Can I Get A Heloc With High Debt To Income

A home equity line of credit is unlikely with a DTI above 43%. Lenders need confidence you have the financial capacity to pay your debt as agreed. This is particularly important with any home loan that uses the property to secure the loan, as is the case with a HELOC or home equity loan.

If you stop making your monthly mortgage payment, HELOC payment, or home equity loan payment, the mortgage lender will forclose on your home, and you will be kicked out. In addition to being homeless, your credit score will plunge, making it extremely difficult to find a new place to rent. And you likely wont qualify for another mortgage for a couple of years.

That is why secured loans that leverage your home are difficult to qualify for with a high DTI things can get real messy when borrowers default on home loans.

How Do You Calculate Dti

If you’re about to apply for a new loan, calculating your DTI can help you understand how a lender will view your application. It’s not difficult to make this calculation, but you will need to gather some information.

There are two types of DTI lenders might consider when you’re applying for a loan:

- Front-end DTI includes your regular monthly housing expenses: mortgage or rent, home or renters insurance, property taxes and homeowners association fees. It does not include utilities, phone bills or similar expenses.

- Back-end DTI includes all of the monthly housing expenses listed above as well as any additional monthly debt payments: credit card minimum payments, student loans, personal loans and auto loans.

To calculate your DTI, first determine what your gross monthly income is. That’s what you earn monthly before taxes and other payroll deductions, plus any tips, bonuses, business income, pensions, social security, child support or alimony.

Divide your total monthly housing expenses by your gross monthly income to get your front-end DTI. Add your monthly housing expenses and your monthly debt payments, then divide this figure by your gross monthly income to get your back-end DTI.

Let’s say your gross monthly income is $7,000 with a monthly housing expense of $2,250 and additional monthly debt of $600.

Your front-end DTI:

$2,850 / $7,000 = 41%

How To Calculate Your Debt To Income Ratio

Its pretty simple to calculate your DTI percentage. Take the sum of your total monthly debts, and then divide that sum by your monthly household income. Then, multiply that number by 100 to see your percentage.

Your monthly debts include your monthly payments that are required, regular, and recurring. And your gross household income includes the pre-tax income you make each month.

To see this calculation written as an equation, well call the sum of your total monthly debts D and your total gross household income I.

x 100

You May Like: How Long Does Bankruptcy Last In Ontario

How To Lower Your Dti

If your debt-to-income ratio is not within the recommended range, you can lower your DTI a number of ways:

- Pay off debt: If possible, the preferred option to lower your DTI is by repaying as much of your debt as you can manage. To make the most impact, prioritize the debt with the highest monthly payment.

- Restructure your loans: Seek out options for lowering the interest rate on your debt or attempt to lengthen the duration of the loan through refinancing options.

- Look into loan forgiveness: These types of programs may help to eliminate some of your debt entirely.

- Pay off high-interest loans: If youre unable to refinance your loans, focus on repaying the higher-interest ones first. These carry a heavier weight in your DTI calculation, so paying them off first will improve the ratio.

- Seek out an additional source of income: If youre able to, generating an additional income stream will help improve your DTI ratio.

Why Does Your Dti Ratio Matter

Lenders may consider your DTI ratio as one factor when determining whether to lend you additional money and at what interest rate. Generally speaking, the lower a DTI ratio you have, the less risky you appear to lenders. The preferred maximum DTI ratio varies. However, for most lenders, 43 percent is the maximum DTI ratio a borrower can have and still be approved for a mortgage.

You May Like: How To File For Bankruptcy In Ohio Without A Lawyer

How Do You Calculate Debt To Income Ratio

Debt to income ratio is the percentage of your total amount of monthly debt payments over your total amount of gross monthly income .

DTI ratio = Total monthly debt payments ÷ Total gross monthly income

Monthly debt payments include:

Income has to be verifiable. Off the books or under the table income cannot be used when calculating DTI for several reasons but primarily because there has to be a way to prove legitimacy if an auditor requests to see it.

When additional income is not verifiable from regular pay stubs or direct deposits, the lender may request documentation in the form of tax returns or bonus award letters and deposits.

In the case of tips or gratuities, some lenders may use a conservative estimate based on hours worked monthly.

If the additional income is actually from another person within the household, that income can only be used if their debts are also included in the calculation.

It is likely that the lender will require this person to be on the loan in order to use their income and in doing so, will require the same income verification as that of the original borrower.

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

Read Also: Who Has Filed The Most Bankruptcies

What Is A Good Dti Ratio

After you calculate your debt-to-income ratio, you will arrive at a figure. But what does this number mean? From a creditors perspective, the higher your DTI percentage, the greater the risk.

Each lender will determine its criteria for DTI ratios. Theres no universal cutoff point between a good DTI ratio and a bad one. However, here are some general guidelines courtesy of the CFPB:

- 43%: In general, this is the highest ratio you can have and still be eligible for a qualified mortgage.

