How Can I Avoid Paying Back Student Loans

You can avoid paying more than you owe by changing your payments to direct debit in the final year of your repayments. Keep your contact details up to date so SLC can let you know how to set this up. If you have paid too much the Student Loans Company will try to: contact you to tell you how to get a refund.

The Truth About Bankruptcy

If youre reading this, youre probably thinking about bankruptcy. The world may tell you this route is a fresh start . . . or a horrible ending. But whats the truth about bankruptcy?

In simple terms, bankruptcy is a legal process a person can go through to clear some of the debts theyre unable to pay.

If youre so overwhelmed by debt that bankruptcy feels like your only option, know these three things: 1) There is hopeand you will be okay. 2) There are other optionsand you should try every single one before jumping into bankruptcy. 3) Bankruptcy does not define you and will not be the end.

Keep these three things in mind as you read through the rest of this article and learn the truth about bankruptcy, including a breakdown on these specific topics:

Sell Everything In Sight

You have money hanging around in the form of DVDs, TVs, boats, clothes, books, furniture, tools, office supplies, craft supplies, toys and more. Get rid of everything you dont need. That sounds drastic, but so is filing for bankruptcy. Take the money you make and put it toward getting bills up to date. Those late fees only make things worse.

Recommended Reading: What Can They Take In Bankruptcy

Things Dave Ramsey Is Dead Wrong About

by Christy Bieber | March 28, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Following this advice by Dave Ramsey could get you into financial trouble.

Dave Ramsey is one of the most popular financial gurus in the country, and his Baby Steps program has helped millions of people to take control of their finances. But while there are merits to much of his advice, there are a few things that Dave Ramsey is simply wrong about.

Unfortunately, if you follow all of his advice you could end up getting into some financial trouble in the long run. Here are four of the key things Ramsey is wrong about that could lead you astray.

Try Financial Coaching Before Making The Decision To File Bankruptcy

Financial coaches can give you an unbiased perspective on your financial situation.Financial coaches can talk with you about alternatives to bankruptcy and create a customized plan to get you out of the red. Bankruptcy Attorney Hollis Joslin is happy to evaluate your situation to see if a financial coach might be an option to bankruptcy. 602-354-3890

Recommended Reading: What Happens When Chapter 13 Bankruptcy Is Dismissed

How Can I Stop Garnishments And Lawsuits And Repos Without Filing Bankruptcy How Can I Get Out Of Debt Without Filing Bankruptcy

These are common questions, just like can I stop a foreclosure without filing bankruptcy and can I stop repo without filing bankruptcy. These and other questions about bankruptcy are answered here in a very good article edited by Bankruptcy Lawyer Hollis Joslin to include additional information and paraphrased from Dave Ramsey’s, The Truth about Bankruptcy

Getting out of Debt

Dont Buy An Engagement Ring From A Jewelry Store

You want to dazzle her, but you shouldnt start your life together with a pile of debt.

On the Bobby Bones radio show in 2019, Ramsey was asked about the popular rule of thumb that helps suitors decide how much to spend on an engagement ring.

The jewelry stores say three months . I say one month, he quipped.

Diamonds are like furniture. Theyve got a huge market, so where you buy it can be very, very important. If you can go to a diamond broker or someone who knows a little bit about diamonds, even a high-end pawn shop, you can get for a quarter on the dollar. And really good stones.

Also Check: How Long Does Bankruptcy Stay On Record

Are Student Loans Forgiven At Age 65

Nothing happens to student loans when you retire. You will still owe your federal student loans. Theyre also not forgiven because you retire. Federal student loans do, however, allow you make monthly payments based on your income, the number of people living with you that you support, and your student loan balance.

Talk To A Financial Coach

You dont have to walk this alone. Read that again: You dont have to walk this alone. Get with a financial coach and talk about your situation. They arent here to judgetheyre here to help.

A financial coach can help you figure out a personalized plan of action for your specific situation. And yes, talking about money can be terrifying, but if you declare bankruptcy, your financial privacy will be out the window immediately. Opening up to a trustworthy financial coach now can help you avoid having to open up to a whole courtroom of people in bankruptcy.

Recommended Reading: Why You Should File For Bankruptcy

Dave Ramseys Belief On Bonds

Dave Ramsey doesnt believe in bonds.This isnt my assumption. Dave Ramsey states,When you add it all up, bonds are just as risky as stocks. But, historical average returns for long-term government bonds are a little over 5% compared to the stock market as a whole at 12%.;

Is he correct inhis assertion? Or his belief that stocks are just as risky as bonds? Ill leavethe answer to this up to your discretion.

