Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The Debt

The specific DTI required to qualify for a mortgage depends on the mortgage lender, as well as other financial markers like down payment amount and credit score.

For instance, Fannie Mae, which sets the standards for conventional loans, sets a maximum DTI of 36%, though it can go up to 45% for those with higher down payments and/or better credit scores.

Government-subsidized loans, on the other hand, such as FHA, USDA and VA loans, generally offer more lenient DTI maximums. For USDA loans, the maximum DTI is 41% for FHA loans, its 43% , and VA loans dont carry a specific maximum DTI, but requires additional financial scrutiny for those whose ratio is above 41%.

What Is The Difference Between Front

Youll sometimes see a lender express maximum DTI ratios in pairs, such as 29%/41%. This is because theyre expressing two separate figures: front-end DTI and back-end DTI.

Front-end DTI is calculated using only housing-related debts and expenses, such as your mortgage, property taxes, and homeowners insurance.

Back-end DTI is calculated using all of your monthly debt repayments, including housing and the others listed above, and is also the number most often used by lenders to assess your eligibility. For the purposes of this article, all the specific debt-to-income ratios well mention are back-end DTI.

Also Check: What Was The National Debt

How To Qualify For A Mortgage With A High Dti

It is possible to buy a home with a high debt-to-income ratio. If you are approved with a DTI above 43%, your loan may be subject to additional underwriting that can result in a longer closing time.

Overall, higher DTI ratios are considered a greater risk when an underwriter reviews a mortgage loan for approval. In some cases, if the DTI is deemed too high, the lender will require other compensating factors to approve the loan, explains DiBugnara. He says compensating factors can include:

- Additional savings or reserves

- Proof of on-time payment history on utility bills or rent

- A letter of explanation to show how an applicant will be able to make payments

A higher credit score or a bigger down payment could also help you qualify. Cook notes that, for conventional, FHA, and VA loans, your DTI ratio is basically a pass/fail test that shouldnt affect the interest rate you qualify for.

But if you are making a down payment of less than 20% with a conventional loan, which will require you to pay mortgage insurance, your DTI ratio can affect the cost of that mortgage insurance, adds Cook. In other words, the higher your DTI, the higher your private mortgage insurance rates.

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

You May Like: What Percent Of Chapter 7 Bankruptcies Are Dismissed

Dti Ratio Requirements For Major Mortgage Programs

FHA Loans

FHA loans are backed by the US Federal Housing Administration and offer a more lenient credit score requirement. FHA loans typically require borrowers to have a maximum DTI score of 57% or lower.

USDA Loans

USDA loans can only be used to purchase or refinance homes situated in rural areas. To qualify for a USDA loan, borrowers are expected to have a DTI ratio of less than 41%. In addition, your adjusted household income must not exceed 115% of the median income in your specific location.

VA Loans

Insured by the Department of Veteran Affairs, VA loans are targeted at offering low-cost mortgage loans to past and present US armed forces members. One of the upsides to VA loans is that it does not require a down payment. In some cases, you can get a VA loan with a DTI ratio of up to 60%.

Conventional Loans

There is no specific ideal DTI ratio that fits all mortgage situations when it comes to conventional loans. DTI requirements are typically tailored based on a borrowers mortgage situation, type of loan, and lender. However, youll need to have a DTI of 50% or less to be eligible for a conventional loan.

What Is A Good Debt To Income And How To Lower It

Any DTI above 43% the lenders see it as a red flag and wont lend any more debts if your DTI is above 43%. This ratio depends on the lender to lender and programs to programs.

Some mortgage programs may have a maximum DTI at 55%. And some lenders may consider a maximum DTI at 50%. Any DTI lower than 36% is regarded as an excellent debt to income ratio.

Obviously, the lower the better, but 36% is counted as ideal DTI. Lenders might also consider not more than 28% of it to be coming from mortgage payments.

