Undue Hardship And Student Loan Discharge

To succeed in having your student loans discharged, you must demonstrate that not having them discharged would cause you to experience “undue hardship.” For a bankruptcy court to take your side, you will have to meet specific conditions. The problem is that there is no uniform set of conditions.

However, your student loan creditorswhich may include lenders, servicers, and collection agencies, depending on the types of loans you have and how far behind you are on paymentsmust also meet specific conditions. They must satisfy the preponderance of the evidence standard, a high standard that requires them to prove that their claims against you are valid. They must also prove that your loans meet the conditions of section 523.

Other Options If You Cannot Discharge Your Debt

If your student loan is not considered an undue hardship and cannot be discharged through a Chapter 7 or Chapter 13 bankruptcy, you may have other options.

For example, you may be able to use another payment plan that offers more affordable payment options. You may qualify for deferment or forbearance. You may be able to restructure your payment plan to make it more manageable.

Get Student Debt Relief

If you are looking for relief from student loan debt, a bankruptcy or consumer proposal can eliminate certain student debt. Student debt can be included in a bankruptcy or consumer proposal depending on how old your student loans are, whether your student debts are a private student loan with a bank or are government guaranteed student loans, and what your budget can afford. Our licensed insolvency trustees can help you review the pros and costs of each student debt relief option and decide which will work for you. Here is some information you may want to talk about.

Read Also: How Often Can You File Bankruptcy In California

Is Your Private Student Loan A Qualified Educational Loan

As stated above, if you have a private student loan, you may have other arguments available in addition to undue hardship. You can discharge private student loans in bankruptcy in a number of other ways.

There is a presumption that student loans in bankruptcy are non-dischargeable if they meet the statutory requirements. For private student loans, this requires the loan to be a qualified educational loan.

To be a qualified education loan, a private student loan must be:

- For an eligible student

I Was A Weepy Mess When I First Met With Mr Yaldou Feeling Quite Overwhelmed Helpless And Embarrassed At The Thought Of Having To File For Bankruptcy

“Mr. Yaldou was comforting and reassuring, taking me under his wing much like a “big brother”. He, Nick Chambers, Lisa Segur, and his entire legal staff, were never too busy to answer my questions and respond to my emails throughout the entire bankruptcy process. Everyone was absolutely wonderful!!! If you’re looking for a knowledgeable, top-notch legal team, then I highly recommend Yaldou Law.”

Rebecca D.

Read Also: Fizzics Beer Net Worth

What Is A Chapter 13 Bankruptcy Plan

A Chapter 13 bankruptcy plan is a reorganization plan detailing how you will pay some or all of your creditors. A typical Chapter 13 plan lasts three or five years, during which you make… Read more >

A Chapter 13 bankruptcy plan is a reorganization plan detailing how you will pay some or all of your creditors. A typical Chapter 13 plan lasts three or five years, during which you make monthly payments to a court-appointed representatives, called a trustee, under a court-approved plan of reorganization. That trustee distributes plan payments to your creditors as scheduled in your Chapter 13 bankruptcy plan.

Student Debts Usually Not Dischargeable

Most debts can be discharged in a bankruptcy. A debt being discharged essentially means it has been erased. You no longer owe the creditor for the debt, and your creditor can no longer harass you or otherwise try to collect. This the prime reason for filing bankruptcy to afford you a fresh start after you have been overwhelmed by debt, often debt you did not intentionally incur.

Student loans are different, though. Congress has passed a number of laws that make it nearly impossible for student loans to be discharged in bankruptcy, whether they are private or federal.

There are some exceptions. In the Brunner vs. New York State Higher Education Services Corporation case, a federal appeals court ruled that a student loan could be discharged if it met certain circumstances causing an “undue hardship.”

Under that ruling, an undue hardship means you cannot maintain a minimal standard of living while repaying the loan, that the state of affairs is likely to persist, and you have made a good faith effort to pay off the loan.

Few people will meet the stringent standards, and the court does not even necessarily have to follow the ruling. Your bankruptcy lawyer can review your circumstances and give you an honest assessment of your chances of getting student loans discharged, and make your case to the court.

