Gross Federal Debt Vs Net Debt

Chart D.16f: Federal Debt Gross and Net

The US federal government differentiates between Gross Debt issued by the US Treasury and Net Debt held by the public. The numbers on Gross Debt are published by the US Treasury here.Numbers on various categories of federal debt, including Gross Debt, debt held by federal government accounts, debt held by the public, and debt held by the Federal Reserve System, are published every year by the Office of Management and Budget in the Federal Budget in the Historical Tables as Table 7.1 Federal Debt at the End of the Year. The table starts in 1940. You can find the latest Table 7.1 in here.

The chart above shows three categories of federal debt.

1. Monetized debt , i.e., federal debt bought by the Federal Reserve System

2. Debt held by the federal government e.g., as IOUs for Social Security

3. Other debt , i.e., debt in public hands, including foreign governments.

What Is The National Debt Year By Year From 1790 To 2019

Getty

America’s debt has always grown. Here’s a quick tour through the centuries that shows why.

Recently we wrote about the U.S. national debt. It’s a subject that always deserves more coverage because while it’s one of the most discussed policy issues in American politics, far too few politicians talk about it in the language of economic policy.

Discussion national debt is a debate that should take place in the context of interest rates, private sector crowd-out, inflation, dollar stability and the role of Treasury bonds in the global marketplace. It should consider fiscal policy, with the real costs of inaction on any policy issue weighed against the costs of a given initiative. Instead, we get macroeconomic takes on the latte factor.

Complexity doesn’t make the national debt an irrelevant issue, and the scope of America’s borrowing does matter a great deal. To fully understand that, we have to see how and why America’s debt has grown more or less steadily since those first colonists got ticked off about paying their taxes in the late 1700s:

The Late 19th Century: 1850

But then the Civil War happened.

Leading up to the Civil War, America fought a war with Mexico to annex Texas and California. That added more than $63 million to the national debt .

But the bigger picture is, America has never really stopped paying for the Civil War. Whether or not you approve of government debt, those five years were the first time that the national debt truly spiked. Between 1860 and 1866 the debt rose from $64.8 million to more than $2.7 billion, approximately $42 billion by today’s standards.

To keep the nation whole, President Abraham Lincoln pushed debt to nearly 30% of gross domestic product and introduced the first income tax in American history. This was the first time America would experience the one-way ratchet of debt that follows each of the country’s major wars.

Each major conflict in U.S. history has been accompanied by a sharp rise in debt as the government raises funds to pay for the fighting. This wartime debt establishes a new normal, setting the baseline around which debt will fluctuate until the next major war pushes borrowing higher. In the wake of the Civil War, the U.S. debt rose to more than $2 billion and never dipped below $1.5 billion afterward, although a rapidly growing economy did quickly reduce the debt’s share as a portion of GDP after the end of the Civil War.

Yet neither of these events triggered the usual cycle of crisis-fueled borrowing. Instead, government debt ticked marginally down in 1893.

Recommended Reading: How Many Years Between Chapter 7 Bankruptcy

Lower Returns On Your Investments

Bonds issued by the Treasury are typically seen as low-risk investments. When interest rates rise, the yield on these low-risk investments also rises, making them more attractive investments for income-minded investors over other riskier income-generating investments like corporate bonds.

This could leave companies that typically rely on bonds short on the loans they need to finance expansions and operations and translate into lower returns for equity investors when companies fail to meet revenue targets.

Tracking The Federal Deficit: June 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $173 billion in June, the ninth month of fiscal year 2021. Junes deficit was the difference between $450 billion in revenue and $623 billion in spending.

So far this fiscal year, the federal government has run a cumulative deficit of $2.2 trillion, the difference between $3.1 trillion in revenue and $5.3 trillion in spending. This deficit is nearly triple the shortfall over the same period in FY2019 , but is 19% lower than at the same point in FY2020. This is the first time in FY2021 that the cumulative deficit has decreased year-over-year.

Analysis of Notable Trends: Thus far in FY2021, year-over-year comparisons of deficit levels have largely reflected the trajectory of the COVID-19 pandemic and subsequent federal response. BPC expects this trend to continue through the rest of the fiscal year.

Cumulative year-to-date outlays are up 6% compared to the first nine months of FY2020 and are 58% greater than at this point in FY2019. These changes are indicative of continued spending towards COVID-19 relief programsin particular, refundable tax credits and supplemental unemployment compensationas every month to date in the current fiscal year has contained pandemic-related expenditures, whereas only March-June did for the relevant period last year.

