How Does The Debtor Get A Discharge

Unless there is litigation involving objections to the discharge, the debtor will usually automatically receive a discharge. The Federal Rules of Bankruptcy Procedure provide for the clerk of the bankruptcy court to mail a copy of the order of discharge to all creditors, the U.S. trustee, the trustee in the case, and the trustee’s attorney, if any. The debtor and the debtor’s attorney also receive copies of the discharge order. The notice, which is simply a copy of the final order of discharge, is not specific as to those debts determined by the court to be non-dischargeable, i.e., not covered by the discharge. The notice informs creditors generally that the debts owed to them have been discharged and that they should not attempt any further collection. They are cautioned in the notice that continuing collection efforts could subject them to punishment for contempt. Any inadvertent failure on the part of the clerk to send the debtor or any creditor a copy of the discharge order promptly within the time required by the rules does not affect the validity of the order granting the discharge.

When To Write A Goodwill Letter Instead

A goodwill letter is a request that asks a lender or creditor to remove derogatory information from your credit report. Unlike a dispute, the creditor has no obligation to take any action in response to a goodwill letter or assist your credit repair efforts.

Goodwill letters are most effective when consumers had some temporary difficulty that resulted in failing to make timely payments. For example, your goodwill letter may explain that you suffered a severe injury or illness that prevented you from working and created struggles with paying bills.

The effectiveness of a goodwill letter that cites extenuating circumstances is further increased when the account has since been back into good standing. Accounts that have been forwarded to a collection agency and left unpaid are less likely to be successful using a goodwill letter.

Keep in mind that some goodwill letters involving unpaid accounts may be open to a compromise. The creditor might respond to the goodwill letter stating they will consider removing the negative credit entry if the debt is paid however, these arrangements should always be first put in writing.

The pay-for-delete option has risks because the organization is not legally obligated to remove the entry from your credit report regardless of whether the debt is paid. Also, if the debt was sold to a third-party collector the original creditors negative entry may remain and affect your credit score.

Dont Cast Blame Or Shirk Responsibility

Hardship letters are designed to explain circumstances, not point fingers. No matter how unfair your situation might be, an effort to deflect blame or scapegoat in your hardship letter will be a red flag for the lender.

Instead, focus on describing the exact predicament, your response to the situation and why you need the creditors help to succeed.

You May Like: How To Be A Bankruptcy Lawyer

Get Ahead Of Your Debt

No matter where you stand financially, always be ahead of your debt, so you understand everything required by you, even in emergencies.

Financial hardship can be depressing, but if you reach out to the people, you owe they may give you some space or make arrangements to help keep you out of the bankruptcy office.

Its a bad place to be, but explore all your options and fear no one.

Discussion: Have you ever experienced financial hardship, and how did you handle it? Would you mind leaving me your comments below?

