Us National Debt Tops $31 Trillion For First Time

Americas borrowing binge has long been viewed as sustainable because of historically low interest rates. But as rates rise, the nations fiscal woes are getting worse.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

By Alan Rappeport and Jim Tankersley

WASHINGTON Americas gross national debt exceeded $31 trillion for the first time on Tuesday, a grim financial milestone that arrived just as the nations long-term fiscal picture has darkened amid rising interest rates.

The breach of the threshold, which was revealed in a Treasury Department report, comes at an inopportune moment, as historically low interest rates are being replaced with higher borrowing costs as the Federal Reserve tries to combat rapid inflation. While record levels of government borrowing to fight the pandemic and finance tax cuts were once seen by some policymakers as affordable, those higher rates are making Americas debts more costly over time.

So many of the concerns weve had about our growing debt path are starting to show themselves as we both grow our debt and grow our rates of interest, said Michael A. Peterson, the chief executive officer of the Peter G. Peterson Foundation, which promotes deficit reduction. Too many people were complacent about our debt path in part because rates were so low.

Resort To Extraordinary Measures

Prior to the 2011 debt ceiling crisis, the debt ceiling was last raised on February 12, 2010 to $14.294 trillion.

On April 15, 2011, Congress passed the last part of the 2011 United States federal budget in the beginning 2012, authorizing federal government spending for the remainder of the 2011 fiscal year, which ended on September 30, 2011. For the 2011 fiscal year, expenditure was estimated at $3.82 trillion, with expected revenues of $2.17 trillion, leaving a deficit of $1.48 trillion. This includes, public and federal debt, as well as the GDP. Leaving a budget deficit of 38.7%, the world’s highest.

How The Large Us Debt Affects The Economy

In the short run, the economy and voters benefit from deficit spending because it drives economic growth and stability. The federal government pays for defense equipment, health care, building construction, and contracts with private businesses. New employees are then hired and they spend their salaries on necessities and wants, like gas, groceries, new clothes, and more. This consumer spending boosts the economy. As part of the components of GDP, federal government spending contributes around 7%.

Over the long term, debt holders could demand larger interest payments, because the debt-to-GDP ratio increases, and this high ratio of debt to gross domestic product tells investors that the country might have problems repaying them. That’s a newerand worryingoccurrence for the U.S. Back in 1988, the national debt was only half of what the U.S. produced that year.

Don’t Miss: Cheap Pallets Of Merchandise For Sale

Who Owns The National Debt

According to the Treasurys 2019/20 Debt Management Report, as of September 2018, 32% of government gilts were owned by UK Pension and Insurance companies, 28% were owned by foreign investors, and 24% of the national debt was owned by the government itself through the Bank of Englands Asset Purchase Facility referenced above.

In 2019, private debt in the United Kingdom was recorded as being 190% of GDP, twice that of public sector debt.

