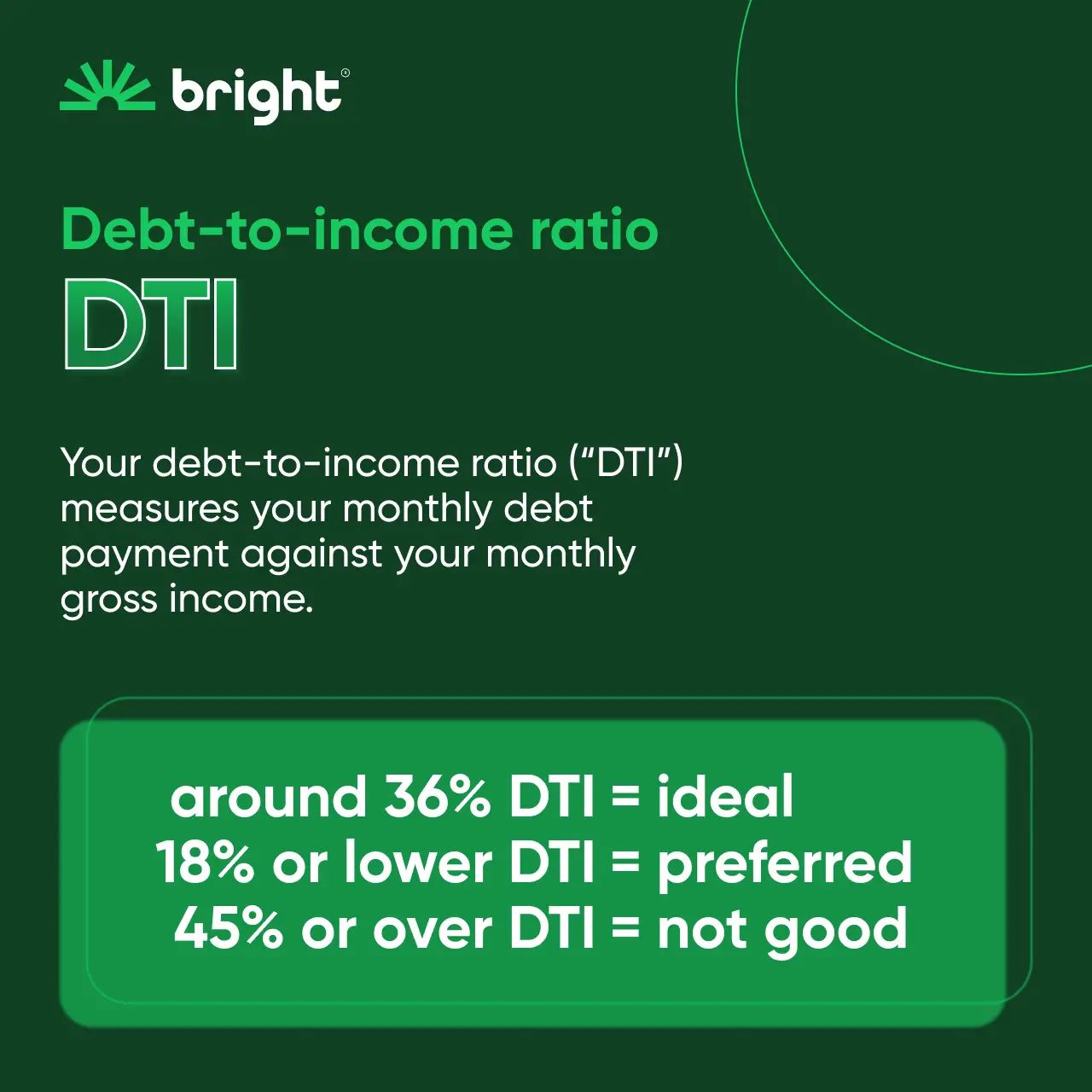

The debt-to-income ratio is a metric used by creditors to determine the ability of a borrower to pay their debts and make interest payments. The DTI ratio compares an individuals monthly debt payments to his or her monthly gross income. It is a key indicator that lenders use to measure an individuals ability to repay monthly payments and accumulate additional debt.

Learn More About Saving And Buying A Home

After getting your finances in order, you may be in a strong position to start shopping for a home. Congrats on all that hard work! Theres a lot to learn about each phase of the home-purchasing process, so take the time to educate yourself. Our first-time home-buyers guide can help educate you on what youll need to know.

While youre making strides towards that big purchase, remember to get in touch with your American Family Insurance agent. Theyre your trusted resource that can help you get the coverage your new home needs. And with an easy-to-understand plan in place, youll know youve got the coverage you need to protect everything that matters most.

