What Types Of Personal Bankruptcy Are There In Canada

Bankruptcy in Canada is governed by the Bankruptcy & Insolvency Act . Individuals who are having personal debt problems have the option under bankruptcy law to file personal bankruptcy or a consumer proposal in order to eliminate their debt. Bankruptcy is seen as the solution of last resort while a consumer proposal is a way to repay a portion of your debts over a longer period of time.

If personal bankruptcy is the best financial solution to deal with your debts, as part of the , your bankruptcy trustee will review your situation to determine which type of bankruptcy they will need to file with the Office of the Superintendent of Bankruptcy.

In general there are two types of personal bankruptcy in the BIA that may apply:

- A Summary Administration and

- An Ordinary Administration Bankruptcy

How Many Types Of Bankruptcies Are There

Bankruptcy is not an unfamiliar term to most people in the US. It is usually an option for people who are unable to settle their debts. It helps in making a plan that will enable them to get rid of their debts. In the United States, it is handled in the federal courts.

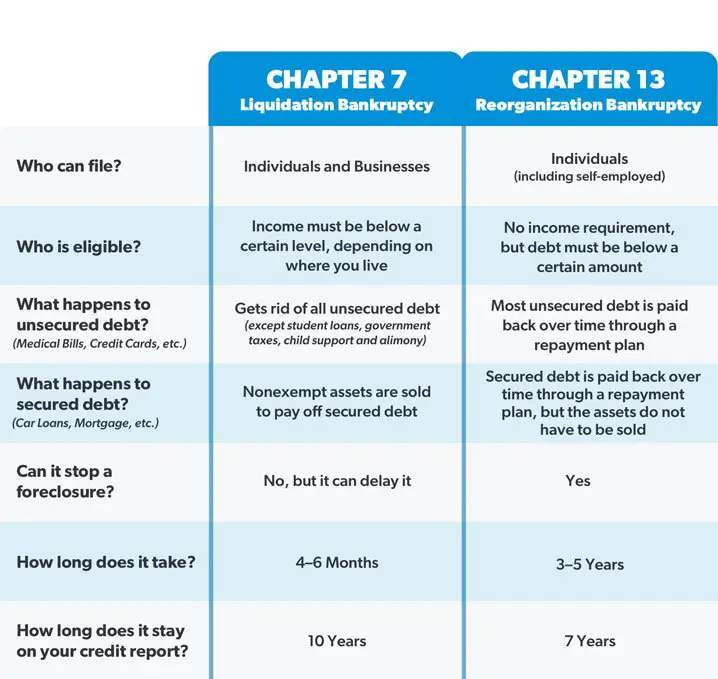

The most common types of bankruptcy are Chapter 13 and Chapter 7 because they are readily available to people. Generally, there are six different chapters of bankruptcy in the United States. The section below explains what you need to know about each chapter.

Types of Bankruptcies

The United States Bankruptcy code comprises five chapters for debts owed in the country, while the sixth type has to do with debt involving more than a country.

Furthermore, each chapter applies to a specific type of debtor as it has a unique goal. Below are the details of the bankruptcy options in the United States:

-

Chapter 7

This type of bankruptcy is available for Businesses or individuals. It can also be referred to as liquidation. This chapter allows debtors to discharge most debts after giving up their nonexempt assets. One of the major requirements for this type of bankruptcy is that the state’s median income must be more than the debtors income. Discharging debts in chapter 7 bankruptcy is not automatic. You can only walk away from eligible debits.

-

Chapter 9

-

Chapter 11

-

Chapter 12

-

Chapter 13

-

Chapter 15

THANKS FOR VISITING.

Unemployed Homeowners With Significant Equity Possibly Chapter 7

If a homeowner has a significant amount of equity in property, then Chapter 7 may or may not be the best option. If the homeowner’s state exempts a generous amount of home equity, then the home may be safe. But if the state homestead exemption doesn’t cover the equity, the homeowner may lose the home in a Chapter 7 bankruptcy. Because the homeowner will only be able to keep the home in Chapter 13 bankruptcy if he or she has enough income to fund a repayment plan, it’s unlikely Chapter 13 will be available to an unemployed homeowner.