Our Fiscal Forecast The Structural Deficit

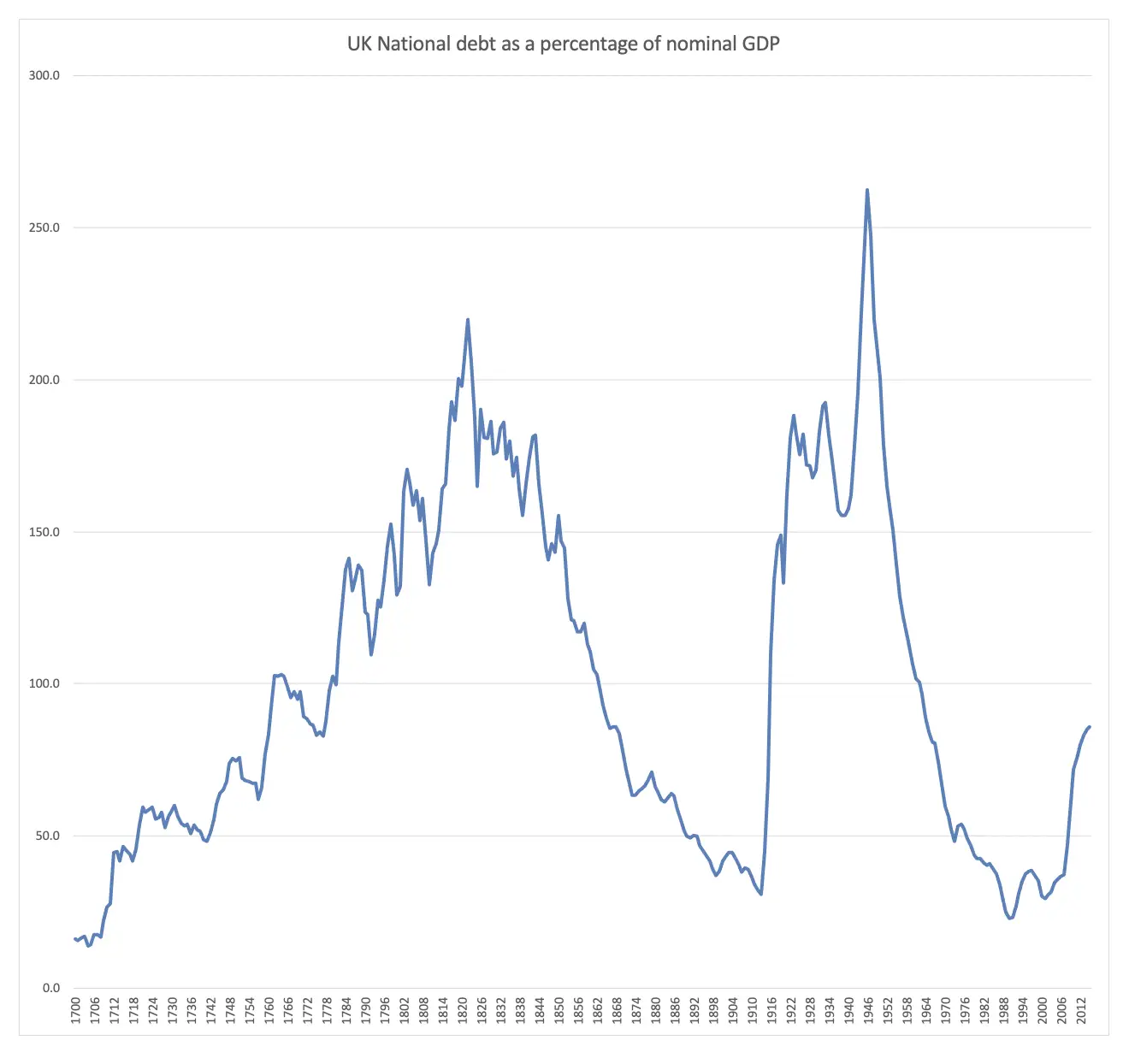

At 79 percent of GDP, our federal debt is at its highest point since just after World War II. Unfortunately, the even more depressing fiscal fact is that our debt is projected to nearly triple over the next 30 years to more than twice the size of the U.S. economy. These levels have no precedent in American history.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch between spending and revenues, and the gulf between them is growing.

The growth in our deficit is caused primarily by three key drivers of spending demographics, healthcare costs, and interest on the debt as well as by revenues that are insufficient to cover the promises that have been made.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch.

Read Also: How To Find Bankruptcy Filings In Texas

Does Government Borrowing Create New Money

In most cases the process of government borrowing does not create any new money. While most individuals and businesses accept bank deposits in payment, the UK government does not they require that the purchasers of new bonds settle the transaction by transferring central bank reserves into a government-owned account at the Bank of England. This means that new money is not created in the process of government borrowing.

For example, lets say a pension fund holds an account at MegaBank, and wishes to buy £1 million in government bonds. The fund asks MegaBank, which is one of the Gilt-Edged Market Makers , to buy £1 million of new government bonds. MegaBank decreases the pension funds account by £1 million and then purchases the bonds on behalf of the pension fund. To settle its transaction with the government, it transfers £1 million of reserves to the governments account at the Bank of England. The balance of MegaBanks account at the Bank of England will drop by £1 million. The government now has £1 million of central bank reserves in its account at the Bank of England, which can be used to make payments. It has borrowed the money without any additional deposits being created.

