What Are Short Term Instruments In Ireland

The NTMA issues three types of short-term loans:

Recommended Reading: Foreclosed Homes Jacksonville Fl

Twin Towers Attacks Corporate Scandals And Wars In Afghanistan And Iraq

The terrorist attack of September 11, 2001, led to the War in Afghanistan, and eventually, the invasion of Iraq in March of 2003. The war lasted more than eight years, ending on December 18, 2011.

The stock market had experienced a brief slide after the terrorist attacks. But after rallying, the market began to fall again in March of 2002, partially due to corporate fraud scandals of 2001, such as Enron, Tyco, and WorldCom.

National Debt: $6.783 trillion

How Has The Covid

According to the Congressional Budget Office, debt held by the American public will rise to 98% of GDP due to the economic impact of the coronavirus pandemic and legislative actions taken as a result. The CBO says that the main driver of the increased debt is a federal budget shortfall of $3.3 trillion, the largest since 1945.

Read Also: Us Debts To China

Stock Market Crash & The Great Depression

On October 29, 1929, wild speculation and rapid expansion finally caught up with Wall Street. The Black Tuesday stock market crash resulted in billions of dollars lost. In its aftermath, America and the rest of the industrialized world spiraled into the Great Depression, which lasted until 1939. It was the deepest and longest-lasting economic downturn in the U.S. up to that time.

National Debt: $17 billion

Where Can I Trade Commodities

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Recommended Reading: Government Programs To Help Pay Mortgage 2020

How Government Debts Affect You

The approximate interest rate on the cost of market debt in Canada is about 2.01 percent. Interestingly enough, the country accrues $75 million of debt per day in interest charges alone. That trickles down to the taxpayers, many of whom are seeking debt relief options for themselves.

According to the Financial Post, a study shows that Canada is a world leader in debt. One hypothesis for the debt getting so high is the fact that Canada came out largely unscathed from the last financial crisis. Low interest rates encouraged more borrowing, which led to bankruptcies and other economic downturns.

Bernard Madoff Ponzi Scheme & Housing Bubble

Bernie Madoff, former chairman of the NASDAQ and owner of a large investment advisory firm, admitted to running one of the largest investment fraud schemes in Wall Street history. For years, Madoff had been using funds from investors to pay returns to other investors, defrauding his clients by around $18 billion.

This was also the year that the U.S. housing bubble burst. For most of the decade, housing values had been high, and just about anyone could qualify for an adjustable-rate mortgage with low or no down payment.

When interest rates rose and housing prices fell, homeowners couldn’t make their mortgage payments. Large financial institutions were left holding portfolios of worthless mortgage-backed securities.

National Debt: $10.205 trillion

Also Check: How Long For Bankruptcy To Be Removed From Credit Report

Why Is The Debt So High

As of March 2022, the U.S.s national debt stands at $30.2 trillion.Factors that contribute to the U.S.s high national debt include continued federal budget deficits, the government borrowing from the Social Security Trust Fund, the steady Treasury lending from other countries, low interest rates that promote increased investment, and raised debt ceilings.

Other factors that contribute to the high national debt include the inefficient healthcare system and the changing demographics of the country. Though the U.S. spends more than other countries on healthcare, health outcomes are not much better. In addition, the Baby Boomer generation are now becoming elders and seeking benefits and increased healthcare services. The government will spend, sometimes inefficiently, more on programs and services for the longer living older generations.

How To Look At The National Debt By Year

It’s best to look at a country’s national debt in context. During a recession, expansionary fiscal policy, such as spending and tax cuts, is often used to spur the economy back to health. If it boosts growth enough, it can reduce the debt. A growing economy produces more tax revenues to pay back the debt.

The theory of supply-side economics says the growth from tax cuts is enough to replace the tax revenue lost if the tax rate is above 50% of income. When tax rates are lower, the cuts worsen the national debt without boosting growth enough to replace lost revenue.

Don’t Miss: Personal Loans For High Debt To Income Ratio

How We Gather National Debt Data

Most of our data is directly obtained from official government agencies and central banks. When this is not possible, we use data from:

This raw data is then processed through our algorithms. Among other variables, these algorithms consider the average 10-year interest rate paid on the debt to calculate the current debt amount at the time you are viewing the debt clock.

We update our exchange rates using data from the European Central Bank.

Also Check: How Do People Get Into Debt

The New Deal & The Agricultural Adjustment Administration

In this year, approximately one-fourth of U.S. workers were unemployed, thanks to the stock market crash of 1929 and the Great Depression. The New Deal was President Franklin Roosevelt’s effort to revive the economy and bring about reforms in industry, agriculture, labor, finance, and housing. Roosevelt drummed up support for the program in a series of fireside chats broadcast to the American people.

