The Populist Backlash In Chapter 11

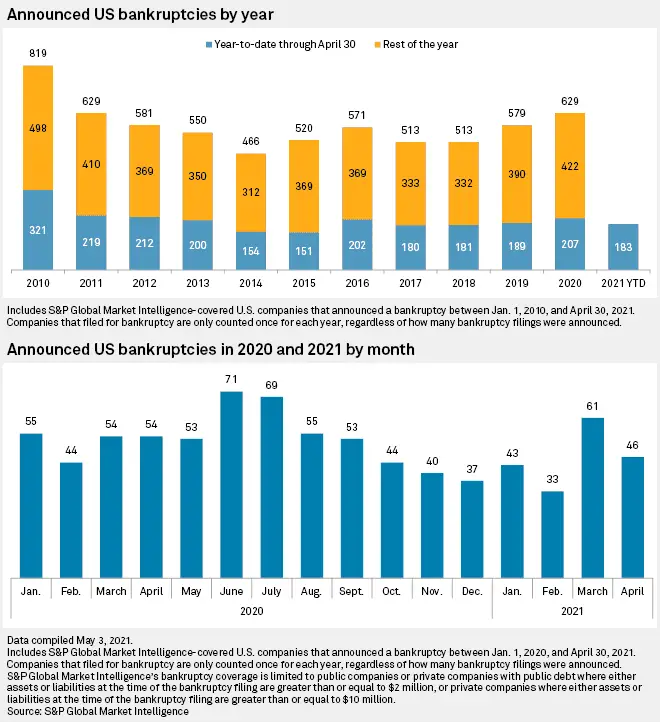

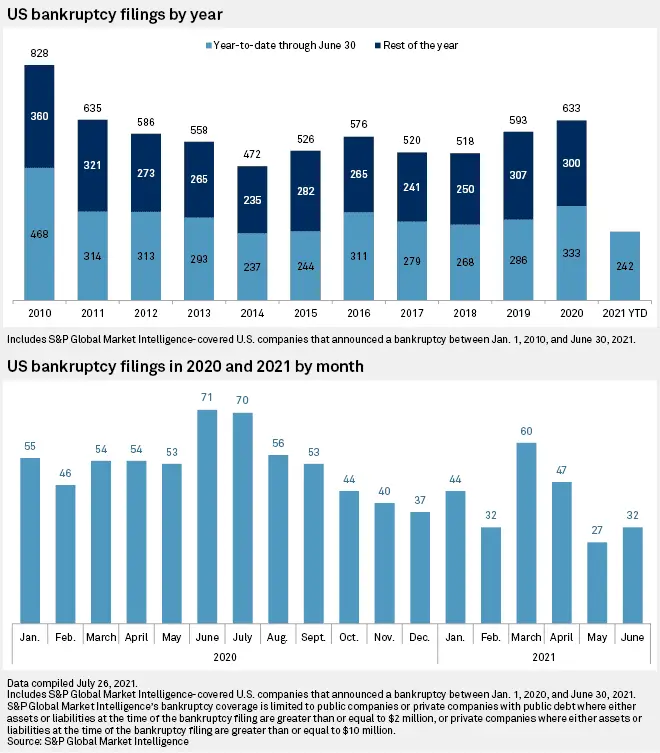

From a bankruptcy perspective, the pandemic has unfolded differently than many expected. Prior economic crises have caused sharp upswings in bankruptcy filings. The 2007-2009 crisis was true to form, with business bankruptcy filings doubling during this time, to 60,837 in 2009 from 28,322 in 2007.1 Given that governments almost completely shut down the American economy in 2020, an even greater surge seemed likely. Many observers predicted a massive wave of bankruptcies.2 Bankruptcy scholars and bankruptcy organizations sprang into action, calling for Congress to increase the capacity of the bankruptcy system and to assure access to financing for companies that filed for bankruptcy.3

How Do You File For Business Bankruptcy

Sole proprietors are the only business entity that can legally file for business bankruptcy without an attorney. Still, no business owner should file for bankruptcy on their own. The filing process is too arduous to be handled by someone simultaneously trying to run a business.

Step one is filing an official bankruptcy petition in https://www.uscourts.gov/about-federal-courts/court-role-and-structure your businesss local jurisdiction of the US Bankruptcy Court and paying the filing fee for your type of bankruptcy. This is followed by a slew of paperwork that depends on the type of bankruptcy and your business entity.

Why Do Businesses File For Bankruptcy

A myriad of circumstances can render a business unable to repay their debts. What makes bankruptcy different than other possible solutions to this problem is the opportunity to start fresh. The debts you are unable to pay are forgiven, and your creditors are given some degree of compensation.

