Us Federal Debt Since 1900

Chart D.13f: Federal Debt since 1900

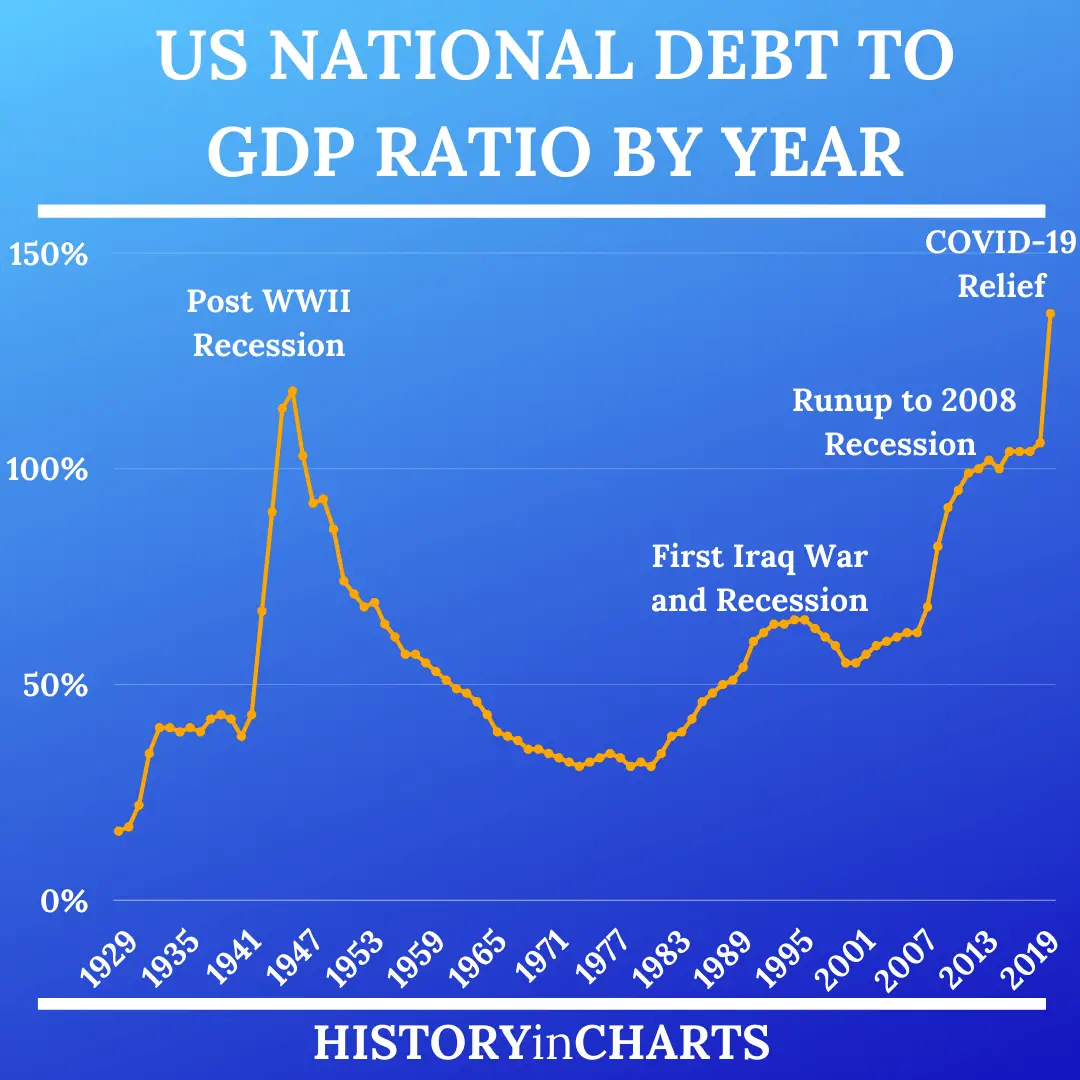

Federal debt began the 20th century at less than 10 percent of GDP. It jerked above 30 percent as a result of World War I and then declined in the 1920s to 16.3 percent by 1929. Federal debt started to increase after the Crash of 1929, and rose above40 percent in the depths of the Great Depression.

Federal debt exploded during World War II to over 120 percent of GDP, and then began a decline thatbottomed out at 32 percent of GDP in 1974. Federal debt almost doubled in the 1980s, reaching 60 percent of GDP in 1990 andpeaking at 66 percent of GDP in 1996, before declining to 56 percent in 2001. Federal debt started increasing againin the 2000s, reaching 70 percent of GDP in 2008. Then it exploded in the aftermath of the Crash of 2008, reaching 102 percentof GDP in 2011.

