How Does The Dti Ratio Work

When you apply for a mortgage loan, lenders need to assess your ability to repay the hundreds of thousands of dollars theyre loaning you. Calculating your DTI ratio is one aspect of this assessment.

First, lenders add up your monthly debt payments like credit card payments, car payments and student loans and your new monthly mortgage payment.

The sum is then divided by your monthly gross income to get your DTI ratio as a percentage.

Note that expenses such as groceries, utilities and gas generally dont factor into your DTI ratio, so youll want to leave those out when making your calculations.

Lets crunch some hypothetical numbers to see how Fannie Maes higher DTI ratio limit may affect you. In the example below, we assume your monthly gross income is $5,000 and your total monthly debt is $2,250:

Monthly gross income: $5,000

Can I Use My Credit Card Before Closing On A House

And make sure you are not late on car, credit card or other outstanding debt payments from the time you begin house-hunting until you have closed. Paying your bills late will drop your FICO score, so it’s a good idea to avoid that scenario at any time, but especially when you are seeking to close on a mortgage loan.

Conventional Loans Vs Other Types Of Mortgages

Conventional loans are similar to other types of home loansespecially those that are government-backed, such as FHA and USDA loans. However, because conventional mortgages are issued by private lenders and may not be insured by the government, they typically require higher minimum credit scores in order to qualify.

The biggest difference between conventional mortgages and other government-backed home loans is that government-backed loans are typically designed to help low-to-moderate-income borrowers or those with lower credit scores. Conventional loans, on the other hand, are ideal for those with good credit, steady jobs and low debt-to-income ratios.

Also Check: Can You File Bankruptcy Twice In Ohio

Can I Refinance A Mortgage With A Bad Debt

Yes, you may be able to. The same rules generally apply if youre taking out a new mortgage or refinancing an existing one.

If your debt-to-income ratio has risen significantly since you took out your mortgage, refinancing with the same provider might be difficult, though it all depends on how flexible theyre willing to be.

It is, however, possible to remortgage with a new lender, as you may be a better fit for their affordability and eligibility criteria.

If you have previously remortgaged to consolidate debts then youll be subject to extra scrutiny from underwriters and they may apply a lower debt-to-income threshold.

Make an enquiry and the advisors we work with can talk you through your options and search the whole market to find the best deals.

Current Minimum Mortgage Requirements For Conventional Loans

Down payment. Youll need at least a 3% down payment for a conventional loan. The funds can come from a gift or your own money.

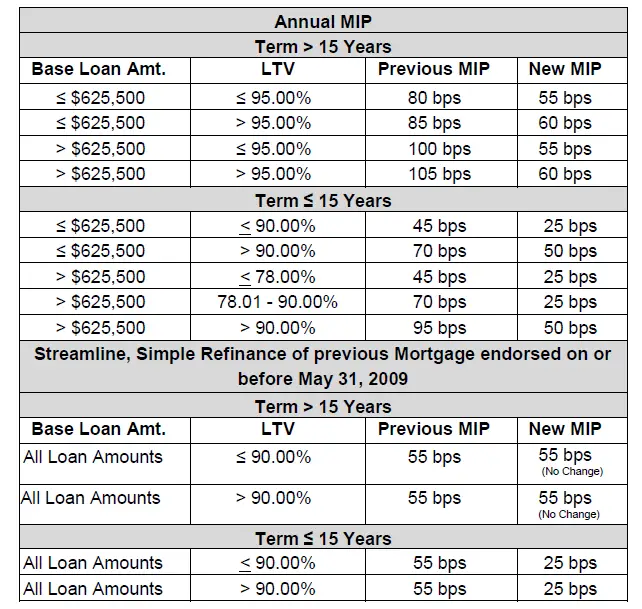

Mortgage insurance. Conventional loans with less than 20% down require private mortgage insurance to protect lenders if you default. The higher your down payment and credit score, the lower your PMI will be. You may pay between 0.14% and 2.33% of your loan amount in annual PMI premiums. PMI premiums are normally paid as part of your monthly payment however, PMI can be paid up front in a lump sum at closing.

. Conventional mortgage guidelines require a minimum credit score of 620. Youll snag the best mortgage rates and lower PMI premiums with credit scores of 740 or higher.

Guideline update: Average median credit scoring

Lenders are now allowed to take an average median score to meet the minimum credit score, which is great news for borrowers that need two incomes to qualify but one applicant has a score below the 620 minimum. In the past, that meant a loan denial for a conventional loan. Now, a high credit score borrower can potentially lift a low credit score borrower over the 620 threshold, which could lead to a loan approval thumbs up instead of a hard no.