Read Also: Can You Rent An Apartment After Filing For Bankruptcy

Personal Bankruptcy In Canadaknow How Bankruptcy Works And Get Info On Your Other Options

Before you file for personal bankruptcy, its important that you get the facts needed to make an informed decision. There are also other options which may work for you.

Filing for bankruptcy should always be a last resort. It costs money to go bankrupt and the process to be discharged from bankruptcy takes time. Even if you do end up choosing bankruptcy, why not do so knowing that it truly is your best option? Explore the many alternatives to bankruptcy to find out.

Types Of Bankruptcy In Canadapersonal And Small Business Or Corporate

There are two main types of bankruptcy in Canada: one is personal and the other is business. Whether youre considering filing bankruptcy as an individual or a business, you need to make an informed decision before pursuing this option. Theres a lot of information about bankruptcy that can help you decide if you should file or not.

Also Check: How Much Does It Cost To File Bankruptcy In Wisconsin

When Should I Declare Bankruptcy

When asking yourself Should I file for bankruptcy? think hard about whether you could realistically pay off your debts in less than five years. If the answer is no, it might be time to declare bankruptcy.

The thinking behind this is that the bankruptcy code was set up to give people a second chance, not to punish them forever. If some combination of bad luck and bad choices has devastated you financially, and you dont see that changing in the next five years, bankruptcy is your way out.

Even if you dont qualify for bankruptcy, there is still hope for debt relief. Possible alternatives include a debt management program, a debt consolidation loan or debt settlement. Each one of those choices typically require 3-5 years to reach a resolution, and none of them guarantees all your debts will be settled when you finish.

Remember that bankruptcy carries significant long-term penalties. It is stuck on your credit report for 7-10 years, which can make getting loans in the future very difficult.

The flip side of that is there is a great mental and emotional lift when all your debts are eliminated, and youre given a fresh start.

What Is A Chapter 13 Bankruptcy Used For

Chapter 13 is a type of bankruptcy where people repay their debts over a 3 or 5 year period. People use chapter 13 bankruptcies to repay debt that is out of hand when they do not qualify for a chapter 7, or are trying to repay a secured debt like a home or a car. After the debtor makes payments for the 3 or 5 year period any unpaid debts that can be discharged will be forgiven like in chapter 7. There are more types of debts that are forgivable in chapter 13 than in chapter 7.

You May Like: How Many Bankruptcies Has Donald Trump Filed

There Debt Limitations On Filing A Chapter 13 Bankruptcy

There are debt limits when filing chapter 13 and these normally change a little bit every year. Currently, as of April 2019, a debtor cannot have over $419,275 in unsecured debts which is up from $394,725 from 2018 and cannot have over $1,257,850 in secured debts which is up from $1,184,200 in 2018.

Types Of Business Bankruptcies

Business bankruptcies typically fall into one of three categories. Two Chapter 7 and Chapter 13 are variations on the personal bankruptcy theme. Chapter 11 bankruptcy is generally for businesses that have hit a bad patch and might be able to survive if their operations, along with their debt, can be reorganized.

Business bankruptcies involve legal entities ranging from sole proprietorships and LLCs to partnerships, professional associations, and corporations.

You May Like: Can You Get A Personal Loan After Bankruptcy

Advantages And Disadvantages Of Bankruptcy

If you’re trying to decide whether you should file for bankruptcy, your credit is probably already damaged. But it’s worth noting that a Chapter 7 filing will stay on your for 10 years, while a Chapter 13 will remain there for seven. Any creditors or lenders you apply to for new debt will see the discharge on your report, which can prevent you from getting any credit.

What Bankruptcy Cannot Do For You

1. Bankruptcy will not free you from paying child support and other alimony payments. Courts in the United States take domestic support obligations very seriously, and therefore under public policy reasons they are not dischargeable in bankruptcy.

These types of accountabilities survive bankruptcy in the sense that you will have continue making payment during the bankruptcy. If you are planning on filing for a Chapter 13 bankruptcy, these debts will be a part of your payment plan and any arrears must be paid in full within the specified time period.