You May Like: How Many Times Has Trump Filed Bankruptcies

Student Loans In Bankruptcy: The Brunner Test

Unlike a mortgage or credit card debt, student loan debt is not typically dischargeable in bankruptcy. However, you can get student loan forgiveness if you can prove an undue financial hardship. . To discharge student loans through bankruptcy, an Adversary Proceeding must be filed, and a debtor would argue that paying student loan debt would create an undue hardship for the debtor. The Brunner standard states:

How Do I Prove Undue Hardship On My Student Loan

To prove undue hardship, you must file a separate adversary proceeding with the bankruptcy court explaining your situation and why repayment of your student loan would be an undue… Read more >

To prove undue hardship, you must file a separate adversary proceeding with the bankruptcy court explaining your situation and why repayment of your student loan would be an undue hardship. Please consult with a bankruptcy attorney to discuss your options. Learn more >

Also Check: When Did Trump File For Bankruptcy

Reasons For The Department Of Education To Oppose Fewer Undue Hardship Discharge Petitions

The U.S. Department of Education can choose to not oppose undue hardship petitions for the bankruptcy discharge of federal student loans. It should exercise this authority more often. Here are a few recommendations for when undue discharge petitions for student loan should be allowed without opposition.

You May Like: Can You Rent An Apartment After Filing For Bankruptcy

How Do I Challenge My Student Loan Debt In Bankruptcy

Once you have filed for bankruptcy or we have re-opened a prior bankruptcy, the next step to discharge student loans in bankruptcy is to file a separate action within the bankruptcy case, known as an adversary proceeding. This adversary proceeding is similar to a lawsuit in that it will start with the filing of a complaint and can proceed through a trial and appeal, if necessary.

This process, within a bankruptcy, can be very difficult and our highly specialized student loan lawyers are some of the few attorneys that understand how to best proceed with challenging student debt through an adversary proceeding.

You May Like: Renting A House After Bankruptcy

How Congress Tightened Bankruptcy Laws Affecting Student Loans With Biden’s Support

Without singling out student debtors, Biden argued at a February 2001 hearing that somethings rotten in Denmark because so many people were declaring bankruptcy during a booming economy.

An awful lot of people are discharging debt that shouldn’t, Biden said. Something’s going on here. And it says to me it’s got to be tightened.

Biden said during a March 2020 presidential debate on CNN that he didn’t like the 2005 legislation but that he worked with Republicans to improve it. One of the bill’s provisions required undue hardship to wipe out private student loans in addition to government loans. At the time, he was campaigning against Sen. Elizabeth Warren, D-Mass., who proposed to forgive $50,000 in student loans for each borrower and eliminate the onerous undue hardship standard.

“I did not like the rest of the bill, but I improved it,” Biden said of the 2005 measure.

Biden pledged during the campaign to “end the absurd rules that make it nearly impossible to discharge student loan debt in bankruptcy.” He also campaigned for “an immediate cancellation of a minimum of $10,000 of student debt per person.”

But lawyers and student advocates doubt Biden will overhaul bankruptcy law.

“He had no intention of doing that,” Austin Smith, a New York bankruptcy lawyer, told USA TODAY. “He has instructed his Department of Education to fight these things tooth and nail, which I think is really unforgivable.”

Do I Need To Authorize Ecmc To Talk To Someone Other Than Myself About My Bankruptcy Case

No. However, if you wish ECMC to discuss your private information to someone other than you or your attorney, we will need you to complete and sign an Authorization giving your consent… Read more >

No. However, if you wish ECMC to discuss your private information to someone other than you or your attorney, we will need you to complete and sign an Authorization giving your consent. Send the form directly to ECMC. Mail the form to:

ECMC

Read Also: Does Bankruptcy Affect Renting

Explain The Proposed Law To Allow Bankruptcy For Student Loans

If enacted, the bipartisan FRESH START through Bankruptcy Act would change the current law to remove the lifetime ban on student loan discharge in bankruptcy and replace it with a 10-year ban.

Under the proposed law, if borrowers can show that paying their student loans caused undue hardship during the first 10 years, then they can get it discharged after that 10-year period is over without having to prove that it would be an undue hardship from that point forward.

This change would only apply to federal student loans, not private student loans. Any discharge of private student loans, regardless of the repayment timeline, would still require proving undue hardship.

To help shoulder some of the financial cost to the federal government of this proposed change, the bill also includes an accountability measure for colleges and universities. The schools would have to reimburse the government for a portion of the discharged student loan amount depending on the cohort default rate and repayment rate of the institution at the time the first loan payment comes due.