The Agricultural Adjustment Administration was one New Deal initiative. It sought to curtail farm production by subsidizing farmers who reduced their output. By 1936, payments totaling $1.5 billion had been paid out.

National Debt: $23 billion

Don’t Miss: What Is Better Bankruptcy Or Debt Consolidation

How Is National Debt Rated

Rating agencies score governments on a range of metrics. Countries with higher ratings can offer lower interest rates on their bonds because they are considered to be safe investments.

When investigating a countrys economy, the national debt is one metric that rating agencies note.

They also look at the debt-to-GDP ratio, the national debt per head of population, the interest rates on government debt, and the average bank lending rate.

How Much Do Other Countries Owe The Us

Public debt makes up three-quarters of the national debt, and foreign governments and investors make up one-third of public debt. As of , the countries with the most debt owed to the U.S. are Japan, China, the United Kingdom, Luxembourg, and Ireland.

Though China had been the long-standing top placeholder for the country with the most debt owed to the United States, Japan currently holds $1.3 trillion worth of U.S. debt. The second place holder, China, currently holds $1.1 trillion in Treasury holdings. Together, they hold 31% of all foreign-owned U.S. debt.

Recommended Reading: Does Bankruptcy Wipe Out Student Loans

Does The National Debt Affect American Citizens

The US national debt does have the potential for ramifications that individual citizens may be impacted by. According to the Congressional Budget Office, US citizens could feel the effects of a large national debt in higher taxes, lower ability to fund benefits and services, and less money to meet economic crises like wars or natural disasters like the coronavirus pandemic.

Why Is The Us In Debt

Countries around the world currently hold a national debt in order to grow the economy and the country, debt is oftentimes needed to fund expansions and programming. The United States debt levels are extremely high, and can be attributed, in part, to income inequalities and trade deficit. These two factors indicate that some level of debt must be taken on in order to keep the economy moving. The U.S.s national debt increased 840% during the period from 1989 to 2020.

Read Also: Who Can Declare Chapter 13 Bankruptcy

How Much Would Each American Owe To Pay Off Its National Debt

The US Census Bureau estimates the American population is 324,356,000 at the end of 2019. The US national debt as of 2019 was approximately $22.7 trillion. Thus, every American, regardless of age, would have to pay nearly $70,000 to resolve the US national debt. If only adults are taken into account, then the per capita debt would be about $90,500.

