Submitting An Electronic Proof Of Claim

A creditor can easily and efficiently submit an electronic Proof of Claim online through the appropriate website for the relevant bankruptcy court for the case. This option does not require a login or password. Supporting documentation may be uploaded and attached to the digital Proof of Claim form.

The contact information and mailing address of the creditor will be automatically added to the courtâs system. This allows the creditorâs claim to be submitted properly within the bankruptcy claims priority matrix of the specific case it pertains to, and ensures important case documents can be served to the correct contact and address of the creditor. By filing electronically, a creditor’s claim becomes immediately recognized in the bankruptcy case. Creditors can print or save their progress electronically to access the claim later, and can also receive confirmation of their submission.

The process of filing an electronic Proof of Claim includes answering a series of questions to ensure the creditor completes the Proof of Claim accurately.

Deadline To File A Proof Of Claim Form In Bankruptcy Chapters 7 12 And 13

The deadline for filing a proof of claim form for nongovernmental creditors in Chapter 7, 12, or Chapter 13 bankruptcy cases is 70 days after the petition filing date. Government entities have additional time and must file a proof of claim within 180 days after the “order for relief” or bankruptcy filing date.

The first notice sent to creditors includes the deadline for filing proofs of claim. This notice informs creditors that a petition has been filed and indicates the date set for the meeting of creditors. This notice also sets the last date they can file objections to the discharge.

Although the court doesn’t usually permit extensions once the deadline has passed, the court has the power to extend the filing time if a creditor shows extenuating circumstances.

Proof Of Claim Requirements For Chapter 11 Bankruptcy

Chapter 11 is solely for companies that plan to reorganize and continue business at the conclusion of the bankruptcy.

Chapter 11 creditors are not required to file a Proof of Claim because the debtor is required to file a Schedule of Assets and Liabilities. If the customers Schedule of Liabilities lists the creditors claim in the correct amount and does not designate the claim as disputed, unliquidated or contingent, the creditor will be able to participate in any distributions for its category .

If the creditors claim is listed incorrectly , or designated as disputed, unliquidated or contingent, a Proof of Claim should be filed. If it is not filed, the Bankruptcy Court will consider the customers Schedule of Liabilities as accurate and make any distributions accordingly.

Don’t Miss: Who Gets Paid First In Bankruptcy

Give Information About The Claim As Of The Date The Case Was Filed

In part 2 of the proof of claim form, describe your claim in a way that will allow the Bankruptcy Judge to understand what you are owed and why.

- Question 7: If possible, identify the precise dollar amount of your claim. Include interest, penalties, and fees.

- If you do not know the precise amount the Debtor owes you, then describe your claim and why you cannot determine the exact amount. This will be the case if you have a lawsuit against the Debtor or have guaranteed an obligation of the Debtors that has not matured. If necessary or helpful, attach additional information that describes a pending lawsuit, legal claims, indemnity claims, guaranty claims, or any other legal theory under which the debtor owes you money.

- Be accurate, and do not exclude any legal theory that gives rise to your right to payment from the Debtor. If you do not include it in your proof of claim, you may or may not be able to amend your claim at a later date.