Dont Miss: How To File Bankruptcy In Wisconsin

Loan Servicer Quits The Business

Pennsylvanias student financial aid agency plans to end its role as a federal student loan servicer when its current contract with the U.S. Department of Education expires later this year, . . .

Always seemed weird to me that the a state government agency, which makes and oversees student loans in Pennsylvania, got into this business in the first place.

PHEAA plans to continue to invest its earnings from its other student loan business lines to supplement the state funding for the college student grant program it administers.This year, it is putting $15 million of its earnings to help boost the maximum college grant to $5,000 the grants do not have to be repaid. When combined with the investment from PHEAAs earnings made over the past decade, it brings this supplemental funding for the grant program to over $1 billion.

But this is my favorite part:

In the 12 years since PHEAA accepted the terms of its federal servicing contract, the federal loan programs as managed by the U.S. Department of Education have grown increasingly complex and challenging while the cost to service business increased dramatically, New said in a statement.

When the student loan servicers have trouble figuring out the government rules, you understand why the student loan borrowers have such a hard time.

Always leave them laughing:

4. Unlimited frozen yogurt at the food court: Only $40,000 per year.

If you enjoyed this post, make sure you !

Also Check: Bankruptcy Preparation Service

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How An Attorney Can Help You Address Student Loan Debt

Attorneys understand that sometimes you need a fresh financial start, and that filing for bankruptcy is one way to achieve this goal. Hard-working people can fall on tough financial times through no fault of their own. An attorney can provide you with legal advice and guidance regarding your rights and options. A lawyer can help you resolve delinquencies or defaults or apply for student loan discharge. So, if you want to seek help or even discharge of your student loans, you will want to seek the help of a bankruptcy attorney.

We are committed to helping families resolve legal challenges and get back to their lives. We offer the guidance and support that you will need when you are involved with the legal system.

Contact Us for a Consultation Today

Recommended Reading: Dave Ramsey And Bankruptcy

Getting Student Loans Discharged Is Difficult But Not Impossible

Even though some student loans are eligible to be discharged in bankruptcy, doing so is no easy task. Unlike credit cards or medical bills, having student loans discharged is notoriously difficultbut not impossible.