2. Eliminate your student loans. Unfortunately, education loan obligations are not forgiven in bankruptcy. Unless you can prove that you find it almost impossible to live a decent life and that paying your student loans will cause you âundue hardshipâ, it is nearly impossible to get eliminate student loans through bankruptcy. You may, however, succeed in delaying or lowering your student loans through student loan modifications.

Please take note that it is extremely hard to meet this criteria and pursuing this will be very difficult even if you do qualify.

3. Remove your tax debts and other non-dischargeable payables

4. Remove court fines, legal penalties, or criminal offenses

Also Check: How To File Bankruptcy In Wisconsin

Do You Need Legal Help

Contact us today!

There are four types of bankruptcy: chapter 7, 11, 12, and 13. They are named depending on their chapters in the United States Bankruptcy code. The types differ based on the debtor, the debtors income, and the methods used in repaying the debts.

Chapter 7 and 13 bankruptcy are for individuals seeking to settle their debt. Bankruptcy can often be confusing and frustrating for an individual to understand, and contacting a San Antonio bankruptcy attorneycould make the process much more painless.

Chapter 7 bankruptcy is sometimes called a straight bankruptcy. It is basically a liquidation. With this type of bankruptcy, the debtor has to turn in all property for liquidations except that which is exempt. Basic household furnishings and work-related objects are those that might be exempt. The trustee then turns over the cash to the creditors. There is no reorganization in chapter seven, only declaration. It can be seen as a fresh start from the debtor in the way that ownership for non-exempt items is given up and the debtor gets to start over. Chapter 7 is generally a quicker process than chapter 13 and is the type that more individuals would qualify for.

Chapter 11 and 12 bankruptcy is for businesses or farmers.

Jeff Davis is the Owner of the Davis law firm and a highly experienced San Antonio bankruptcy attorney. To find out more information about a San Antonio bankruptcy lawyer, please visit www.jeffdavislawfirm.com.

What Bankruptcy Can Do For You

Now that we have discussed the different types of bankruptcies available to U.S. residents we will discuss the types of debts that are dischargeable in bankruptcy. Although bankruptcy is able to eliminate most debts, it does erase some. You can expect bankruptcy to provide the following advantages:

Recommended Reading: Can You Rent An Apartment After Filing For Bankruptcy

For Many Debtors Chapter 7 Bankruptcy Is A Better Option Than Chapter 13 Bankruptcy

By Cara O’Neill, Attorney

In many cases, Chapter 7 bankruptcy is a better fit than Chapter 13 bankruptcy. For instance, Chapter 7 is quicker, many filers can keep all or most of their property, and filers don’t pay creditors through a three- to five-year Chapter 13 repayment plan. But not everyone qualifies to file for Chapter 7 bankruptcyand in some cases, Chapter 7 doesn’t provide the help the filer needs. Find out when Chapter 7 bankruptcy might be more advantageous than Chapter 13 bankruptcy.

If you’d like step-by-step guidance through the bankruptcy process, read What You Need to Know to File for Bankruptcy in 2021.

Drawbacks Of Chapter 13 Bankruptcy

Most people prefer Chapter 7 bankruptcy because, unlike Chapter 13 bankruptcy, it doesn’t require you to repay a portion of your debt to creditors. In Chapter 13 bankruptcy, you must pay all of your disposable incomethe amount remaining after allowed monthly expensesto your creditors for three to five years.

Also Check: Has Donald Trump Filed Bankruptcy

Which Type Of Bankruptcy Is Best For You

When evaluating the different types of bankruptcies as an individual, youre most likely going to settle for either Chapter 7 or Chapter 13.

Each type of bankruptcy offers alleviation from at least a partial amount of your debt through a bankruptcy discharge. However, each carries its own drawbacks.

Chapter 7 bankruptcy is usually a faster affair, resolving itself within half a year, and you dont need to deal with trustees since there isnt a repayment plan. The major drawback, if you have anything of value that is non-exempt, then its most likely going to be liquidated to repay the creditors.