How To Calculate Debt

You can calculate your DTI ratio before you apply for a mortgage, regardless of which kind of loan youre looking to get.

There are two types of ratios that lenders evaluate:

- Front-end ratio: Also called the housing ratio, this shows what percentage of your income would go toward housing expenses. This includes your monthly mortgage payment, property taxes, homeowners insurance and homeowners association fees, if applicable.

- Back-end ratio: This shows how much of your income would be needed to cover all monthly debt obligations. This includes the mortgage and other housing expenses, plus credit cards, auto loan, child support, student loans and other debts. Living expenses, such as utilities and groceries, are not included in this ratio.

The back-end ratio may be referred to as the debt-to-income ratio, but both ratios are usually factored in when a lender says theyre considering a borrowers debt-to-income ratio for a mortgage.

Follow these steps to calculate your DTI:

Read Also: How To Declare Bankruptcy In Pa

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

Why Does Your Debt

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

Don’t Miss: Liquidation Pallets Fort Worth

Focus On Increasing Your Income

Boosting your income can also help you work toward an ideal debt-to-income ratio. If youre overdue for a raise, it might be time to ask your boss for a salary increase. You could also pick up a side job, such as tutoring, freelancing in a creative field or working as a virtual admin, to increase your earnings. Those looking to make a more extreme change might seek out a new company or career path.

Finding ways to make more money will not only help you get the right debt-to-income ratio for a personal loan, mortgage or another type of financing, it can also give you more financial stability. You may have more wiggle room in your budget to build an emergency fund and avoid taking on new debts.

What Is Considered A Good Dti Ratio

What counts as a good DTI will depend on what type of loan you want. Some lenders allow a higher DTI, while others require a lower cut-off.

In general, lenders prefer that your back-end ratio not exceed 36%. That means if you earn $5,000 in monthly gross income, your total debt obligations should be $1,800 or less. However, some lenders might make an exception if you have excellent credit. In fact, its possible to qualify for a loan with up to a 50% DTI as long as youre an otherwise highly qualified borrower.

Mortgage lenders, in particular, tend to have more hard-and-fast rules. They typically prefer a front-end DTI of 28% or less. That means your mortgage payments cant be any higher than 28% of your gross monthly income. So if you take home $5,000 per month, your mortgage payments shouldnt be any higher than $1,400.

On the other hand, conventional mortgage lenders, as well as FHA and USDA lenders, will typically allow a back-end DTI of up to 43%, giving your budget a little more wiggle room. VA loans usually require a back-end DTI of 41% or less.

Knowing your front-end and back-end DTI can help you figure out how much house you can afford. If you apply for a mortgage and the payments would cause you to exceed either of these DTI requirements, you may have to go with a smaller loan or could be denied a loan altogether.

You May Like: Us Debt To Gdp Chart

What Is A Debt

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

Different loan products and lenders will have different DTI limits. To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000. If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

Open A Debt Consolidation Loan Or Balance Transfer Credit Card

Debt consolidation may help you get a better interest rate and pay down your balances sooner, ultimately helping you bring down your debt-to-income ratio.

Two common strategies of consolidating debt is with a personal loan or a balance transfer credit card:

| Debt consolidation vs. balance transfer |

| Debt consolidation loan |

Also Check: How Long Does Personal Bankruptcy Last

Why Is Knowing Your Dti Ratio Important

Your DTI ratio is utilized by lenders as a measuring tool. Your DTI ratio helps lenders determine your ability to manage your finances, specifically, your monthly payments to repay the money you borrowed. Keep in mind that lenders do not know what you will do with your money in the future, so they refer to historical data to verify your income and debt totals. Moreover, your DTI ratio illustrates that you have a sufficient balance between your income and debt, thus, are more likely to be able to manage your mortgage payments.

How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

Read Also: How To Get A Car Loan After Bankruptcy Discharge

What’s The Difference Between Your Debt

Debt-to-credit and DTI ratios are similar concepts however, it’s important not to confuse the two.

Your debt-to-credit ratio refers to the amount you owe across all revolving credit accounts compared to the amount of revolving credit available to you. Your debt-to-credit ratio may be one factor in calculating your credit scores, depending on the scoring model used. Other factors may include your payment history, the length of your credit history, how many credit accounts you’ve opened recently and the types of credit accounts you have.

Your DTI ratio refers to the total amount of debt you carry each month compared to your total monthly income. Your DTI ratio doesn’t directly impact your credit score, but it’s one factor lenders may consider when deciding whether to approve you for an additional credit account.

Familiarizing yourself with both ratios may give you a better understanding of your credit situation and help you anticipate how lenders may view you as you apply for credit.

