Business Liquidation And When To Choose It

In Australia, business liquidation applies only to businesses operating under a company structure. Its a way of dealing with debt that cant be repaid, and its generally considered an option of last resort.

Liquidation involves appointing a liquidator who will realise the companys assets and try to repay the creditors. The company directors cede control and the liquidator takes over the business. Once the assets have been sold and the companys structure dismantled, the business is shut down permanently.

Liquidation can happen after the business has already entered voluntary administration. It can also happen if the company has terminated a Deed of Company Arrangement.

Liquidation can be court ordered, which is when creditors apply to the court to wind up a company . Liquidation could, alternatively, be voluntary, which happens when the companys shareholders resolve to enter liquidation .

Note that liquidation can also happen to solvent companies if the shareholders decide to wind up the company and cease trading for non-debt-related reasons .

So liquidation could be the right option if the company has no other options, has debts that have to be repaid, and cant continue to trade viably without breaching insolvent trading laws.

For solvent and insolvent companies, its the only way to cease operations and permanently shut down the business, and to do so in an orderly and cost-effective way. It also gives the business an opportunity to explore what went wrong.

What Is The Difference Between Bankruptcy And Insolvency

David Kirk, insolvency practitioner, offers an overview of the two processes.

In short, bankruptcy only applies to an individual, not a partnership entity or limited company. Insolvency, on the other hand, is a global term that’s used to describe all types of financial failure.

Bankruptcy is just one of the various types of personal insolvency others include individual voluntary arrangements, debt relief orders and debt management plans.

Individuals and bankruptcy

An individual, whether in business, employed or unemployed, can be declared bankrupt if they owe more than £5,000 to any creditor. This process is called a ‘creditor’s petition’, and can take between a month and two months to complete.

To speed up the process, an individual can also apply to the court in order to make themselves bankrupt. This process can be as quick as only a week to two weeks, and is known as a ‘debtor’s petition’. To undertake a debtor’s petition, you must pay court fees of about £800 to make yourself bankrupt this will stop creditors from contacting you direct.

Bankruptcy usually lasts for a year if you cooperate with the official receiver or your trustee in bankruptcy. It is worth noting that until you are made bankrupt, bailiffs can still call at your door to attempt to take goods.

As a licensed insolvency practitioner, I often see people who want to avoid bankruptcy, but who soon realise that it may be a sensible option for them.

Types of insolvency

About the author

Explained: The Difference Between Liquidation Bankruptcy And Insolvency

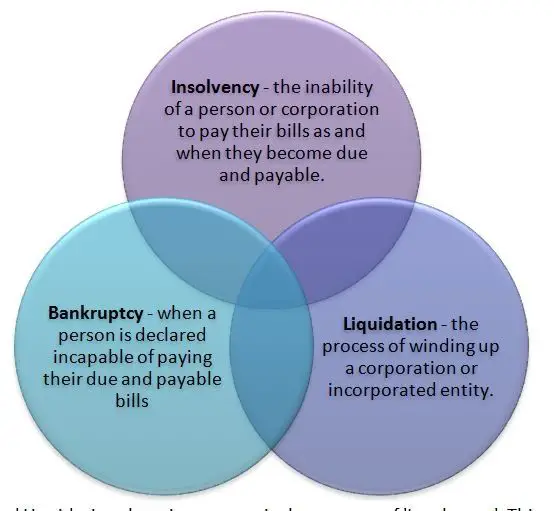

For most people, there is no difference between liquidation, bankruptcy, and insolvency. The terms amount to the same thing the inability of a person or business to pay their debts.

However, there are important differences to understand especially if you or your business are facing financial difficulty.

Below is a breakdown of the differences between liquidation, bankruptcy, and insolvency.

Also Check: What Is Epiq Bankruptcy Solutions Llc

Company Bankruptcy And When To Choose It

Business bankruptcy is an option of last resort. In Australia, bankruptcy applies only to individuals, not companies.

You could be declared bankrupt if youre an individual and youre in financial trouble to the extent you cant meet your debt obligations.

Whether youre running your business as a sole trader or as a partnership, you as an individual could be declared bankrupt, not your business, from a technical standpoint. For this reason, a company cant enter bankruptcy, because there are no bankruptcy provisions for businesses operating as a company structure.