In other words, any debts you incurred before the filing are eliminated once the bankruptcy case comes to an end.

You May Like: What Debts Are Included In Bankruptcy

Bankruptcy Filings During And After The Covid

Economists have long argued that economic activity influences businesses filing for bankruptcy. This relationship is grounded in the simple idea that economic downturns can sufficiently reduce liquidity such that debtors are unable to meet debt obligations as they become due and might require court-driven solutions.

Indeed, in the past two years a lengthy list of companies filed for bankruptcy in a wide array of industries, including: retail, commercial real estate, leisure and travel, air travel, restaurant and food service, energy, and communications.

What Is Small Business Bankruptcy

Bankruptcy is a legal process available if you are unable to repay your debts. Through business bankruptcy, eligible companies debts are eliminated or put on a repayment plan. Creditors receive a portion of debt repayment through the debtors available assets.

Both individuals and businesses can file for bankruptcy. In 2020, there were 22,482 business bankruptcies and 659,881 non-business bankruptcies for a total of 682,363.

Bankruptcy has the potential to wipe out all the debts you list when filing. But, not all debts are eligible to be forgiven through bankruptcy. Debts you may still owe after successfully filing for bankruptcy include tax claims.

You May Like: Which Kind Of Bankruptcy Proceeding Is Considered A Liquidation Proceeding

What Is Chapter 7 Business Bankruptcy

Chapter 7 business bankruptcy is designed for businesses that cannot repay their debts because they can no longer maintain operations and earn revenue. The company shuts down so the court-appointed trustee can liquidate its assets and repay the creditors. All directors and employees are dismissed.

The liquidation process is pretty simple. Most Chapter 7 filers owe debts to multiple creditors. Thus, the trustee divides the businesss assets to compensate each creditor for the amount owed. Thanks to federal and state bankruptcy exemption laws, creditors cannot seize certain types of personal assets. For example, you probably wont have to give up full ownership of your home or vehicle under Chapter 7 bankruptcy.

Though all business entities can legally file Chapter 7, most filers are reportedly sole proprietors. This is because only sole proprietors are eligible to receive whats known as a debt discharge after filing Chapter 7. If you are discharged from a business debt, you will no longer be responsible for paying it back, even if the original agreement included a personal guarantee. Thus, the creditor cannot seize your personal assets.

Discharges are not available to corporations, LLCs, and partnerships. When owners of these business entities sign a personal guarantee on a loan, filing for Chapter 7 wont protect them from having their personal assets seized if they cant pay off the debt.

What Are The Three Types Of Business Bankruptcy

Chapter 7 is the only form of business bankruptcy that is legally available to all types of businesses. You dont have to meet any requirements to file.

However, chapters 11 and 13 are only available for certain types of businesses and carry specific requirements.

Each type also has a unique legal process and can result in different outcomes for the business at hand. Heres what happens when a business owner files for each of the three types:

Read Also: Free Foreclosure Listings Ct

Business Bankruptcy: Additional Tips

As you can see, business bankruptcy isnt always a death sentence. But thats no reason to take this decision lightly in any way. Business bankruptcy should only enter the discussion when you have no other possible options for repaying your debts.

Filing for bankruptcy can negatively affect numerous aspects of your life, not just your personal credit or financing eligibility.

For example, once you file bankruptcy forms to the court, your bankruptcy becomes public record. If you are considering filing, get ready to explain your decision to different people time and time again. Its relatively safe to assume that anyone who should know about your bankruptcy will eventually know. This includes competing businesses, employees, family members, and potential employers.

Depending on your desired field, having a bankruptcy on your record can make it very difficult to get a job. You should probably steer clear of the finance industry or any industry with comprehensive employee screening policies, like law enforcement. Rebuilding your reputation and sense of confidence after filing for bankruptcy could be one of the most stringent tests of your career.

The Running List Of 2021 Retail Bankruptcies

The pace of bankruptcies in retail hit a high-water mark last year, after years of elevated filings that tracked with a major shakeout in the industry.

In the years leading up to 2020, those retailers that were forced to reorganize, sell themselves or liquidate entirely were typically the heavily indebted, often from private equity buyouts. The pandemic’s massive disruption to sales and consumer demand brought financial strain, and sometimes ruin, to a much wider swath of the industry. Retailers that might have chugged along for years filed as they ran into liquidity shortages or faced eviction over unpaid rent.

