How Can I Get Out Of Debt Fast

How soon you can get out of debt depends on how much debt you have and how much more you can pay to reduce it. Create a plan, set a budget, and do not acquire more debt. Consider restricting nonessential spending and use what you save to pay down your debt.

Often, creditors require you to only pay a minimum amount. Pay more than the minimum to quickly reduce what you owe. Debt consolidation is also an option that can help you restructure your debt into more manageable terms, helping you get out of debt faster.

What Is Corporate Debt

Companies looking to borrow funds often issue bonds to raise money. Corporate bodies use other forms of debt, such as commercial paper and bonds, to raise money, which is not available to individuals.

Bonds enable corporations to generate capital by selling a repayment guarantee to investors. Institutions and individuals can acquire bonds at a predetermined coupon rate or interest rate.

The operation of corporate debt is comparable to that of traditional loans. However, the borrower is the corporation, while investors are either creditors or lenders. Commercial paper is a short-term obligation with a maturity of fewer than or equal to 270 days.

What Is An Example Of Warrant Issuance

Lets assume that a company is looking to raise capital to finance the purchase of a real estate property.

The companys objective is to raise $10 million in capital.

The companys shares are trading at a market price of $10 per share.

To finance the acquisition, the company decides to issue bonds for $10 million at a lower rate of interest but offers the bondholders warrants giving them the right to purchase common shares in the future.

The company issues warrants allowing the warrant holder to purchase common shares at a price of $15 per share for a period of one year.

This means that if the companys stock price increases to $20 within the year, the warrant holder can exercise the warrants and acquire the shares at $15 thereby making a profit of $5 per share.

So there you have it folks!

What does a warrant mean in finance?

In a nutshell, a warrant is a type of security allowing its holder to purchase or sell an underlying security, generally stocks, at a fixed price before a specified expiration date.

Warrants are similar to options in finance as they both grant the holder the right to buy or sell securities at a predetermined price before a certain date.

However, warrants are typically issued directly by the issuer or authorized institutions whereas option contracts can be issued by any investor in the market.

In many cases, warrants are issued along with bonds or preferred shares but they can be detached and sold on over-the-counter markets.

Don’t Miss: How Long Is Chapter 7 Bankruptcy

What Is The Difference Between Warrants And Options

Both warrants and options work in similar ways as they offer the holder the right to buy or sell an underlying security at a specific price before a certain date.

However, the main difference is that options are generally contracts issued by third parties whereas warrants are issued directly by the issuer.

Also, warrants are generally traded on over-the-counter markets whereas options are traded on exchanges.

In addition, when warrants are issued, the issuer will need to issue additional shares thereby diluting the other shareholders whereas option contracts are non-dilutive.

More Efficient Doesnt Mean More Effective

Every business is constantly looking for ways to be more efficient in their operations and processes. What has been compromised with this mindset, however, is the customer. Making certain processes quicker and easier doesnt inherently come with a problem-solving component. On the contrary, it sometimes just means that the problem only arrives more quickly and easily. For example, a person can get a loan and therefore get themselves into debt within a few simple clicks on a website.

If processes are being made more efficient, then they need to deliver value more efficiently, too. This is for both parties involved, not just a one-sidedness of ease. Firms need to focus on destination and outcomes, not just the efficiency of processes.

Read Also: Can Only 1 Spouse File For Bankruptcy

Secured Debt Vs Unsecured Debt

A debt can also be categorised as secured debt or unsecured debt. The major difference between the two is the presence or absence of collateral. It is a form of security to the lender against the non-repayment from the borrower.

Secured debt means the borrower has to put some asset or collateral for a loan. In the event of default, the lender can use the assets to repay the funds that it has advanced to the borrower.

Unsecured debt is not backed by collateral, and if the borrower defaults on the payment, the lender has no assets to confiscate to recover the losses. For instance, personal loans, credit cards, etc. As a result, unsecured debts are subject to high-interest rates than secured debts. The interest rates are higher due to the absence of collateral. Also, unsecured debts are more flexible as they can be used for a wide range of needs rather than secured debt, which can be used only for a specific reason. Furthermore, there is a quicker application process for unsecured debt as it does not require the application of collateral. Therefore, you must understand the advantages and disadvantages of each while settling the monetary choices.