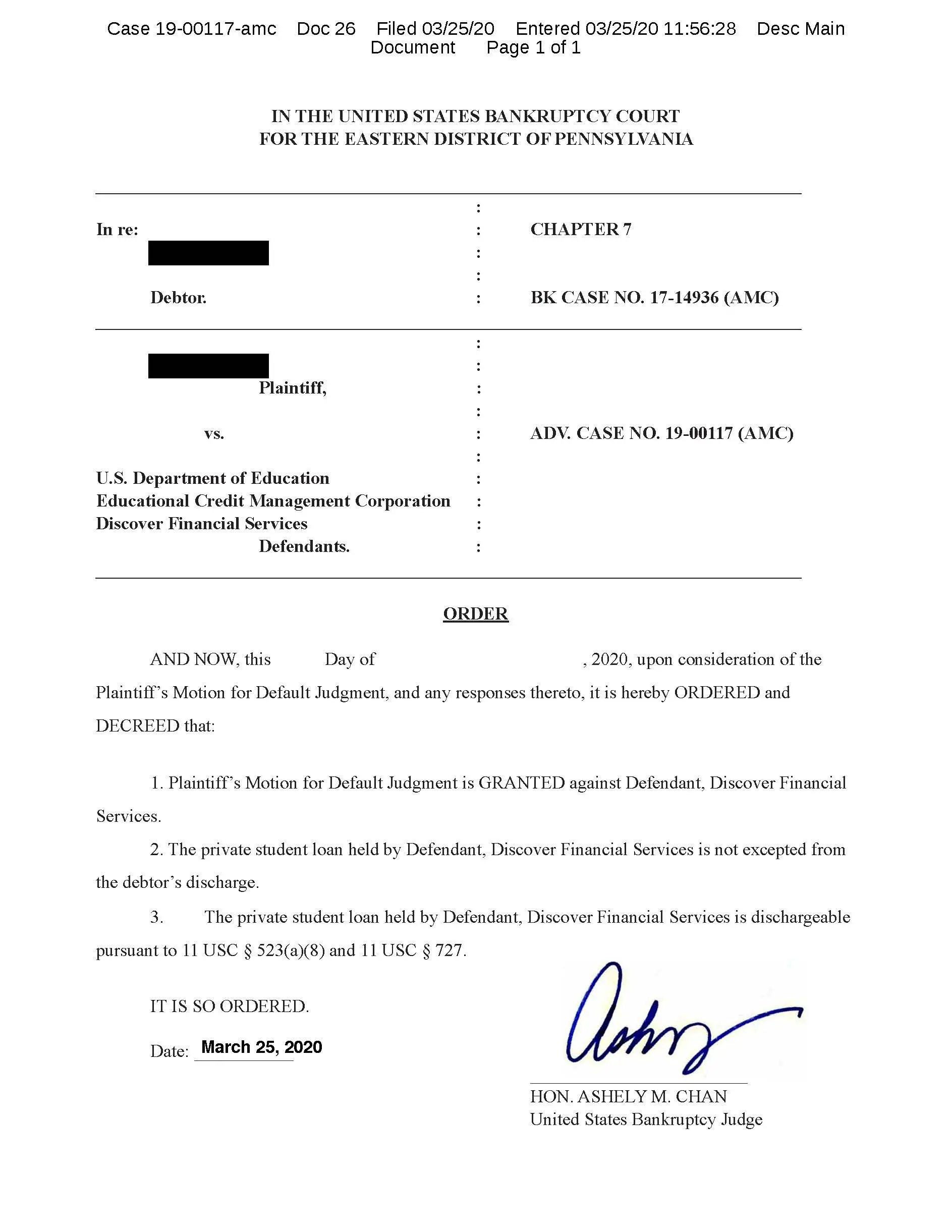

In July 2021, a New York-based federal appeals court ruled that private student loans could not be protected from discharge in a Chapter 7 bankruptcy. Federal student loans may qualify for discharge if youre able to prove undue hardship.

If managing your student loans has become a major financial burden, read on to learn how bankruptcy works, how to get student loans discharged, and alternatives you may want to consider.

Loan Discharge Because Of Disability

If you are disabled, you may be able to get your loans discharged without having to go through bankruptcy proceedings.

With certain federal loans, Total and Permanent Disability Discharge is available to those who are totally and permanently disabled. If youre eligible, the loan servicer can forgive the total remaining balance of your loans. For more information and how to apply, visit DisabilityDischarge.com.

Although not all private loan lenders offer discharges in the case of disability, some do. For example, College Ave will forgive the remaining balance if the borrower becomes permanently disabled.

If you have a disability and want to apply for a loan discharge, contact your lender directly via the customer service department. Explain your situation and what has changed since you took out the loans, and ask if the lender offers loan discharges in the case of disability.

Recommended Reading: Sba Loan Bankruptcy Discharge

Private Student Loans Can Now Be Discharged In Bankruptcy But Consider The Alternatives First

In July 2021, a federal court ruled that private student loans can be discharged in bankruptcy. But student loan refinancing may offer a better way to manage your college debt without significantly damaging your credit score.

Bankruptcy is a legal proceeding that provides financial relief for consumers who cannot repay their debt. Many types of debts can be forgiven in bankruptcy, including credit card debt and medical debt. But certain types of educational benefits, such as federal student loans, cannot be discharged in bankruptcy.

In previous bankruptcy cases, it was unclear whether private student loans were dischargeable loans until July 2021, when a federal court ruled that private student loans are not considered qualified higher education expenses under the U.S. Bankruptcy Code.

Discharging private loans in bankruptcy may provide much-needed respite for debtors who can’t meet their debt obligations, but bankruptcy has a lasting impact on an individual’s finances and credit score. It’s important to consider the alternatives before resorting to bankruptcy.

If you’re having trouble making your private student loan payment, then refinancing may be the answer. By refinancing your college debt to a lower rate, it may be possible to reduce your monthly payment so you can avoid defaulting on your loans.

Student Loans And Taxes

Various forms of educational debt relief may be available to you under the 2017 Tax Cuts and Jobs Act. However, none spell forgiveness. For example, the Act provides tax cuts for educational costs.

However, if youve applied for Sallie Mae complete forgiveness because youre disabled, youll be happy to learn that under the Act the forgiven loan no longer counts as income.

Several other proposed changes to laws affecting student loans are in the works. For example, the cap for income-driven repayment plans may increase from 10 percent of discretionary income to 12.5 percent. So keep an eye on the news for updates on what passes and what doesnt.

Don’t Miss: How Many Bankrupcies Has Trump Had