COVID-19 is still with us. So are all of its consumer habit-changing effects. While millions have already been vaccinated, with the number jumping every day, millions more are still avoiding offices, parties, travel and all manner of other social events. The tide could shift over the course of the year, which means consumers could start refreshing their wardrobes and return to stores in greater numbers. But there are still many unknowns in the year ahead.

Retail companies are still under strain. According to BDO survey data, 42% of retail CFOs reported that they expect to restructure or reorganize as fallout from the COVID-19 pandemic persists into 2021. That can mean a lot of things, but it includes bankruptcy. A similar share of CFOs said they expect revenue declines in the year ahead.

| Retailer |

|---|

Also Check: How To File For Bankruptcy In Australia Yourself

Eligibility For Chapter 11 Or Chapter 13 Bankruptcy

Virtually anyone can file for Chapter 11 bankruptcy, but all small businesses are ineligible to file for Chapter 13 except for sole proprietors. Here’s how it works.

Chapter 13 eligibility. Chapter 13 is available to individuals and sole proprietors with regular income. Small companies formed as corporations, partnerships, or other entities aren’t eligible for Chapter 13 relief. However, that’s not to say that someone who owns a business can’t file an individual Chapter 13, and sometimes doing so helps.

Most filers’ plans direct income toward the debts filers want to be paid most, like mortgages, car loans, equipment payments, and other secured obligations. Filers pay significantly less toward credit card debt, medical bills, and unsecured personal loans. Also, business debts you’re personally liable for will be included in your plan.

However, not everyone qualifies for Chapter 13. You’ll need sufficient income to support a Chapter 13 plan and will be subject to debt limitations that change periodically and other Chapter 13 eligibility requirements.

As of April 1, 2022, a filer’s debt can’t exceed $1,395,875 in secured debt and $465,275 in unsecured debt. These figures apply to cases filed between April 1, 2022, and March 31, 2025.

Chapter 11 Subchapter V is limited to “small business filers” with a total debt burden of $3,024,725 or less .

Learn about other options for struggling businesses in Small Business Bankruptcy.

Chapter 11 Proceedings: Pros And Cons

Chapter 11 cases are complex and expensive, which is the most significant disadvantage for small business owners. It’s also why Chapter 11 cases make up only a tiny percentage of bankruptcy cases filed. However, special procedures available to small businesses through Chapter 11, Subchapter V can help lower costs significantly.

Important Chapter 11 advantages include:

- The plan creates new contract terms between the debtor and creditors and can be as long as needed, which is helpful for a small business debtor who needs extended payment terms on real property mortgages or equipment loans.

- If less than the full balance on a particular debt is to be paid in the plan, the debt discharge will occur at plan confirmation rather than after completion of the plan, unless the court approves a plan without creditor consensus in Chapter 11, Subchapter V cases.

- Unlike Chapter 13, Chapter 11 doesn’t require debtors to turn over their disposable income to a trustee. The “debtor in possession” remains in control of the business.

- In Chapter 11, the appointment of a trustee to manage the case is the exception rather than the rule and is usually appointed when gross mismanagement or fraud is suspected.

Also, small business debtors can take advantage of special provisions that help streamline Chapter 11 matters. You’ll qualify as a small business debtor under Chapter 11, Subchapter V if you’re an individual or entity who is:

For more information, see Chapter 11 Bankruptcy: An Overview.

Read Also: Can You File Bankruptcy While On Social Security

Filing Bankruptcy As A Partnership

Partnerships are formal arrangements between two or more parties for the management and operation of a business. But technically, a partnership does not exist as a separate legal entity it simply describes the association of the partners.

In good times, partners share in the profits. In bankruptcy, they may well share in the obligation to satisfy debts. It all hinges on the structure of the partnership.

The partnership that files for Chapter 7 bankruptcy, whatever the setup, is in for a rough ride, resulting in the loss of investments, lawsuits outside bankruptcy court, and the likely collapse of the partnership itself.

Thinking of trying the Chapter 13 reorganization path? Good luck with getting creditors to accept a long, drawn-out partial repayment plan if some combination of the partners has sufficient personal assets to pay off all the partnerships debts. An alert creditor may attempt to move the case into Chapter 7 to recover all its owed, rather than some reduced portion.

Thats the reason most partnership agreements contain a poison pill clause: The moment one partner files for bankruptcy, the business dies, preventing trustees or creditors from suing other partners to recover debts.

Consumer Bankruptcy In The Age Of Covid

Alan C. Hochheiser

The last year and half was a time to be remembered in Bankruptcy Law. It started with an eye on increasing the ability of small businesses to utilize the Chapter 11 process in a more efficient and less expensive way, which led to record number of commercial filings, a reduction in consumer filings, and a test of the bankruptcy system. What will the second half of 2021 look like? This article will walk you through Consumer Bankruptcies in the age of COVID-19. The article will discuss the filing trends, Supreme Court cases , proposed legislation and the arena of consumer protection cases in bankruptcy proceedings.