Dont Try To Get Rich Too Quickly

While its great to come into a sudden windfall, Ramsey says its better to build a fortune slowly and sustainably.

Ninety percent of the I have met did it gradually, Ramsey said on his radio show in 2017. Im not against getting money quickly … but there are all kinds of problems that go with it when it comes quickly…. How often have we seen the young athlete get money and it destroys their life?

He said the Book of Proverbs sums it up: Wealth grown hastily will dwindle.

His advice isnt just based on Biblical wisdom; Ramsey is also speaking from experience. He gained and lost a $4 million portfolio flipping houses before age 30.

Read Also: Which Statement Regarding Bankruptcy Is Not True

What Dave Ramsey Gets Right: The Hard Work

Good debt management is 80% behavior and 20% head knowledge. It isnt rocket science as some debt management companies try to make you believe.

Dave is correct when he says that getting out of debt is 80% behavior and 20% head knowledge. The key to getting out of debt is more about learning good habits than anything else.

Thats why the best debt management companies also offer non-profit consumer credit counseling to help their clients build a budget and learn to live within their financial means. That way its not just about getting out of debt, but staying out. And thats where the financial expertise and advice of a trusted credit counselor can make a huge difference.

However, theres a critical piece of the puzzle that Dave completely ignores!

Non-profit Debt Management companies have arrangements with all the major creditors, banks and finance companies and in most cases, most of our clients will reap benefits from all of these that endure from the day they enroll in the DMP until the total debt is paid.

On your own, you will mostly receive short- term benefits , and then you are right back to square one again. You can prevent that situation with the help of a nonprofit debt management company, like CreditGUARD.

Why Dave Ramsey Is Wrong About Debt Management

Unfortunately for Dave, a large majority of the comments are from people who actually went through a DMP and know FIRST-HAND just how helpful they can be.

Lets actually break down some of Daves claims to see just how factual they are.

You may get out of debt but only with your credit trashed.

Dave Ramsey says DMPs help you get out of debt, but leave your credit trashedand we wholeheartedly disagree. It doesnt matter how you pay off your debtwhether individually or with professional helphowever you do it, less debt means better credit. Thats why people who enroll in a debt management program actually come out with higher .

You May Like: Do You Lose Your House In Bankruptcy

Dont Give Your Kids An Allowance

Ramsey says America doesnt have a debt crisis; it has a parenting crisis. Financial literacy starts at home, and parents are setting their kids up for failure by giving them an allowance.

I just dont like the word. Allowance kind of sounds like, Youre not good enough, so I have to do something for you. It kind of sounds like welfare. Instead, we called it commission. You got paid for doing chores. Work? Get paid. Dont work? Dont get paid, he told CNN in 2014.

His daughter Rachel Cruze, co-writer of the book Smart Money Smart Kids, agreed that kids quickly learn that money doesnt come from Mom and Dads back pocket.

Of course, Ramsey said, all the work he made his kids do was age-appropriate. Youre 4 years old, were not going to send you off to the salt mines, he joked.

Dave Ramsey Warns: Don’t Do These 10 Things With Your Money

Dave Ramsey says you can solve your money troubles just as soon as you stop causing them.

The money management guru has been doing out his signature blend of tough-love financial advice and Biblical wisdom since 1992. He learned it all the hard way: In his 20s, Ramsey built a million-dollar fortune flipping houses but lost it all when banks started calling in his debts. He had to buckle down to build back up from bankruptcy.

Now his radio show is syndicated on more than 600 stations, and hes authored several books. He teaches Americans how to avoid wallowing in debt even during the current financial crisis.

Here are 10 of Dave Ramsey’s biggest money “don’ts.”

Read Also: What Is The Number One Cause Of Bankruptcies In America

Look At Options To Bankruptcy

Try your best to pay off your debt before filing bankruptcy. Get on a bare-bones budget. Negotiate for manageable terms or lower interest rates with creditors. Some creditors will even reduce principal balances rather than settle for nothing, which is what they would likely receive if you file bankruptcy. Move to a smaller residence with a lower cost. Take on an extra job or drive Uber to pay the bills. Did you know Bankruptcy lawyer Hollis Joslin drove Uber through law school and while starting his practice! There’s no shame in doing the work you need to do to get your finances in order. If you don’t have any luck getting a better deal with creditors, call bankruptcy attorney, Hollis Joslin. Hollis does more than bankruptcy, he also negotiates with creditors and he can often get a better result than you may get on your own. 602-354-3890.;

Where Does Dave Ramsey Start To Go Wrong

Ramseys formula for managing debt is perfect. I have read several posts on the fallacies of his seven baby step method. While I might tweak it a bit , I like its simplicity and that it is a great starting point for those who are overwhelmed by debt.