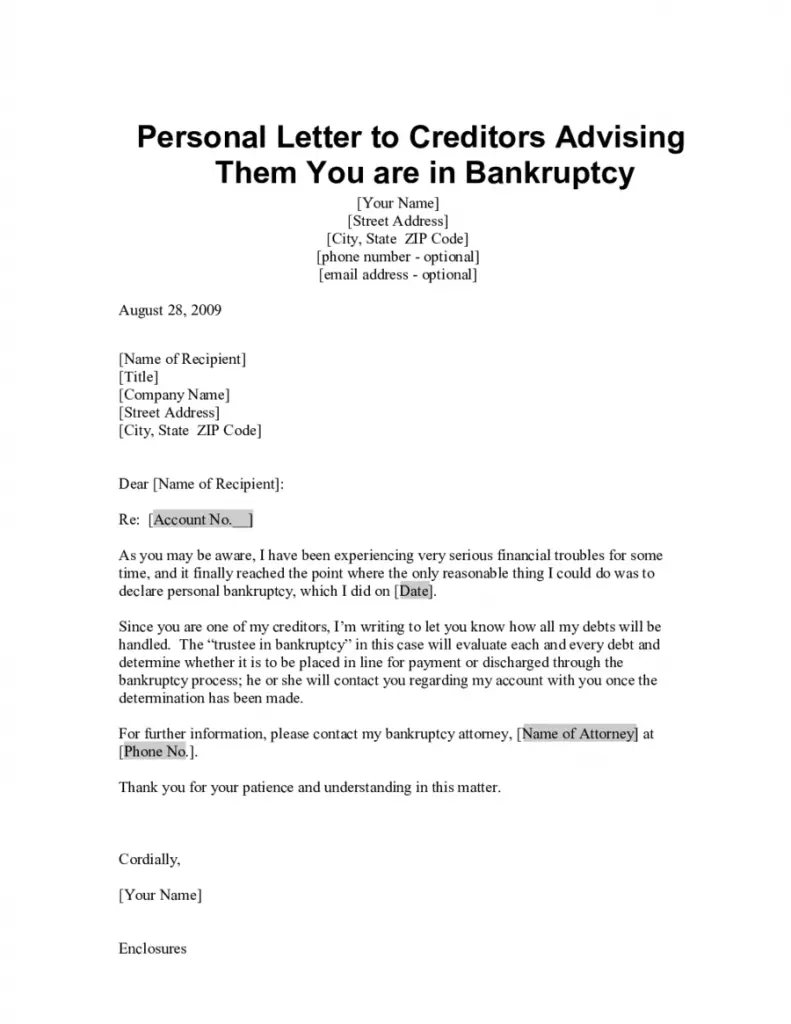

A Sample Letter Template

Chicago, IL 60018

To Whom It May Concern:

The credit information currently on my credit report contains an entry showing a late payment for March 2018 for my closed XYZ credit card account #02-44575.

I acknowledge that I was unable to fulfill the terms of the account agreement by failing to properly adhere to the monthly payments. In late February 2018, I was involved in a serious bicycle accident that resulted in my inability to work for several months.

During the period of my recovery, I struggled to maintain my financial obligations and had late payments. I have since been carefully budgeting and satisfying all of my monetary responsibilities and payments to improve my credit score.

It would assist me tremendously if you could make a goodwill adjustment that removes this negative payment entry from my three credit bureau reports. This is a closed account that represents a past failure that I am hopeful will not continue to hinder my future.

Thank you for your consideration.

Sincerely,

John Smith

Recommended Reading: How Many Times Did Donald Trump File For Bankruptcy

What Is A Debt Settlement Letter

If youâre unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. Itâs not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

If youâre writing and sending the debt settlement letter yourself, be sure to follow up on it. Thereâs a chance it could get lost or the creditor or debt collection company wonât properly process it. If your letter ends up in the wrong department, it could be delayed or never read and processed.

Money Earned In April 2019

Where did all the money go?

One budget category that jumped for us in April was telecommunications as we upgraded to android boxes.

The only problem is that we have 12 months of cable renewal with Rogers, so we will cancel that next year and stay strictly with the android boxes.

Another big expense went to dental because Mrs. CBB needed a crown and will need another in May.

That means another $600 charge. Her dentist also suggested Invisalign braces to help with her clicking jaw and spaces.

Like most benefits, ours covers $2500 lifetime for braces, but Im sure the total will be around the $5-7k mark.

Both Mrs. CBB and I reviewed our budget categories in April and updated each as prices have increased for most services related to our home.

We try to do this as often as possible, but its easy to become lazy and view it as overage when its the actual bill.

For example, you might get a notice that your Rogers Cell phone bill will be going up by $5, so you must increase that number in your budget.

Next month we will see a huge increase in our insurance payments as weve taken a slightly different route with that, as I will discuss in an upcoming blog post.

We will also see a decrease in our investments as Ive had to stop my RRSP for 2019 to avoid over-payment, which I will also discuss.

Overall it was a busy month, and as most homeowners experience during the Spring and Summer, lots of money end up on home maintenance and renovations.

Mr.CBB

Don’t Miss: Can You Get An Sba Loan With A Bankruptcy

Time Frame For Removal Of Credit Entries

|

Currently active accounts in good standing |

Ongoing/indefinite |

|

Hard credit inquiry |

2 years |

Based on the above data, often a consumer may choose to simply wait it out until the negative entry is due for removal from credit bureau reports. Keep in mind that it might take a few months for all the credit bureau reports to be updated after reaching these limits.