Read Also: Can You File For Bankruptcy If You Owe The Irs

Revolutionary War Kicks Off Us Debt

Wars were always a major debt factor for our nation. Congress could not finance the Revolutionary war with large tax raises, as the memory of unjust taxation from the British stood fresh in the minds of the American public. Instead, the Continental Congress borrowed money from other nations.

The founders led negotiations with Benjamin Franklin securing loans of over $2 million from the French Government and President John Adams securing a loan from Dutch bankers. We also borrowed from domestic creditors. While the war was still going on, in 1781, Congress established the U.S. Department of Finance.

Two years later, as the war ended in 1783, the Department of Finance reported U.S. debt to the American Public for the first time. Congress took initiative to raise taxes then, as the total debt reached $43 million.

Can America Keep Piling Up Debt

Economists debate whether the spending is sustainable. The U.S. finances the debt by selling bonds at auction. Demand has traditionally been high due to the size of our economy and a historically stable government, but the Treasurys auction of bonds in March 2021 was met with a tepid response.

Historically low interest rates meant the U.S. borrowed money cheaply, and it would theoretically invest it in an economy that would produce higher rates of return.

But interest rates are not expected to stay low forever. The 10-year rate on Treasury notes was expected to rise from 1.7% in March 2021 to at least 2.0% by the end of 2021, according to Kiplingers forecast.

The cost to just finance our debt is expected to be $378 billion in 2021 and increase to $665 billion by the end of the decade, according to CBO estimates. That money will be spent only on interest, not on the principal.

The U.S. is by far the most indebted organization in world history. While debt has been an issue since the inception of the U.S., its rapid growth will continue to challenge lawmakers into creating better programs to reign in expenditures, as well as American consumers who must develop improved way of managing their personal debt.

6 Minute Read

You May Like: What Happens When You Declare Bankruptcy Uk

Federal Debt: Total Public Debt As Percent Of Gross Domestic Product

Observation:

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Release: Debt to Gross Domestic Product Ratios

Units: Percent of GDP, Seasonally Adjusted

Frequency: Quarterly

Notes:

Federal Debt: Total Public Debt as Percent of Gross Domestic Product was first constructed by the Federal Reserve Bank of St. Louis in October 2012. It is calculated using Federal Government Debt: Total Public Debt and Gross Domestic Product, 1 Decimal :GFDEGDQ188S = /GDP)*100

National Debt And Budget Deficit

The federal government creates an annual budget that allocates funding towards services and programs for the country. This is made up of mandatory spending on government-funded programs, discretionary spending on areas such as defense and education, and interest on the debt. The budget deficit can be thought of as the annual difference between government spending and revenue. When the government spends more money on programs than it makes, the budget is in deficit.

You May Like: What Does It Mean When A Bankruptcy Case Is Dismissed

Budget Deficit By Year Since 1929

The deficit since 1929 is compared to the increase in the debt, nominal GDP, and national events in the table below.

The national debt and GDP are given as of the end of the third quarter of each year unless otherwise notedspecifically, September 30. The date coincides with the budget deficit’s fiscal year-end. GDP for years up to 1947 isn’t available for the third quarter, so annual figures are used.

The first column represents the fiscal year, followed by the deficit for that year in billions. The next column is how much the debt increased for that fiscal year, also in billions. The third column calculates the deficit-to-GDP ratio. It indicates that there was a surplus if numbers are in parentheses. The fourth column describes events that affected the deficit and debt.

GDP is as of June 30, 2021, for 2021. The national debt increase is from October 1, 2020, to June 30, 2021. The estimated fiscal year budget deficit is from the CBO and was released on July 1, 2021.

| FY |

|---|

| 12.1% |

Public Debt Goes Online

Despite backlashes against ’80s “greed,” and the obstacle of the huge public debt , the economy of the United States was relatively strong at the start of the new decade. The government made a commitment to “fiscal discipline,” and in 1998, President Bill Clinton presented to Congress the first balanced federal budget since 1969.

Throughout the ’90s, a Wall Street boom drove investment in Treasury securities. Treasury kept up with demand by taking advantage of many technological breakthroughs.

Throughout the ’90s, a Wall Street boom drove investment in Treasury securities. Treasury kept up with demand by taking advantage of many technological breakthroughs.

In 1992, Bureau computer systems are again upgraded when the IBM mainframe is replaced with an Amdahl system. It’s about this time that the first “computer virus” strikes at Public Debt.

Read Also: Will Filing Bankruptcy Stop Student Loan Garnishment

Great Depression And Stock Market Crash

People started investing heavily in the stock market in 1920 unaware that Black Tuesday would dawn with an $8 billion loss in market value when the stock market crashed on October 29, 1929. The United States relied on the gold standard and raised inflation, rather than lowering rates to ease the burden of inflation.

