Why Is The Debt

The importance of debt to income ratio need not be overemphasized. It is one of the most important factors that lenders consider when determining whether to approve a loan. A high DTI can make it difficult to get approved for a loan and may result in higher interest rates and fees.

A low DTI, on the other hand, indicates that you have more capacity to take on new debt. This makes you a more attractive borrower and may result in lower interest rates and fees.

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

Read Also: Auctions Close To Me

How To Lower Your Debt

What Is A Good Debt

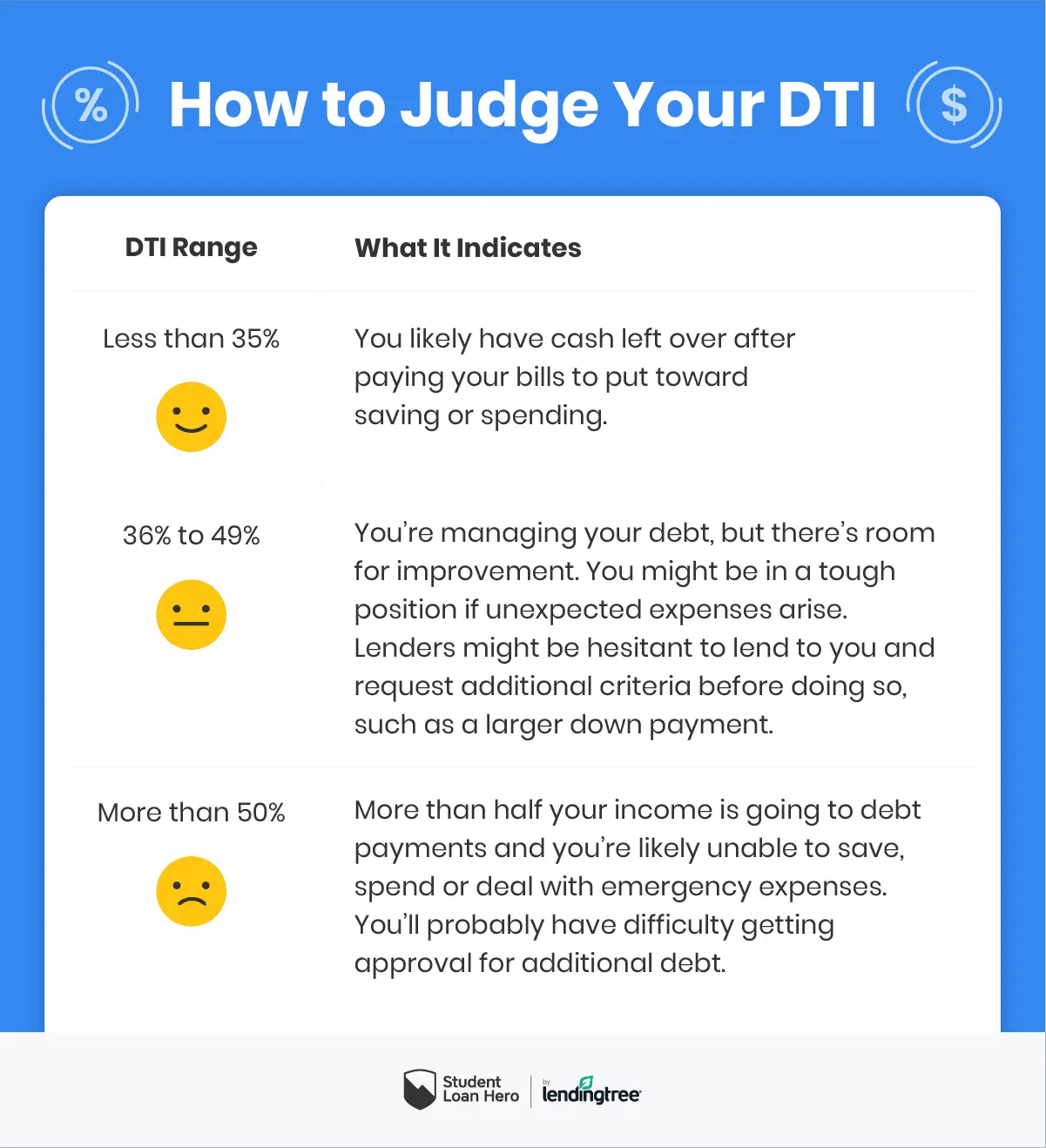

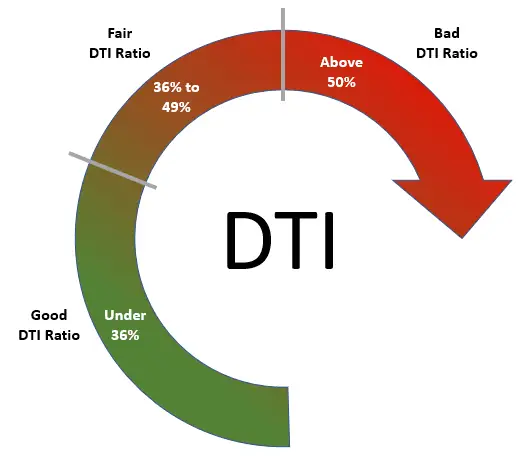

In addition to your , your debt-to-income ratio is an important part of your overall financial health. Calculating your DTI may help you determine how comfortable you are with your current debt, and also decide whether applying for credit is the right choice for you.