The Debt Clock Tracks The Us National Debt

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

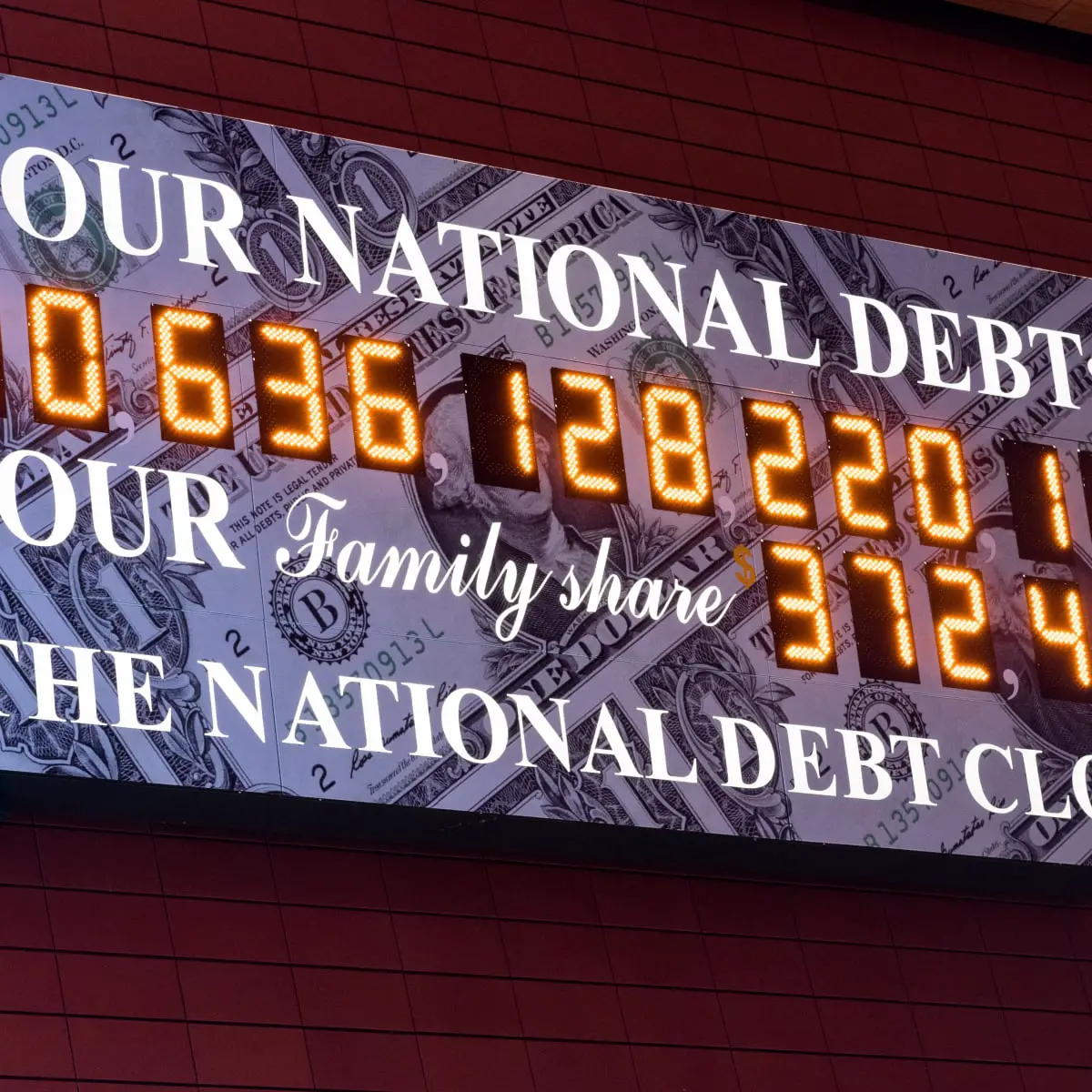

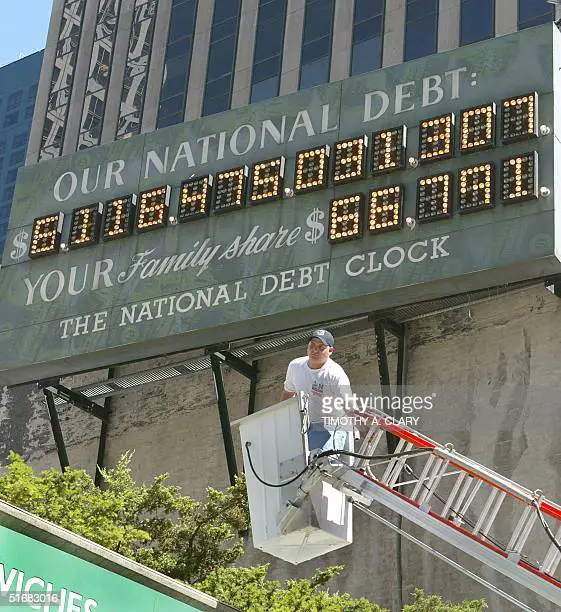

The national debt clock tracks the U.S. debt. It surpassed $31 trillion in October 2022. The clock sits at Anita’s Way, between One Bryant Park and 151 West 42nd Street on Sixth Avenue in New York City.

You don’t need to travel to see the debt clockyou can visit the U.S. Treasury website, Debt to the Penny, to download the current and archived amount of U.S. national debt.

Recommended Reading: Can You File Bankruptcy On Student Loans

Major Events And The Impact On Us Debt

It helps to consider the national debt in context. During times of war, the U.S. increases military spending. When the economy is down, the federal government uses spending and tax cuts to spur growth. When these expansionary fiscal policies boost economic growth, higher tax revenues can be used to pay back the debt.

Here’s a timeline of the national debt by year, and how it compares to national events.

Breakup Of Northern Securities

In 1902, President Theodore Roosevelt ordered the Justice Department to break up the Northern Securities Company. This holding company controlled the main railroad lines from Chicago to the Pacific Northwest.

Roosevelt took the position that the company was an illegal monopoly. The company appealed the move, and the case went all the way to the Supreme Court, which ruled in favor of the federal government.

National debt: $2.3 billion

Also Check: Pallets Of Goods For Sale

Which Bonds Have Been Swapped

The bonds were created in batches of different maturity dates. Of these, bonds with a maturity date of 2038, 2041, 2043, 2045, and 2047 have already been swapped.

Floating rate bonds with maturity dates of 2049, and 2053 are still in circulation.

In 2020, the NTMA borrowed 1.25bn to bridge the gap between government debt and raised taxes.

Student Loan Debt Clock

Student Loan Debt Clock

This Student Loan Debt clock reports an estimate of current student loan debt outstanding, including both federal and private student loans. This student loan debt clock is intended for entertainment purposes only. The actual total debt outstanding demonstrates more volatility at the beginning of each semester, when most student loans are disbursed.