In 2020, the total number of bankruptcy filings was 544,463. This was approximately 230,000 fewer filings then in either 2018 or 2019. Only Chapter 11 filings increased in 2020 to 8,113. This was almost a 1,300-case increase from 2019. This reduction of cases overall during the pandemic could be due to several factors, including:

- the foreclosure and eviction moratorium ,

- many financial institutions scaling back on vehicle repossessions

- collection agency restrictions on the type of debt that could be collected,

- closing of courts around the country, and the corresponding inability to obtain and execute on judgments,

- increased unemployment benefits to laid off individuals, and

- the stimulus checks.

For more business law content, visit businesslawtoday.org.

Also Check: Can You Discharge Private Student Loans In Bankruptcy

Reasons To File Business Bankruptcy

If your business is failing, bankruptcy might be your best option. You might file for bankruptcy to:

So, what causes bankruptcy in business? You may be left with small business bankruptcy as a result of:

- Poor market conditions

Bankruptcy Filings May Increase: Know Your Options Now

NYC bankruptcy attorney at the Law Office of William Waldner whose sole focus is in the areas of chapter 7 and chapter 13 bankruptcy cases.

Getty

For all its ups and downs or perhaps its downs and downs 2020 had one odd outlier of positivity: there were fewer bankruptcy filings by both businesses and individuals than in 2019 and fewer than had been projected before the pandemic took hold. As last year wasn’t exactly normal, especially for small businesses and their owners, the unexpectedly low rate of bankruptcies is all the more surprising.

There are several factors that likely played a role here. Landlords and lenders have been more flexible than usual as shutdowns hit everybody unexpectedly, and the stock market has been more resilient this year than in our last major downturn, too. Both of these have made it easier to keep the lights on, at home and at work. Legislation like the CARES Act and other pandemic-related assistance programs also provided a boost, with loans, eviction moratoriums and unemployment payments helping many stave off dissolution.

If you’re among the small business owners contemplating a bankruptcy for your business or as an individual here’s why a potential bankruptcy boom might matter for you and what you can do about it.

You May Like: When Do You File For Bankruptcy

Chapters 11 And 1: Process

Once your local jurisdiction receives your official petition, you can then file your reorganization plan. In addition to your repayment strategy, your plan must include details about your businesss liabilities, assets, and current partnerships . Its relatively similar to the lengthy business plans required for traditional business loans.

If your creditors approve your reorganization plan, a date for a confirmation hearing will be set. Its here where the bankruptcy court will either accept or reject your proposed plan. If approved, you can continue running your business and put your reorganization plan into action. From the moment your plan is approved until all debts are paid off, the bankruptcy court must approve virtually all business decisions.

You will also probably have to send financial statements to the court periodically. This will prove that you follow the strategies laid out in your plan and are on track to achieving your repayment goals.

What Is Chapter 11 Business Bankruptcy

Chapter 11 business bankruptcy is designed for businesses struggling with debt but not to the point where they cannot maintain operations and earn revenue. The filing allows them to negotiate new arrangements with creditors that must be approved by the bankruptcy court. For example, the bankruptcy court might approve a proposal to extend the terms of a business loan from five years to ten. The plan would have to be approved by the creditor as well.

Thanks to these new arrangements, the business can repay its debts while maintaining operations and gradually regaining profitability.

To file Chapter 11, your business must prove that it is currently generating steady revenue. You must also submit a reorganization plan that outlines your strategy for repaying your debts and when you expect each debt to be paid off in full. Common examples of such strategies include selling off assets, re-financing long-term debts, taking out business loans, or selling ownership shares. The bankruptcy court must approve your reorganization plan along with your creditors.

Don’t Miss: Bank Owned House For Sale

Reorganization Benefits For Small Business Owners

Chapters 11 and 13 both allow debtors to propose a plan to restructure their finances, which can help a company stay in business. If you qualify, a Chapter 11 or a personal Chapter 13 plan can:

- allow you to retain property needed to operate your business

- give you time to sell assets you don’t need or can’t afford to keep

- modify payment terms on secured debts , and

- discharge obligations you can’t pay over the plan term .

Keep in mind that a business can’t file Chapter 13 . But even so, a small business can benefit from an owner filing for Chapter 13 because it can free up cash, which is why some small business owners choose Chapter 13 over Chapter 11.