Hypothetically, let us say your DTI is above the 43% mark, there are only two simple solutions to lower your DTI, make more money, or reduce your debts.

To make more money, you can always work part-time or open a small side business which would help you to not only increase your monthly income but also keep your debts to a minimum.

Any financial advisor will suggest not to get into unnecessary debts. Avoid getting unnecessary appliances, electronics, or any things that do not have a good depreciation value.

This way, you can always keep your debts to a minimum, and making sure you qualify for bigger loans when you actually need it.

Recommended Reading: Can A Person File Bankruptcy On Student Loans

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyoure applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If youre new to building credit

- If youve had financial problems in the past like a bankruptcy or foreclosure

- If youre taking out ajumbo loan

You May Like: How Much Interest Do I Pay On A Mortgage

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you wont likely have money to handle an unforeseen event and will have limited borrowing options.

Also Check: Are Bankruptcy Courts Affected By Government Shutdown

What Is Included In The Total Debt Ratio

In addition to the housing payment, there are other debts included in this calculation. These payments include installment, revolving, other housing payments for other properties, IRS or state income tax payment plans, garnishments, alimony, child support, car leases, and possibly others. Though, 401k loan payments are excluded from debt ratio calculations.

What Is The Dti To Qualify For A Mortgage

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender.

Recommended Reading: Chapter 7 Bankruptcy Petition

What Happens If I Cannot Get An Approve/eligible Per Automated Underwriting System

If the borrower does not get an approve/eligible per the automated underwriting system and gets a refer/eligible per AUS findings, the file can be manually underwritten. Manual underwriting is the process where a human mortgage underwriter is assigned to the file and thoroughly underwrites the file. The mortgage underwriter will be more thorough on manual underwrites when reviewing the borrowers credit, credit history, income history, and the ability to pay the new mortgage loan. Use the VA DTI Calculator to determine what your debt-to-income ratio is on manual underwriting.

Also Check: Can You File Bankruptcy On Student Loans In Collections

Do All Lenders Have The Same Dti Requirements On Va Loans

Government and conventional loans have a set maximum DTI cap on their mortgage loan program. Mortgage lenders usually have lower debt-to-income ratio requirements than the agency DTI requirements. The lower the debt-to-income ratio, the better. Low DTI means the borrower has low monthly debts compared to his income. The VA DTI Mortgage Calculator will get you the most accurate estimated housing payment including the VA MIP, PMI, Taxes, Insurance, and HOA if applicable.

Don’t Miss: How To File Bankruptcy In Tennessee

What Dti Should I Aim For

As a rule of thumb, your DTI should range between 36% and 43% when youre applying for a mortgage.

That said, a lower debt-to-income ratio is always better. The lower your debt-to-income ratio, the better mortgage rate youll get.

DTI is a key ingredient in home affordability for many borrowers: When a low DTI helps you avoid high-interest mortgage loans, you can afford a more expensive home.

Importance Of Dti In Mortgages

Lenders are going to use DTI in conjunction with your to make a more realistic picture of you as a borrower.

Not just by how good you were in paying your debts in the past, but also do you have the means to take on additional debt and have enough income to cover it all every month.

Lenders want to see if you have a balance, and you dont have a ton of debts.

Also, they want to see that your income and your debts are pretty balanced. Lenders would look at how many debts can you afford as opposed to how many debts you are already paying.

If most of your income is going towards your existing debts, a lender might see this as no room left for additional debt, and your loan application may be denied.

When looking at the DTI, lenders know that people with lower DTI have a higher chance to get the desired loan.

If your DTI is low, the lender understands that there is less risk involved and would anticipate your payments accordingly.

Borrowers with low DTI are more likely to make payments with less chance of default.

Read Also: Houses For Sale By Bank

Having A Good Dti Isnt Too Hard

Your debt-to-income ratio is one of the most important factors in qualifying for a mortgage.