To spend the money it could now transfer the reserves to Regal Bank where an NHS hospital holds an account. Regal bank would then receive £1 million of central bank reserves, and could increase the account balance of the hospital by £1 million.

Why Is The Us In Debt

Countries around the world currently hold a national debt in order to grow the economy and the country, debt is oftentimes needed to fund expansions and programming. The United States debt levels are extremely high, and can be attributed, in part, to income inequalities and trade deficit. These two factors indicate that some level of debt must be taken on in order to keep the economy moving. The U.S.s national debt increased 840% during the period from 1989 to 2020.

Don’t Miss: National Debt Real Time

Current Foreign Ownership Of Us Debt

apan owned $1.23 trillion in U.S. Treasurys in June 2022, making it the largest foreign holder of the national debt. The second-largest holder is China, which owns $967.8 billion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their own currencies. This helps to keep their exports to the U.S. affordable, which helps their economies grow.

China replaced the U.K. as the second-largest foreign holder in 2006 when it increased its holdings to $699 billion.

The U.K. is the third-largest holder with $615.4 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. Luxembourg is next, holding $306.8 billion. The Cayman Islands, Switzerland, Ireland, Belgium, France, and Taiwan round out the top 10.

Who Holds The Debt

The bulk of U.S. debt is held by investors, who buy Treasury securities at varying maturities and interest rates. This includes domestic and foreign investors, as well as both governmental and private funds.

Foreign investors, mostly governments, hold more than 40 percent of the total. By far the two largest holders of Treasurys are China and Japan, which each have more than $1 trillion. For most of the last decade, China has been the largest creditor of the United States. Apart from China, Japan, and the UK, no other country holds more than $500 billion.

In response to the pandemic, the Federal Reserve dramatically increased its purchases of U.S. debt, buying in days what it used to buy in a month, and the central bank committed to essentially unlimited bond buying. Since March 2020, the Feds balance sheet has almost doubled to $8 trillion, renewing concerns among economists about the Feds independence.

Read Also: What Does Foreclosure Mean

Impacts Of Government Debt

Government debt accumulation may lead to a rising interest rate, which can crowd out private investment as governments compete with private firms for limited investment funds. Some evidence suggests growth rates are lower for countries with government debt greater than around 80 percent of GDP. A World Bank Group report that analyzed debt levels of 100 developed and developing countries from 1980 to 2008 found that debt-to-GDP ratios above 77% for developed countries reduced future annual economic growth by 0.017 percentage points for each percentage point of debt above the threshold.

Excessive debt levels may make governments more vulnerable to a debt crisis, where a country is unable to make payments on its debt, and it cannot borrow more. Crises can be costly, particularly if a debt crisis is combined with a financial/banking crisis which leads to economy-wide deleveraging. As firms sell assets to pay off debt, asset prices fall which risks an even greater fall in incomes, further depressing tax revenue and requiring governments to drastically cut government services. Examples of debt crises include the Latin American debt crisis of the early 1980s, and Argentina’s debt crisis in 2001. To help avoid a crisis, governments may want to maintain a “fiscal breathing space”. Historical experience shows that room to double the level of government debt when needed is an approximate guide.

