The Ontario Collection Agency That Speaks Their Language

Because of the ethnic diversity in Ontario, particularly in the Greater Toronto Area, a language barrier can often hinder collection efforts. Working in communities Canada-wide, MetCredit employs professionals who speak an amazing range of languages. At the time of this writing, we are able to communicate effectively with clients and debtors in at least 20 commonly-spoken languages.

Founded in 1973, MetCredit has earned a strong reputation as an ethical Ontario collection agency that partners with its clients to collect quickly on a 100% contingency basis. Many of the companies for which we collect are engaged in niche businesses or retail businesses, where it is critical to maintain strong customer relationships wherever possible, while preserving our clients reputation and customer base.

Put Dci Credit Services Inc To Work For You Today

DCI Credit Services is a locally owned collection agency that has been in the collection and check recovery business since August of 1958. Being local allows us to be in touch with the business culture of the area which in turn enhances our communication and results with your customers. By being able to increase the cash flow of our clients we allow them to spend more time on their business and customers. Our organization has experience in collecting all types of debt including medical, retail, commercial, financial, utility, credit cards, legal judgments. We also specialize in collecting NSF checks.

We take customer service very seriously and pride ourselves in returning more dollars to our clients by investing tremendous amounts of capital into employee education as well as technology updates. We also offer on-site client training seminars as well as customizable reports that allow the client to stay current with the information that has been turned over to us. By utilizing the most up-to-date technologies in the industry, we are able to process large amounts of information very rapidly which has led to the highest recovery rates in our companys 50+ year history. We have a proven track record of collection recovery and have been the standard in the area for over 50 years. We have many long-term recovery customers and have experienced tremendous growth over the last 10 years. We can get the job done for you.

Financial Services Debt Collection Tailored To Your Needs

Financial services debt collections require a special approach. A collection agency plays an essential role in your banks budget, but your good name is at stake with every collection call. IC System recovers more revenue because we have a consumer-friendly approach that results in fewer complaints.

Reach out to our dedicated team for one of our agencys custom collection solutions that have helped banks, credit unions, accountants, and other businesses recover more revenue.

Read Also: Can A Bankruptcy Trustee Find Bank Accounts

Why Should You Get The International Debt Collections Handbook

Thousands of businesses receiving the International Debt Collections Handbook regard it as an invaluable and high-demand tool for decision making. They are of the opinion that:

- Knowledge of the amicable collection process and country-specific legislation surrounding collections is vital

- Information regarding local expertise ensures that businesses follow a professional and successful collection approach

- No business is immune to the risks associated with international trade and can be exposed to poor payment behaviour.

What Is Credit Collection Services

Based in Norwood, Massachusetts, Credit Collection Services has a deep history. The company was founded in 1969 and currently has more than 750 employees within the United States.

They collect debts for:

- retail company credit cards

- banking and insurance companies

The company claims to receive annual placements in excess of $5 billion, making CCS Collection one of the largest debt collection services in the country.

A common practice of the company is to handle a large volume of past-due debt owed to a single client company.

That may include hundreds or thousands of individual debts.

Because of the companys size and long history, they operate nationwide.

Its possible youll hear from Credit Collection Services no matter where you live in the US, or even if you move from one state to another.

Depending on the client company theyre working with, Credit Collection Services may operate as the first line of collections for a companys accounts receivable department.

If they work in this capacity, they may not contact you about a past-due debt, but a current obligation.

However, like all collection agencies, one of their primary businesses is the collection of bad debt.

Your obligation has reached bad-debt status anytime its been past due for well beyond what would normally be considered a reasonable timeframe.

And this is usually when debt collection services become most aggressive.

Read Also: How To File Bankruptcy Chapter 11

Who A Debt Collector Can Contact

A debt collector can only contact your friends, employer, relatives or neighbours to get your telephone number or address.