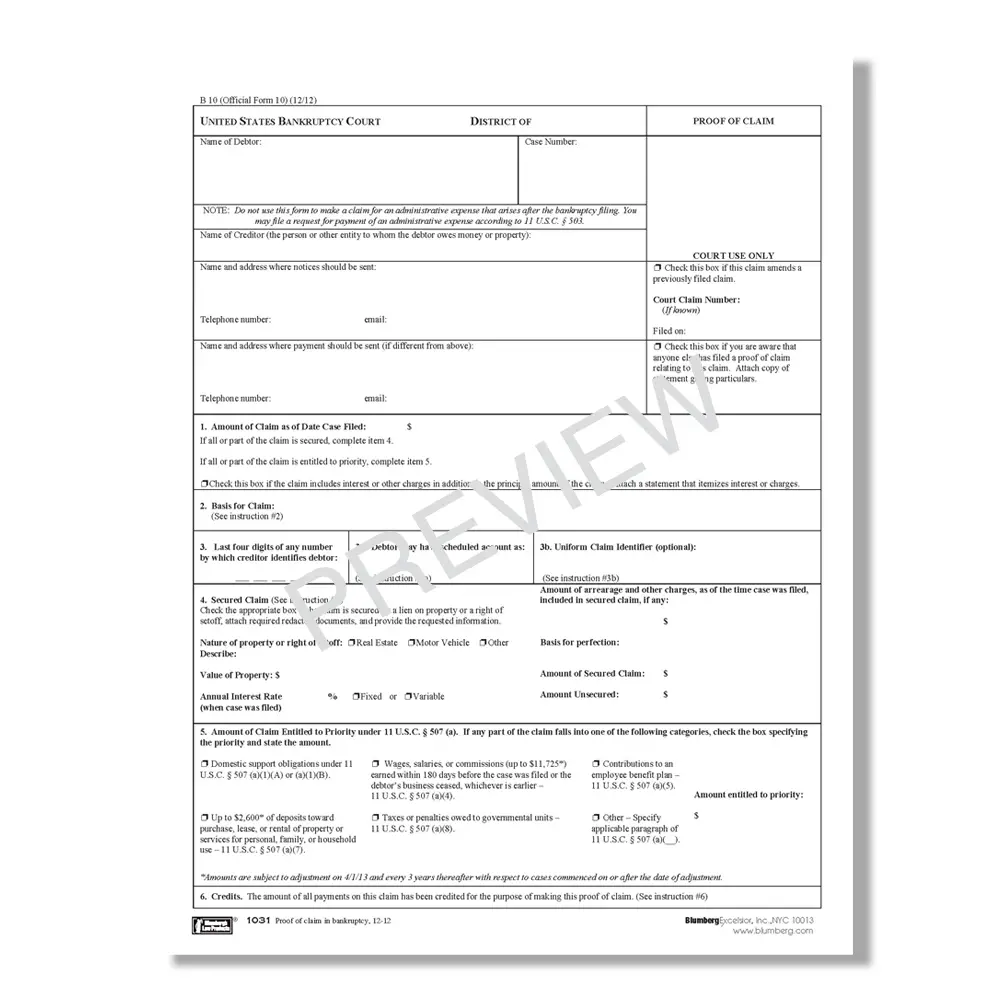

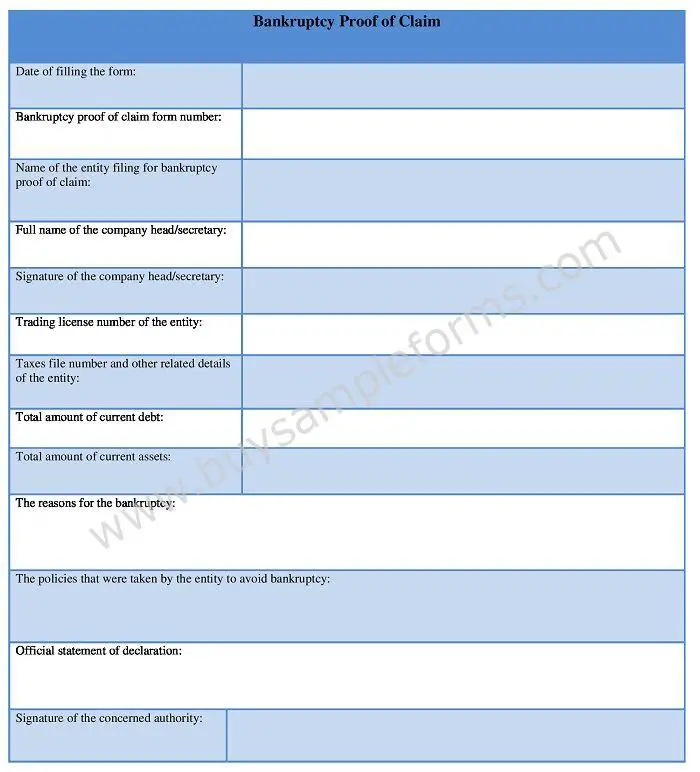

Completing A Proof Of Claim Form

If you receive a Proof of Claim form from the bankruptcy court, use these step-by-step instructions to help you complete the form correctly.

Note: If you receive a bankruptcy notice without a claim form, you can download this blank Proof of Claim form . To help you with some of the information required on this form, be sure to read How to Process a Proof of Claim.

Write the name of the person or company that has filed bankruptcy and owes you payment.

You May Like: Amazon Pallets For Sale Charlotte Nc

Issues For Secured Creditors

A secured creditor who fails to file a proof of claim still may have a lien on the asset attached to its debt. As a result, a debtor will be able to keep that asset only if they keep up with their payments under the loan. This is true even if they filed under Chapter 13 or Chapter 12, which technically allow a debtor to keep all of their assets if they can pay their debts under a repayment plan. To address this problem, the debtor can file a proof of claim on the creditors behalf. The bankruptcy trustee then will set aside funds from the debtors monthly payments to pay off the secured creditor. Or the debtor can make payments directly to the creditor, but this is uncommon because a debtor usually has no money left over to cover anything beyond necessities and plan payments.

Last reviewed October 2022

Objecting To A Proof Of Claim

With Chapter 7, if any proofs of claim are actually submitted, usually only the trustee can object to the filed claim. Usually, the filer doesnât have a stake in whether a particular creditor gets paid, so they donât have any standing to file the objection. They canât win or lose anything if a creditor files a proof of claim, so they canât argue against the creditorâs claim.