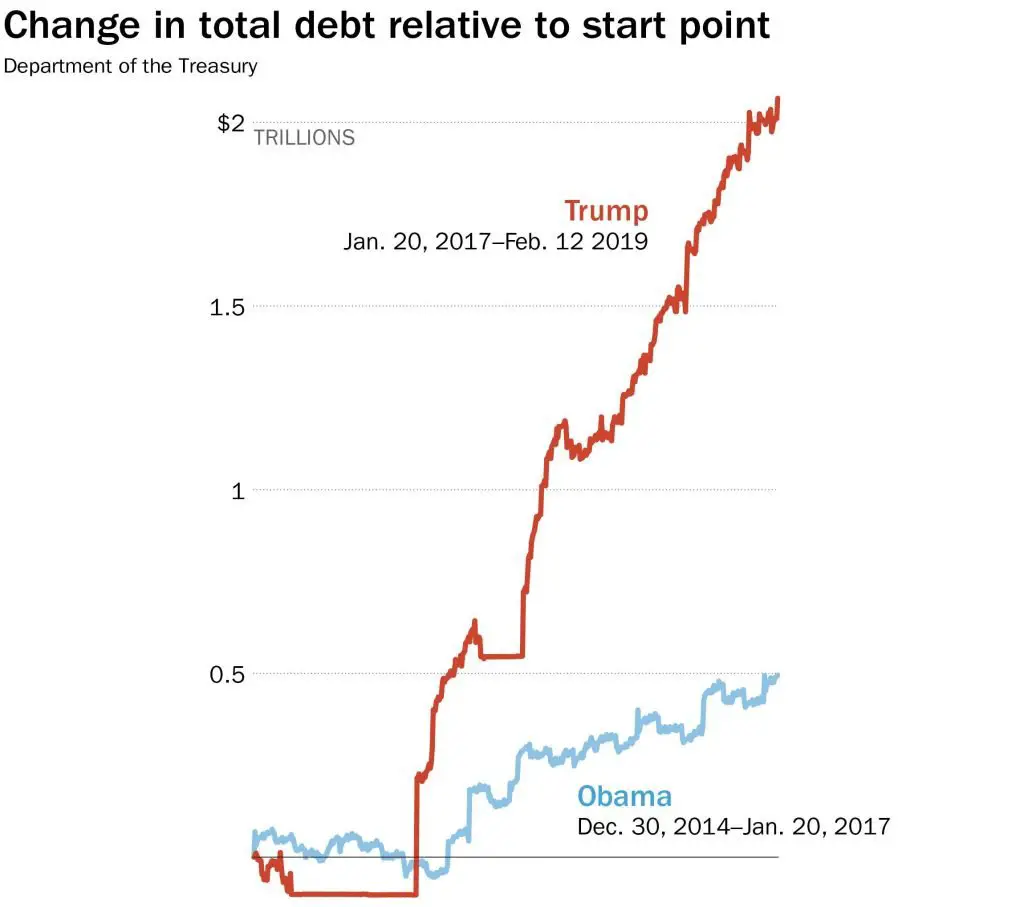

The Types Of Presidential Decisions That Impact National Debt

Presidents can have a tremendous impact on the national debt. They can also have an impact on the debt in another presidentâs term. When President Trump took office in January of 2017, for the first nine months of his presidency, he operated under President Obamaâs budget which didnât end until September, 2017. So for most of a new presidentâs first year in office, he isnât accountable for the spending that takes place. As strange as this may seem, itâs actually by design to allow time for the new president to put a budget together when in office.

You May Like: Can You File Bankruptcy More Than Once

Recent Concern About Budget Deficits And Long

| This article or section possibly contains synthesis of material which does not verifiably mention or relate to the main topic. Relevant discussion may be found on the . ( |

Underlying the contentious debate over raising the debt ceiling has been an anxiety, growing since 2008, about the large United States federal budget deficits and the increasing federal debt. According to the Congressional Budget Office : “At the end of 2008, that debt equaled 40 percent of the nation’s annual economic output . Since then, the figure has shot upward: By the end of fiscal year 2011, the Congressional Budget Office projects federal debt will reach roughly 70 percent of gross domestic product â the highest percentage since shortly after World War II.” The sharp rise in debt after 2008 stems largely from lower tax revenues and higher federal spending related to the severe recession and persistently high unemployment in 2008â11. Though a balanced budget is ideal, allowing down payment on debt and more flexibility within government budgeting, limiting deficits to within 1% to 2% of GDP is sufficient to stabilize the debt. Deficits in 2009 and 2010 were 10.0 percent and 8.9 percent respectively, and the largest as a share of gross domestic product since 1945.

What Are The Policy Options For Dealing With The Debt

Politicians and policy experts have put forward countless plans over the years to balance the federal budget and reduce the debt. Most include a combination of deep spending cuts and tax increases to bend the debt curve.