DiscoverMore

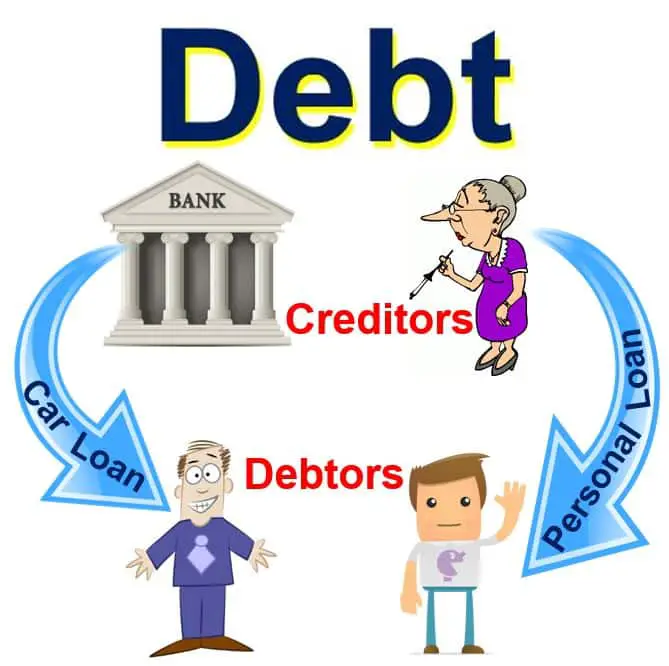

How Do Debts Work

Most debt results from the purchase of goods or services on credit. The creditor provides the debtor with a loan, and the debtor agrees to repay the loan, plus interest, over a period of time. Debt can also result from other financial transactions, such as borrowing money from family or friends, using a credit card, or taking out a home equity loan.

There are many different types of debt, but all debts have one thing in common: they must be repaid. When you borrowed money to buy a car, for example, you agreed to repay the loan over a period of time. The same is true for student loans, credit card debts, and mortgages.

All debts have two components: the principal and the interest. The principal is the amount of money that you borrowed, and the interest is the fee that you pay for borrowing the money. The interest rate is the percentage of the principal that you will pay in interest. For example, if you borrow $100 at an interest rate of 10%, you will owe $110 to the creditor after one year. The extra $10 is the interest.

Over time, debt can become a burden if it is not managed properly. When you have too much debt, it can be difficult to make your monthly payments and pay off your debt. In some cases, debt can even lead to bankruptcy. Therefore personal finance is important for effective debt management.

Also Check: How Does Foreclosure Affect Your Credit

Understanding The Customer Is The Key Driver For Sustainable Change For Financial Firms

Theres a serious debt problem consuming society. People are being increasingly overwhelmed with debt and are struggling to make repayments. This is affecting households in a plethora of ways, impacting mental health, and also causing issues on the side of the institution.

Getting into debt has never been so easy as it is today. However, the solutions to help people get out of debt arent keeping up.

Debt resolution needs a rethink. As we look towards the future, in a climate where money is on everyones mind, its crucial to see what needs to change to avoid the worst outcomes of a financially unstable society.

What Is A Good Debt

What counts as a good debt-to-equity ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky. Companies in some industries, such as utilities, consumer staples, and banking, typically have relatively high D/E ratios. Note that a particularly low D/E ratio may be a negative, suggesting that the company is not taking advantage of debt financing and its tax advantages.

You May Like: How To File For Bankruptcy In Oregon

Benefits Of Refinancing Debts

- Debt refinancing can be of benefit in some cases when it allows you to access the equity in your home.

- Refinancing a loan allows you to save money by getting a lower interest rate on the new loan.

- Another benefit of debt refinancing is that it helps if you are having financial problems and need an extension on your original loan.

- The debt refinancing process often involves consolidating debt from several different credit cards into a single, larger loan with a lower interest rate. This lowers your monthly payment and can save you money over the life of the new loan.

An Academic Definition For Technical Debt

With the wide array of opinionated definitions for technical debt, several academic works have attempted to present an unbiased, concrete definition for this abstract concept. For example, an article in the Information and Software Technology Journal defines technical debt in very specific terms:

Technical debt describes the consequences of software development actions that intentionally or unintentionally prioritize client value and/or project constraints such as delivery deadlines, over more technical implementation, and design considerations

The same article expands on the metaphor for technical debt, Conceptually, technical debt is an analog of financial debt, with associated concepts such as levels of debt, debt accrual over time and its likely consequences, and the pressure to pay back the debt at some point in time.

You May Like: What Is Us Debt

What Is Technical Debt

Technical debt describes what results when development teams take actions to expedite the delivery of a piece of functionality or a project which later needs to be refactored. In other words, its the result of prioritizing speedy delivery over perfect code.

If youve been in the software industry for any period of time, chances are youve heard the term technical debt. Also known as design debt or code debt, the phrase is widely used in the technology space. It is referred to as a catchall that covers everything from bugs to legacy code, to missing documentation. But what exactly is technical debt anyway? And why do we call it that?

Technical debt is a phrase originally coined by software developer, Ward Cunningham, who in addition to being one of 17 authors of the Agile Manifesto, is also credited with inventing the wiki. He first used the metaphor to explain to non-technical stakeholders at WyCash why resources needed to be budgeted for refactoring.

He didnt realize at the time, but he had coined a new buzzword in the software community. Later, it would become the subject of countless academic studies, debates, and panel discussions.

Years later, Cunningham described how he initially came up with the technical debt metaphor:

For an in-depth look at technical debt, watch this video:

What Is A Debt

Definition: Debt is defined as an obligation to pay someone else money. Debt is the act of owing money to someone else. Debt is a common practice for businesses and people in many parts of the world who use it to finance major purchases that they could not otherwise afford.

