Less To Spend On Other Government Initiatives

The more money the U.S. has to spend on meeting its debt obligations as interest rates increase, the less financial capacity it could have to fund programs focused on education, veterans benefits and transportation.

This breakdown of the 2019 Federal Budget from the Council on Foreign Relations shows how the budget pie is only so big, so when one area increases , another must decrease.

How Does The National Debt Affect Me

Interest payments also have an important role as they grow in step with the national debt. As the government allocates more funds towards paying off interests, other investment areas could get crowded out. Areas such as education, research and development, and infrastructure may not progress at sufficient or adequate levels due to interest payments. Interest payments currently take many of the dollars that are raised through federal income, estate, and federal excise taxes. Net worth is also an important and interesting factor that can be affected by the national debt.The cost of borrowing money to purchase large assets such as homes will increase due to the Federal Reserves interest rates. Interest rates will push down the prices of homes as individuals will struggle to qualify for mortgage loans this will then lower prices on home values.

Social Security System Strains

For decades, payroll tax receipts earmarked for Social Security have exceeded benefit payments, producing system surpluses that have masked the structural U.S. budget deficit. But those surpluses shrank before turning into a shortfall in 2021, and in the near future, the deficits are expected to increase as baby boomer retirements swell the ranks of Social Security recipients.

The Old-Age and Survivors Insurance Trust Fund funding Social Security payments for retirees saw annual gains that peaked at about $180 billion from 2006 to 2008. Those surpluses are projected by the trust funds board of trustees to give way to growing deficits, potentially topping $200 billion annually by 2028 and $300 billion by 2030. In combination with payroll taxes, the $2.75 trillion trust fund is expected to finance full benefit payments until it is exhausted in 2034.

Growing life expectancy and reduced fertility rates are expected to reduce the share of working-age population from 58.3% in 2021 to 54.6% by 2050. Over the same span, the ratio of working-age Americans to those of retirement age is projected to drop from 3.4-to-1 to 2.6-to-1.

