Putting It All Together: Dti Credit Score And More

Keep in mind there are several criteria lenders use to judge your creditworthiness and DTI is just one of them. If you have a high DTI but a good credit score and good credit history, your DTI might play less of a role in the lenders decision. Thus, if youre a physician with significant debt, you might still qualify for a loan despite having a high DTI if you have a good credit score and history. Many lenders offer Physician mortgages for this reason.

What Do The Numbers Mean

So youve calculated your DTI and gotten your numbers, but what does it mean? If youre a financially responsible person, you should calculate the debt-to-income ratio not only because youre applying for a mortgage but also to know where your financial health stands.

A lower number, usually anything below 36%, is considered a good number. This means you have fewer debts to service, and your income is pretty good. You have good chances of qualifying for a loan, such as a mortgage if you need one.

However, a higher number, usually 37% to 43%, means you have very little to spare. Many lenders will not be willing to give you their money with this number. Well, other lenders will still give you a mortgage with this number. But you shouldnt be in a hurry to take it because it comes with its share of drawbacks.

Instead of taking a loan with a high DTI and putting yourself in deeper financial struggles, you should consider reviewing your financial health. Experts agree that if you happen to reach a 50% DTI, youre risking your financial health. Any lender willing to give you a mortgage with this ratio is pushing you further into economic decline. You should strive to push your debt-to-income ratio towards 0% as much as possible. Everyone should strive to get to a debt-free life to consider themselves financially healthy.

The Bottom Line: Know How To Figure Out Your Debt

To recap, your debt-to-income ratio is the percentage of your gross monthly income that is spent on monthly debt payments. Its a very important number, because lenders use it to determine if youre a credit risk, and to ascertain what interest rate to offer you for your loan.

Understanding your DTI is a critical step in assessing whether youre ready to begin the process of buying a home.

Recommended Reading: How To See If Your Bankruptcy Is Discharged

How To Lower Your Dti

If your DTI is not within the recommended range, you can attempt to lower your DTI through a number of techniques. The preferred option is to pay off as much of your debt as you can manage, but you can also try restructuring your loans. Seek out options for lowering the interest rate on your debt or attempt to lengthen the duration of the loan through refinancing options. Look into loan forgiveness programs that may help to eliminate some of your debt entirely.

If youre unable to refinance your loans, focus on paying off the high-interest ones first. These carry a heavier weight in your DTI calculation, so paying them off first will improve the ratio.

If you can, seek out an additional source of income. This additional stream of income will help to improve your DTI ratio.

Calculating Dti Ratio For A Va Loan

Only certain types of debts and income count toward your DTI ratio.

Lenders will consider your major revolving and installment debts, mostly pulled directly from your . These are expenses like mortgages, car loans, student loans, credit card debt and more. But lenders can also consider obligations that don’t make your credit report, like child-care costs, alimony and even commuting expenses.

If you have collections or charge-offs on your credit report, lenders won’t typically factor those into your DTI ratio calculation unless you’re making regular monthly payments on those debts.

But lenders may have a cap on how much of this derogatory credit you can have. Guidelines and policies can vary by lender.

The biggest debt is likely to be your projected monthly mortgage payment, which will include the principal and interest on the loan along with estimated escrow amounts for property taxes and homeowners insurance. On VA loans, lenders will also include an estimated cost for monthly utility bills, multiplying the home’s square footage by 0.14.

Lenders will add up these debts and divide them by your gross monthly income. The VA allows lenders to “gross-up” tax-free income to create a pre-tax figure to calculate the DTI ratio.

Don’t Miss: How To Remove Bankruptcies From Your Credit Report

Maximum Dti By Type Of Loan

Your lenders maximum DTI limit will depend, partly, on the type of loan you choose:

- Conventional loan: Up to 43% typically allowed

- FHA loan: 43% typically allowed

- USDA loan: 41% is typical for most lenders

- VA loan: 41% is typical for most lenders

These rules dont always apply to all borrowers in the same way.

For example, even if your DTI meets your loans requirements, you wont be guaranteed approval. Your credit score, down payment amount, or income could still undermine your eligibility.

And it works the other way around, too: Some borrowers whose DTI ratios come in a little too high may still qualify if they have excellent credit or can make a larger-than-required down payment.

Divide And Convert Result To A Percentage

The final step in calculating debt-to-income ratio is dividing the gross monthly income number by the sum of the fixed monthly debt. Voila! This is your debt-to-income ratio.

Lets work through an example.

- Assume you pay rent at a monthly rate of $1,000

- You also have a car payment of $400

- And a minimum credit card payment of $150

This is a total monthly debt amount of $1,550 per month.