However, hes not always right about how one should grow their finances. Once an investor moves out of the realm of debt and on to the path of investing and financial independence, this is the area where I find that Ramsey starts to go wrong. Im taking the time to highlight just why I think so here:

Don’t Miss: Can You Buy A House After Bankruptcy Canada

Is Bankruptcy The New College Trend

According to USA Today, 19% of bankruptcy filers are college students. Think about that stat for one minute: One out of every five people who file bankruptcyone of the worst financial things that can happen to someonespend their days on a college campus.

Thats sad. But its also a sobering reality and a reminder that its up to parents and high schools to help students understand that its not okay to borrow money. College students have enough temptations already, and its insane that any 21-year-old should ever feel the need to file bankruptcy.

So what happened? Somewhere along the way, these kids learned that debt was just a way of life. And as soon as they set foot on campus, they bought into that mentality.

Housing? Charge it. Tonights $5 dinner? Put it on the credit card. Books? Slap down Visa. What starts out as using a credit card here and there turns into a debt so large that they feel the need to declare bankruptcy. Ridiculous!

But we cant blame students for making poor financial decisions when they have never been taught differently. And we cant let these decisions go unchecked and then expect students to all of the sudden get it after graduation.

It doesnt have to be this way.

A student could work a 20 hour/week part-time job, making $8/hour for their four years of college and earn $33,000which is enough to cover the expenses that an average student takes out in loans.

Empowering Students to Make Sound Financial Decisions for Life

Is Dave Ramsey Right Part 2

by TRS | Jan 21, 2019 | Financial Hosts |

This is part 2 of two financial talk show hosts Bob Brinker and Dave Ramsey.

In the late 90s, I had a conversation with my brother about a financial talk show host that he was listening to. My brother is more than ten years younger than I, so he represents a completely different generation a generation which had different hosts, financial advisors and more such as Dave Ramsey.

I had listened to many of the talk show hosts out there of my era such as Bob Brinker, but Dave Ramsey was new to me. I had already been investing for quite some time now, and I was well on my way to financial independence so I had some understanding of the financial environment, however Dave Ramseys approach both intrigued and puzzled me. Talking to my brother helped shed some more light on this talk show host.

You May Like: What Happens If You Declare Bankruptcy Uk

Are Student Loans Forgiven After 10 Years

The Public Service Loan Forgiveness program discharges any remaining debt after 10 years of full-time employment in public service. Term: The forgiveness occurs after 120 monthly payments made on an eligible Federal Direct Loan. Periods of deferment and forbearance are not counted toward the 120 payments.

Who Will Get The 3rd Covid Stimulus Check And When Can They Expect It

The point is that youre looking to the government to fix your life, and as long as you wait on Washington, DC, to fix your life, youre gonna suck, he said. Your life is gonna suck. And thats not poor-shaming. Thats shaming stupidity.

Ramsey who launched his financial advice empire after his real estate business went bust and pushed him into bankruptcy did not mention the COVID-19 pandemic, which sparked a historic economic downturn and has put millions of Americans out of work.

He did, however, admit that he wouldnt turn down a $600 check if it were offered to him.

Ive been broke and I never even then thought $600 was gonna change my life, back when $600 was a lot of money, he said. Would $600 help? Yeah, if you hand it to me, Ill take it.