This does not apply in the following cases:

- the person being contacted has guaranteed your loan

- your employer is contacted to confirm your employment

- you’ve given your consent to the financial institution that they can contact the person

If you gave consent orally to your financial institution, you must receive written confirmation of your consent either on paper or electronically.

Commercial Consumer Medical And Tax Collection Services

Keystone Credit Services LLC is a full-service collection agency offering a variety of collection services to companies of every size. We represent clients in many industries including government, construction, property rental, schools and more.

Keystone is unlike other collection agencies. We firmly believe in the importance of compliance, trust and integrity. We do not charge our clients additional fees for services such as credit reporting, letter services and free review of the default wording on your contracts, proposals and financial responsibility agreements.

Read Also: What Is Exempt In Chapter 7 Bankruptcy

Disability Profiles Supported In Our Website

- Epilepsy Safe Mode: this profile enables people with epilepsy to use the website safely by eliminating the risk of seizures that result from flashing or blinking animations and risky color combinations.

- Visually Impaired Mode: this mode adjusts the website for the convenience of users with visual impairments such as Degrading Eyesight, Tunnel Vision, Cataract, Glaucoma, and others.

- Cognitive Disability Mode: this mode provides different assistive options to help users with cognitive impairments such as Dyslexia, Autism, CVA, and others, to focus on the essential elements of the website more easily.

- ADHD Friendly Mode: this mode helps users with ADHD and Neurodevelopmental disorders to read, browse, and focus on the main website elements more easily while significantly reducing distractions.

- Blindness Mode: this mode configures the website to be compatible with screen-readers such as JAWS, NVDA, VoiceOver, and TalkBack. A screen-reader is software for blind users that is installed on a computer and smartphone, and websites must be compatible with it.

- Keyboard Navigation Profile : this profile enables motor-impaired persons to operate the website using the keyboard Tab, Shift+Tab, and the Enter keys. Users can also use shortcuts such as M , H , F , B , and G to jump to specific elements.

Ready For The Right Kind Of Collections Personal Contact Revenue Impact

Thank you for your interest in CSI, the easiest-to-switch-to collections upgrade you will ever make. Where consumer & patient bill paying experience-based collections meets the industry’s highest recovery rates.

At CSI, we are proud to offer the industry’s highest level of security, client transparency, communication and reporting, all with the easiest-to-switch-to process which makes upgrading to CSI completely seamless.Our clients enjoy the collections, knowledge and power of ten consolidated collection agencies under one umbrella. Let us help you keep your focus on managing & growing your organization successfully with our easy-to-use, time-and money-saving processes.

Don’t Miss: How Much Debt Is Needed To File Bankruptcy

Will Security Credit Services Sue Me Or Garnish My Wages

Its possible, but if you work with a law firm like Lexington Law, you have nothing to worry about. They will help you dispute the collection account with the credit bureaus and possibly remove it from your credit report. Its also possible that you never hear from or have to deal with Security Credit Services again.

What A Debt Collector Can’t Do

A debt collector can’t do the following:

- suggest to your friends, employer, relatives or neighbours that they should pay your debts, unless one of these individuals has co-signed your loan

- use threatening, intimidating or abusive language

- apply excessive or unreasonable pressure on you to repay the debt

- misrepresent the situation or give false or misleading information

A debt collection agency can’t add any collection-related costs to the amount you owe other than:

- fees for non-sufficient funds on payments that you submitted

Also Check: How Does Filing Bankruptcy Affect Buying A Home

Owing Money To A Bank

If you have an overdue debt owing to a bank, the bank can use its right of set-off to recover the money. The right of set-off allows a bank to withdraw money from your accounts to pay your overdue debt. The bank does not have to give you notice or ask your permission before taking this action. The bank does not have to ask the permission of the court.

Banks may use their right of set-off to collect overdue payments on credit cards, loans, overdrafts or lines of credit. A bank may withdraw money that you have on deposit in any of its branches and apply it to your debt. The bank does not have to leave any money in your account.