- Lets also assume you have a gross monthly income of $5,000.

- Your debt-to-income ratio is $1,550 divided by $5,000, which equals .31. Multiply this number by 100 to get a percentage .

Lenders consider those with a lower DTI to present a lower credit risk. With a 31% DTI, not only will you more likely be preapproved, youll also likely qualify for a low interest rate.

You May Like: How Long Does Bankruptcy Stay On Record

The Fha Streamline Refinance

The FHA offers a refinance program called the FHA Streamline Refinance which specifically ignores DTI, even if its a high DTI that wouldnt qualify for an FHA purchase loan.

Official FHA mortgage guidelines also waive income verification and credit scoring as part of the streamline refi process. Instead, the FHA looks to see that the homeowner has been making the homes existing mortgage payments on time and without issue.

If the homeowner can show a perfect payment history dating back three months, the FHA assumes that the homeowner is earning enough to pay the bills.

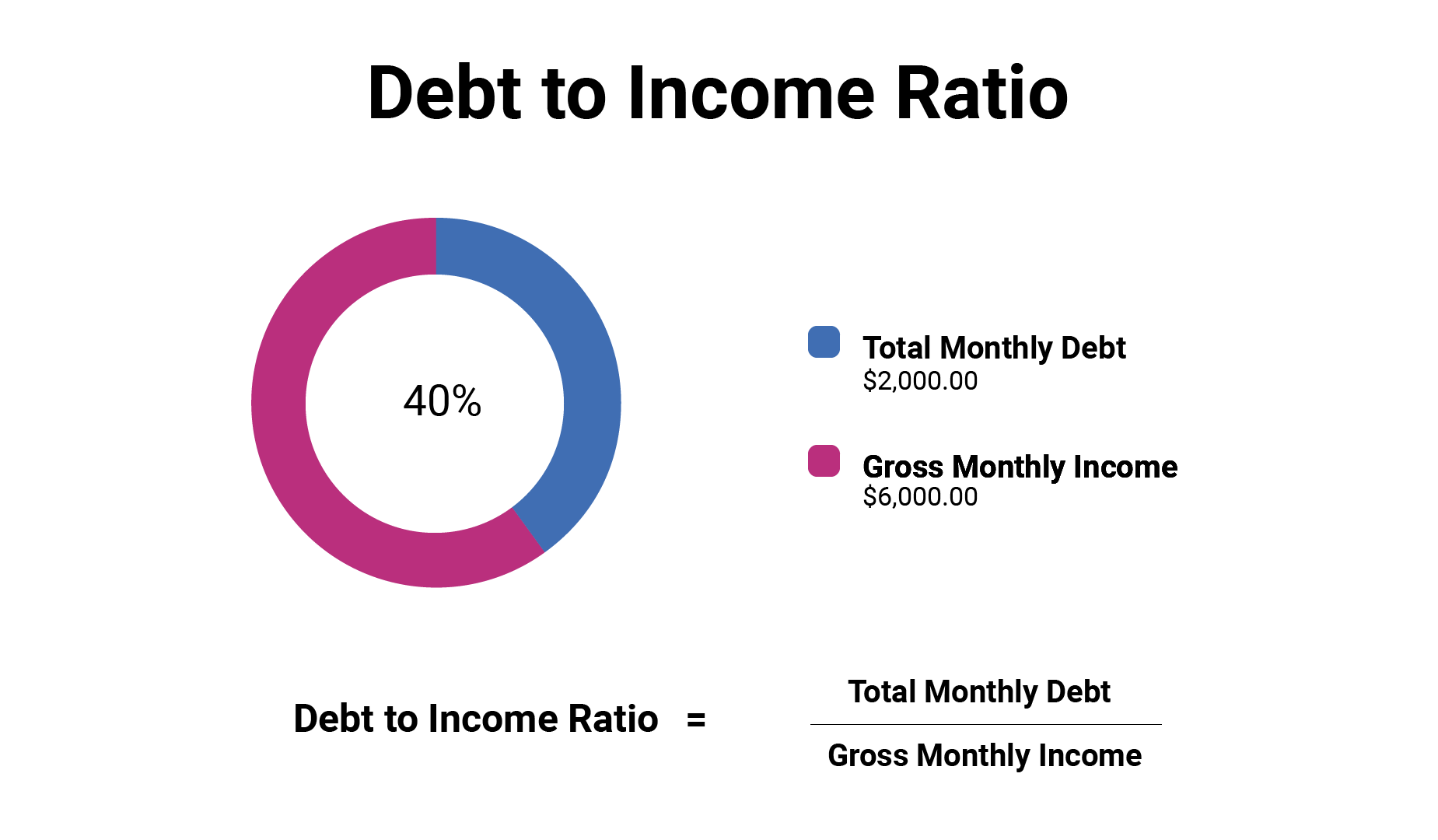

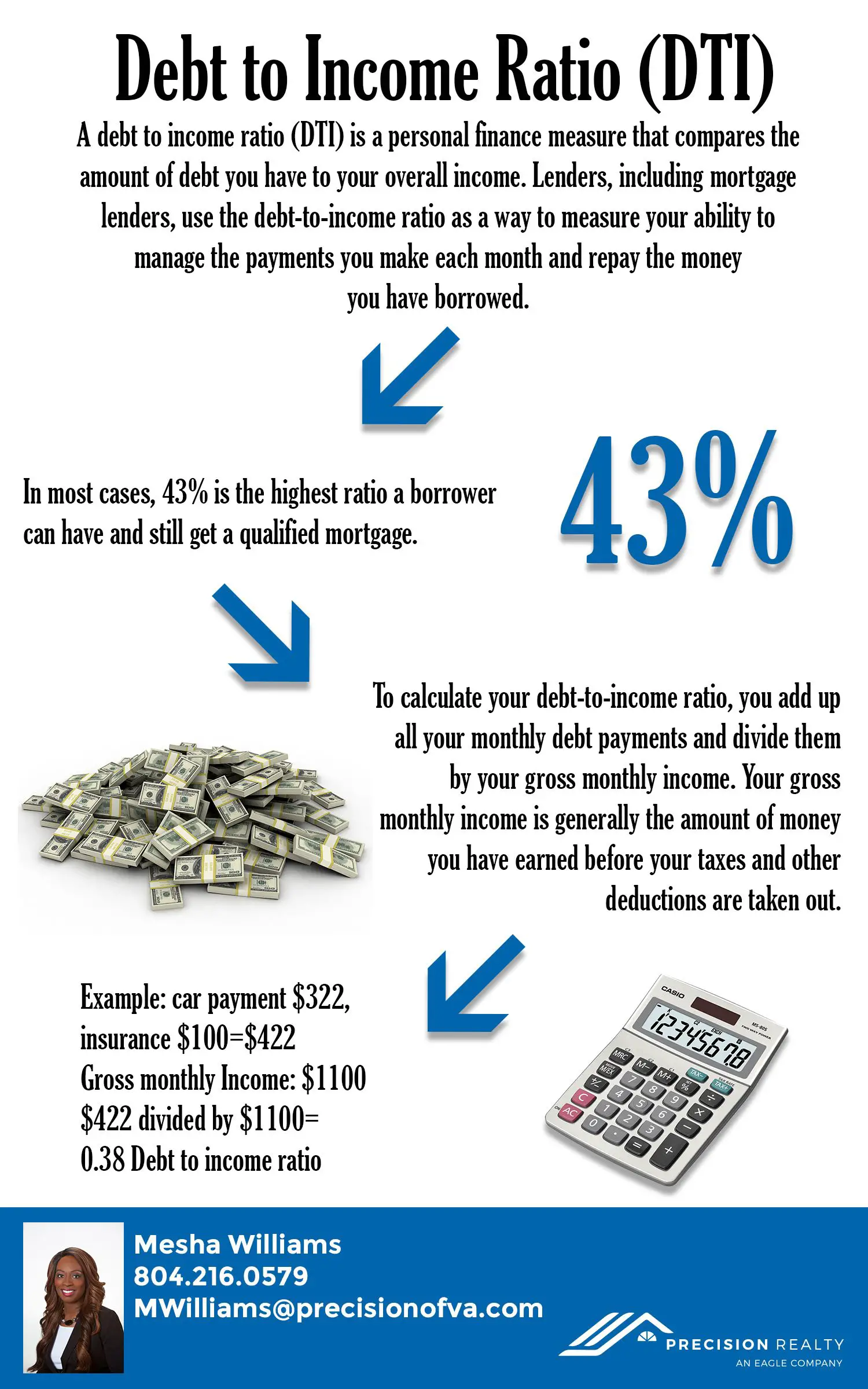

Dti Formula And Calculation

The debt-to-income ratio is a personal finance measure that compares an individuals monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individuals ability to manage monthly payments and repay debts.

You May Like: How To File Bankruptcy Yourself In Ohio

Make A Plan To Reduce Existing Debt

Lowering your debt-to-income ratio number is all about reducing your existing debt. There are two popular methods to paying off debt:

- The Debt Snowball Method: Paying off your smallest debt first and working your way up to your largest.

- The Debt Avalanche Method: Pay off high-interest debts first.