Cut spending. Most comprehensive proposals to rein in the debt include major spending cuts, especially for growing entitlement programs, which are the main drivers of future spending increases. For instance, the 2010 Simpson-Bowles plan, a major bipartisan deficit-reduction plan that failed to win support in Congress, would have put debt on a downward path and reduced overall spending, including military spending. It also would have reduced Medicare and Medicaid payments and put Social Security on a sustainable footing by reducing some benefits and raising the retirement age. However, Biden plans to address gaps in the U.S. social safety net, which could increase demand for more long-term funding.

Some optimists believe that the federal government could continue expanding the debt many years into the future with few consequences, thanks to the deep reservoirs of trust the U.S. economy has accumulated in the eyes of investors. But many economists say this is simply too risky. The debt doesnt matter until it does, says Maya MacGuineas, president of the bipartisan Committee for a Responsible Federal Budget. By taking advantage of our privileged position in the global economy, we may well lose it.

Also Check: Where Can I Buy Liquidation Pallets

The National Debt Dilemma

- The pandemic has taken the U.S. national debt to levels not seen since the 1940s.

- The United States is in a unique position because it holds the worlds reserve currency, allowing it to carry debt more cheaply than other countries.

- Some experts argue that the United States can safely continue to sustain high levels of debt, while others warn that it will eventually have to face the consequences.

The U.S. national debt is once again raising alarm bells. The massive spending in response to the COVID-19 pandemic has taken the budget deficit to levels not seen since World War II. This expansion follows years of ballooning debttotaling nearly $17 trillion in 2019that will now be even more difficult to reduce. Raising the debt ceiling, the legal limit on government borrowing, has become a perennial fight in Congress.

Forms Of Government Borrowing

In addition to selling Treasury bills, notes, and bonds, the U.S. government borrows by issuing Treasury Inflation-Protected Securities and Floating Rate Notes . Its borrowing instruments also include savings bonds as well as government account securities that represent intergovernmental debt.

Other nations have borrowed from international organizations like the International Monetary Fund and The World Bank as well as private financial institutions.

Don’t Miss: Who Is Eligible To File Bankruptcy

Fannie Mae And Freddie Mac Obligations Excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 “makes them even more permanent wards of the state and turns the government’s preferred stock into a permanent, perpetual kind of security”.

How Does The Government Borrow Money

The government typically borrows money from the markets. In its simplest form, some have likened this to the government operating its own savings account service.

The government issues its own bonds . Those who buy these bonds are in effect lending the government money. At a later date, people can always sell on these government bonds to others, through a secondary bond market.

Pension funds and insurance companies traditionally like the idea of investing in the governments bonds because they consider them to be low risk. The UK government has yet to default on its debt obligations, and it is considered unlikely to do so, given that it has the ability to command money from the public through taxation. Government bonds also typically offer an in interest rate in excess of other low risk investments, such as cash.

Historically the government required purchasers of its new bonds to settle the transaction by transferring central bank reserves into a government owned account, thereby ensuring that government borrowing did not create additional money or induce a monetary stimulus to the economy.

One notable exception to the governmental borrowing money through gilt issues has been the Private Finance Initiative. Here the government has also borrowed directly from banks to pay for specific projects.

Also Check: What Is Consumer Debt In Bankruptcy

The Role Of Annuities In The English National Debt

The role of annuities in the evolution of the national debt, to the 171920 South Sea venture, provides interesting contrasts with contemporary continental public debts. As noted, the 1693 Million Pound Loan was actually a life annuity . In 1694, during the formation of the Bank of England, the Exchequer sold a small series of annuities with various durations: for three lives , two lives , and one life . In 1704, the Exchequer sold another series of annuities, paying 6.60% per year: one series for 99 years and the other for one, two, and three lives. Thereafter, from 1705 to 1709, the Exchequer sold another five series of 99-year redeemable or convertible annuities, with rates that fell from 6.60% to 6.25% . In 1710, it began issuing a combination of 32-year annuities and redeemable lottery loans, at 9.00%. By 1719, the long-term annuities had been increased and converted into 5.00% annuities, totaling £13 331 320, and the short-terms annuities had been expanded and converted into a total of £1 703 366, with an average rate of 7.143%.

A.L. Murphy, in, 2013