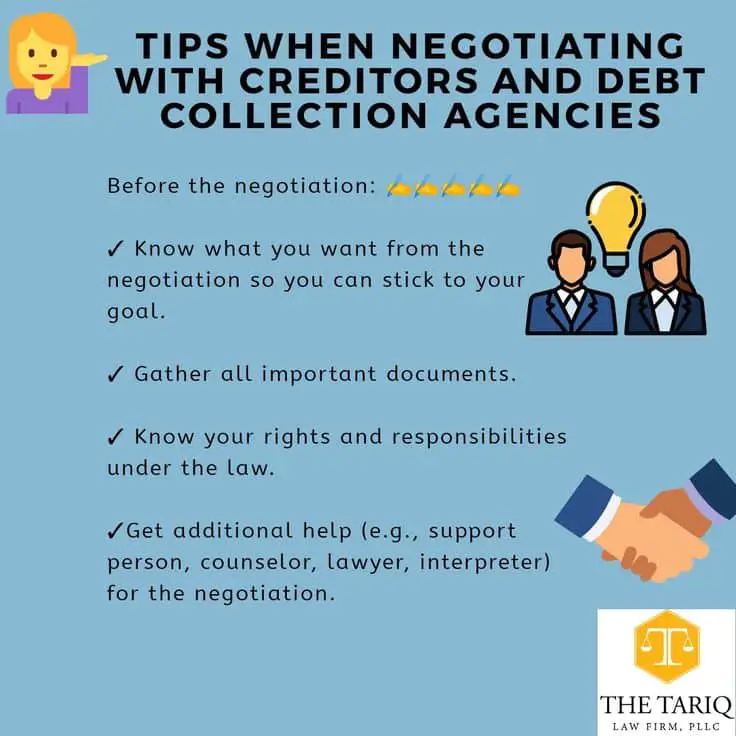

What To Do When A Debt Collector Calls

Make sure to ask for and write down the following information:

- the name of the person calling

- the company the debt collector works for

- the name of the company the debt collector is collecting money for

- the debt collectors telephone number

Ask for details on the debt, such as:

- the amount you owe

- who you owe it to

- when you started owing it

Tell the debt collector that you’ll call back as soon as you verify the information. Look at your bills and bank statements to help you confirm if the debt is yours and the amount you owe is correct.

You can ask the collection agency to contact you only in writing. Ask your legal advisor to send a written request to your creditor by registered mail, including an address and phone number at which you may be contacted.

Don’t Miss: How To Get Approved For A Credit Card After Bankruptcy

A Collection Agency For Banks With Top Security Standards

Keep your sensitive consumer data protected with our comprehensive security network and highly regimented compliance protocols. Learn more about IC Systems security certifications.

- Soc 2 Type II Certification: Our infrastructures hardware, software, personnel, and data handling procedures meet the security standards of the Service Organization Control 2 Type II audit.

- PCI DSS 3.2 Annual Certification: Many collection agencies conduct the Payment Card Industry Data Security Standard self-assessment, and just for the portion of their network processing credit cards . IC System completed the more stringent and externally audited PCI DSS 3.2 Report on Compliance for the best results.

- S2SCORE: Our security auditing firm, SecurityStudio, set our S2SCORE at786.07, which translates to Excellent on their scale out of 850.

A Collection Agency For Banks And Financial Institutions

Your financial institution is in the business of lending money, and no matter the state of the economy, delinquencies will occur. Whether you lend mortgages, issue credit cards, or give loans, some of your customers will miss payments. To improve your financial outcomes, you need a financial services debt collection company experienced in debt recovery for banks and credit unions. But your collection partner should do more than just collect on your behalf they should also protect your consumers with friendly interactions and ironclad information security.