However, if the filer does have enough money to pay off all the claims, and still have money returned to them, they have something at stake. In this case, the filer does have standing, or the ability to object. Even though this isnât normally the situation with Chapter 7 cases, it does happen.

Unlike Chapter 7 Bankruptcy, in Chapter 13 cases, the filer usually pays a small amount to most, or all of their creditors over a three- or five-year period. With Chapter 13 Bankruptcy cases, the proofs of claim are more than a formality. The filer makes monthly payments to the trustee, who divides money up among the creditors. Because the filer does have something at stake, they should review and, if necessary, file an objection to the proofs of claim.

Itâs less important to file proof of claim papers for unsecured creditors in this case, because theyâll receive a portion of whatever is left each month, and their debts will be discharged at the end of your Chapter 13 plan.

Don’t Miss: When Does A Bankruptcy Come Off Your Credit

Electronic Filing Of Proof Of Claim

Effective Tuesday, November 12, 2013, proofs of claim may be created and electronically filed through the Courts website, except in cases where there is a Claims and Noticing Agent assigned. The electronic filing of proofs of claim and amended proofs of claim is strongly encouraged.

-

A Proof of Claim may be filed electronically for all chapters, except cases with a claims and noticing agent. A login and password is not required.

-

The name and complete address of the creditor must appear on the proof of claim form. If an attorney is filing the claim on behalf of a creditor, the attorney should also enter his/her name and address. The name and title, if any, of the person authorized to file the claim is required on the claim form.

-

Please do not upload a completed Proof of Claim as an attachment to the electronically filed claim. Attaching a completed Proof of Claim will result in multiple versions of the Proof of Claim to be filed. If filing an Amended Proof of Claim, the attachment of the previously filed claim is allowed.

The filing of a proof of claim electronically on this courts website shall constitute the filers approved signature and have the same force and effect as if the individual signed a paper copy of the document and the provisions of 18 U.S.C. § 152 shall apply to such filing.

Penalty for filing a fraudulent claim:

Fine of up to $500,000 or imprisonment for up to 5 years, or both. 11 U.S.C. §§ 152 and 3571.

Need More Bankruptcy Help

Did you know Nolo has been making the law easy for over fifty years? It’s trueâand we want to make sure you find what you need. Below you’ll find more articles explaining how bankruptcy works. And don’t forget that our bankruptcy homepage is the best place to start if you have other questions!

|

Our Editor’s Picks for You |

|

More Like This |

Read Also: How To File Chapter 7 Bankruptcy In Washington State

A Creditor Will Need To File A Proof Of Claim Form If Any Of The Following Problems Exist On The Debtors Schedule Of Assets And Liabilities:

- The category of debt is incorrect

- The amount listed is not correct

- The creditor is not listed

- The claim is designated as disputed, unliquidated, or contingent

Even if you are not technically required to file a proof of claim form in a chapter 11 bankruptcy, doing so can provide you with important benefits. For example, the proof of claim will supersede the information regarding the claim that the debtor listed in their schedule of assets and liabilities. Additionally, if you do not file a proof of claim form, the bankruptcy court will accept the information the debtor listed. Filing your form allows you to dispute any inaccuracies in the debtors schedules.

What Is A Proof Of Claim In Bankruptcy

5 minute read â¢Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

A proof of claim is what creditors are required to submit to the bankruptcy court before they can receive any money from the bankruptcy trustee. Itâs the creditorsâ way of saying, âIâm owed money, and here is how much, and why.â The trustee and the person who filed bankruptcy are given an opportunity to review and may object to any proof of claim that is filed in the case. Letâs take a closer look at how this all works.

Written byAttorney Amelia Niemi.

A proof of claim is what creditors are required to submit to the bankruptcy court before they can receive any money from the bankruptcy trustee. Itâs the creditorsâ way of saying, âIâm owed money, and here is how much, and why.â The trustee and the person who filed bankruptcy are given an opportunity to review and may object to any proof of claim that is filed in the case. Letâs take a closer look at how this all works.

Read Also: How Much Is A Bankruptcy Lawyer In Ny

When To File A Proof Of Claim

In a Chapter 7 case, if the bankruptcy trustee finds assets of the debtor that he or she can sell or liquidate, he will notify the creditors that there will be a distribution. In that case, you will be notified of a deadline to file a proof of claim form a form you must file if you wish to be considered for payment. If you don’t, no payment will be made, even if the claim is valid.

In a Chapter 13 case, you will have to file your claim form 90 days after the meeting of creditors. You will not be paid unless you file a proof of claim. If your debt is secured, but you file no claim form, the debtor can file one for you to ensure you’re paid. When that happens, you have no control over what the debtor includes in the form, but you can amend it.