Also Check: How Does Bankruptcy Affect The Economy

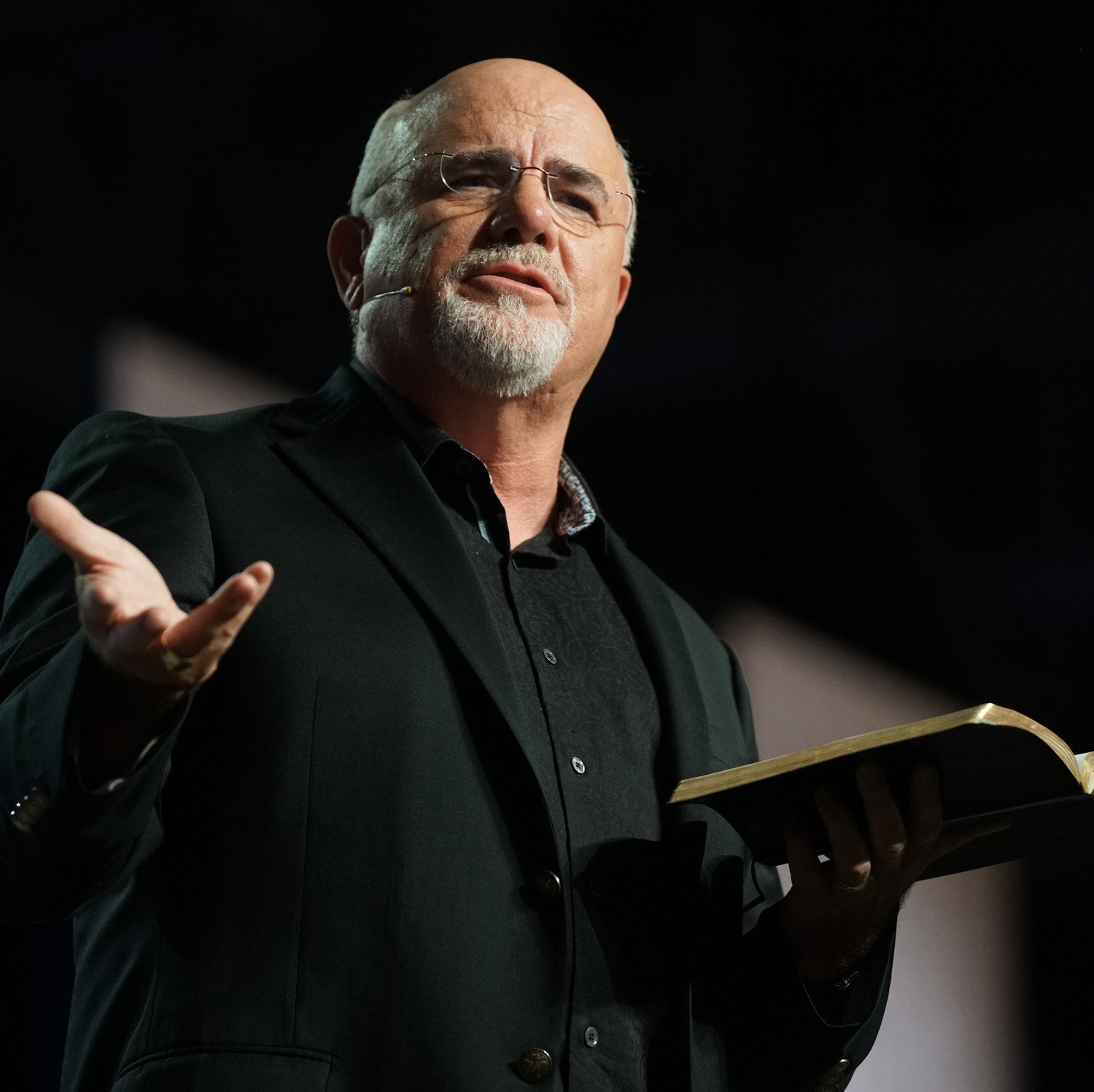

Dave Ramseys Roots And The Christian Focus On Money

Dave Ramsey was an over-leveraged real estate speculator, and in Sept 1988, he, according to his website, filed for bankruptcy due to the forced repayment of his real estate holdings. He recovered financially from this trying event and began counseling others about financial independence, especially at his local church.

What particularly interested me was that Dave Ramseys focus and his outreach was directed largely towards the evangelical community.

Ramsey is an evangelical Christian. He is part of that 25% of the U.S. population that identify themselves as evangelical.

This was a point of interest for me because, you see, my brother and I come from the evangelical community. My brother began listening to Dave Ramsey solely on the fact that he claims to be a devout Christian. His church and many other evangelical churches recommend listening to Ramsey since he follows the biblical teachings on the issue of Money.

The Secret Benefit About Dmps That Dave Ramsey Ignores

In addition to learning better financial habits, theres another HUGE advantage debt management companies have over individuals who are trying to pay off their debt on their own. Ironically, this is something Dave never acknowledges .

The reason people are able to get out of debt faster with a DMP is because debt management companies are able to lower your rates by negotiating on your behalf.

Creditors want reassurance that their outstanding balances will be paid off, which is why its so difficult for an individual to lower their rates on their own. So with that in mind, we have relationships with ALL the credit card companies. We can get all of them to make concessions, lower interest rates and lower payment amounts.

Recommended Reading: Can You File Bankruptcy After A Judgment