- 36%: The CFPB recommends homeowners maintain a DTI ratio of 36% or less.

- 28%: Mortgage debt should ideally be 28% or less.

- 15% 20%: Renters should aim for a DTI ratio between 15% 20% for their debts. Your monthly rent payment does not figure into this calculation.

What Is The Debt

Expressed as a percentage, your debt-to-income ratio for a mortgage is the portion of your gross monthly income spent on repaying debts, including mortgage payments or rent, credit card debt and auto loans.

Lenders might hesitate to work with someone who has a higher DTI ratio because theres a larger risk that the borrower might not repay their loan if they have other significant debt payments.

Also Check: How Long After Bankruptcy Can You Get A Credit Card

What Is A Good Dti Ratio For A Personal Loan

To understand how lenders view a good DTI for a personal loan, its useful to first learn how DTI ratio figures into mortgages. There are two types of DTI in the mortgage market:

Although the exact definition of a good DTI ratio varies with each personal loan provider, its a good bet that the 36% value is key.

However, mortgages are secured, and personal loans are not. It stands to reason that a provider of unsecured personal loans would consider only a lower DTI ratio to be good since the lender assumes more risk when a loan is not collateralized.

Therefore, a good DTI ratio for a personal loan is probably 15% or less.

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Recommended Reading: Can You Get A Personal Loan After Bankruptcy

What Is A Good Debt To Income Ratio

Lenders typically consider a debt to income ratio of 30% or below to be excellent.

However, the impact of DTI on loan approval may depend on such things as your credit report/score, the type of loan for which you are applying, assets in your possession including personal savings.

If, for example, your credit report includes debt in collections , charge-offs, and/or other delinquent credit issues, a low debt to income ratio may not be quite as effective as it should be in your application process.

In other words, a debt to income ratio of 40% coupled with a great credit score, may be in better shape for lender approval than a debt to income ratio of 30% combined with a poor credit rating.

Below are different levels of debt to income ratios accompanied with a rough level of grading:

| Debt to income |

|---|

| Unacceptable |

It is the lenders responsibility to determine credit worthiness of the borrower and also their ability to repay the debt.

Lenders want to approve loans, but these approvals must be within acceptable guidelines so there is no undue financial burden on the borrower and no unnecessary risk for the lender.

Exceptions will sometimes be made, but there must be a valid reason. Anytime an exception is made to loan policy, there will need to be substantial documentation.

Try A More Forgiving Program

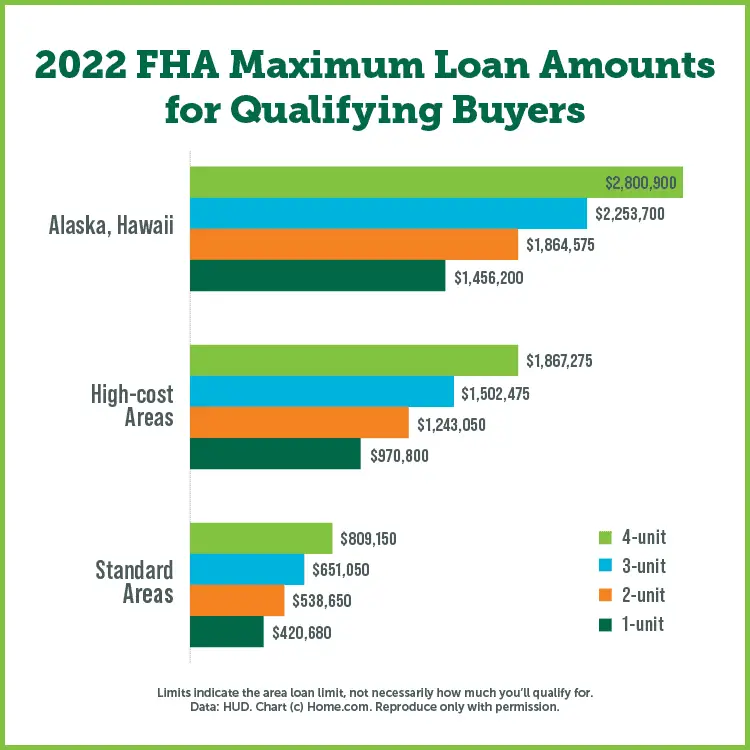

Different programs come with varying DTI limits. For example, Fannie Mae sets its maximum DTI at 36 percent for those with smaller down payments and lower credit scores. Forty-five is often the limit for those with higher down payments or credit scores.

FHA loans, on the other hand, allow a DTI of up to 50 percent in some cases, and your credit does not have to be top-notch.

Likewise, USDA loans are designed to promote homeownership in rural areas places where income might be lower than highly populated employment centers.