During the following era, income inequality between classes grew. More than 25 percent of the workforce was unemployed, people made purchases on credit and were forced into foreclosures and repossessions.

President Franklin D. Roosevelt developed programs for unemployment pay and social security pensions, along with providing assistance to labor unions. Although Roosevelt addressed many problems in the U.S. economy, the funding for his programs grew the national debt to $33 billion.

Consequences Of Rising National Debt By Year

![US National Debt (And Related Information) [OC] : dataisbeautiful US National Debt (And Related Information) [OC] : dataisbeautiful](https://www.bankruptcytalk.net/wp-content/uploads/us-national-debt-and-related-information-oc-dataisbeautiful.png)

26. Each percentage point above a public debt-to-GDP ratio of 77% costs 0.017 percentage points of real annual growth for a developed economy.

Economists examine the effect of high public debt, particularly in relation to the countrys GDP, on the long-term growth of its economy. There is a threshold under which a high debt-to-GDP ratio helps the economy, as there is more credit available to fund growth activities.

Beyond this limit, which is 77% for developed economies and 64% for emerging markets, debt can be harmful to a countrys economy. The US debt chart shows that the share held by the public crossed the 77% public debt-to-GDP mark in 2017.

27. Each $1 of new borrowing reduces total investment by $0.33.

This slowdown occurs because of a phenomenon called crowding out, where investors purchase government securities instead of making productive investments into buildings, machinery, equipment, software, new ventures, etc. This impacts workers productivity growth and, in turn, their incomes and wages.

The CBO has projected that the Gross National Product per person will be about $98,000 in todays dollars if the US national debt graph comes down to historical levels . By contrast, if the debt continues rising the way it is now, the GNP per person will be $90,000.

28. Under current laws, the US national debt interest payments will exceed the spending on defense by 2025 and become the single largest government expenditure by 2050.

Recommended Reading: Can A Bankruptcy Trustee Find Bank Accounts

The Types Of Presidential Decisions That Impact National Debt

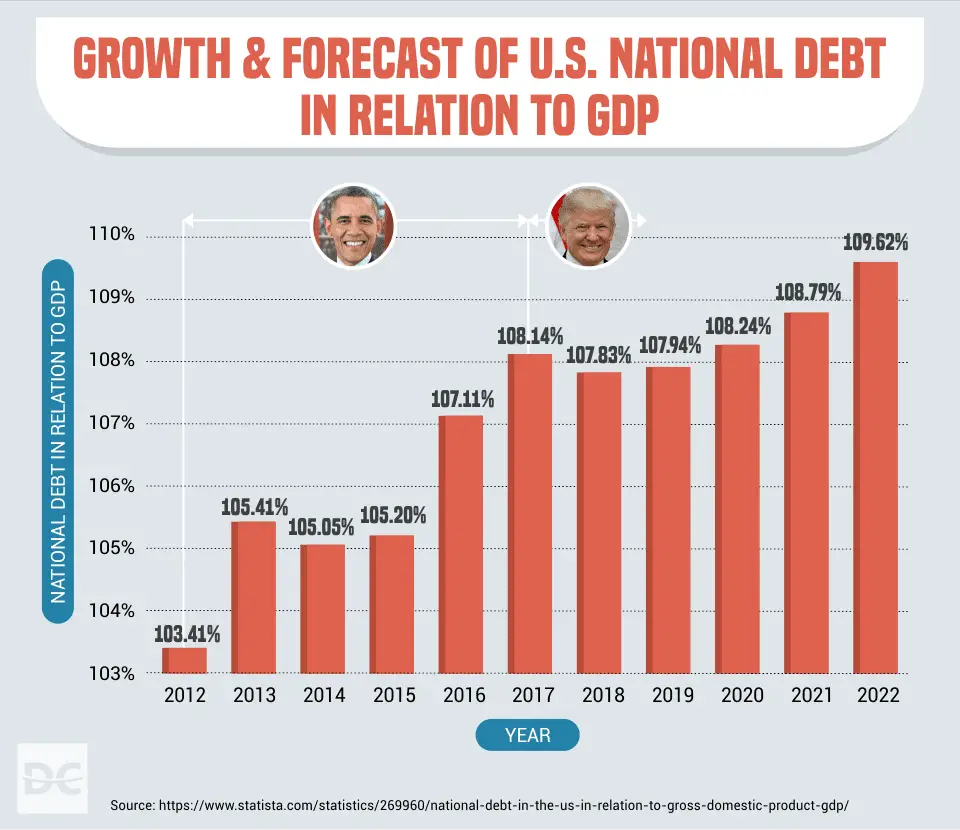

Presidents can have a tremendous impact on the national debt. They can also have an impact on the debt in another presidentâs term. When President Trump took office in January of 2017, for the first nine months of his presidency, he operated under President Obamaâs budget which didnât end until September, 2017. So for most of a new presidentâs first year in office, he isnât accountable for the spending that takes place. As strange as this may seem, itâs actually by design to allow time for the new president to put a budget together when in office.