Employment. Lenders require proof of steady income and need to verify the income is likely to be predictable in the future. Youll typically need to document two or more years of variable income earned from commissions, bonuses or overtime.

Recommended Reading: New Jersey Chapter 7 Bankruptcy

So What Is A Good Debt To Income Ratio

Again, tough to answer, but a good goal for borrowers would be a maximum 29% housing ratio and 41% total DTI. Thus, a borrower should qualify for most programs available. Borrowers with compensating factors like higher credit scores, assets, or down payment could very possibly qualify with 55% or more debt ratio.

It is always a good idea to budget yourself. Just because a lender says your debt to income ratio works, doesnt mean you can make it happen. There are other areas in a familys budget. These include medicine, doctor bills, utilities, daycare, and car maintenance that do not affect loan approval. Yet, they certainly affect a familys bottom line. So, even if approved, ensure that the mortgage payment works for you and not just the loan program.

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johnâs income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

Also Check: What Does Foreclose Mean

How Do Mortgage Lenders Calculate Dti

How to calculate your debt-to-income ratio

Conventional Loan Guidelines Faq

What is a conforming loan?

A conforming loan has a dollar amount at or below the limits set by the Federal Housing Finance Agency . Additionally, conforming loans must meet the funding criteria set by Fannie Mae and Freddie Mae.

On the lenders side, this allows them to sell conforming loans on the secondary mortgage market, which frees up capital for lenders to continue making home loans to other borrowers.

What is a mortgage loan limit?

A mortgage loan limit represents the maximum loan amount that Fannie Mae and Freddie Mac will purchase or guarantee for mortgage lenders.

With that, mortgage lenders are able to lend more than this dollar amount. But if a lender extends a mortgage for more than the conforming loan limits, the lender cannot sell the mortgage to Fannie Mae or Freddie Mac.

Why do loan limits matter?

Loan limits matter because many lenders want to sell their home loans on the secondary mortgage market. As a result, borrowers can be hard-pressed to find a lender thats willing to offer a loan over the predetermined limit.

When shopping for a home, buyers should keep the conforming loan limits in mind. Although its possible to get a larger loan, conventional loans that meet these standard limits are much easier to come by.

What if my loan is over the conventional loan limit?

Whats the jumbo loan limit for 2022?

A home loan that exceeds the conforming loan limits is considered a jumbo mortgage.

What are the conventional loan limits for 2022?

You May Like: Who Filed For Bankruptcy

Can A Second Mortgage Eliminate Pmi

A loan option that is rising in popularity is the piggyback mortgage, also called the 80-10-10 or 80-5-15 mortgage.

This loan structure uses a conventional loan as the first mortgage , a simultaneous second mortgage , and a 10% homebuyer down payment. The combination of both loans can help you avoid PMI, because the lender considers the second loan as part of your down payment. A piggyback loan can make homeownership accessible for those who may not yet have saved a down payment.

For an in-depth look at these loans, see our piggyback loan blog post.

Whats The Difference Between Front

Mortgage lenders often look at your front-end and back-end debt-to-income ratios when they review your loan application. Your front-end DTI includes just your housing costs in relation to your income. Lenders frequently want your front-end debt-to-income ratio to be below 28%.

Your back-end DTI includes your housing costs as well as the cost of other monthly debt payments on student loans, car loans, credit cards, and more in relation to your income. Mortgage lenders frequently want your back-end debt-to-income ratio to be below 36%.

Don’t Miss: How Does Bankruptcy Work In Colorado

How To Shop For Jumbo Loans

Jumbo loans are a financing method for properties with a higher price tag. Below, MoneyGeek outlined six important steps you need to take when getting a jumbo loan.

Determine jumbo loan limits

Jumbo loan limits are greater than the baseline loan limit set by the FHFA for conforming loans $726,200 in most counties and $1,089,300 in high-cost areas for a single-unit property in 2023.

Research home prices

Knowing the local housing market in your desired location is essential for your journey to home ownership. It can help you fine-tune your budget and submit an offer.

Boost your credit score

Its smart to improve your credit score before pursuing a jumbo loan application. If possible, you want a score of 700 or higher to increase your chances of getting a jumbo loan and avoiding higher interest rates.

Save up for a down payment

Saving up for a down payment is critical in achieving homeownership. Most jumbo loan lenders require a 20% down payment, but some offer flexibility and allow a minimum down payment of 10%.

Shop and compare lenders

Its important to remember that the jumbo loan market is smaller than the market for conforming loans. You need to do your due diligence in shopping around and comparing lenders to find the best option for your particular needs and situation.