DTI determines whether youre eligible for the type of mortgage you want. It also determines how much house you can afford. So naturally you want your DTI to look good to a lender.

Luckily, thats not too hard. Todays mortgage programs are flexible, and a wide range of debt-to-income ratios fall in or near the good category. So theres a good chance you can get approved as long as your debts are manageable.

In this article

What Is The Maximum Allowable Dti

The specific debt-to-income requirements vary from lender to lender, but conventional loans often range from 36% to 45%.

For your mortgage to be a qualified mortgage, the most consumer-friendly type of loan, your total ratio must be below 43%. With those loans, federal regulations require lenders to determine you have the ability to repay your mortgage. Your debt-to-income ratio is a key part of your ability.

Lenders may look at different variations of the debt-to-income ratio: the back-end ratio and the front-end ratio.

Recommended Reading: How Long To Keep Bankruptcy Papers

How To Improve Debt

If youre denied a loan, or if you know your DTI is too high, there are steps you can take to lower it. Your DTI is just a snapshot in time of your current monthly debt in relation to your income and can improve with a little work. Consider these options:

What Factors Make Up A Dti Ratio

Your debt-to-income ratio consists of two components: front-end DTI and back-end DTI. And, your lenders will examine both. Your front-end ratio simply looks at your total mortgage payment divided by your monthly gross income, says Cook.

- Front-end DTI: Also known as your housing ratio, this is the percentage of your monthly gross that pays for your mortgage payment, homeowners insurance, property taxes, and any HOA dues

- Back-end DTI: This is the percentage of your monthly gross that goes towards housing and your monthly debt repayment

Most lenders want to see a front-end ratio no higher than 28%. That means your housing expenses including principal, interest, property taxes, and homeowners insurance take up no more than 28% of your gross monthly income.

But in most cases, says Cook, the front-end debt ratio is not the number that matters most in underwriting. Most loan underwriting programs today primarily look at the back-end debt ratio.

Also Check: Good Pallets For Sale

What Is A Debt

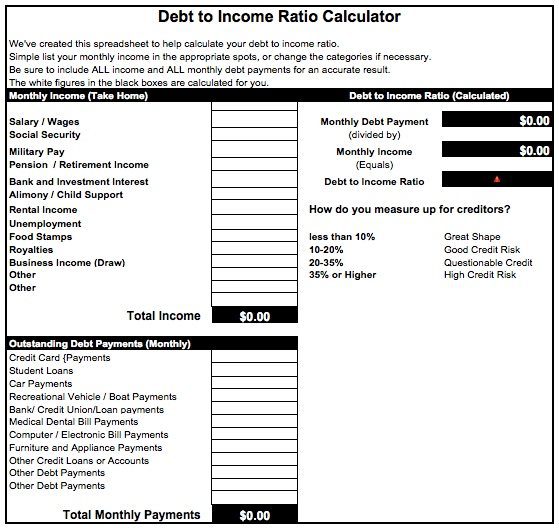

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

Different loan products and lenders will have different DTI limits. To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000. If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

What Does Debt To Income Ratio Mean

Debt to income ratio is a borrowers monthly debt payments divided by their gross monthly income. A very common question is, What is a good debt to income ratio? Although it sounds pretty simple, it is a complicated question. Not only does the answer depend on the loan program, but it is also based on other borrower qualities such as , down payment, and more. If you want a quick response, the answer would be the lower the debt ratio, the better. Chances are, you are seeking a better answer than this, so lets dig in!

You May Like: Distressed Homes For Sale

This Number Gives Lenders A Snapshot Of Your Financial Situation

Sarinya Pingamm / EyeEm / Getty Images

If youre applying for a mortgage, one of the key factors mortgage lenders will look at is your DTIor debt-to-income ratio.

That ratio, which shows the amount of your income that will go towards debt payments, gives lenders a snapshot of your entire financial situation. That helps them understand what you can comfortably afford in terms of a mortgage payment.