Chapter 13 bankruptcy can be long and drawn out, most likely ending after five years from the submission of the petition. You will need to deal with trustees going over your spending since youll be under a new payment plan to reimburse your creditors. However, unlike Chapter 7 bankruptcy, youll be able to retain your property.

When choosing between the two forms, keep in mind that some types of debt cant be discharged by a bankruptcy judge. Debt such as alimony, child support, student loans, and income tax needs to be paid regardless of the Chapter you file.

Bankruptcies For Businesses Cities Farmers And Fishers

The U.S. Bankruptcy Code also provides opportunities for businesses , international companies, farmers, fishers, and cities to manage debt payments. Businesses may file Chapter 11 bankruptcy so that it could deal with secured and unsecured debt payments while continuing to operate the business. Farmers and fishers may file for Chapter 12 international companies Chapter 15 and cities Chapter 9.

While bankruptcy is always an option to solve debt problems, it also carries major consequences. It can lower credit rating and drive interest rates for loans higher. And so, experts advice that people and businesses consider thoroughly other alternatives before deciding to file for bankruptcy.

You May Like: How Many Times Has Trump Declared Bankruptcy

Whats The Cost And Fees Of Filing For A Bankruptcy Discharge

You may be wondering about what itll cost to bankruptcy? A good majority of bankruptcy attorneys recognize this and theyve set up some payment plans that can help people to afford their bankruptcy payments.

Most of the costs youll be required to pay include the filing fee and the attorney fee. The attorney fee varies with a wide range of factors while the filing fee is often between $300 and $400.

Especially since the reason why youre filing for the discharge in the first place is that you cant pay your bills.

Chapter 11 And Chapter 12

Chapter 11 and Chapter 12 are similar to Chapter 13 repayment bankruptcy but designed for specific debtors.

Chapter 11 bankruptcy is another form of reorganization bankruptcy that is most often used by large businesses and corporations. Individuals can use Chapter 11 too, but it rarely makes sense for them to do so.

Chapter 12 bankruptcy is designed for farmers and fishermen. Chapter 12 repayment plans can be more flexible in Chapter 13. In addition, Chapter 12 has higher debt limits and more options for lien stripping and cramdowns on unsecured portions of secured loans.

Recommended Reading: How To File Bankruptcy In Tennessee

If You’re Thinking About Bankruptcy You’ll Need To Consider Which Type Is Right For You Here Are The Highlights

By Cara O’Neill, Attorney

Once you’ve decided that bankruptcy is the right solution for your financial situation, you will need to decide which type of bankruptcy is most beneficial.

If you are an individual or a small business owner, then your most obvious choices are Chapter 7 “liquidation” bankruptcy or Chapter 13 “wage earners” or “reorganization” bankruptcy.

We’ll go over the pros and cons of each, the eligibility rules, and give you some information to help decide which would be best for you in your financial situation.

There are a select few other types of bankruptcies that are available under certain circumstances, and we will touch on those as well.

How Does Bankruptcy Work

Bankruptcy is a method to eliminate or at least reduce your debt when bills pile up beyond your ability to repay them. It should be viewed as a last resort to be considered only when all other potential courses of action to get back on track have been exhausted.

Individuals filing for bankruptcy mostly use either Chapter 7 or Chapter 13. The biggest difference between the two is what happens to your property:

- Chapter 7, which is known as liquidation bankruptcy, involves selling some or all of your property to pay off your debts. This is often the choice if you don’t own a home and have a limited income.

- Chapter 13, also known as a reorganization bankruptcy, gives you the chance to keep your property if you successfully complete a court-mandated repayment plan that lasts between three and five years.

Depending on where you live and your marital status, some of your property may be exempt from being sold when you file Chapter 7 because of state-specific and federal exemptions. With exemptions, whether they be your home equity, retirement accounts or even personal possessions such as jewelry, you receive the allowed exemption amounts, and the rest of the proceeds will be used to pay off debts. You can read more about potential exemptions, and check out this chart for a quick rundown on the two types:

| Chapter 7 |

|---|

- Child support or alimony

- Student loans

Read Also: How Much Does It Cost To File Bankruptcy In Iowa