Federal debt has breached 100 percent of GDP twice since 1900: during World War IIand in the aftermath of the Crash of 2008.

Tracking The Federal Deficit: October 2018

Analysis of Notable Trends in October 2018:The Congressional Budget Office reported that the federal government generated a $98 billion deficit in October, the first month of Fiscal Year 2019. Octobers deficit is 56 percent higher than the deficit recorded a year earlier in October 2017. Total revenues increased by 7 percent , while spending increased by 18 percent , compared to a year earlier.

Methodological Note:

The monthly tracker entries report preliminary spending, revenue, and deficit data from the Congressional Budget Offices Monthly Budget Reviews that are published throughout each fiscal year . These summaries are released around the fifth business day of each month and preview the release of official budget data from the Treasury Department, which is released around the eighth business day of each month . Historically, CBOs preliminary data is accurate, often differing from Treasurys final figures by only a few billion dollars, if at all. For example, CBO preliminarily reported that the total FY2019 deficit was $984 billion in their September 2019 review, matching the official figure Treasury reported later.

The deficit tracker graphic is updated retroactively with official Treasury data the monthly text entries are not.

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

National Debt Vs Budget Deficit

Its important to understand the difference between the federal governments annual budget deficit and the national debt. The federal government generates an annual deficit when its spending over the course of a year exceeds government revenue from sources including taxes on personal income, corporate income, and payroll earnings.

When annual congressional appropriations exceed federal revenue, the U.S. Treasury finances the deficit by issuing Treasury bills, notes, and bonds. These Treasury products may be purchased by investors including individuals and pension funds banks, insurers, and other financial institutions and the Federal Reserve as well as foreign central banks.

A countrys national debt is the sum of such annual budget deficits and any offsetting surpluses. It is the total amount of money that a country owes .

Don’t Miss: How Do You Get A Copy Of A Bankruptcy Discharge

Tracking The Federal Deficit: January 2020

The Congressional Budget Office reported that the federal government generated a $32 billion deficit in January, the fourth month of fiscal year 2020. Januarys deficit is a $40 billion change from the $9 billion surplus recorded a year earlier in January 2019. Januarys deficit brings the total deficit so far this fiscal year to $388 billion, which is 25% higher than the same period last year . Total revenues so far in FY2020 increased by 6% , while spending increased by 10% , compared to the same period last year. (After accounting for timing shifts, spending rose by 6% or $90 billion.

Analysis of Notable Trends in This Fiscal Year to Date: Through the first four months of FY2020, revenue from corporate income taxes rose by 27% . Additionally, Federal Reserve remittances increased by 14% partly due to lower short-term interest rates that reduced its interest expenses. On the spending side, after accounting for timing shifts, total Social Security, Medicare, and Medicaid outlays rose by 6% . Outlays for the Department of Defense rose by 7% , largely for procurement and research and development.

How The Debt Compares To Gdp Plus Major Events That Impacted It

![US National Debt (And Related Information) [OC] US National Debt (And Related Information) [OC]](https://www.bankruptcytalk.net/wp-content/uploads/us-national-debt-and-related-information-oc-national-debt.png)

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The U.S. national debt grew to a record $31.12 trillion in October 2022. It has grown over time due to recessions, defense spending, and other programs that added to the debt. The U.S. national debt is so high that it’s greater than the annual economic output of the entire country, which is measured as the gross domestic product .

Throughout the years, recessions have increased the debt because they have lowered tax revenue and Congress has had to spend more to stimulate the economy. Military spending has also been a big contributor, as has spending on benefits such as Medicare. In 2020 and 2021, spending to offset the effects of the COVID-19 pandemic also added to the debt. In 2022, tax increases on the wealthy and corporations decreased the future debt outlook, but student loan forgiveness increased it.

One way to look at the national debt is by comparing it to GDP each year, as well as other major events that have impacted it. Below, we’ll dive into the U.S. national debt per year and what caused it to grow over time.

You May Like: Income Debt Ratio For Mortgage

Are The National Debt And The Budget Deficit The Same Thing

No, the deficit and the national debt are different things, although related. The national debt is the sum of a nations annual budget deficits, offset by any surpluses. A deficit occurs when the government spends more than it raises in revenue. To finance its budget deficit, the government borrows money by selling debt obligations to investors.

Tracking The Federal Deficit: December 2019

The Congressional Budget Office reported that the federal government generated a $15 billion deficit in December, the third month of fiscal year 2020. Decembers deficit is 7% higher than the deficit recorded a year earlier in December 2018. Decembers deficit brings the total deficit so far this fiscal year to $358 billion, which is 12% higher than the same period last year. Total revenues so far in FY2020 increased by 5% , while spending increased by 7% , compared to the same period last year.