When you apply for credit, lenders evaluate your DTI to help determine the risk associated with you taking on another payment. Use the information below to calculate your own debt-to-income ratio and understand what it means to lenders.

You May Like: Which Type Of Bankruptcy Results In Liquidation

What Debts Do Lenders Use To Calculate Debt

Lenders consider the following types of debts when calculating your debt-to-income for a mortgage.

- – the minimum payment from the credit report. Suppose the credit report does not show a minimum amount. In that case, the lender uses 5% of the outstanding balance for the monthly debt. Or, they’ll use the monthly payment on your credit card statement.

- Installment loans, such as car and student loans, with more than ten payments remaining

- Other mortgages and real estate owned that you’ll retain

- Support payments – any alimony, child support, or separate maintenance payments you must make under a written agreement

Lenders will use your future mortgage payment – the estimated housing payment of principal & interest, taxes, insurance, and homeowner’s association dues, if applicable when calculating the debt-to-income for a mortgage.

To see the actual rate and monthly payment, including all components of the PITI, check out our Mortgage Calculator. Then, feel confident in buying a home because you know what to expect.

What Age Should You Be Debt Free

Kevin O’Leary, an investor on Shark Tank and personal finance author, said in 2018 that the ideal age to be debt-free is 45. It’s at this age, said O’Leary, that you enter the last half of your career and should therefore ramp up your retirement savings in order to ensure a comfortable life in your elderly years.

You May Like: Can One Person In A Marriage File Bankruptcy

What’s The Difference Between Your Debt

Debt-to-credit and DTI ratios are similar concepts however, it’s important not to confuse the two.

Your debt-to-credit ratio refers to the amount you owe across all revolving credit accounts compared to the amount of revolving credit available to you. Your debt-to-credit ratio may be one factor in calculating your credit scores, depending on the scoring model used. Other factors may include your payment history, the length of your credit history, how many credit accounts you’ve opened recently and the types of credit accounts you have.

Your DTI ratio refers to the total amount of debt you carry each month compared to your total monthly income. Your DTI ratio doesn’t directly impact your credit score, but it’s one factor lenders may consider when deciding whether to approve you for an additional credit account.

Familiarizing yourself with both ratios may give you a better understanding of your credit situation and help you anticipate how lenders may view you as you apply for credit.

How Does Debt To Income Ratio Work

DTI works by comparing your monthly debt payments to your monthly gross income. To calculate DTI, you first need to know your total monthly debt payments. This includes all debts, such as , car loans, student loans, and any other recurring payments.

Next, youll need to know your gross monthly income. This is the amount of money you earn each month before taxes and other deductions are taken out.

Once you have both numbers, you can calculate your DTI by dividing your total monthly debt payments by your gross monthly income. The resulting number is expressed as a percentage.

Don’t Miss: Did Loot Crate File For Bankruptcy

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

How Is Your Debt

You can determine your debt-to-credit ratio by dividing the total amount of credit available to you, across all your revolving accounts, by the total amount of debt on those accounts.

For example, say you have two credit cards with a combined credit limit of $10,000. If you owe $4,000 on one card and $1,000 on the other for a combined total of $5,000, your debt-to-credit ratio is 50 percent.

Don’t Miss: Can You File Bankruptcy On Private School Loans

How To Calculate Debt

In order to figure your debt-to-income ratio, you need to determine your monthly gross income before taxes. This must include all sources of income you may have.

Next, determine what your monthly debt payments are. If youve already , or used a free debt management tool, this should be easy. Be sure to include credit cards, auto loan, mortgage, and so on.

The final step in calculating your debt-to-income ratio is to divide your total monthly debt payments by your monthly income gross.To get a percentage, move the decimal point over to the right two times.

Heres an example of a monthly debt to income ratio formula calculation:

What Debts Do Lenders Exclude When Calculating The Debt

Lenders generally exclude certain debts when calculating a mortgage’s debt-to-income . These debts may include:

- Debts that you’ll pay off within ten months of the mortgage closing date

- Debts not reported on credit reports, such as utility bills and medical bills

- Debts paid by others

To exclude debt others pay, you’ll need to prove to the lender that someone else made the payments on time for at least the last 12 months. Lenders accept 12 months’ bank statements or canceled checks.

If the debt is a mortgage, to exclude it and the total monthly housing payment from your DTI, the person making the payments must be on the mortgage – they signed the loan agreement.

Let’s say your parents co-signed the mortgage you used to buy a house last year. And since then, you have made the payments on time, at least for the previous 12 months. When your parents apply for a mortgage to buy a refinance their home, they may exclude your debt – the debt from the mortgage they co-signed for you, by providing their lender with copies of your bank statements proving you made timely mortgage payments for the last 12 months.

Lenders may use different methods for calculating DTI, so it’s always a good idea to check with your lender to determine which debts they will exclude from the calculation.

You May Like: How Often Can You File Bankruptcy In Tennessee

How To Improve Your Debt To Income Ratio

You can lower your debt to income ratio by:

- Consolidating higher interest rate debt to a lower interest rate. This would lower your monthly payment and decrease your debt-to-income ratio.

- You might want to consider paying off some debt to lower your ratio if possible. Keep in mind the down payment requirement for the loan you are considering and make sure you still have enough cash reserves to meet that requirement as well.

- If you are able to, increasing your gross monthly income will lower your ratio.

Its important to know that even if you have a higher debt to income, that doesnt mean you wont get approved for a loan. Debt to income is just one piece of the puzzle used to qualify you as a borrower. Each loan program has its own credit guidelines, so its important to have an open line of communication with your lender.

We want to do what is best for you, both now and long term. The more information we know, the more we can help find a product that will work best for you and your budget, says Stone. If you dont qualify for the loan type that is best for you at the time, we will help navigate you through your options for getting qualified. These may include ways to improve your credit profile or decrease your debt to income ratio so that you will qualify.

What Is Debt To Income Ratio

-

Centennial Funding

-

Financial Literacy

Businesses require money to function and expand. To get this money, they may take out loans. The debt-to-income ratio is a metric used by lenders to determine how much debt a company can afford. It is calculated by dividing the total amount of monthly debt payments by the companys gross monthly income.

This article will discuss everything you need to know about your debt-to-income ratio, including how its calculated, what factors impact it, and how you can improve your DTI.

Recommended Reading: Warehouse Pallets For Sale

What Factors Make Up A Dti Ratio

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

How High Interest Rate Environments Affect Debt To Income Ratio Requirements

When interest rates rise, the monthly payment for your loan is higher than compared to the payment with a lower rate, therefore, you will qualify for less of a mortgage. This is something to keep in mind when interest rates are rising, especially if your debt to income ratio is in the higher range. Rising rates may decrease what you qualify for, says Stone.

You May Like: How To Declare Bankruptcy In Maryland

Should I Apply For A Home Loan With A High Dti

In limited instances, high debt-to-income ratios mean lenders may be less willing to give you a mortgage loan or may ask you to pay a higher interest rate for the loan, costing you more money. While you can still apply for and receive a mortgage loan with a high DTI, its best to look for ways to lower the ratio if possible so you can get a better interest rate.

How Is Your Dti Ratio Calculated

To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income the total amount you earn each month before taxes, withholdings and expenses.

For example, if you owe $2,000 in debt each month and your monthly gross income is $6,000, your DTI ratio would be 33 percent. In other words, you spend 33 percent of your monthly income on your debt payments.

Read Also: How To Claim Bankruptcy In South Carolina

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

Breaking Down The Dti Ratio

Lenders often evaluate two different DTI ratios: the front-end ratio and the back-end ratio.

The front-end ratio, sometimes called the housing ratio, shows what percentage of a borrowerâs monthly income is used for housing expenses. This ratio could include monthly mortgage payments, homeowners insurance, property taxes and homeowners association dues.

The back-end ratio is the amount of a borrowerâs income that goes toward housing expenses plus other monthly debts. And it can include revolving debts such as credit card or car payments, student loans and child support.

Lenders typically say the ideal front-end ratio should be no more than 28%, and the back-end ratio, including all expenses, should be 36% or lower. In reality, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios, depending on the type of loan youâre applying for.

Don’t Miss: How To File For Bankruptcy In Maryland

What Happens If My Debt

If your debt-to-income ratio is higher than the widely accepted standard of 43%, your financial life can be affected in multiple waysnone of them positive:

- Less flexibility in your budget. If a significant portion of your income is going towards paying off debt, you have less left over to save, invest or spend.

- Limited eligibility for home loans. A debt-to-income ratio over 43% may prevent you from getting a Qualified Mortgage possibly limiting you to approval for home loans that are more restrictive or expensive.

- Less favorable terms when you borrow or seek credit. If you have a high debt-to-income ratio, you will be seen as a more risky borrowing prospect. When lenders approve loans or credit for risky borrowers, they may assign higher interest rates, steeper penalties for missed or late payments, and stricter terms.

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Don’t Miss: How Long Bankruptcies On Credit Report

How Much Do Debt Ratios Affect A Credit Score

Your income does not have an impact on your credit score. Therefore, your DTI does not affect your credit score.

However, 30% of your credit score is based on your credit utilization rate or the amount of available on your current line of credit. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score. That means that in order to have a good credit score, you must have a small amount of debt and actively pay it off.