When youre declared bankrupt, a few things happen:

Bankruptcy can be voluntary or involuntary. You can apply to be declared bankrupt, or you can be taken to court by your creditors and the court could declare you bankrupt.

Bankruptcy is one option among many others for dealing with debt. Someone whos insolvent should look at other options first, like working with creditors for an informal repayment agreement, get expert advice to help out with their business, or pursue one of the alternatives to bankruptcy under the Bankruptcy Act.

So bankruptcy could be the right option if youre an individual struggling with debt and you have explored all other options and discovered there are no viable alternatives.

Difference Between Bankruptcy And Liquidation

Last updated on by Surbhi S

Bankruptcy can be understood as a financial state, whereby a person is declared insolvent by the court, resulting in legal orders directed to resolve insolvency, i.e. to dispose of personal assets to discharge obligations. On the other hand, liquidation may be defined as the process of winding up of companys affairs by disposing-off assets, in order to discharge liabilities of the debenture holders creditors, employees and other parties.

While bankruptcy nothing but a legal scheme, wherein the person who is insolvent/bankrupt seeks relief, whereas liquidation is a procedure of final closure of the entity s business. Before you understand reconstruction of a firm, one has to know the fundamental differences between bankruptcy and liquidation.

You May Like: How Many Times Has Donald Trump Filed Bankruptcy

Difference Between Insolvency And Liquidation

Insolvency is a monetary state. A company can be insolvent, but not yet liquidated. If the commerce liabilities exceed the assets, then the business is insolvent. But, if it is still capable of servicing debts when due, then the business is not cash-flow insolvent. If it is unable to pay debts when due and the liabilities exceed the assets, then it is insolvent.

Liquidation is the winding up of the business estate. However, a company does not have to be insolvent for the entity to be liquidated. If the business is dormant, therefore not operating, and the owner wishes to close it, the best route to prevent creditor claims against the entity in future is to liquidate the entity.

Whats The Difference Between Receivership And Liquidation

Receivership is a form of liquidation governed by Court Orders, the Bankruptcy & Insolvency Act, and Security Agreements with a view to distributing the sale proceeds to the secured creditor. The business can be shuttered wherein all, or a portion, of the businesss assets are sold or a business can keep operating and be sold as a going-concern.

Liquidations are generally governed by the Business Corporations Acts or Wind-Up Acts of the various Provinces. They typically involve shuttering of a business and liquidation of all its assets for the benefit of all the creditors on a priority basis.

Don’t Miss: Renting Apartment After Bankruptcy

Defining Insolvency And Bankruptcy For Uk Businesses

Insolvency and bankruptcy are often confused as being one and the same. When you add terms like administration and voluntary liquidation into the mix, it can all get a little confusing. Here we go through the main differences between insolvency and bankruptcy and when each one applies, specifically in the United Kingdom.

Summary Of Differences Between Liquidation And Bankruptcy

Both liquidation and bankruptcy occur as an option of last resort. They can be voluntary or imposed by the court, but the end result is an attempt to manage assets to pay off debts where possible.

However, the two are different states, as follows:

-

Bankruptcy is an insolvency situation for individuals, while liquidation can occur due to insolvency or another reason, such as ceasing operations.

-

Bankruptcy affects only one individual, whereas liquidation impacts many people, including the directors, shareholders, and employees, who will be affected by debt recovery or employment termination. Both situations influence creditors who are unable to recover their debt.

-

With bankruptcy, the individual will be given relief from paying most debts. Liquidation, on the other hand, means that the company will be shut down in an orderly manner as the liquidator attempts to dispose of any assets to repay company debts.

-

As a result, once a company is shut down from liquidation, it ceases to exist. The company structure is dismantled, and assets are sold off, so it will never return to operations. The legal state of bankruptcy, on the other hand, will only last for several years, after which it wont show in your credit history.

Also Check: Will Filing Bankruptcy Clear A Judgement

How Can I Save My Business From The Brink Of Either Bankruptcy Or Insolvency

If you are on the brink of bankruptcy or insolvency, get in touch with a professional accountant. This is likely to be a tough and emotionally draining time for you, with many hard choices to make. But it doesnt have to mean the end of your venture. An accountant can help you find the best solution, tailored to your business. This could include refinancing or restructuring your debt, setting up a company voluntary agreement or guiding you through the bankruptcy process.