Analysis of Notable Trends in This Fiscal Year to Date: Through the first three months of FY2020, revenue from excise taxes fell by 33% , relative to the same period in 2018, due to a one-year moratorium of the tax on health insurance providers . Conversely, revenue from customs duties increased by 18% as a result of additional tariffs imposed by the current administration, primarily on imports from China. On the spending side, outlays for Department of Defense programs rose by 10% , mostly for procurement. Additionally, Fannie Mae and Freddie Mac began making smaller payments to the Treasury in order to replenish their capital reserves, resulting in an an 88% decline in net payments .

Also Check: Houses Foreclosure For Sale In Florida

Tracking The Federal Deficit: May 2020

The Congressional Budget Office reported that the federal government ran a deficit of $399 billion in May, the eighth month of fiscal year 2020. This represents almost double the monthly deficit recorded in May 2019. So far this fiscal year, the budget deficit has mounted to $1.88 trillion, more than two-and-a-half times as large as at this point last year . Total revenues so far this fiscal year are down 11% compared to the same point last year, while outlays are up 29% .

Analysis of notable trends: CBO notes that the fiscal year so far can be split into two distinct parts: one before the new coronavirus had affected economic output and federal finances and one in which the pandemic had ravaged both . In the pre-coronavirus part of the year, outlays and revenues were each higher than at the same point last year. During the past two months, however, outlays soared while revenues evaporated .

Outlays have surged in response to the health emergency itself and the resulting economic fallout: for example, spending on unemployment insurance soared from $2 billion last May to $93 billion this May spending on refundable tax credits surged from $3 billion last May to $53 billion this May outlays from the Small Business Administration rose from $98 million last May to $35 billion this May and spending on the Public Health Social Services Emergency Fund climbed from $250 million last May to $27 billion this May.

Consequences Of Growing National Debt

Japans experience shows that sovereigns can incur a surprising amount of debt if the countrys central bank is willing to monetize the borrowing, and as long as it doesnt stoke inflation.

But even if the remote risk of default is discounted, rising debt imposes higher interest costs, especially when interest rates rise. The CBO expects the U.S. governments net interest costs to triple over the next decade, reaching $1.2 trillion annually by 2032.

That will force lawmakers to decide between running even larger deficits just to keep spending and revenue constant, or some combination of spending cuts and revenue increases.

If the choice is even larger deficits, bond buyers might require higher yields to compensate them for the resulting increase in risk. Or they may not if slowing economic growth prompts investment flows into fixed income amid expectations of lower interest rates.

Don’t Miss: Free Bankruptcy Credit Counseling

How To Look At The National Debt By Year

It’s best to look at a country’s national debt in context. During a recession, expansionary fiscal policy, such as spending and tax cuts, is often used to spur the economy back to health. If it boosts growth enough, it can reduce the debt. A growing economy produces more tax revenues to pay back the debt.

The theory of supply-side economics says the growth from tax cuts is enough to replace the tax revenue lost if the tax rate is above 50% of income. When tax rates are lower, the cuts worsen the national debt without boosting growth enough to replace lost revenue.

Tracking The Federal Deficit: October 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $284 billion in October, the first month of fiscal year 2021. This deficit is the difference between $238 billion of revenue and $522 billion of outlays. Because November 1 fell on a weekend this year, however, certain payments that would normally be made in November were instead shifted to October, increasing the size of this months deficit. Without those payments, Octobers deficit would have been $230 billion.

Either way, this Octobers deficit is a large increase from last Octobers figure of $134 billion. The year-over-year surge in the deficit is the sum of slightly lower revenues3% lower than last October, mostly due to lower receipts of individual income taxesand much greater outlays37% greater than last October , mainly because of the ongoing response to the COVID-19 pandemic and its economic fallout.

FY2020

You May Like: Can Irs Debt Be Discharged In Bankruptcy

Budget Deficit By Year Since 1929

The deficit since 1929 is compared to the increase in the debt, nominal GDP, and national events in the table below.

The national debt and GDP are given as of the end of the third quarter of each year unless otherwise notedspecifically, September 30. The date coincides with the budget deficit’s fiscal year-end. GDP for years up to 1947 isn’t available for the third quarter, so annual figures are used.

The first column represents the fiscal year, followed by the deficit for that year in billions. The next column is how much the debt increased for that fiscal year, also in billions. The third column calculates the deficit-to-GDP ratio. It indicates that there was a surplus if numbers are in parentheses. The fourth column describes events that affected the deficit and debt.