Mail Documents To Your Trustee

The Chapter 7 trustee is an official appointed by the court to oversee your case and liquidate, or sell, nonexempt property for the benefit of your creditors. Not all types of bankruptcy require the involvement of a bankruptcy trustee, but both Chapter 7 and Chapter 13 cases have one.

Pay attention to mail you receive from the trustee after filing your case. The trustee will send you a letter asking you to mail them certain financial documents, like tax returns, pay stubs, and bank statements. If you donât send the trustee the requested documents following the instructions provided in their letter, you may not get a discharge of your debts.

Recommended Reading: Bankruptcy Petition Preparer Fee

Adding Supporting Documentation Will Strengthen Your Case

Notice in the letter above weve referenced two pieces of supporting documentation, pay stubs, and medical records. You can make your bankruptcy explanation letter even more credible by including supporting documentation.

For example, if the reason for your bankruptcy was medical, include copies of any records that will substantiate the episode. If it was due to divorce, supply a copy of the divorce decree.

Always realize that the lender isnt looking for ways to decline your loan application. Instead, he or she is looking for you to supply proof that will justify approving your loan.

Writing a good bankruptcy explanation letter, and providing supporting documentation, will make it easier for the lender to approve your application. Approach it like your approval depends on it because it just might.Get Help Repairing Your Credit

Does The Debtor Have The Right To A Discharge Or Can Creditors Object To The Discharge

In chapter 7 cases, the debtor does not have an absolute right to a discharge. An objection to the debtor’s discharge may be filed by a creditor, by the trustee in the case, or by the U.S. trustee. Creditors receive a notice shortly after the case is filed that sets forth much important information, including the deadline for objecting to the discharge. To object to the debtor’s discharge, a creditor must file a complaint in the bankruptcy court before the deadline set out in the notice. Filing a complaint starts a lawsuit referred to in bankruptcy as an “adversary proceeding.”

The court may deny a chapter 7 discharge for any of the reasons described in section 727 of the Bankruptcy Code, including failure to provide requested tax documents failure to complete a course on personal financial management transfer or concealment of property with intent to hinder, delay, or defraud creditors destruction or concealment of books or records perjury and other fraudulent acts failure to account for the loss of assets violation of a court order or an earlier discharge in an earlier case commenced within certain time frames before the date the petition was filed. If the issue of the debtor’s right to a discharge goes to trial, the objecting party has the burden of proving all the facts essential to the objection.

Recommended Reading: Is Taco Bell Filing For Bankruptcy

What Can The Debtor Do If A Creditor Attempts To Collect A Discharged Debt After The Case Is Concluded

If a creditor attempts collection efforts on a discharged debt, the debtor can file a motion with the court, reporting the action and asking that the case be reopened to address the matter. The bankruptcy court will often do so to ensure that the discharge is not violated. The discharge constitutes a permanent statutory injunction prohibiting creditors from taking any action, including the filing of a lawsuit, designed to collect a discharged debt. A creditor can be sanctioned by the court for violating the discharge injunction. The normal sanction for violating the discharge injunction is civil contempt, which is often punishable by a fine.

Sample Extension Letter For Bankruptcy

Name of Consumer

RE: Request for extension of bankruptcy case number NUMBER

Name of Court:

I have filed for bankruptcy on DATE and the case number is NUMBER. I am having difficulty meeting the terms of the original bankruptcy agreement and am requesting an extension.

I lost my job as a manager in Name of Grocery Store, and will not be able to make the payments that I agreed to make in my Chapter 13 bankruptcy agreement. I have enclosed my dismissal letter.

I am requesting an extension of 30 days in order to find another job. I have made application to three stores and have interviews for two.

Thank you for considering my request. I can be reached at Phone Number or Email Address if you need any more information.

Sincerely,

Read Also: How Many Times Has Donald Trump Filed Bankruptcy

What Is A Cease And Desist Letter

A cease and desist letter is a formal letter requesting debt collectors to stop contacting you about a debt you owe. The Federal Fair Debt Collections Practices Act requires debt collectors to cease any communication with you after they receive the letter.