IC System has decades of experience in debt collections for financial services institutions with both consumer and commercial debt on PreCollect, Primary, Secondary, and Tertiary inventories. Our experience means we know how to tailor our accounts receivable management solutions to meet your specific needs through friendly collection practices, state-of-the-art technology, and the sense of regulatory security and compliance your business needs.

Also Check: Can Someone File Bankruptcy Without An Attorney

Message From The Ceo Diane Doane

Today, with so many accounts receivables management organizations in the United States, it’s a challenge to choose the right partner. You need an organization that dedicates itself to your needs, rather than its own… that effectively utilizes the latest technology to consistently achieve above-average results… that provides exceptional customer service… and most importantly, that is committed to a long-term, mutually profitable relationship.

As a Sunrise client, not only will you receive our best efforts, but also you will find we are extremely easy to do business with on a day to day basis from our family owner-managers, to our exemplary staff.

Collection Agency For Dallas Texas

No up-front fees, we dont get paid unless you get paid

High success rate on second placement accounts that other agencies failed to collect on

A nationwide network of attorneys

486-5500

Since 1970 First Federal Credit Control has been helping businesses in the Dallas area collect on unpaid balances. Our experienced staff has an average tenure of 18 years and is highly trained in all aspects of collections.

Don’t Miss: How To Claim Bankruptcy In Texas

Will Credit Collection Services Sue Me Or Garnish My Wages

However, if you work with a law firm like Lexington Law, you have nothing to worry about. They will help you dispute the collection account with the credit bureaus and possibly remove it from your credit report. Its also quite possible that you may never hear from or have to deal with Credit Collection Services again.

Notes Comments And Feedback

Despite our very best efforts to allow anybody to adjust the website to their needs, there may still be pages or sections that are not fully accessible, are in the process of becoming accessible, or are lacking an adequate technological solution to make them accessible. Still, we are continually improving our accessibility, adding, updating and improving its options and features, and developing and adopting new technologies. All this is meant to reach the optimal level of accessibility, following technological advancements. For any assistance, please reach out to

Read Also: Will Filing Bankruptcy Stop My Student Loans

Additional Ui Design And Readability Adjustments

Competitive Pricing For Every Business

Our economical rates and customer-friendly approach make our debt collection services not only a powerful tool but also an effective way to help preserve your valuable customer relationships.

Your comprehensive pricing request will include the following:

- No cost pricing quote for your IC System services

- Materials to help streamline your accounts receivable

- A sample IC System agreement

- Establish a follow-up plan

Recommended Reading: How To Refinance A Car After Bankruptcy

After Your Judgement Is Paid

Once you have paid a judgement in full, the judgement should be discharged at the Court of Kings Bench and at the Personal Property Registry. Check to make sure this is done. You should also let the credit bureau know that you have paid the debt. They will enter this information on your credit record.

Paying Your Debt Once It Has Been Transferred To A Collection Agency

If the debt is yours and the amount is correct, paying the full amount you owe will resolve the issue.

When repaying your debt:

- always get a receipt for any payment you make

- only deal with the debt collector who contacted you to make payments

- dont contact the creditor that lent you money, as this might create confusion

If its not possible for you to pay the full amount:

- explain why to the debt collector

- offer an alternate method of repayment, such as monthly payments

- follow up in writing

- include a first payment to show your commitment to paying back the debt, if possible

You May Like: Does Filing For Bankruptcy Affect Getting A Job

Learn Your Rights Under Federal Law

If youre going to take on Credit Collection Services, you need to become familiar with federal law and how it relates to debt collection practices.

Rest assured that the collection agency is aware of those laws. You need to be as well, to level the playing field.

You can learn your rights by reviewing the Fair Debt Collection Practices Act.

More specifically, study the more user-friendly Debt Collection FAQs provided by the Federal Trade Commission .

You may be surprised to learn what collection agencies can and cannot do to collect a debt, including following the statute of limitations and hours in which they can contact you.

Sometimes just letting a collection agent know youre aware of your rights under federal law can go a long way toward keeping your communications more civilized.