GDP is as of June 30, 2021, for 2021. The national debt increase is from October 1, 2020, to June 30, 2021. The estimated fiscal year budget deficit is from the CBO and was released on July 1, 2021.

| FY |

|---|

| 12.1% |

Tracking The Federal Deficit: August 2019

The Congressional Budget Office reported that the federal government generated a $200 billion deficit in August, the eleventh month of Fiscal Year 2019. This makes for a total deficit of $1.067 trillion so far this fiscal year, 19 percent higher than over the same period last year. Total revenues so far in FY 2019 increased by 3 percent , while spending increased by 7 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Trends in the major categories of revenue and spending continued from previous monthscompared to last year, individual income and payroll taxes collectively rose by 3 percent , while spending for the largest mandatory programs collectively increased by 6 percent . Revenues from customs duties increased by 72 percent , primarily due to new tariffs imposed on certain imports from China. Estate tax revenue decreased by 25 percent due to the 2017 tax cuts which doubled the value of the estate tax exemption. Additionally, Fannie Mae and Freddie Mac remitted $16 billion more in payments to the Treasury this year. Finally, net interest payments on the federal debt continued to rise, increasing by 14 percent versus last year due to higher interest rates and a larger federal debt burden.

Don’t Miss: Help With Credit Debt

Forms Of Government Borrowing

In addition to selling Treasury bills, notes, and bonds, the U.S. government borrows by issuing Treasury Inflation-Protected Securities and Floating Rate Notes . Its borrowing instruments also include savings bonds as well as government account securities that represent intergovernmental debt.

Other nations have borrowed from international organizations like the International Monetary Fund and The World Bank as well as private financial institutions.

Tracking The Federal Deficit: September 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $431 billion in September, the final month of FY2022. This deficit was the difference between $488 billion in revenues and $919 billion in spending. Receipts were up by $28 billion , and outlays were up by $394 billion compared to last September. Timing shifts did move some payments to September that otherwise would have been paid in October , contributing to the higher-than-expected deficit last month.

More significantly, the Biden Administrations announcement of a continued repayment pause on and forgiveness of federal student loan payments caused Septembers deficit to be much higher than forecasted. Since federal accounting rules require these changes to be a one-time charge to the government, estimated costs of $426 billion were recorded by the federal government in September. In fact, student loan forgiveness was the single largest contribution to increased federal spending and the deficit in September , accounting for $379 billion. Given the sizeable impact of these one-time policy changes, it is difficult to discern year-over-year major trends for the month of September.

Read Also: How Does Filing Bankruptcy Affect Buying A House

Breakup Of Northern Securities

In 1902, President Theodore Roosevelt ordered the Justice Department to break up the Northern Securities Company. This holding company controlled the main railroad lines from Chicago to the Pacific Northwest.

Roosevelt took the position that the company was an illegal monopoly. The company appealed the move, and the case went all the way to the Supreme Court, which ruled in favor of the federal government.

National debt: $2.3 billion

Also Check: Small Business Liquidation Services

Tracking The Federal Deficit: December 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $20 billion in December 2021, the third month of fiscal year 2022. This deficit was the difference between $486 billion in revenues and $507 billion of spending. Decembers deficit was 85% smaller than that of December 2020. Additionally, both this year and last year, the timing of the New Years Day federal holiday shifted payments that would normally have occurred at the beginning of January into December. In the absence of these timing shifts, the federal government would have run a monthly surplus in December 2021 for the first time since January 2020, prior to the onset of the COVID-19 pandemic.

Analysis of notable trends: Through the first quarter of FY2022, the federal government has run a deficit of $377 billion, $196 billion less than at this point in FY2021. After factoring in the aforementioned timing shifts, the FY2022 deficit to date is $353 billion, or 33% smaller than FY2021the rest of this discussion accounts for these payment shifts. However, this deficit is $17 billion larger than the deficit accrued during the first quarter of FY2020, before the start of the pandemic.

Don’t Miss: Income Required For Mortgage

Understand Inflation And How It Affects You

- Social Security: The cost-of-living adjustment, which helps the benefit keep pace with inflation, will be 8.7 percent next year. Here is what that means.

- Budget Surpluses: Up to 20 states are using their excess funds to help taxpayers deal with rising costs. But some economists worry that the payments could fuel inflation.

- Tax Rates: The I.R.S. has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills.

- Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet. Now, its going to affect the size of your paycheck next year.

In recent weeks, administration officials have walked a thin line on deficits. They have championed deficit-cutting moves like the climate, health care and tax bill that Mr. Biden signed into law in August as necessary complements to the Feds efforts to bring down inflation by raising interest rates. They have said Mr. Biden would be happy to sign further deficit cuts into law, in the form of tax increases on high earners and large corporations.

Our budgets have been heavily fiscally responsible, and they build a very compelling architecture toward critical investments and fiscal responsibility, Jared Bernstein, a member of the White House Council of Economic Advisers, said in an interview. So it would be a mistake to overtorque in reaction to current events.