Thousands of individuals and companies face this situation every year, and there are many different ways to deal with insolvency. With the right approach and professional help, you can come out the other end with a stronger foundation for future growth.

Let us match you to your perfect accountant

Bankruptcy Vs Liquidation For Businesses: Key Differences

Bankruptcy and liquidation both involve a person or business being unable to repay their debts. The key difference is bankruptcy only ever applies to individual persons and liquidation can only apply to businesses operating as a company.

Additionally, while bankruptcy last only three years, liquidation always leads to a permanent closure of the business. And bankruptcy is usually only due to insolvency, while liquidation could be initiated because of insolvency or because the members of a solvent business want to close it down.

Australian Debt Solvers are the experts in business liquidation, and can help you successfully close down your business. Contact us online today for more information, or call us on 1300 789 499.

Or, if you are facing financial difficulties but would like to try to continue operating your company, consider a voluntary administration this would allow you to explore options outside of liquidation.

In this artical

You May Like: Epiq Corporate Restructuring Llc

Whats The Difference Between Bankruptcy And Insolvency

Looking at these examples, the main differences between bankruptcy and insolvency include:

- Bankruptcy is a legal process or court order, while insolvency is a state of financial distress.

- Bankruptcy is a type of insolvency, but there are others.

- Bankruptcy isnt the only way out of insolvency.

- Bankruptcy applies only to individuals and sole traders with unlimited liability. Insolvency applies to businesses as well as individuals.

Whats The Difference Between A Court

In Canada, a receiver must be a Licensed Insolvency Trustee whose license was granted by the federal governments Office of the Superintendent of Bankruptcy. There are two basic types of receivers:

Court-appointed receiver: the Receiver is appointed by the Court through a Court Order upon application by a secured creditor.

Privately-appointed receiver: the Receiver is appointed by the secured creditor pursuant to the terms of the General Security Agreement as between the secured creditor and the debtor.

Also Check: Will Bankruptcy Clear A Judgement

What Are The Types Of Bankruptcy

The two types of bankruptcies are voluntary and involuntary bankruptcy. Voluntary bankruptcy involves the person or business implicated declaring bankruptcy of their own volition. Involuntary bankruptcy involves your creditors taking you to court in order to try to recoup the money that they lent you. The court will assess your case and may then declare you bankrupt.

What Is The Different Between Bankruptcy And Liquidation

The main difference is laid in the cause of each situations. In bankruptcy, the major reason is that the company is unable to pay its debt at maturity so that the creditors petition for bankruptcy in order to recoup their debt. In liquidation or wind-up, it means that the company was brought to termination. The are many grounds for liquidation, such as the company unable to pay its debt or its member agree to terminate its activities .

Please Note:

There is also a difference between “Winding-up” and “Liquidation”.

Winding-up:

It is a process / procedure by which assets of the company are realized and liabilities are settled. It may take several months. A liquidator is appointed to do all these activities. In essence, liquidator is the full in-charge of the company’s affairs. The company still exists with its legal status as a company, but it cannot conduct its business .

Liquidation / Dissolution:

When all the assets of the company are completely realized and all liabilities are completely settled, and affair of the company are fully wound up, the company is liquidated. This is the end of the company’s life. After liquidation, the company dies it has no legal existence, no assets, no liabilities, no management, and nothing else. In pure legal terms, this is called “Dissolution”.

“Liquidation” is also used, alternatively, when a company becomes unable to pay its debts. Then, it is said that the company is liquidated.

Don’t Miss: How Many Times Donald Trump Bankruptcy

When Should I Apply For Bankruptcy

Although bankruptcy can provide debt relief, its not a decision anyone should take lightly. It impacts your day to day life, you risk losing valuable assets, and your credit score is affected for years. Bankruptcy also means you cannot apply for a mortgage until at least six years have passed, and you cannot be a company director until you are released.

Depending on your personal circumstances, bankruptcy may or may not be the debt solution for you. If youre facing severe debt and considering bankruptcy, its best to seek advice first. A debt adviser will provide non-judgemental advice and potentially suggest ways of dealing with debt you didnt previously know about. Debt adviser services are free.