Maximum Dti By Type Of Loan

Your lenders maximum DTI limit will depend, partly, on the type of loan you choose:

- Conventional loan: Up to 43% typically allowed

- FHA loan: 43% typically allowed

- USDA loan: 41% is typical for most lenders

- VA loan: 41% is typical for most lenders

These rules dont always apply to all borrowers in the same way.

For example, even if your DTI meets your loans requirements, you wont be guaranteed approval. Your credit score, down payment amount, or income could still undermine your eligibility.

And it works the other way around, too: Some borrowers whose DTI ratios come in a little too high may still qualify if they have excellent credit or can make a larger-than-required down payment.

Recommended Reading: What’s The Difference Between Chapter 7 And Chapter 13 Bankruptcy

Work On Paying Down Debt

Paying off loans and bringing down debt balances can improve your debt-to-income ratio. To free up cash flow you can use to pay down your debt faster, give your budget a second look.

You may find ways to cut down on monthly expenses such as by:

- Shopping for a lower-cost cell phone plan

- Reducing how often you get food delivery or takeout

- Canceling streaming services you no longer use

When deciding which debt to pay down first, borrowers often use one of two strategies. The debt avalanche method involves targeting your highest-interest debt first, while continuing to make minimum payments on all other debts. This strategy helps you save money on interest over time. The other method, debt snowball, has borrowers focus on the debt with the lowest balance first, while keeping up with the minimum payments on other debts. It helps borrowers stay motivated by giving them small wins on their path to getting out of debt.

If youre unsure how to approach your debt, you could sign up for free or low-cost debt counseling with a certified credit counselor. These professionals can provide personalized financial advice, help you create a budget and provide useful tools that can teach you about money management. You can search for a certified credit counselor through the Financial Counseling Association of America or the National Foundation for Credit Counseling .

How To Get Around A High Dti

The easiest way to lower your debt-to-income ratio is to pay off as much debt as you can but many borrowers dont have the money to do that when theyre in the process of getting a mortgage, because much of their savings are tied up in a down payment and closing costs.

If you think you can afford the mortgage you want but your DTI is above the limit, a co-signer might help solve your problem. Unlike with conventional loans, borrowers can have a relative co-sign an FHA loan and the co-signer wont be required to live in the house with the borrower. The co-signer does need to show sufficient income and good credit, as with any other type of loan.

Sometimes, though, a co-signer isnt the answer. If your DTI is too high, for example, you should consider focusing on improving your financial situation before committing to a mortgage.

Also Check: Liquidation Pallets Orange County

How To Lower Your Dti Ratio

Generally, if youre trying to lower your DTI, there are two things you can do: Increase your monthly income or decrease your outstanding debt. Heres a closer look at how to accomplish each of those goals:

- Increase your monthly income. Increasing your income is easier said than done. Still, if lowering your DTI is a goal, finding ways to increase your pay is one way to do it. It might be time to negotiate a raise at work or take on a few extra hours of overtime. You also can turn a hobby or skill into a lucrative side hustle and bring in extra income on the side when your schedule allows it.

- Your other option is to get rid of some debt so that your monthly payments are lower . Bonus at work? Tax refund? Use these windfalls to make extra lump-sum payments on your debt. By lowering the amount you owe on a monthly basis, your DTI will drop, too.

How To Improve Your Debt

If youre thinking about purchasing a home, its a good idea to calculate your debt-to-income ratio as part of the planning process. This will help you determine if you have the 43% or less debt-to-income ratio that a majority of lenders require. If you find that your debt is too high, it might be a good idea to start tackling some of those balances or finding additional income sources in order to have the best chance of qualifying for a mortgage.Here are a few ways to get started:

-

Use credit cards sparingly. The only way to lower your monthly debts is to pay down your debt, so if you continue to use your credit cards and carry a balance, you wont be able to decrease your monthly expenditures.

-

Keep accurate records of your self-employment income. While you may have at least two years of self-employment under your belt, if you dont have the necessary tax records to back up your income earned, it can be hard to obtain a mortgage.

-

Avoid taking out other loans. If you know purchasing a home is on the horizon, carefully consider how you spend your money. It may not be the best time to purchase a new car or take out a loan for a new diamond ring, as these will be factored into your debt-to-income ratio.

-

Open a savings account. Start saving now, and those dollars will begin adding up! Putting a sizable down payment on a home will reduce the amount you need to borrow, which means a smaller mortgage payment and a lower debt-to-income ratio.

Also Check: Government Debt Consolidation Programs

Dti Formula And Calculation

The debt-to-income ratio is a personal finance measure that compares an individualâs monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individualâs ability to manage monthly payments and repay debts.

How To Lower Your Debt

Also Check: Total Credit Card Phone Number