A debt financial arrangement allows a borrower to borrow money on terms that stipulate repayment after a predetermined period, often with interest. In general, it is a duty for one party, the debtor, to pay money or another agreed-upon amount to another party, the creditor.

Don’t Miss: What Is Better Bankruptcy Or Debt Consolidation

Limitations Of D/e Ratio

When using D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value thats common in one industry might be a red flag in another.

Utility stocks often have especially high D/E ratios. As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply. High leverage ratios in slow-growth industries with stable income represent an efficient use of capital. Companies in the consumer staples sector tend to have high D/E ratios for similar reasons.

Analysts are not always consistent about what is defined as debt. For example, preferred stock is sometimes considered equity, since preferred dividend payments are not legal obligations and preferred shares rank below all debt in the priority of their claim on corporate assets. On the other hand, the typically steady preferred dividend, par value, and liquidation rights make preferred shares look more like debt.

Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio. This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts .

What Is The Difference Between Refinancing And Restructuring

The main difference between refinancing and restructuring is the effect they have on your credit score and monthly bills. Refinancing can actually increase a borrowers credit score because it means paying off several smaller debts in favor of one larger debt. It also lowers monthly payments. Debt restructuring, however, usually causes a borrowers credit score to fall in most cases, it results in higher monthly payments.

Also Check: Bank Repo Houses For Sale

Role Of Central Banks

Central banks, such as the U.S. Federal Reserve System, play a key role in the debt markets. Debt is normally denominated in a particular currency, and so changes in the valuation of that currency can change the effective size of the debt. This can happen due to inflation or deflation, so it can happen even though the borrower and the lender are using the same currency.

A Society Hooked On Credit

Its no surprise that more people are getting into debt. Its an ingrained part of our culture. From a young age, people have to rely on loans. Students take out loans so that they can get by, and it begins the journey of relying on credit.

The way debt can be encouraged also shows itself in credit scores a credit score essentially can reward people for not being good with money.

In the West, credit cards are almost romanticised. Theres an impression of free money to buy whatever you want, whenever you want it. Around 59.6 million credit cards were issued in the UK last year showing demand is there.

More and more businesses are offering credit options for people to purchase goods, Klarna, Clearpay and Very Pay to name a few. It sets an alarming precedent that soon if a company doesnt offer these options, it will suffer competitively and be somewhat of a disappointment for consumers. This will further normalise relying on credit and getting into debt as a result.

So, how can we manage a society increasingly hooked on credit and drowning in problem debt?

Don’t Miss: Overstock Phone Number For Orders

Good Debt Vs Bad Debt

While all debt comes with a cost, you can generally classify any borrowed money as either good debt or bad debt based on how it affects your finances and your life. Good debt helps you increase your income or build wealth. Bad debt, however, doesnt provide many benefits or offer a return on what you pay for it.

Student loans and mortgages are common examples of good debt because they can help you increase your earning potential and build wealth.

An auto loan could be good or bad debt depending on the terms: A high-interest-rate loan is likely a bad debt the use makes the loan good debt.

Net Debt And Total Cash

The net debt calculation also requires figuring out a company’s total cash. Unlike the debt figure, the total cash includes cash and highly liquid assets. Cash and cash equivalents would include items such as checking and savings account balances, stocks, and some . However, it’s important to note that many companies may not include marketable securities as cash equivalents since it depends on the investment vehicle and whether it’s liquid enough to be converted within 90 days.

Read Also: How To File Bankruptcy Yourself In Arkansas

Using Technology The Right Way

Technology has been used by many firms, especially challenger banks, to change the way they operate. But, this hasnt necessarily been for the better. Digital technology and the software available to banks has simply sped up their processes. Part of this includes making obtaining a loan quicker, easier and more accessible for the consumer.

To better deal with consumer debt, firms need to make getting to a solution this quick and easy too. Technology is there to help us and make our lives better, only if its used in the right way. Firms need to invest in solution-centred technology that can help consumers to manage their money better.

Financial Firms Need A Better Way To Deal With Debt As It Increases

People in the UK owed £1,767.1 billion of debt at the end of January 2022. According to the same source, this is up £62.2 billion from the same time last year.

The cost of credit is increasing, and firms are still incentivising staff to hand it out to customers. It’s creating a bigger diversion of wealth, and the younger generation are suffering for it. It perhaps wouldnt be such a big issue if incomes were keeping up with the cost of credit increase, but generally they arent. And now, people are in a position where they are unable to make repayments.

This is partly because incomes are not increasing as the cost of living does, because of the energy crisis resulting in households struggling financially and unexpected financial shocks caused by the pandemic.

These societal problems that are contributing to more people to get into debt arent going away. In fact, theyre only getting worse. Firms need to shift the way they manage their customers not just to protect their business, but to help protect their most vulnerable customers. This is something firms need to start taking appropriate responsibility for.

You May Like: How To File For Bankruptcy In Ma