What The National Debt Means To You

The U.S. national debt has long been the subject of significant political controversy. Given its rapid rise in recent years following federal spending increases tied to the COVID-19 pandemic, it’s easy to understand why the issue is drawing more attention from economists, financial markets participants, and critics of government policies.

Polls have long shown high levels of public unease with the U.S. government’s debt, which topped $31 trillion in October 2022. The debt has grown in nominal terms and also relative to the U.S. gross domestic product .

At the same time, large majorities of Americans backed the pandemic relief spending while opposing spending cuts for the costliest government programs. Most also believe they’re already paying too much in federal income tax, while increasingly backing tax increases for corporations and the rich.

The public debt people say makes them uncomfortable is the inevitable result of the tax and spending policies that continue to enjoy broad public support. A related problem is that many aren’t sure what effect the national debt has or might have on their own lives and finances.

Is The National Debt A Problem

Economists and lawmakers frequently debate how much national debt is appropriate. Most agree that some level of debt is necessary to stimulate economic growth and that there is a point at which the debt can become a problem, but they disagree about where that point is. If the debt does get too big, it can result in cuts to government programs, tax hikes, and economic turmoil.

How Much Can A Government Borrow

- Japans national debt is 265% of GDP and has been high for a couple of decades. This reflects the ability of Japan to borrow from domestic citizens. Despite prolonged periods of high debt, interest rates are still low because markets feel the government is still solvent.

- A developing economy like Argentina has a track record of default on debt, therefore markets are less willing to lend money to the government. Therefore when debt levels in Argentina increase it has a greater effect on pushing up interest rates.

Factors that depend on how much a government can borrow include

- Default rates of government

- Inflationary pressures. High inflation will make investors less willing to buy government bonds because they will devalue due to inflation

- Can the government print its own money? If the government can print money it can avoid liquidity issues, though there is potential danger of inflation.

- What are the prospects for economic growth? Higher economic growth makes it easier to reduce debt to GDP ratios over time.

- How much can a government borrow?

Recommended Reading: Does Bankruptcy Pay Off Car Loans

China Total Debt: $1437800000000

China underwent a series of economic reforms in 1978, and has since become among the fastest growing, ranking as second in largest economy in the world in 2016 as rated by GDP. It possesses the largest by the purchasing power parity, and maintains the position of being the largest exporter in the world.

Measuring Money And Markets In 2022

Every time we publish this visualization, our common unit of measurement is a two-dimensional box with a value of $100 billion.

Even though you need many of these to convey the assets on the balance sheet of the U.S. Federal Reserve, or the private wealth held by the worlds billionaires, its quite amazing to think what actually fits within this tiny building block of measurement:

Our little unit of measurement is enough to pay for the construction of the Nord Stream 2 pipeline, while also buying every team in the NHL and digging FTX out of its financial hole several times over.

Heres an overview of all the items we have listed in this years visualization:

| Asset category |

|---|

Read Also: Save My House Government Program

Servicing The National Debt

Similarly, households have finite lifespans, and therefore a time-constrained ability to earn money. Prudence may dictate getting out of debt and starting to accumulate retirement savings long before they are needed. Countries, on the other hand, can expect to generate revenue indefinitely, and they are usually able to refinance debt.

Countries must still pay interest on the debt of course, and debt service costs are another useful indicator of debt’s sustainability. U.S. debt service costs amounted to 1.5% of GDP in 2021, down from 3% in 1995. However, the Congressional Budget Office projects the federal government’s debt service costs will rise to 7.2% of GDP by 2052 as a result of “rising interest and mounting debt.”

How To Calculate The Debt

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

10’000 Hours / Getty Images

The debt-to-GDP ratio compares a country’s sovereign debt to its total economic output for the year. Its output is measured by gross domestic product .

Don’t Miss: What Does Chapter 13 Bankruptcy Cover

Why Is National Debt A Problem

If a government increases its national debt to a level that the market thinks is too high, it will have to increase the interest it pay in order to find lenders.

With the backstop of a high return from a safe source, banks do not need to lend to businesses to make a profit. When banks are less interested in offering loans, they raise interest rates for all borrowers.