You May Like: How To Stop Foreclosure

What The National Debt Means To You

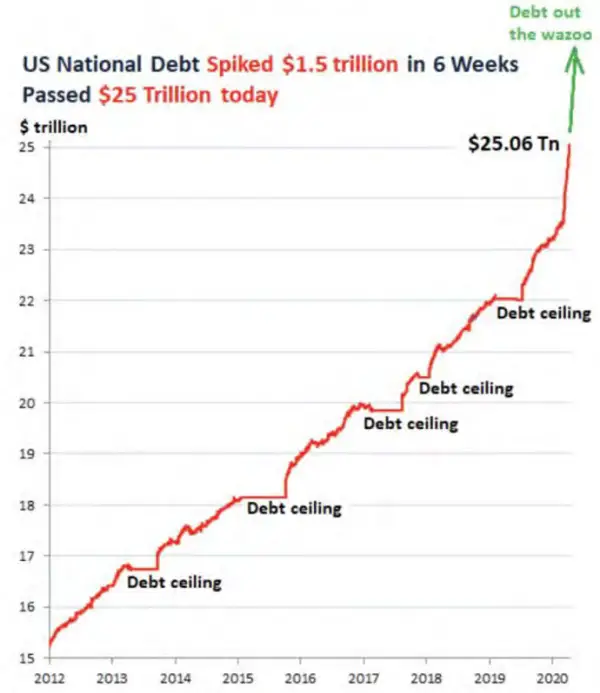

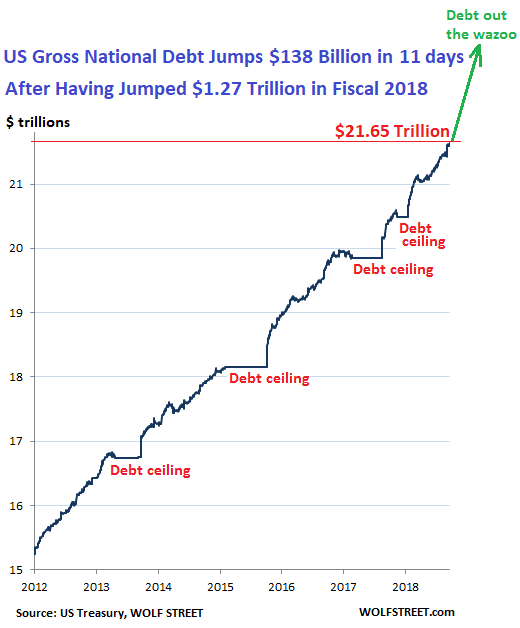

The U.S. national debt has long been the subject of significant political controversy. Given its rapid rise in recent years following federal spending increases tied to the COVID-19 pandemic, it’s easy to understand why the issue is drawing more attention from economists, financial markets participants, and critics of government policies.

Polls have long shown high levels of public unease with the U.S. government’s debt, which topped $31 trillion in October 2022. The debt has grown in nominal terms and also relative to the U.S. gross domestic product .

At the same time, large majorities of Americans backed the pandemic relief spending while opposing spending cuts for the costliest government programs. Most also believe they’re already paying too much in federal income tax, while increasingly backing tax increases for corporations and the rich.

The public debt people say makes them uncomfortable is the inevitable result of the tax and spending policies that continue to enjoy broad public support. A related problem is that many aren’t sure what effect the national debt has or might have on their own lives and finances.

Whos Responsible For The Current National Debt

In short? Pretty much every administration.

Regardless of political affiliation, parties in power have run up the deficit through higher spending and lower revenue collection, says Brian Rehling, head of Global Fixed Income Strategy at Wells Fargo Investment Institute.

While its easy to say a particular president or presidents administration caused the federal deficit and national debt to move a certain direction, its important to note that only Congress can authorize the type of legislation with the most impact on both figures.

Heres a look at how Congress acted during four notable presidential administrations and how their actions impacted both the deficit and national debt.

Read Also: Wholesale Liquidation Pallets For Sale

What’s The Difference Between The Debt And The Deficit

The deficit is the difference between what the U.S. Government takes in from taxes and other revenues, called receipts, and the amount of money it spends, called outlays. The items included in the deficit are considered either on-budget or off-budget.

You can think of the total debt as accumulated deficits plus accumulated off-budget surpluses. The on-budget deficits require the U.S. Treasury to borrow money to raise cash needed to keep the government operating. It borrows the money by selling securities to the public.

The Treasury securities issued to the public and to the Government Trust Funds then become part of the total debt.

You are leaving AARP.org and going to the website of our trusted provider. The providers terms, conditions and policies apply. Please return to AARP.org to learn more about other benefits.

Your email address is now confirmed.

You’ll start receiving the latest news, benefits, events, and programs related to AARP’s mission to empower people to choose how they live as they age.

You can also manage your communication preferences by updating your account at anytime. You will be asked to register or log in.

Tracking The Federal Deficit: November 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $193 billion in November, the second month of fiscal year 2022. This deficit was the difference between $474 billion of spending and $281 billion of revenue. Novembers deficit was 33% larger than the deficit recorded in November 2020. However, spending last November was artificially lowered by the fact that November 1 fell on a weekend, shifting $63 billion worth of payments into late October. If not for the timing shift, this Novembers deficit would have been 7% less than that of November last year.

Analysis of notable trends: Through the first two months of FY2022, the federal government has run a deficit of $358 billion$71 billion less than at this point last yearas spending rose 4% and revenues surged 24% this year, reflective of the nations ongoing economic recovery.

Also Check: What Does Bankruptcy Petition Mean On Credit Report

Tracking The Federal Deficit: June 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $173 billion in June, the ninth month of fiscal year 2021. Junes deficit was the difference between $450 billion in revenue and $623 billion in spending.

So far this fiscal year, the federal government has run a cumulative deficit of $2.2 trillion, the difference between $3.1 trillion in revenue and $5.3 trillion in spending. This deficit is nearly triple the shortfall over the same period in FY2019 , but is 19% lower than at the same point in FY2020. This is the first time in FY2021 that the cumulative deficit has decreased year-over-year.

Analysis of Notable Trends: Thus far in FY2021, year-over-year comparisons of deficit levels have largely reflected the trajectory of the COVID-19 pandemic and subsequent federal response. BPC expects this trend to continue through the rest of the fiscal year.