You May Need To File This Form If You Are A Creditor In A Bankruptcy

Adene Sanchez / Getty Images

Are you a in a bankruptcy case? Just because your borrower has filed bankruptcy doesn’t mean you’ll never see a penny. In many casesparticularly a Chapter 7 bankruptcythe court will find no assets it can liquidate to pay your debt. In other cases, like a Chapter 13 case, the debtor makes monthly payments for three to five years. So you will have a fair chance of getting something out of it, but only if you take the time to fill out, document, and file a proof of claim form.

This article will help guide you through the form if you’ve been named as a creditor in a bankruptcy case.

You May Like: How To File For Bankruptcy In Nj

If This Claim Replaces Or Amends A Previously Filed Claim:

If this takes the place of or changes a Proof of Claim already filed, check the appropriate box and list the appropriate date filed.

Note: You can amend a previous Proof of Claim, if you:

- Over- or under-estimated your claim

- Omitted a portion of your claim

- Have been paid for your claim

Check the box, note that youre amending it here and list the date filed. As long as your previous claim was well documented and filed in good faith, you wont be penalized.

- Basis for claim: Check the box that correctly describes what payment is owed for

- Date debt was incurred: Enter the date the product was purchased or the service was used.

- If court judgment, date obtained: If the claim is based on a state court judgment, write the judgment date here.

- Total amount of claim at time case was filed: Enter the dollar amount of money owed here.

- If all or part of claim is secured, complete Item 5 or 6 below: See further explanation in 5 and 6.

- Check this box if claim includes interest or other charges: After checking the box, attach a document itemizing the interest and additional charges.

How To File A Proof Of Claim Amendment

A Creditor is not limited in the amount of times they can amend their bankruptcy claim, even if the changes are made subsequent to the Bar Date. If a creditor discovers additional funds that are owed or come to find that a mistake has been made in the original filing, a new Proof of Claim form can be completed and filed.

In order to file a Proof of Claim amendment, simply download a blank Proof of Claim document and fill it out accordingly. Make sure to enter the original bankruptcy claim number into the designated field called âAmendment Claim #â and reference the appropriate bankruptcy case number along with the Debtor Name. Each additional time an amendment is filed on a particular bankruptcy claim, it is required to enter the previous Amendment Claim Number.

Generally, it is recommended to file a Proof of Claim as soon as possible and as often as needed. Do not hesitate to file for an amendment on a bankruptcy claim if a mistake is discovered, or additional claim amounts are owed. The amendment will serve to keep the court records accurate and up to date in the bankruptcy proceedings, especially when rulings are made pertaining to creditor voting rights, and eventual payout distribution.

Don’t Miss: How To File Bankruptcy In Mn

Classification Of A Bankruptcy Claim

Secured Claim vs Unsecured Claim

An essential aspect in filing the Proof of Claim is to determine whether a bankruptcy claim falls into one of two classifications: Secured or Unsecured. What is the difference?

Under 11 U.S.C. §506, a secured claim is debt that is supported by collateral or a lien on a specific property of the Debtor. The classification of secured claims are given priority in the bankruptcy claims process, meaning they have the right to be paid from the available funds or bankruptcy estate before other Creditor classes are paid out . The amount listed in a secured claim typically cannot exceed the value of the collateral or specific property on which a Creditor has a lien. The additional amount owed that exceeds the value of the collateral or property will be treated as an unsecured claim.

Conversely, an unsecured claim is by definition one that does not meet the requirements of a secured claim. Simply put, unsecured claims are debts that are not guaranteed by collateral or a lien on the Debtorâs assets.

Priority Claim vs Non-Priority Claim

For creditors with an unsecured claim, it is also imperative to determine whether their unsecured claim is considered a priority claim or non-priority claim. How can this be determined?

Bar Date For Proofs Of Claim

The Bar Date is the last date creditors may file Proofs of Claim against the customer.

Notice of the Bar Date is given in the formal Notice of Bankruptcy filing issued by the Bankruptcy Court clerk. The Notice will usually include the Proof of Claim form and instructions for completing it.

Proofs of Claim filed after the Bar Date are not generally given any consideration by the Bankruptcy Court. Some exceptions are allowed, however.

What if you miss the filing date?

If you fail to file a Proof of Claim by the Bar Date, and your relationship with the customer is still good, you can request that the customer file the claim for you. However, in most cases, the burden will fall on you to convince the Court that you had a legitimate reason for missing the deadline. Ignorance of the law or the excuse that The Bankruptcy Notice was never received is usually not considered adequate.

According to a Supreme Court decision in 1993, there are four factors that determine whether late filings are excusable: whether allowing the late claim will prejudice the debtor the length of the delay in filing the claim and the resulting potential impact on the judicial proceedings the reason for the delay, including whether the delay was within the reasonable control of the creditor filing the claim and whether the creditor that filed the claim acted in good faith.

What if the debtor objects to your claim?

Recommended Reading: Should I File For Bankruptcies