Nation Closing In On $314t Borrowing Limit

The federal government is closing in on the $31.4 trillion borrowing limit, meaning a high-stakes fight over raising the debt ceiling is fast approaching.

An estimate from the Peter G. Peterson Foundation places the nations debt at $31.39 trillion and counting on Wednesday, just a hair below the limit set more than a year ago.

That doesnt mean the debt ceiling will have to be lifted this week or even this month. The Treasury Department can generally use what are known as extraordinary measures to put off an actual debt crisis.

But its clear the fight is edging closer, putting the White House on a collision course with a new House majority demanding deep discretionary spending cuts in exchange for any increase to the debt ceiling.

I think this is going to be the defining moment of the year, Maya MacGuineas, president of the Committee for a Responsible Federal Budget said, adding its certainly possible that well hit that limit this month, or next month.

The extraordinary measures used by Treasury generate cash to help the government pay its debts, which include halting pension fund contributions and prematurely redeeming Treasury bonds, could run out sometime in July, according to an estimate from the CRFB.

That means Congress will need to act by mid-summer at the latest to prevent the government from defaulting on its debt.

Theres also concern about how it would impact the countrys standing on the global stage.

Also Check: What Do You Need To Do To File Bankruptcies

The First Decades: 1790

The Treasury’s published records go back to 1790, but U.S. debt began with the Revolutionary War. The fledgling United States issued loan certificates to governments in Europe to help pay for the war, and by the time official reports began in 1783 owed $43 million.

Yet the system of U.S. debt didn’t entirely formalize until 1790 with the Revenue Act, when Alexander Hamilton began issuing a new series of federal bonds to collect the debt of the colonies into one guaranteed federal obligation. This established what has become an essential principle of the U.S. federal system: the country has one economy with all debts ultimately secured by the national government.

It didn’t necessarily have go this way. At the time Hamilton called for such action, the states owed a collective $25 million . Given the cultural and political independence of states in early America, representatives from wealthier states could easily have objected to having their money spent on other people’s debts.

America has been in debt from the first shots of the Revolutionary War, and largely for three reasons: First, running a large nation is expensive. Second, fighting wars is expensive. Third, and most notably in the beginning, the early U.S. government didn’t have the power to directly tax its citizens. Until a temporary federal income tax came along during the Civil War, most of the U.S. government’s revenue came from sales and import duties.

The Federal Debt Ceiling

The federal debt ceiling is the legal amount of federal debt that the government can accumulate or borrow to fund its programs and pay for fees such as the national debt interest. Since its creation through the Second Liberty Bond Act in 1917, the debt ceiling has grown about 100 times. These instances have included permanent raises, temporary extensions, and revisions to what the debt limit can be defined as. When the debt ceiling isnt raised, the federal government is unable to issue Treasury bills and must rely solely on tax revenues to pay for its programs this has occurred 7 times since 2013.

Recommended Reading: What Is Chapter 13 Bankruptcies

National Debt By President

18. In terms of Dollar value, Barack Obama was the US President who grew the debt burden the most.

President Obama added $8.6 trillion to the nations debt during his two terms. Both he and President George W. Bush, who added the second-greatest amount to the US national debt, had to fight the 2008 recession and also incur higher mandatory spending for Social Security and Medicare.

The $831-billion economic stimulus package, tax cuts worth $858 billion, increased defense spending to $855 billion, and the Patient Protection and Affordable Care Act expenses were some of the key reasons for the continuous increase in national debt per year during President Obamas terms.

19. In percentage terms, the US president who grew the debt burden the most was Franklin D. Roosevelt.

While the US national debt climbed by only $236 billion in Dollar terms under President Roosevelt, the percentage increase was 1,048%. The two most significant expenses under FDR were the New Deal following the Great Depression and World War II. Similarly, the second-highest debt addition in percentage terms was under President Woodrow Wilson because of World War I.

20. The wars in Afghanistan and Pakistan have cost the US more than $2.3 trillion.

21. The US budget deficit increased to more than $2.8 trillion in 2021 from less than $1 trillion in 2019.

22. According to CBOs estimates, the budget deficit for fiscal 2022 should be significantly lower compared to the previous years.