Perhaps the most lenient of all are VA loans, which is zero-down financing reserved for current and former military service members. DTI for these loans can be quite high, if justified by a high level of residual income. If youre fortunate enough to be eligible, a VA loan is likely the best option for high-debt borrowers.

Recommended Reading: Bankruptcy Proof Of Claim

What Is Considered A Good Dti Ratio

What counts as a good DTI will depend on what type of loan you want. Some lenders allow a higher DTI, while others require a lower cut-off.

In general, lenders prefer that your back-end ratio not exceed 36%. That means if you earn $5,000 in monthly gross income, your total debt obligations should be $1,800 or less. However, some lenders might make an exception if you have excellent credit. In fact, its possible to qualify for a loan with up to a 50% DTI as long as youre an otherwise highly qualified borrower.

Mortgage lenders, in particular, tend to have more hard-and-fast rules. They typically prefer a front-end DTI of 28% or less. That means your mortgage payments cant be any higher than 28% of your gross monthly income. So if you take home $5,000 per month, your mortgage payments shouldnt be any higher than $1,400.

On the other hand, conventional mortgage lenders, as well as FHA and USDA lenders, will typically allow a back-end DTI of up to 43%, giving your budget a little more wiggle room. VA loans usually require a back-end DTI of 41% or less.

Knowing your front-end and back-end DTI can help you figure out how much house you can afford. If you apply for a mortgage and the payments would cause you to exceed either of these DTI requirements, you may have to go with a smaller loan or could be denied a loan altogether.

Defining Debt And Income

To calculate your DTI, you first need to know what counts as debt and what counts as income.

-

What counts as debt?

Debt includes your regular monthly repayments on personal loans, student loans, car loans, mortgages or any other type of loan. Your monthly minimum credit card payments also count as debt, as do unpaid bills sent to collection agencies.

-

What doesnt count as debt?

Things like rent, utility bills, cable bills arent included in your DTI. Car insurance, health insurance and other types of insurance premiums also dont count as debt.

You might think that monthly bills besides credit card and loan payments should count. But heres why they dont: With these bills, youre paying for a service, typically one thats consistent.

-

What counts as income?

The income DTI refers to is your gross monthly income that is, your income before taxes or deductions are subtracted. Income includes your salary, but its not limited to just what you bring in each month.

Tips or bonuses, pensions, retirement account distributions, Social Security benefits, alimony and child support all count as income too. Think of income as any kind of money thats coming in that you dont have to repay.

Read Also: Why Is The Us In Debt

Why Is Your Dti Ratio Important

A DTI is often used when you apply for a home loan. Even if youre not currently looking to buy a house, knowing your DTI is still important.

First, your DTI is a reflection of your financial health. This percentage can give you an idea of where you are financially, and where you would like to go. It is a valuable tool for calculating your most comfortable debt levels and whether or not you should apply for more credit.

Mortgage lenders are not the only lending companies to use this metric. If youre interested in applying for a credit card or an auto loan, lenders may use your DTI to determine if lending you money is worth the risk. If you have too much debt, you might not be approved.

What Is A Good Percentage Of Debt To Income Ratio

Since your debt to income ratio can keep you from getting a loan with a reasonable interest rate, we need to examine how bad your situation is before you apply for a loan. According to Investopedia, mortgage lenders use DTI in their calculations and believe the ideal debt to income ratio is 36% or lower and your mortgage loan should be no more than 28% of your total DTI. Some lenders like to see an even smaller amount.

If your DTI ratio is lower than that, youre in a good position! If, like many Americans, your income ratio could be better, there are several ways to improve your situation with a debt management plan.

Also Check: Foreclosed Homes For Sales

How Dti Impacts Your Credit Score

Not only does your DTI impact your ability to secure a loan, it also indirectly affects your credit. That means even if you arent trying to borrow money right now, a DTI thats too high could knock points off your credit score and make it tougher to secure an apartment or open a utility account.

The main reason DTI and credit are related is because the total amount of debt you owe affects approximately 30% of your FICO score. The lower the amount of debt you owe in relation to your available credit, the better for your score. Conversely, the more debt you have to your name, the worse its impact on your score. So if you have a high DTI, it follows that you are probably using a significant portion of your available credit.

DTI also can impact your credit if you owe so much that you arent able to keep up with payments. As the most heavily weighted factor in calculating your credit score, payment history makes up 35%. Just one missed payment can knock quite a few points off your score, so its important to keep your debt levels manageable.

Find Ways To Make Debt Less Expensive

When paying off debt, the name of the game is making your debt as cheap as possible. If youre carrying high-interest credit card debt, try to find less costly alternatives, such as:

- The balance transfer offer mentioned above.

- Asking your current card companies/debtors for a lower interest rate.

- If you already own a home, you might consider a cash-out refinance to consolidate debt.

- Applying for a personal loan with a fixed repayment schedule to consolidate debt to a lower interest rate.

Read Also: Do You Get Any Money If Your House Is Foreclosed