Because debt-to-income calculates total monthly payment obligations, and most installment loans have fixed monthly amounts whether you pay extra or not , it may make sense to pay off the smallest debts first in order to get those recurring monthly payments off the books.

No matter which way you choose to tackle your debt the result is the same: paying off debt not only saves money on interest, but also lowers your DTI.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

Also Check: How To Liquidate Cryptocurrency

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johns income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

Don’t Miss: What Happens After Bankruptcy Chapter 7

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Find Ways To Make Debt Less Expensive

When paying off debt, the name of the game is making your debt as cheap as possible. If youre carrying high-interest credit card debt, try to find less costly alternatives, such as:

- The balance transfer offer mentioned above.

- Asking your current card companies/debtors for a lower interest rate.

- If you already own a home, you might consider a cash-out refinance to consolidate debt.

- Applying for a personal loan with a fixed repayment schedule to consolidate debt to a lower interest rate.

Recommended Reading: Can You File Bankruptcy To Avoid Paying A Judgement

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Whats The Impact Of Dti For Student Loan Refi

Your DTI also plays a role in whether you can refinance your student loans. There isnt a hard and fast rule of thumb for the maximum DTI to have when refinancing your student loans but typically, a DTI of 40% or lower is considered a reasonable threshold when youre applying to refinance the lower your DTI is, the higher the chance youll qualify for a new loan with a lower interest rate.

Recommended Reading: Can You Include A Judgement In A Bankruptcy

What Dti Should I Aim For

As a rule of thumb, your DTI should range between 36% and 43% when youre applying for a mortgage.

That said, a lower debt-to-income ratio is always better. The lower your debt-to-income ratio, the better mortgage rate youll get.

DTI is a key ingredient in home affordability for many borrowers: When a low DTI helps you avoid high-interest mortgage loans, you can afford a more expensive home.

How To Calculate Dti

How to Calculate DTI on a VA Loan| Car Loan | |

|---|---|

| Child Care/ Child Support/ Alimony | $300 |

| DTI Ratio = | 39% |

It’s also important to understand that mortgage lenders don’t consider all income equally. Some forms of income will count toward qualifying for a mortgage with no problem. But other forms, like overtime, self-employment income and others, will often require at least a two-year history. And some forms of income, like GI Bill housing allowances, won’t be counted as effective income toward a mortgage.

Lenders don’t count all your debts, either. Things like cell phone bills, car and health insurance, groceries and other expenses aren’t factored into this calculation.

Calculating your DTI ratio is one step. But the question is: How does that number affect your ability to land a VA home loan?

Don’t Miss: Is My 401k Protected From Bankruptcy

Va And Lender Dti Benchmarks

Lenders can set their own benchmarks for the maximum allowable DTI ratio. Those caps can vary based on a host of factors, including the presence of compensating factors and whether the loan file needs to be underwritten manually.

Some lenders might allow a DTI ratio above 50 percent, even well above it, in some cases, depending on the strength of the borrower’s overall credit and lending profile.

In these cases, borrowers will get an up-close look at the link between DTI ratio and the VA’s guideline for discretionary income, known as residual income.

What Is The Debt

Debt-to-income ratio, or simply DTI, refers to the percentage of your monthly income that goes toward debt payments.

When applying for a mortgage, youll authorize a credit check where lenders examine your credit history, including your current debts and the minimum monthly payments for these debts.

Theyll calculate your total monthly debt payments, and then divide this by your gross income to determine your DTI ratio. So, if you have a gross monthly income of $5,000, and $500 in monthly debt payments, you have a DTI ratio of 10%which is excellent.

But mortgage lenders dont only look at your current debts when calculating DTI ratio. They also factor in future mortgage payments to gauge affordability.

So, if youre thinking about buying a property with an estimated monthly payment of $1,300, youll have future monthly debt payments of $1,800. Assuming the same gross monthly income of $5,000, your DTI ratio increases to 36% after buying a home.

A good debt-to-income ratio to buy a house depends on your mortgage program. If you apply for a conventional home loan, your ideal DTI ratio should be 36% or less. On the other hand, if youre looking at an FHA home loan, these programs may allow DTI ratios up to 43%.

To be clear, though, these are only guidelines, and not hard or fast rules. Lenders sometimes allow higher DTI ratios, such as when a borrower has certain compensating factors.

How to Improve Your Debt-to-Income Ratio

Bottom Line

You May Like: What Happened To Gm Stock After Bankruptcy

Your Maximum Loan Amount :

The proportion of your income that can apply to debt service varies by loan type. The hard cap for most loans is 50%, but loans under 43% are more likely to receive appraisal waivers and faster underwriting turnaround times. The more risk presented to the underwriter, the more diligent they will be.