Cumulative year-to-date outlays are up 6% compared to the first nine months of FY2020 and are 58% greater than at this point in FY2019. These changes are indicative of continued spending towards COVID-19 relief programsin particular, refundable tax credits and supplemental unemployment compensationas every month to date in the current fiscal year has contained pandemic-related expenditures, whereas only March-June did for the relevant period last year.

Looking To The Future

Now that we have seen what the historical picture of the debt, deficits, mandatory spending, discretionary spending, and revenues look like, lets look at projected spending levels and deficits for 20202030. Figure 16 shows that:

- Federal spending as a percentage of GDP is projected to increase from 21% to about 23.5% during the 2020s.

- The projected increase in spending will culminate in a projected deficit increase of about 1% of GDP per year, from just under 5% to just under 6%.

- The growth will be driven by increases in mandatory spending, which is projected to increase from just under 13% to just over 15% of GDP per year.

- Net interest on the debt is also projected to increase during the 2020s from under 2% to over 2.5% of GDP per year.

- Discretionary spending is projected to continue its decline from 6.25% to 5.6% per year.

- Increases in the deficit are likely to be driven primarily by the increases in mandatory spending.

There are several reasons to have concerns about the current and projected path of government spending and revenues and the corresponding additional debt with these deficits.

The amount the government borrows each year may impact credit markets, which may slow economic growth.

You May Like: J And J Bankruptcy

Read Also: Can You File Bankruptcy On Government Debt

Us National Debt Through World War I

The United States began incurring debt even before it became a nation, as colonial leaders borrowed money from France and the Netherlands to win their independence from Great Britain in the Revolutionary War.

The Continental Congress, forerunner to the U.S. Congress, did not have the power to tax citizens, and the debt continued to grow. By 1790, it had topped $75 million, with a 30 percent debt-to-GDP ratio, according to an accounting presented that year by Alexander Hamilton, the first secretary of the U.S. Treasury.

The growing U.S. economy helped decrease the debt-to-GDP ratio to below 10 percent until the War of 1812, when the country had to go deep in debt to fight Britain once again.

By the time Andrew Jackson took office in 1828, the national debt was $58 million, an obligation Jackson called the national curse. By selling off federally owned land in the West, Jackson had paid off all of the national debt by January 1835. Within a year, however, an economic recession led the government to start borrowing, and it would never again be debt-free.

What Makes The Debt Bigger

The current leading federal spending categories, which include Social Security, Medicare/Medicaid, and defense, are the same as they were in the 1990s. Thats when the U.S. national debt was much lower relative to GDP. The U.S. remains the worlds largest economy and one of the richest countries. How, then, did the debt situation deteriorate? Numerous factors are in play.

Don’t Miss: Heloc Debt To Income Ratio

Tracking The Federal Deficit: August 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $173 billion in August, the eleventh month of fiscal year 2021. Because August 1 fell on a weekend this year, certain large federal payments that typically pay out on the first of the month were shifted into late July. If not for this timing shift, the August deficit would have been $233 billion$60 billion greater than reported. Monthly revenues rose 20% compared to last August, primarily due to increased income and payroll tax receipts. Spending increased by 4% year over year, driven by changes in pandemic response spending.

So far this fiscal year, the federal government has run a cumulative deficit of $2.7 trillion, the difference between $3.6 trillion in revenue and $6.3 trillion in spending. This deficit is 10% lower than over the same period in FY2020, but more than 150% larger than the FY2019 deficit at this point in the year.

Analysis of Notable Trends: With one month to go until the close of fiscal year 2021, the federal government is on track to record a somewhat smaller deficit than last year. The economic recovery has buoyed revenues, and the tapering of some large pandemic relief programs has slowed growth in outlays.

Does Government Borrowing Create New Money

In most cases the process of government borrowing does not create any new money. While most individuals and businesses accept bank deposits in payment, the UK government does not they require that the purchasers of new bonds settle the transaction by transferring central bank reserves into a government-owned account at the Bank of England. This means that new money is not created in the process of government borrowing.