It is a good idea to discuss your options with an attorney so that you are able to make the best decision for your situation. Other options may include:

- Directing all creditor communications to your attorney

How To Write A Debt Settlement Proposal Letter

Your debt settlement letter should include the following pieces of information:

-

Your proposed settlement amount â Make sure you state this as a dollar amount, not a percentage of your debt.

-

How you want the creditor to report the debt to the credit bureaus â Let them know that you want them to report the debt as âpaid in fullâ in your credit history if thereâs a settlement.

-

Why they should accept your offer â This can include a description of your financial hardship, like losing a job.

Keep the format and tone of the letter formal but polite. Youâll want to avoid coming across as too casual to make sure the reader takes your letter seriously. When ending the letter, ask the creditor to issue a response, even if they decide to reject your offer. When you mail the letter, send it via certified mail with a return receipt requested.

Also Check: How Many Bankruptcies Has Donald Trump Filed

Letter Of Explanation To A Lender For Filing Bankruptcy

Bankruptcy can be a mental relief for some people. For others, it can be an emotional, gut-wrenching experience. Bankrupt borrowers may feel remorse because they gave a promise that they would pay their bills, and lenders made loans to them in good faith based on this promise. Consumers going through bankruptcy may want to write a letter to a lender for many reasons.

How Do You Write A Letter For Explanation Of A Bankruptcy

The purpose of a letter of explanation of a bankruptcy is to explain to a potential lender the extenuating circumstances for an unfavorable credit history. These can include loss of a job, medical problems, family member deaths and other circumstances that are unlikely to reoccur. A combination of these credible excuses sometimes help reduce the waiting period for obtaining a new mortgage after bankruptcy or foreclosure, according to Innman News.

With the Federal Housing Administration, the normal waiting period for obtaining a mortgage after a Chapter 7 bankruptcy is five years. According to Innman News, a well-written letter of explanation detailing the extenuating circumstances and the individual’s efforts to fix the problem that lead to the bankruptcy filing has the potential to reduce the waiting period to two years. Because lenders sometimes impose stricter limits than the federal agencies, borrowers have the burden of proof that they are worth the financial institution risking losing FHA funding due to too many foreclosures.

In the period between filing for bankruptcy and qualifying for a new mortgage, families often find themselves looking at rental properties for a place to live. The bankruptcy makes finding rentals difficult too. However, a similar letter addressed to property management companies increases the chances to get a rental property, according to Myvesta Foundation.

Don’t Miss: How Many Bankruptcies Has Donald Trump Filed

The Cause Of The Bankruptcy

The bankruptcy was caused by extenuating circumstances. These are hardships that are beyond your control. Examples include a job loss followed by an extended period of unemployment, a business failure, a divorce, a period of disability, or a critical illness of yourself or a family member. There are others, but those are the most common.

The reader should absolutely state his job loss as the reason for the bankruptcy. It will also help to provide any supporting documentation to prove his point.

The worst explanation is that you got too deep in debt, couldnt pay your bills, and resorted to bankruptcy to get yourself out of trouble. No matter how you see this explanation, the lender will interpret it as your bankruptcy resulting from financial irresponsibility.

Can The Discharge Be Revoked

The court may revoke a discharge under certain circumstances. For example, a trustee, creditor, or the U.S. trustee may request that the court revoke the debtor’s discharge in a chapter 7 case based on allegations that the debtor: obtained the discharge fraudulently failed to disclose the fact that he or she acquired or became entitled to acquire property that would constitute property of the bankruptcy estate committed one of several acts of impropriety described in section 727 of the Bankruptcy Code or failed to explain any misstatements discovered in an audit of the case or fails to provide documents or information requested in an audit of the case. Typically, a request to revoke the debtor’s discharge must be filed within one year of the discharge or, in some cases, before the date that the case is closed. The court will decide whether such allegations are true and, if so, whether to revoke the discharge.

In chapter 11, 12, and 13 cases, if confirmation of a plan or the discharge is obtained through fraud, the court can revoke the order of confirmation or discharge.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Start The Conversation With A Lender

Whether youre hoping to buy a home in a few months or a few years, know that its worth the wait. This is especially true for those who have filed for bankruptcy in the past and may need to pause their home buying journey as a result.

Interested in learning more about qualifying for a home loan? Contact one of our dedicated mortgage consultants today.