High interest on loans increases business costs and the return on investment that is funded on debt reduces. In this instance, businesses cease to expand and unemployment rises.

Ranked: The Worlds 100 Biggest Pension Funds

View the high-resolution of the infographic by .

Despite economic uncertainty, pension funds saw relatively strong growth in 2021. The worlds 100 biggest pension funds are worth over $17 trillion in total, an increase of 8.5% over the previous year.

This graphic uses data from the Thinking Ahead Institute to rank the worlds biggest pension funds, and where they are located.

Read Also: Who Can File For Bankruptcy In Ny

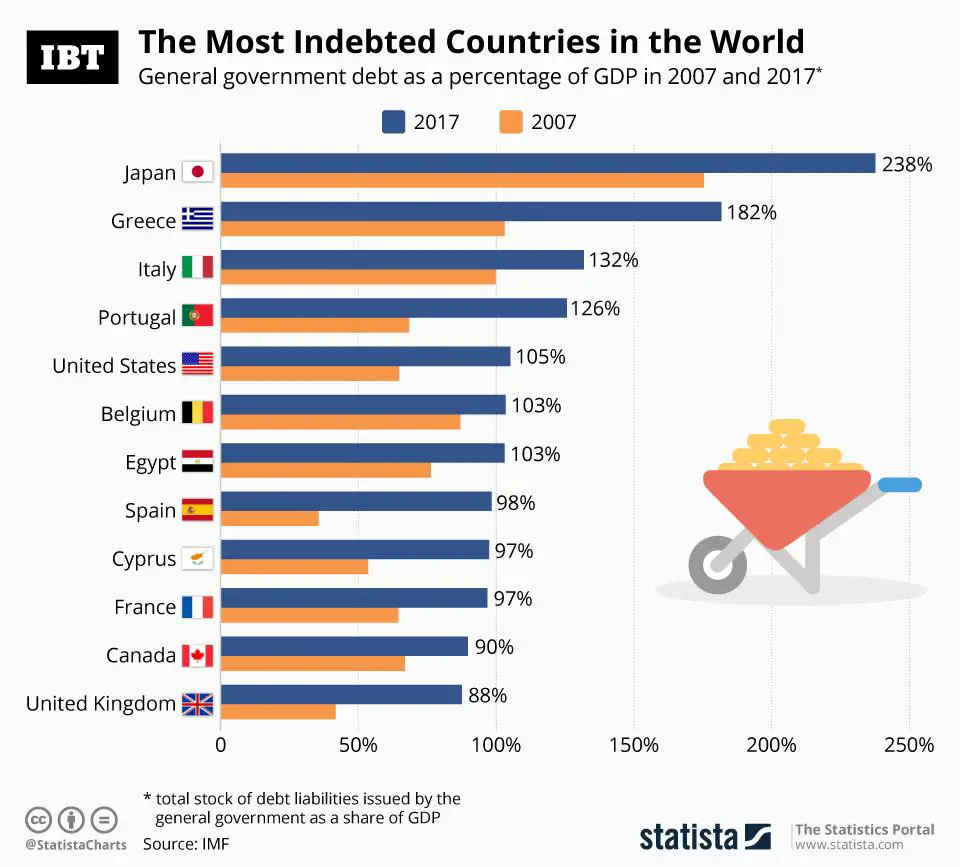

Highest Levels Of Government Debt In The World

The country with the highest debt to GDP ratio in 2020 was Venezuela a reflection of a collapsing economy and failure to collect tax revenues.

The second biggest debt burden is Japan with 256% though this is very different situation with economic stability and prosperity. The Japanese government is able to borrow from private individuals in Japan. Conflict in Sudan and Eritrea have played a large role in their high debt levels.

How The Debt Compares To Gdp Plus Major Events That Impacted It

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The U.S. national debt grew to a record $31.12 trillion in October 2022. It has grown over time due to recessions, defense spending, and other programs that added to the debt. The U.S. national debt is so high that it’s greater than the annual economic output of the entire country, which is measured as the gross domestic product .