For example, lets say a pension fund holds an account at MegaBank, and wishes to buy £1 million in government bonds. The fund asks MegaBank, which is one of the Gilt-Edged Market Makers , to buy £1 million of new government bonds. MegaBank decreases the pension funds account by £1 million and then purchases the bonds on behalf of the pension fund. To settle its transaction with the government, it transfers £1 million of reserves to the governments account at the Bank of England. The balance of MegaBanks account at the Bank of England will drop by £1 million. The government now has £1 million of central bank reserves in its account at the Bank of England, which can be used to make payments. It has borrowed the money without any additional deposits being created.

To spend the money it could now transfer the reserves to Regal Bank where an NHS hospital holds an account. Regal bank would then receive £1 million of central bank reserves, and could increase the account balance of the hospital by £1 million.

Recommended Reading: What Is The Best Way To Rebuild Credit After Bankruptcy

Debt By Year Compared To Nominal Gdp And Events

In the table below, the national debt is compared to GDP and influential events since 1929. The debt and GDP are given as of the end of the fourth quarter in each year to coincide with the end of the fiscal year. That’s the best way to accurately determine how spending in each fiscal year contributes to the debt and compare it to economic growth.

From 1947-1976, debt and GDP are given at the end of the second quarter since, during that time, the fiscal year ended on June 30. For years 1929 through 1946, debt is reported at the end of the second quarter, while GDP is reported annually, since quarterly figures are not available.

The Role Of Government

What role the government should play in managing the debt is contested. Some policymakers place a lower emphasis on this problem, while some see the debt as a dangerous symptom of out-of-control spending. Those who view the debt as a serious problem tend to fall into two lines of thought: seek spending restraint and new rules to enforce it, or expand the power of the federal government by raising taxes and imposing controls on the industries contributing most, such as healthcare.

Recommended Reading: How Can You Get A Bankruptcy Off Your Credit Report

The National Debt Is Now More Than $31 Trillion What Does That Mean

The gross federal debt of the United States has surpassed $31,000,000,000,000. Although the debt affects each of us, it may be difficult to put such a large number into perspective and fully understand its implications. The infographic below offers different ways of looking at the debt and its relationship to the economy, the budget, and American families.

The $31 trillion gross federal debt includes debt held by the public as well as debt held by federal trust funds and other government accounts. In very basic terms, this can be thought of as debt that the government owes to others plus debt that it owes to itself.

Americas high and rising debt matters because it threatens our economic future. The coronavirus pandemic rapidly accelerated our fiscal challenges, but we were already on an unsustainable path, with structural drivers that existed long before the pandemic. Putting our nation on a better fiscal path will help ensure a stronger and more resilient economy for the future.

National Debt By President

The National Debt has always been an area of interest for the United States President George Washington appointed future President Alexander Hamilton to understand and solve the $80 million debtthat had accrued due to the Revolutionary War. Hamilton came up with the plan to pay off the debt through taxes and the creation of the national bank. Since then the United States has steadily increased its budget deficit, and the national debt has continued to rise.The first time that the national debt hit the $1 billion mark was in 1863 while the Civil War was occurring it hit the $2 billion was two years later when the civil war ended in 1865. As the country went to battle during World War I and World War II, the national debt hit the $10 billion mark and $100 billion marks respectively. By 1982 after the Vietnam War and the Cold War, the national debt hit the $1 trillion mark for the first time in history. By the 21st Century, the national debt got to $20 trillion after major events such as the War on Terror and the Great Recession. Today , the national debt stands at $30.2 trillion and public debt is roughly 100% of the country’s GDP.

Don’t Miss: What Is Debt To Income Ratio Mean

Our Fiscal Forecast The Structural Deficit

At 79 percent of GDP, our federal debt is at its highest point since just after World War II. Unfortunately, the even more depressing fiscal fact is that our debt is projected to nearly triple over the next 30 years to more than twice the size of the U.S. economy. These levels have no precedent in American history.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch between spending and revenues, and the gulf between them is growing.

The growth in our deficit is caused primarily by three key drivers of spending demographics, healthcare costs, and interest on the debt as well as by revenues that are insufficient to cover the promises that have been made.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch.