Chapter 20 Bankruptcy: Filing Another Bankruptcy Before The Time Limit Is Up

The time limits above refer to how long a debtor has to wait to discharge debt through another bankruptcy. If you aren’t looking for another debt discharge, but would like to arrange a plan to manage your remaining debts, filing a Chapter 13 bankruptcy immediately after a Chapter 7 discharge might be an option for you.

Filing for Chapter 7 and Chapter 13 in succession is informally called a “Chapter 20 bankruptcy.” The process of filing for Chapter 13 right after the Chapter 7 discharge process can be complicated, and many courts will not allow a double filing before the time limit is up. An attorney can explain the strategy behind double filing and how it may fit into your specific circumstances.

Reasons To Switch Your Bankruptcy Filing From The Previous Chapter

The type of bankruptcy you file will change your repayment plan, the amount of unsecured debts you owe, and the amount of time the bankruptcy stays on your record. It may make sense to file for a different bankruptcy than you used in your previous case.

A bankruptcy attorney can help you understand the best debt relief options for you. An attorney can’t change the time limits between filing dates, but they can help you decide if switching your Chapter is a smart idea. They can also help you prepare to file as soon as the date is available to you.

You can apply one of these strategies to your second bankruptcy filing:

- Switching from Chapter 7 to Chapter 13: If you pay off unsecured debts during Chapter 7, you can file a Chapter 13 to create a repayment plan to pay off tax debt or other debts that were not discharged during the Chapter 7 filing.

- Switching from Chapter 13 to Chapter 7: If you pay back 100% of unsecured debt to creditors, the six-year waiting period can be waived. In some cases, you only need to pay back 70% of unsecured debt. The first bankruptcy case needs to be in good faith in order to file for Chapter 7.

- Repeating Chapter 13 bankruptcy filing: Some people may repeat Chapter 13 filing to manage student loans or tax debts repayment. These debts cannot be discharged, so they must eventually be paid in full.

Should I Hire A Bankruptcy Attorney If I Want To File For Bankruptcy More Than Once

While hiring an attorney adds another expense for people who are already strapped financially, it is usually well worth the money to hire a bankruptcy lawyer. An attorney will make sure everything is filled out and filed correctly, and can guide you throughout the entire bankruptcy process.

- No fee to present your case

- Choose from lawyers in your area

- A 100% confidential service

Don’t Miss: How Many Bankruptcies Did Trump Have

Filing Under The Same Bankruptcy Chapter: Chapter 7 And Chapter 13

Here are the timeframes if you plan to file the same bankruptcy chapter that you filed the first time:

Successive Chapter 7 cases

- You’ll have to wait eight years after the first Chapter 7 case filing date before filing the second case.

Successive Chapter 13 cases

- Two years must elapse between filing dates before you’ll be entitled to receive a second Chapter 13 discharge.

Filing Chapter 7 After Chapter 13

The waiting period is six years if you want to file Chapter 13 after filing Chapter 7. You gain a benefit if you paid your unsecured creditors everything you owed in the initial Chapter 13 bankruptcy. If that is the case, the waiting period can be waived. It would be wise to consult an attorney if considering this option.

Also Check: Bankruptcy Document Preparers

A Job Loss Or Serious Illness

Job loss or serious illness can be devastating and not just emotionally, but also financially.

Bills and debt tend to pile up quickly during these times, which can make it impossible to generate the monthly income you were once used to.

If job loss, medical emergency, or other financial disaster has made it impossible for you to come up with a monthly income, and there is no way that you will be able to recover in a quick amount of time, then bankruptcy can provide the relief you might need to help you recover from these financial setbacks.

Different Types Of Bankruptcy Explained

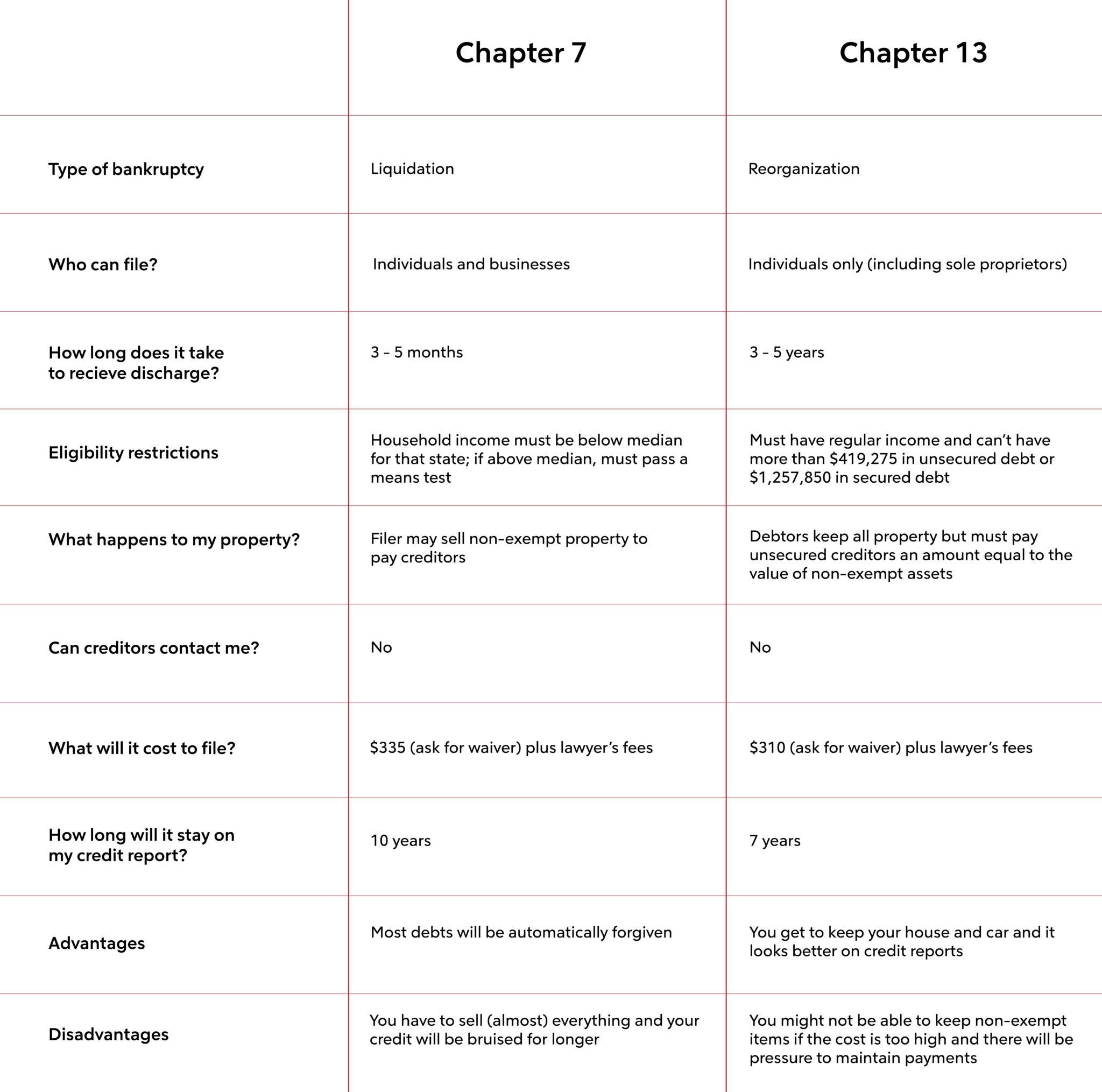

A Chapter 7 bankruptcy eliminates most debt, including credit card debt, without requiring repayment of any kind. Instead of a repayment plan, the Chapter 7 bankruptcy process liquidates your non-exempt assets to partially repay your debts. A Chapter 13 bankruptcy allows you to keep all of your property as long as the monthly repayment plan pays for the value of your assets. The debts that donât get paid as part of the repayment plan are discharged once the plan has been completed. The discharge of your debts gives you the fresh start you need.

The Chapter 11 bankruptcy process provides similar relief to that provided in Chapter 7 and Chapter 13, but is generally reserved for filers with businesses or significant assets and is a lot more expensive than even a Chapter 13 bankruptcy. This article will focus specifically on Chapter 7 and Chapter 13 bankruptcy.

Also Check: How To Claim Bankruptcy Without A Lawyer

How Do You File A Subsequent Bankruptcy

Filing for a second or subsequent bankruptcy is a difficult decision that cannot be taken lightly. If you are considering this option, your first step should be to contact a trusted Licensed Insolvency Trustee immediately. They will advise you by reviewing your financial circumstances and considering other options available to you. As the only professionals in Canada legally able to administer all types of debt relief, they are best placed as the experts to helping you on the pathway to financial freedom. It may be that a bankruptcy alternative like a consumer proposal is more appropriate to help you in your situation. If you do choose to proceed with a second or subsequent bankruptcy, at Spergel, you are in great hands. Our debt relief experts have been helping Canadians gain financial freedom for over thirty years, and you will be assigned your own trustee to walk you through each and every step of the debt relief process.

Still curious about how many times can an individual file bankruptcy? Book a free consultation with one of our reputable Licensed Insolvency Trustees. We will offer you advice on your unique financial circumstances, and will walk you through each step of the debt relief process. If you are considering bankruptcy, get in touch today you owe it to yourself.