Throughout the years, recessions have increased the debt because they have lowered tax revenue and Congress has had to spend more to stimulate the economy. Military spending has also been a big contributor, as has spending on benefits such as Medicare. In 2020 and 2021, spending to offset the effects of the COVID-19 pandemic also added to the debt. In 2022, tax increases on the wealthy and corporations decreased the future debt outlook, but student loan forgiveness increased it.

One way to look at the national debt is by comparing it to GDP each year, as well as other major events that have impacted it. Below, we’ll dive into the U.S. national debt per year and what caused it to grow over time.

Don’t Miss: What Are 4 Advantages Of Filing Bankruptcy

United Kingdom Total Debt: $7499400000000

The United Kingdom is ranked as having the fifth largest economy in the world by nominal GDP. It is the ninth largest by purchasing power parity. It is a developed country that has a high-income economy with a very high ranking in the Human Development Index. For this category, it comes in as number sixteen. The United Kingdom is unique in tht it is the first country in the world to become industrialized. It was the leading power of the 19th century and into the early 20th century. It is still a great power today and its military, economic, cultural, political and scientific influence are shown throughout the world. It is a permanent member of the United Nations Security Council. It is one of the leading members of the EU and the European economic Community until recently, when the national referendum regarding the UKs membership in the EU was passed with the agreement to leave the Union. The UK is currently negotiating heir exit from the EU. The country is also a member of the North American Treaty Organization, the Group of 20, the Commonwealth of Nations, the G7 finance ministers, the Council of Europe, the G7 forum, the Organization for Economic Cooperation and Development, the G20 and the World Trade Organization.

Canada Total Debt: $1791870000000

Canada ranks number eleven for having the most debt of all countries in the world, and the fifteenth for the highest nominal per capita income. It ranks number ten for its Human Development Index and is one of the top counties for certain international measurements. These include: economic freedom, civil liberties, education, quality of life and governmental transparency. Canada sponsors a national health care system for its citizens. It is a member of multiple international organizations which are: The North American Free Trade Agreement the Asia-Pacific Economic Cooperation forum G7, The Group of Ten the North Atlantic Treaty Organization, the G20 the United nations and is a nation that lies within the Commonwealth of nations as well as a member of the Francophonie.

Recommended Reading: How Long After You File Bankruptcy Can You File Again

National Debt By Country: The Top Iou Nations

Debt is a serious thing.

But how do you measure it?

Besides the national debt statistics, there is another figure that is probably a better indicator of how much a specific country is in debt. It is the figure that indicates debt as a percentage of GDP.

Wait.

What is GDP?

The gross domestic product is an economic indicator of the overall health of the economy of a country. This percentage can give us some insight as to whether the indebted country is able to pay out the outstanding debt.

Because countries with large total debt can have strong economies to handle it, well use this ratio when looking at national debt by country in our ranking.

Ready?

All Of The Worlds Money And Markets In One Visualization

The era of easy money is now officially over.

For 15 years, policymakers have tried to stimulate the global economy through money creation, zero interest-rate policies, and more recently, aggressive COVID fiscal stimulus.

With capital at near-zero costs over this stretch, investors started to place more value on cash flows in the distant future. Assets inflated and balance sheets expanded, and money inevitably chased more speculative assets like NFTs, crypto, or unproven venture-backed startups.

But the free money party has since ended, after persistent inflation prompted the sudden reversal of many of these policies. And as Warren Buffett says, its only when the tide goes out do you get to see whos been swimming naked.

Recommended Reading: How Long Does Foreclosure Stay On Credit Report

Other Reasons For National Debt

Other obvious reasons for national debt are more mundane costs which occur as a result of culture and lifestyle.

For example, the healthcare costs in the United States have been rising for years and is one of the highest in the world.

Another reason for rising debt is the economic infrastructure we live in, which relies on productivity in individuals. As people live longer, more money is paid out in pensions.

The sustainability of such expenses largely depends on the countrys economic infrastructure, which in many cases, is lagging behind and adding to rising national debt-to-GDP ratios.