In June 2010, total student loan debt outstanding exceeded total credit card debt outstanding for the first time. The seasonally adjusted figure for revolving credit in the Federal Reserves G.19 current report was $826.5 billion in June 2010. Revolving credit started declining in September 2008 when it reached a peak of $975.7 billion. The decrease is probably due a combination of higher minimum payments on credit cards, which were increased to 4% from 2%, lower credit card limits and tighter credit underwriting. Student loan debt, on the other hand, as been growing steadily because need-based grants have not been keeping pace with increases in college costs. Federal student loan debt outstanding reached approximately $665 billion and private student loan debt reached approximately $168 billion in June 2010, for a total student loan debt outstanding of $833 billion. Total student loan debt is increasing at a rate of about $2,853.88 per second.

Practical tips for minimizing debt and reducing the cost of education financing include:

Don’t Miss: Liquidations Pallets For Sale

Global Recession And Collapse Of Wall Street

Starting in late 2008, the U.S. went into the deepest economic downturn the country had seen since the Great Depression. Investment banks collapsed due to the subprime mortgage crisis. President Barack Obama began his first term in January of 2009. By the end of the year, there were signs of recovery, but a full return to a healthy economy wouldn’t come for several years.

National Debt: $11.910 trillion

Coronavirus And The National Debt

The U.S. government has taken efforts to offset the effects of worldwide health pandemic by borrowing money to invest in individuals, businesses, and state and local governments. Of these responses, the CARES Act has been the largest stimulus package in U.S. history. This stimulus package included $2.3 trillion towards relief for large corporations, small businesses, individuals, state and local governments, public health, and education. In order to pay for the relief fund, the government needed to expand its debt to do so, the government borrowed money from investors through the sales of U.S. government bonds.

Also Check: When Can You Get A Home Loan After Bankruptcy

National Debt And Budget Deficits

It takes a lot of money to keep the U.S. government running, and much of it is borrowed money. The federal government has a budget deficit whenever it spends more money than it brings in through taxesin other words, when expenditures are higher than revenues. Deficits must be financed by borrowing money. Interest must be paid on borrowed money, which adds to the deficit. As budget deficits add up year after year, they create the national debt. When the federal government takes in more money than it spends in a year, it is said to have a budget surplus.

A Us Debt Default Would Echo Through The Global Economy By Reducing International Trade Make Dollarized Economies Suffer And Affect Business Contracts

More than 33 years ago, a billboard-sized running total display was installed a block away from Times Square in New York City to remind passersby how much money the U.S. federal government has borrowed from the public and has yet to pay back.

RELATED:

However, this tally, well-known as the National Debt Clock, did not seem to bother successive U.S. governments, including the current administration. It read US$31.1 trillion for the first time on Oct. 3, and is still ticking away madly.

The swelling national debt number, edging closer to the US$31.4-trillion statutory ceiling the U.S. Congress placed on the government’s borrowing ability, has raised concerns about U.S. fiscal sustainability and its negative spillover effects on global financial markets.

DISGRACEFUL RECORD

The total public debt outstanding reached US$31.1 trillion on Oct. 3, including US$24.3 trillion in debt held by the public and US$6.8 trillion in intergovernmental holdings, said the U.S. Treasury Department’s daily treasury statement released on Oct. 4.

In fact, real-time data released by the official website of the National Debt Clock showed that the debt number, having so far well surpassed US$31.1 trillion, amounts to more than 93,400 dollars of debt per American citizen, and nearly US$250,000 of debt per taxpayer.

DEBT ADDICT

“By the 21st century, the national debt got to 20 trillion dollars after major events such as the War on Terror,” it said.

TIME BOMB

Read Also: Paying Off Debt During Underwriting

Total Federal Agency Debt In 2023

Chart C.01a: Recent Federal Agency Debt

At the end of FY 2023 the federal agency debtin the United States is guesstimated to be $11.92 trillion.

Agency debt is debt issued by federal agencies andgovernment-sponsored enterprises, and is not included in the total gross debt of the federal government.

Get more information about Agency Debt here.

How Does The National Debt Affect Me

Interest payments also have an important role as they grow in step with the national debt. As the government allocates more funds towards paying off interests, other investment areas could get crowded out. Areas such as education, research and development, and infrastructure may not progress at sufficient or adequate levels due to interest payments. Interest payments currently take many of the dollars that are raised through federal income, estate, and federal excise taxes. Net worth is also an important and interesting factor that can be affected by the national debt.The cost of borrowing money to purchase large assets such as homes will increase due to the Federal Reserves interest rates. Interest rates will push down the prices of homes as individuals will struggle to qualify for mortgage loans this will then lower prices on home values.

Also Check: Can Medical Debt Be Discharged In Bankruptcy

How Is Government Deficit Different From Government Debt

Government debt is a figure that represents the money owed by a national government. However, when a government spends more than its revenue in a year, it runs a budget deficit that fiscal year. It has to fill the funding gap with debt.

Politicians tend to attract votes by promising large sections of the population more payments from the government than they pay in through tax.

They dont want to scare off those people who pay in more than they take out, and so they try to avoid increasing tax levels.