Liquidation Vs Bankruptcy Whats The Difference

While the words bankruptcy and liquidation are often used interchangeably, they are actually two different occurrences. Because they are both so frequently associated with business failure, it is easy to see why one may think they are the same thing. The truth of the matter, however, is that they are not interchangeable and they both serve two very different purposes.

It is important to know the difference as a business owner because if the day ever comes where the business begins to fail, youll need to know what your options are. Knowing that you can declare bankruptcy without necessarily having to liquidate, or that you can liquidate without having declared bankruptcy, can help you to make informed decisions regarding the future of your business.

Bankruptcy

Insolvency, another word for bankruptcy, occurs when an individual or a business accumulates so much debt that they are unable to repay their creditors.

- Bankruptcy is often a last resort after every effort has been made to work with a debt counselor and creditors to pay off all or part of the debt.

- Bankruptcy can be voluntary or court ordered.

- In order to declare bankruptcy an individual or business must legally file and apply to court.

- Certain criteria must be met in order to qualify for bankruptcy.

- One of the stipulations of a business bankruptcy may be to liquidate company assets in order to repay part or all of its debt.

Liquidation

Don’t Miss: How To Claim Bankruptcy In Massachusetts

Understanding The Difference Between Liquidation And Bankruptcy

Bankruptcy and liquidation are often confused and used interchangeably, but these two terms are actually very different. While both could involve insolvency the inability to meet debt obligations theyre not interchangeable terms. Here, we explore the key differences you should know about between liquidation and bankruptcy.

Insolvency Liquidation And Bankruptcy Whats The Difference

How to distinguish between Insolvency, Bankruptcy and Liquidation

We often hear the terms insolvency, liquidation and bankruptcy thrown around and even used interchangeably. But what do they actually mean? And how can you tell which term applies to what situation?

Here we will discuss what they mean, and how they are used to describe particular financial situations.

Recommended Reading: How To File For Bankruptcy In Wisconsin

The Difference Between Bankruptcy And Insolvency

I was with a friend recently who was telling me about a family member whose finances were circling the drain.

Shes got no savings, her credit cards are maxxed, shes getting calls from creditors all day long…shes bankrupt.

Im sorry to hear that, I said with some sympathy. “Now that shes filed though, the calls should stop.

My friend looked at me, aghast. Oh no, shes not bankrupt bankrupt. I meant shes broke.

I didnt press the point, but people frequently use the word “bankrupt” to describe a situation where a person or company no longer has money to pay off debts and obligations. That situation is called insolvency. Being bankrupt and being insolvent are actually two different financial states…or straits.

Bankruptcy is a legal process for liquidating what property and assets a debtor owns to pay off their debts. Insolvency is a financial state in which a persons debts exceed their assets. Someone whos bankrupt is insolvent, but someone whos insolvent isnt necessarily bankrupt.

For example, my friends family memberIm sure there are many attorneys whod add up her assets and liabilities, see that shes insolvent, and advise her to file for bankruptcy. Sometimes thats the only way out of a bad financial situation. But she wouldn’t be bankrupt unless she filed a case in court.

How To Prevent Bankruptcy

Bankruptcy is generally a last resort, for businesses and individuals alike. Chapter 7 will, in effect, put a business out of business, while Chapter 11 may make lenders wary of dealing with the company after it emerges from bankruptcy. A Chapter 7 bankruptcy will remain on an individuals credit report for 10 years, a Chapter 13 for seven.

While bankruptcy may be unavoidable in many instances , one key to preventing it is borrowing judiciously. For a business, that could mean not using debt to expand too rapidly. For an individual, it might mean paying off their credit card balances every month and not buying a larger home or costlier car than they can safely afford.

Before filing for bankruptcy, and depending on their own internal legal resources, businesses may want to consult with an outside attorney who specializes in bankruptcy law and discuss any alternatives that are available to them.

Individuals are required by law to take an approved credit-counseling course before they file. Individuals also have other resources available to them, such as a reputable debt relief company, which can help them negotiate with their creditors. Investopedia publishes an annual list of the best debt relief companies.

Read Also: What Does Dave Ramsey Say About Bankruptcy