Interested In Trading Commodities

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Recommended Reading: What Happens After Bankruptcy Petition Is Filed

National Debt Of Important Industrial And Emerging Countries In 2021 In Relation To Gross Domestic Product

| National debt in relation to gross domestic product |

|---|

| Japan |

Values have been estimated and rounded.

Citation formats

exclusive corporate function

Get full access to all features within our Corporate Solutions.

Statista Corporate Solutions

- Immediate access to statistics, forecasts, reports and outlooks

- Usage and publication rights

Statista Accounts:$468 / Year

You only have access to basic statistics.

- Instant access to 1m statistics

- in XLS, PDF & PNG format

- Detailed references

Corporate solution including all features.

Do Government Deficits Recover

This situation creates an annual deficit that is unlikely to end until the accumulated debt becomes unsustainable and the governments finances collapse.

Other governments only borrow to stimulate the economy during a recession, calculating that they can repay that debt once expansion returns and produces a government budget surplus.

If the country and its government have a good reputation, the instruments that it issues in order to raise debt to cover a deficit represent a safe investment. See our example on foreign investors in U.S debt.

Governments that run constant deficits to buy votes find it difficult to attract loans.

You May Like: Credit Card Forgiveness Program

The National Debt Affects Everyone

If that forecast were to come to pass, the incremental increase over current debt service costs would be roughly equivalent to the Social Security’s current funding needs at about 5% of U.S. GDP.

This would almost certainly force policymakers to make painful choices, with consequences that would be felt worldwide. It’s also possible this scenario won’t come to pass because of steps taken in order to avoid it, actions likely to have significant effects in their own right. Or the distant future could look more like the recent past, with investors willing to accept minimal Treasury yields based on the available alternatives.

Just as U.S. currency in circulation is a Federal Reserve liability akin to debt, Treasury obligations may be thought of as an interest-bearing currency. And if cash and Treasury debt are equivalent, then the issuance of U.S. government debt is only material to the extent it incurs future debt service costs.

Which Countries Have The Lowest National Debt

Does national debt matter? Is it an indication of financial stability? Not always.

There is only one debt-free country as per the IMF database. For many countries, the unusually low national debt could be due to failing to report actual figures to the IMF.

Another instance where low national debt might be a bad sign is if a countrys economy is so underdeveloped that nobody would want to lend to them.

Here the ten least indebted nations in the world in 2020 as per the IMFs reported data:

| Rank | |

|---|---|

| Congo, Dem. Rep. of the | 16.1% |

| 16.5% |

You May Like: What Are The Consequences Of Filing Bankruptcy

Average Personal Debt By Country

The data below shows how each country fares when it comes to household or personal debts in the year 2020. The data is from the Organization for Economic Co-Operative and Development .

The average personal debt in each country is represented as the percentage of the annual disposable income of each country. The OECD defines disposable income as income available to households such as wages and salaries, income from self-employment and unincorporated enterprises, income from pensions and other social benefits, and income from financial investments .

The list is arranged from the country with the highest average personal debt to the country with the lowest personal debt.

The Largest Pension Funds Ranked

Here are the top 100 pension funds, organized from largest to smallest.

| Rank | |

|---|---|

| U.S. | $54.9B |

U.S. fund data are as of Sep. 30, 2021, and non-U.S. fund data are as of Dec. 31, 2021. There are some exceptions as noted in the graphic footnotes.

Japans Government Pension Investment Fund is the largest in the ranking for the 21st year in a row. For a time, the fund was the largest holder of domestic stocks in Japan, though the Bank of Japan has since taken that title. Given its enormous size, investors closely follow the GPIFs actions. For instance, the fund made headlines for deciding to start investing in startups, because the move could entice other pensions to make similar investments.

America is home to 47 funds on the list, including the largest public sector fund: the Thrift Savings Plan , overseen by the Federal Retirement Thrift Investment Board. Because of its large financial influence, both political parties have been accused of using it as a political tool. Democrats have pushed to divest assets in fossil fuel companies, while Republicans have proposed blocking investment in Chinese-owned companies.

You May Like: How To Buy Truckloads Of Merchandise