Go through the application

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.

Recommended Reading: Where To Buy Merchandise Pallets

Why Does It Take So Long To Get A Loan

There are some common scenarios that can lead to a longer processing time. Here are some factors that might cause a mortgage lender to take a relatively long time with processing.

In 2014, a new set of mortgage rules took effect, and they’ve had an impact on how lenders originate home loans. The Ability-to-Repay rule, for example, requires mortgage companies to thoroughly verify and document a borrower’s financial ability to repay the loan. As a result of these and other government regulations, mortgage lenders might take a long time to process and approve loans

When you apply for a home loan, your application and paperwork might pass through the hands of half-a-dozen different people (or even more, if you use one of the big banks. Loan officers, processors and underwriters, oh my! And additional documents might be requested at each stage. Think of a snowball getting larger as it rolls downhill.

This is another reason why mortgage lenders can take a long time when processing loans. There are many steps in the process, many documents to review, and several different people involved.

Granted, some lenders have made big advancements with streamlining in recent years. This is especially true for those companies that put an emphasis on technology, web-based applications, and the like. But by and large, it’s still a cumbersome process with lots of paperwork along the way.

Im Ready To Apply For A Conventional Loan

Conventional loans are a great mortgage option for qualifying homebuyers. Depending on your financial situation, its likely a conventional loan will offer lower rates than other types of mortgages. Down payment requirements are as low as 3%, and private mortgage insurance is cancelable when home equity reaches 20%.

Tim Lucas

Editor

Recommended Reading: How To Find Out If Someone Filed Bankruptcy

Before We Get Into The Changes Fannie Mae Made To Its Debt

Your debt-to-income ratio weighs how much you owe each month against how much you earn. Its generally calculated by adding up your monthly bills and dividing the total by your gross monthly income more on that later.

Though its not used to calculate your credit scores, your DTI ratio can play a key role when you apply for a mortgage. Why? Because it helps mortgage lenders evaluate how much additional debt you can handle.

Carrying too much debt is one of the main roadblocks for many first-time homebuyers who apply for a mortgage.

Lenders generally view such borrowers as being higher-risk even if they make good money and have strong credit. But that perception may be starting to shift.

Fannie Mae, the leading provider of mortgage financing in the U.S., relaxed its debt-to-income ratio requirements in 2017, from 45% to 50% if certain conditions are met, to give more potential borrowers access to credit.

If you have a high debt-to-income ratio but great credit and a stable income, Fannie Maes higher DTI ratio limit might help you get approved for a mortgage. But for homebuyers who dont fit this bill, the higher limit is unlikely to help much.

Lets take a closer look at how Fannie Maes limit increase impacts your loan-approval chances.

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you wonât likely have money to handle an unforeseen event and will have limited borrowing options.

Don’t Miss: Dti For Conventional Loan

What Is Included In The Total Debt Ratio

In addition to the housing payment, there are other debts included in this calculation. These payments include installment, revolving, other housing payments for other properties, IRS or state income tax payment plans, garnishments, alimony, child support, car leases, and possibly others. Though, 401k loan payments are excluded from debt ratio calculations.

How Does Our Income

To calculate your DTI ratio using our income-debt ratio calculator, enter the following information:

Annual gross income: Enter your annual gross income the total amount you earn per year before taxes and deductions are taken out. If you dont know what your annual income is, estimate it based on your average monthly income.

Minimum monthly credit card payment: This is the amount on your credit card bills you must pay, at a minimum, each month.

Auto loan payment: Include your auto payment for a leased or purchased vehicle, along with any monthly payments toward a spouse or another family members vehicle.

Other loan obligations: Also include any other loan obligations you may have, such as student loans, personal loans, home equity loans, and other debts that appear on your credit report.

After inputting these numbers, our calculator will show you how much money you have left over each month after paying your total monthly debts and your estimated maximum mortgage payment.

The more money you have remaining after paying your existing monthly debts, the more you can afford in a monthly mortgage payment. However, its important not to overextend your housing budget. Consider the other costs of homeownership homeowners association dues, maintenance, repairs, and future improvements when figuring out a comfortable monthly housing payment.

Read Also: Can You Keep Your Car After Bankruptcy

This Number Gives Lenders A Snapshot Of Your Financial Situation

Sarinya Pingamm / EyeEm / Getty Images

If youre applying for a mortgage, one of the key factors mortgage lenders will look at is your DTIor debt-to-income ratio.

That ratio, which shows the amount of your income that will go towards debt payments, gives lenders a snapshot of your entire financial situation. That helps them understand what you can comfortably afford in terms of a mortgage payment.