Can I File A Different Chapter Of Bankruptcy

If you filed for one type of bankruptcy and youre interested in filing for a different type, there are still time limits that affect when you can receive a second discharge.

- If you received a Chapter 7 discharge and you now want to file for Chapter 13: You must wait four years from the date you filed the Chapter 7 case to be eligible for a discharge in a Chapter 13 bankruptcy.

- If you received a Chapter 13 discharge and you now want to file for Chapter 7: Typically, you must wait six years from the date you filed the Chapter 13 case before you can file for Chapter 7. However, if before six years you have paid back all your unsecured debts, or paid at least 70% of your unsecured debts , you are able to file for Chapter 7 immediately.

Also Check: Kodak Bankruptcy Filing

Consider A Consumer Proposal

What are your options if you have declared bankruptcy in the past, and you have new debts? To avoid the additional costs and consequences of filing bankruptcy more than once you could consider a as a way to negotiate a settlement with your creditors. You will avoid a repeat bankruptcy but still find a solution to your current financial problems.

If you find yourself facing the possibility of filing bankruptcy a second or third time, and ask them about your alternatives.

Can I File For Bankruptcy More Than Once In Ohio

So, how many times are you allowed to file bankruptcy? Technically, there is no law against filing multiple bankruptcies. However, there are laws that limit how often you can have your debts discharged through bankruptcy, and there may not be much to gain by filing for bankruptcy if you cant discharge any of your debts. How often you can have your debts discharged depends on which chapter of the Bankruptcy Code you most recently used and which chapter you wish to use for your latest claim.

Don’t Miss: How Often Can You File Bankruptcy In Ohio

The Chapter 13 Plan And Confirmation Hearing

Unless the court grants an extension, the debtor must file a repayment plan with the petition or within 14 days after the petition is filed. Fed. R. Bankr. P. 3015. A plan must be submitted for court approval and must provide for payments of fixed amounts to the trustee on a regular basis, typically biweekly or monthly. The trustee then distributes the funds to creditors according to the terms of the plan, which may offer creditors less than full payment on their claims.

There are three types of claims: priority, secured, and unsecured. Priority claims are those granted special status by the bankruptcy law, such as most taxes and the costs of bankruptcy proceeding. Secured claims are those for which the creditor has the right take back certain property if the debtor does not pay the underlying debt. In contrast to secured claims, unsecured claims are generally those for which the creditor has no special rights to collect against particular property owned by the debtor.

The plan must pay priority claims in full unless a particular priority creditor agrees to different treatment of the claim or, in the case of a domestic support obligation, unless the debtor contributes all “disposable income” – discussed below – to a five-year plan.11 U.S.C. § 1322.

If Your Previous Bankruptcy Was A Chapter 13

If you successfully filed for Chapter 13 bankruptcy in the past, this means you had your debts restructured so you could pay them off over three to five years. This also means that you were able to keep your personal property throughout the bankruptcy process.

If you are in a position where you need to file bankruptcy again after a Chapter 13 bankruptcy, you will find that the waiting limits arent quite as severe.

According to Jay Fleischman, a consumer protection attorney with over 20 years of experience representing people in bankruptcy cases, you can file for Chapter 7 bankruptcy any time after a Chapter 13 bankruptcy provided your previous bankruptcy case resulted in you paying off all debts included in the case. The court may, however, allow another discharge if the old case paid at least 70% of your creditors and the new Chapter 13 plan was proposed in good faith and represents your best effort, said Fleischman.

If your Chapter 13 bankruptcy did not result in you meeting these requirements, then you must wait six years from the date of your Chapter 13 filing to file for Chapter 7 bankruptcy.

If you filed for Chapter 13 in the past, you are also eligible to receive a discharge in a Chapter 13 case as long as the first case was filed more than two years before the new one, noted Fleischman.

Read Also: How To File Bankruptcy In Ky

Myth #: You Will Never Get Credit Again If You File For Bankruptcy

Not true. Although a bankruptcy can stay on your credit report for up 10 years from the date of filing, you can start rebuilding your credit as soon as your bankruptcy is closed and discharged. Many of our clients purchase new homes, vehicles, and even qualify for credit cards a few months after the bankruptcy is concluded. In fact, many creditors will start offering credit right after the discharge. With proper planning and counseling, you can get new credit much sooner than expected.

Advantages Of Chapter 13

Chapter 13 offers individuals a number of advantages over liquidation under chapter 7. Perhaps most significantly, chapter 13 offers individuals an opportunity to save their homes from foreclosure. By filing under this chapter, individuals can stop foreclosure proceedings and may cure delinquent mortgage payments over time. Nevertheless, they must still make all mortgage payments that come due during the chapter 13 plan on time. Another advantage of chapter 13 is that it allows individuals to reschedule secured debts and extend them over the life of the chapter 13 plan. Doing this may lower the payments. Chapter 13 also has a special provision that protects third parties who are liable with the debtor on “consumer debts.” This provision may protect co-signers. Finally, chapter 13 acts like a consolidation loan under which the individual makes the plan payments to a chapter 13 trustee who then distributes payments to creditors. Individuals will have no direct contact with creditors while under chapter 13 protection.

Don’t Miss: Toygaroo Company

How Often Can You File For Bankruptcy

By FindLaw Staff | Reviewed by Bridget Molitor, J.D. | Last updated June 30, 2021

During your lifetime, you can file for bankruptcy protection as many times as you need it. There is no limit to how many times you can file, but there are time limits between filing dates.

You could file but not receive any debt discharge in some cases, so you need to be careful.

The U.S. Bankruptcy Code determines the time limits based on what Chapter you file under. The clock starts on the day you filed the previous bankruptcy case . These time limits refer only to bankruptcies where you have received a discharge of your debts.

Chapter To Chapter Options

Chapter 7 to another Chapter 7 bankruptcy 8 years Chapter 7 now filing for Chapter 13 bankruptcy 4 years Chapter 13 now filing for Chapter 7 bankruptcy 6 years Chapter 13 to another Chapter 13 bankruptcy 2 years

The wait times help prevent abuse of the system and high credit card debt that cannot be repaid. You are expected to make your best effort to pay off bankruptcy in between filings.

Don’t Miss: Auto Financing After Bankruptcy Discharge

Experienced California Bankruptcy Lawyers

Have you previously filed for bankruptcy relief and are now wondering if you are eligible to file again? The attorneys at Resnik Hayes Moradi LLP can help. Call 344-0043, orcontact our firm online to arrange a free consultation.

Our bankruptcy professionals meet with clients from 7:00 a.m. to 7:00 p.m., Monday through Friday. Weekend appointments are also available.

Learn The Truth Before Filing

If you are overwhelmed with debt that you cannot repay, you are probably considering filing for bankruptcy. However, if you are like most people, some of what you know about bankruptcy might be colored by several of the prevalent myths in our society. Before you begin exploring your options, take a moment to dispel these common bankruptcy myths, so you do not end up making any decisions based on these misconceptions.

Find out if bankruptcy is right for you by contacting Law Office of Kimberly A. Sheek today at 842-9776 to schedule a consultation.

Also Check: Epiq Beaverton

Filing Chapter 13 After A Chapter 13 Discharge: 2 Years

If you had a Chapter 13 bankruptcy discharge and are looking to file again, you must wait two years from the previous filing date.

While this is the shortest time allowed between any two filings, it is also the rarest sequence because a Chapter 13 restructuring typically takes three or five years to repay. But a Chapter 13 can sometimes be discharged early due to additional extreme hardship.

Is Filing For Bankruptcy Bad

Bankruptcy and the filing of bankruptcy often gets a bad rep. The common story is that it can take years to recover. But a lot of times, bankruptcy can be just what you need for financial recovery and freedom.

While its true that filing for Chapter 13 or Chapter 7 bankruptcy has its downfalls it will lower your credit score by 100 points or more and thus directly impact your ability to qualify for new credit cards, a mortgage loan, auto loan, or personal loan for a few years after you file but that doesnt mean that you should avoid it at all costs.

Bankruptcy can be seen as a last resort, but many people often say they wish they had filed sooner. When diverting all your money to pay off debt and that leaves you with no money for food or, living expenses, and theres is nothing left over, thats catastrophic, and then it makes sense to file for bankruptcy. If you find yourself in that spot, we advise you at least speak with a bankruptcy attorney that can advise you on your options.

Also Check: Trump Bankruptcy Record

Chapter 7 Vs Chapter 13 Bankruptcy: Whats The Difference

Its important to note the differences between Chapter 7 and Chapter 13 bankruptcy before we discuss how often consumers can file for this type of protection.

Chapter 7 bankruptcy is a process that helps consumers liquidate their assets and pay off delinquent debts. While Chapter 7 bankruptcy allows consumers to keep some of their personal assets up to certain limits, consumers typically choose this type of bankruptcy when they dont have many assets to protect. Chapter 7 bankruptcy can take three to six months to complete, but it does allow consumers to discharge delinquent debts and get a fresh start.

With Chapter 13 bankruptcy, consumer debts are restructured instead of discharged. Families and couples typically choose this type of bankruptcy because they have assets to protect, such as significant equity in their home. Once the Chapter 13 bankruptcy process begins, a court-approved debt repayment plan is set up and followed over three to five years. At the end of Chapter 13 bankruptcy, consumers will have been able to keep all their property and pay off unsecured debts included in their bankruptcy.